FDI in Vietnam reaches USD318.72 billion over last 10 years

Contact

FDI in Vietnam reaches USD318.72 billion over last 10 years

Khanh Nguyen, Associate Director Capital Markets of JLL Vietnam, discusses foreign direct investment (FDI) and real estate development in Vietnam.

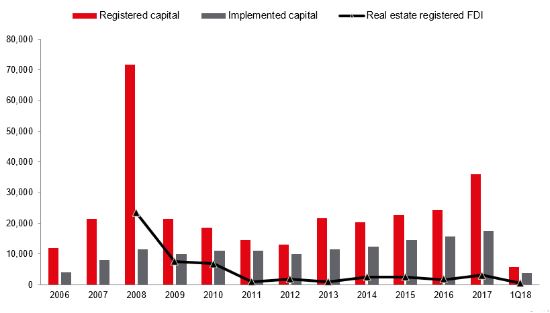

Over the past 10 years, despite the ups and downs of Vietnam's economy in general and the real estate market in particular, FDI inflows remained stable with the cumulative total registered FDI reached the level of approximately US$318.72 billion by the end of 2017, in which cumulative direct investment in the real estate sector achieved US$53.2 billion, according to FIA’s statistics.

Most notably, FDI into Vietnam in the recent 3 years (2015-17) has continuously increased as compared to the period of 2010-13 and most of the capital inflow was deployed into projects. In contrast, capital inflows to Vietnam in 2007 was triple that of 2005, and peaked in 2008 with the registered amount of almost US$72billion, as capital inflows almost quadrupled in a year (Figure 1). It is important to note that most of the capital was not deployed into projects during that time. While capital inflow in 2008 was six times higher than in 2005, the number of projects implemented was just 10% higher in 2008 compared to 2005. However, this amount was never fully disbursed. The FDI in the recent years is to attract realistic projects that will disburse their commitment rather than holding while attracting co-investors.

Figure 1: FDI’s by year (US$ million)

Cumulative registered FDI is the successive additions of registered investment from effective projects only up until 20 December 2017. Source: GSO, FIA

FDI inflow into Vietnam real estate market

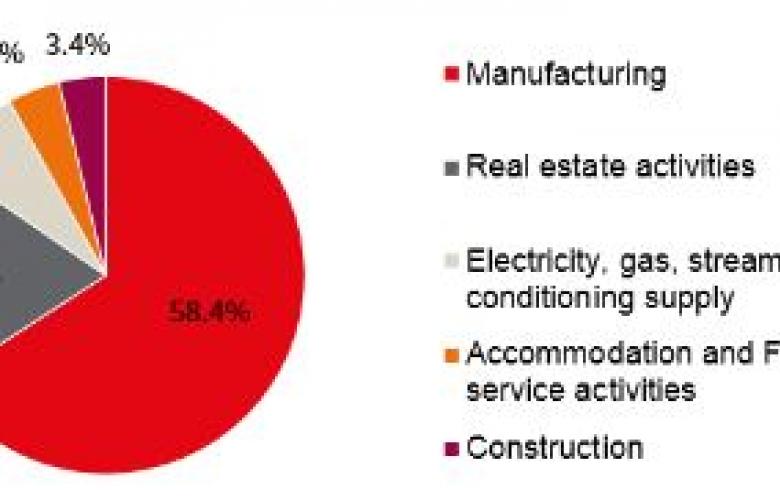

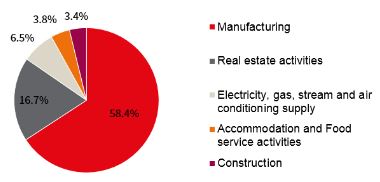

Over the years, FDI inflows into the real estate sector in Vietnam have often been ranked second or third, followed by manufacturing – the largest recipient of FDI among Vietnam’s sectors. (Figure 2).

Figure 2: Top 5 Vietnam’s FDI by economic activity

(*) Cumulative to 20/12/2017 - Effective projects only. Source: FIA Vietnam

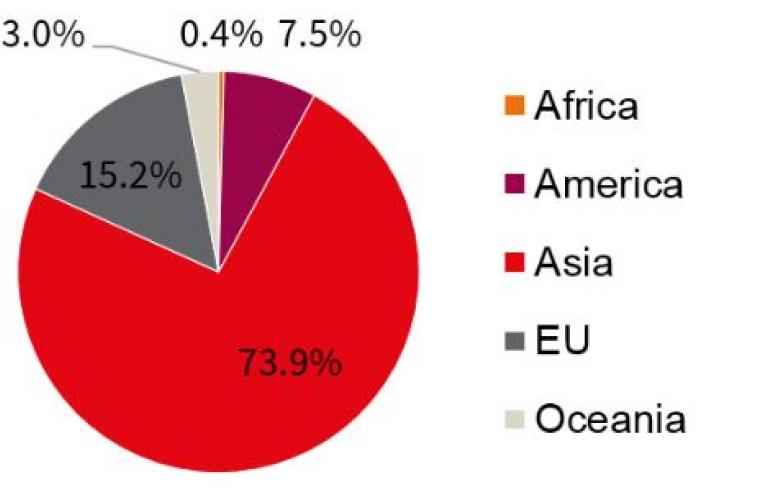

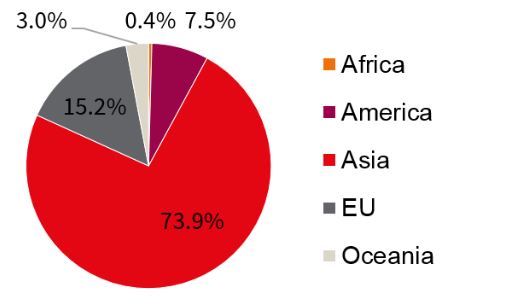

Vietnam’s strong and stable growth performance over the past decade has been an attractive magnet for foreign investors, especially those from Asia such as Japan, Korea, Singapore, Hong Kong, Taiwan and China. Their market share accounted for 73.9% of total FDI of all industries including real estate, followed by the EU countries at 15.2% (Figure 3). Most of EU investors invest in the fields such as design, electronics, home appliances and furniture, etc. However, with the need to expand their footprint to Vietnam, these European firms also have an increasing demand for direct investment in commercial real estate through acquiring buildings for their headquarters or showrooms in non-CBD areas.

