Major Industrial Volume Muted Over High Cost of Funds - Savills

Contact

Major Industrial Volume Muted Over High Cost of Funds - Savills

A bigger demand for logistics and 3PLs freight solutions amid borders reopening helped bring around the rents of overall and modern warehouses, according to Savills in its Market in Minutes – Hong Kong Industrial Sales and Leasing report for Q1 2023.

A bigger demand for logistics and 3PLs freight solutions amid borders reopening helped bring around the rents of overall and modern warehouses, according to Savills in its Market in Minutes – Hong Kong Industrial Sales and Leasing report for Q1 2023.

Rebound in logistics demand after borders reopening

The long-awaited borders reopening propelled strong recovery of logistics demand, with air cargo throughputs in particular rebounding by 6.6% in February 2023, after 13 straight months of decline. The gradual resumption of air freight, as well as cross-border land transport, helped rebuilt a lot of 3PLs freight solutions for clients, with operators seeing more light in their business growth in the near term.

Nevertheless, CAPEX and general lack of availability (except Goodman Westlink) meant relocations remained scarce, with a few major renewals being recorded over the quarter, led by a take-up of 88,000 square feet at the Tien Chu (Tsing Yi) Industrial Centre by Good View Development Group Ltd.

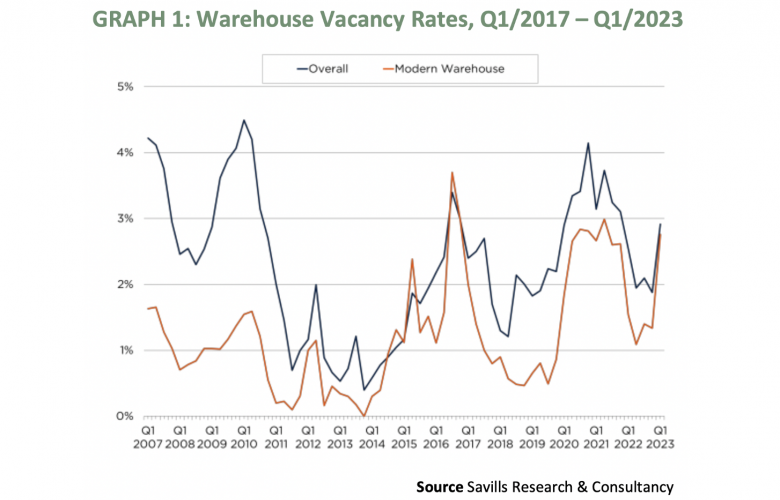

Vacancy rates at healthy levels despite marked increase

With the addition of Goodman Westlink, overall and modern warehouse vacancy rates increased to 2.9% and 2.8% respectively, which were still at healthy levels. As such, landlords were able to hold onto asking rents with overall and modern warehouse rents edging up by 0.5% and 0.6% respectively in Q1/2023.

Investors have contrasting appetites for en-bloc and strata-titled industrial

Though interest rates actually declined throughout Q1 with the 3-month HIBOR declining from 5.0% at the end of 2022 to 3.5% in mid-April, effective cost of funds were still high at around 5% to 6%. It meant that most investors, including investment funds who were most active in the en-bloc industrial market in 2022, remained on the sideline. As a result, no major industrial transactions over HK$100 million were recorded over the quarter.

The investment transaction volume of stratified industrial premises saw a very different picture: Volume reached 477 transactions in Q1, up 27% quarter-on-quarter, with small lump sum deals (HK$10 million or below) registering a 30% growth over the period, reflecting renewed optimism among local investors on stratified industrial properties.

Warehouse rents to remain stable in 2023

Looking ahead, the expected rebound in retail sales (in the order of 5% to 10%), as well as sustained growth in e-commerce (13%) should give solid support to logistics demand in 2023. Nevertheless, the imminent completion of the 4-million square feet CaiNiao Smart Gateway at the Hong Kong International Airport remain an overhang to the market. We expect warehouse rents to remain broadly the same this year, with the market likely to resume growth from 2024 onwards when new warehouse completions are gradually taken up.

Mr. Jack Tong, Director, Research & Consultancy of Savills commented: "Reviving retail sales and online sales should induce related logistics demand to thrill, while major industrial transactions are likely to be rare with only end users still looking for opportunities."

Mr. James Siu, Deputy Managing Director, Head of Kowloon, Industrial Development & Investment of Savills said: "Interest rate hikes will hit price growth in the short term, leading to slight adjustment in prices in 2023, but continuous end users’ demand should support en-bloc / majority holdings sales from 2024 onwards."