Slower sales during mid-year break in private residential units - June 2018

Contact

Slower sales during mid-year break in private residential units - June 2018

Mr Ong Teck Hui, National Director of Research & Consultancy at JLL reports on the private residential units sold by developers in June 2018.

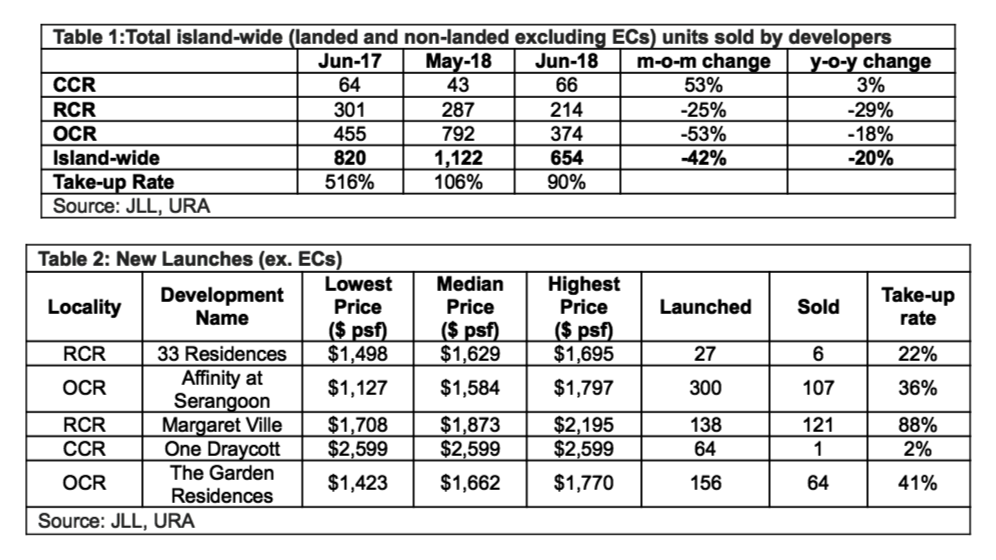

In June 2018, developers sold 654 private residential units, a drop of 41.7% from the 1,122 units sold in May and also 20.2% lower than in June last year.

The tally for the first half of the year is estimated at 4,090 units, about 32.3% below the 6,039 units which developers sold for the same period in 2017.

The 726 new private homes launched in June is 31.5 per cent below the 1,060 released in May. Private homes launched in the first half of 2018 totalled an estimated 3,371 units, 14.9 per cent lower than the 3,960 units launched for the same period last year.

The top selling private residential projects in June were:

- Margaret Ville (121 units at a median price of $1,873 psf)

- Affinity at Serangoon (107 units at a median price of $1,584 psf)

- The Garden Residences (64 units at a median price of $1,662 psf)

- Twin Vew (64 units at a median price of $1,350 psf)

- 120 Grange (42 units at $3,159 psf)

New project launches:

Launches picked up in June, with five new private residential projects released to marked.

- Affinity at Serangoon launched 300 of its 1,052 units for sale with 107 units taken up at a median price of $1,584 psf.

- The Garden Residences launched 156 of its 613 units and sold 64 at a median price of $1,662 psf.

- Margaret Ville launched 138 of its 309 units, disposing of 121 at a median price of $1,873 psf.

- One Draycott launched all of its 64 units for sale with one taken up at a median price of $2,599 psf.

- 33 Residences launched all of its 27 units for sale and 6 were sold at a median price of $1,629 psf

Executive Condominium (EC) market

In the absence of new EC launches, buyers faced limited choices from the few remaining units in EC projects under marketing. Rivercove Residences sold 29 units in June at a median price of $1,000 psf, clearing 627 of its 628 units. Parc Life sold 11 units at a median price of $884 psf while Northwave disposed of 9 units at a median price of $853 psf. Altogether, 52 new ECs were sold in June, a 62 per cent decline from the 137 units sold one month earlier.

Mr Ong Teck Hui, National Director of Research & Consultancy at JLL, commented:

“Despite the buoyant residential market, primary market sales of private homes for the first half of 2018 is about 32 per cent lower y-o-y. This is in stark contrast to secondary market sales in the first half which shows a 37 per cent y-o-y increase (based on caveats) and more truly reflects the magnitude of demand in the market. It also shows lost opportunity in the primary market as 6,000 or more new private homes could have been taken up in 1H18 if launches had been more forthcoming.

The recent upward revision in Additional Buyer’s Stamp Duty (ABSD) and tightening in Loan to Value (LTV) limits would impact investors most, i.e. those buying their second or subsequent property. First time buyers are more affected by the lower LTV as they can now borrow less and have to fork out a higher cash/CPF outlay for upfront payment. With the tighter measures in place, demand is expected to moderate but there will still be interest from buyers who are now more price sensitive but may still purchase if pricing is realistic.

New home sales in July are expected to surpass those of June because the last minute launches of Park Colonial, Riverfront Residences and Stirling Residences on the night of 5 July before the measures took effect, possibly resulted in sales of more than 1,000 units. New home sales in the second half of 2018 are dependent on launches, some of which may be delayed or reduced due to developers being cautious of the uncertain market. Consequently, new home sales for 2018 are now estimated at 8,000 to 9,000 units or 15 to 25 per cent lower than in 2017.”

Source: JLL, URA

For more information about Singapore's residential development sales, email Ong Teck Hui, National Director of Research and Consultancy at JLL via the contact details listed below.

Similar to this:

Increased launches cause pick up for developer sales - May 2018 Singapore

Slow pick-up in new residential project launches for April 2018 in Singapore

Singapore sees low key sales and launches in February due to festive month