American investors are also key players in the Vietnamese market as they ranked third in FDI capital. Although there are no official break-down statistics on FDI inflows into real estate sector by countries, it can be seen that there has been increasing interest from private equity firms in real estate market as they consider Vietnam to be an attractive investment destination. One of the notable American investors is the New York-based private equity firm Warburg Pincus, who has committed over US$1 billion in Vietnam, in which a majority of this fund is allocated to set up real estate platforms including retail, hotels, industrial and logistics.

Figure 3: Breakdown of Vietnam’s FDI by region (*)

(*) Foreign direct invested capital till valid as of 20 Dec.2017. FDI of all economic activities including real estates. FDI from the EU is ranked second following Asia. Source: FIA Vietnam.

High-end residential market – the top choice of foreign investors

As more than 10 years ago, FDI inflows were concentrated in the high-end residential segment. Famous names in the market such as Keppel Land, CapitaLand with the first high-end real estate projects in Vietnam such as The Estella or The Vista.

Since the market share of FDI projects is not high, the average price of high-end primary stocks in 2007 was at US$2,800/sqm (exchange rate 16,112 VND/US$), representing an increase of 86% as compared to the sales launch of the previous year. This created a virtual supply-demand imbalance that pushed prices beyond the affordability of home buyers with real demand. There has been a long queue of buyers trying to compete for a very limited availability of these products due to virtual speculation.

Until March 2008, with the overheating of the market in 2007 and the impact of the global financial crisis, monetary instruments were unmanageable as interest rates increased rapidly which reached 25% and peak inflation at 23%. Subsequently, the real estate market fell into a

recession and FDI inflows to the real estate sector also decreased. This capital flow started to recover by the end of 2013, early 2014.

Since then, the market has become more familiar with the names of other FDI investors such as Hong Kong Land (The Nassim project), Frasers Property (Q2 Thao Dien project) or Mapletree (One Verandah project). JLL also noted that they are not new investors in the Vietnamese market, but rather looking to expand their residential portfolio outside of traditional investment in the construction / ownership of leading Grade A or Grade B office buildings in Hanoi (Pacific Place, Central Building, 63 Ly Thai To) or in HCMC such as M Plaza and Me Linh Point Tower.

Emerging trend to expand FDI inflows into the mid-end and affordable housing segments

With the recovery of the real estate market, foreign investors, especially those from Japan, are looking to pour their capital into Vietnam's real estate market. Investment segment of diversified joint ventures are targeting the mid-end and affordable segment. Following this trend, there are many investors considering and willing to participate in joint ventures and contribute capital with reputable Vietnamese investors.

And commercial real estate with FDI also gradually increases supply over the years

With the total office supply 10 years ago was about 650,000 m2, until now, this number has increased by three times, of which, the supply from office buildings with FDI contributions increased to 500,000 m2, doubled since the past 10 years. Previously, with the demand for

Grade A office space, tenants have only a handful of options from Grade A buildings built since the 90s, such as:

- Sunwah Tower

- Diamond Plaza

- Saigon Center (Phase 1)

- Metropolitan

Over the past five years, the market has witnessed a significant increase in Grade A supply from FDI investors such as:

- Vietcombank Tower

- Saigon Center (Phase 2)

- Deutsches Haus

Not only the traditional office business, the office market embraces a diversity of new investment concepts such as co-working spaces or serviced offices. JLL expects the trend to accelerate, due to

- Changing demographics and working styles

- Companies realizing the need for flexibility in their leases due to rapid changes in the business environment

Real estate FDI prospects for 2018

2018 marks a 10-year period since the downturn of the real estate market and nearly 5 years of market recovery. Given the monetary policies are expected to stay neutral-to-accommodative to support growth when FDI inflows in hundred millions of dollars are poised to enter the real estate market in Vietnam, we expect the real estate market to continue stabilising and growing. M&A activities and other forms of direct investment will continue to reach new records.

JLL forecast the real estate market outlook as follows:

- Deals are available but harder to execute due to divergence in pricing expectations between buyers and sellers.

- More opportunistic funds will focus on new areas (e.g. school, hospital, construction).

- Limited yield compression but asset prices should rise further due to rent growth.

- Demand for co-working space is growing from both small and large enterprises.

- REITs to expand capital sources. By the end of 2017, the notable transactions of Pullman Jakarta Central Park Hotel in Indonesia, Capri by Frasers HCMC and IBIS HCMC in Ho Chi Minh City with total investment portfolio value of US$130 million by a Thai-listed REIT (SHREIT) have proven the intra-regional capital flows and the appeal of investment assets in Vietnam to international investors.

- Continued strong interest in industrial and logistics assets. The lack of high specification, modern logistics warehouse space and strong demand from regional occupiers are supporting for the potential growth of this industry. As such, this sector remains on the radar of foreign investors and developers in 2018.

For more information about FDI in Vietnam, phone or email Khanh Nguyen, Associate Director of Capital Markets, JLL Vietnam via the contact details listed below.

Similar to this:

Vietnam an "attractive destination for foreign investment" says JLL