A cautious residential land sales programme in view of buoyant collective sales market

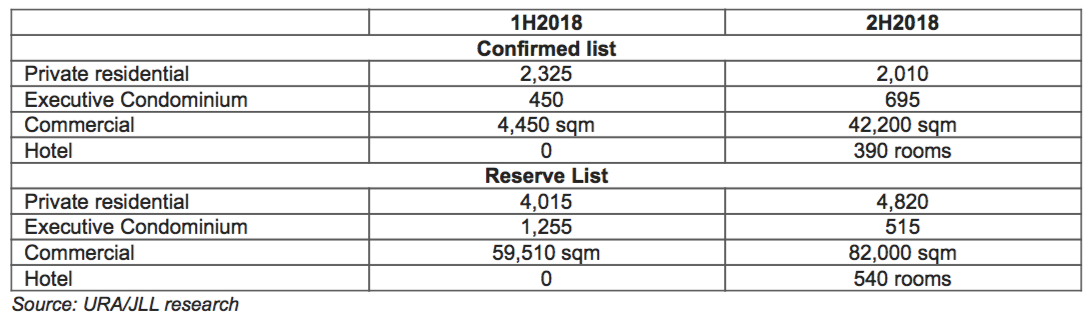

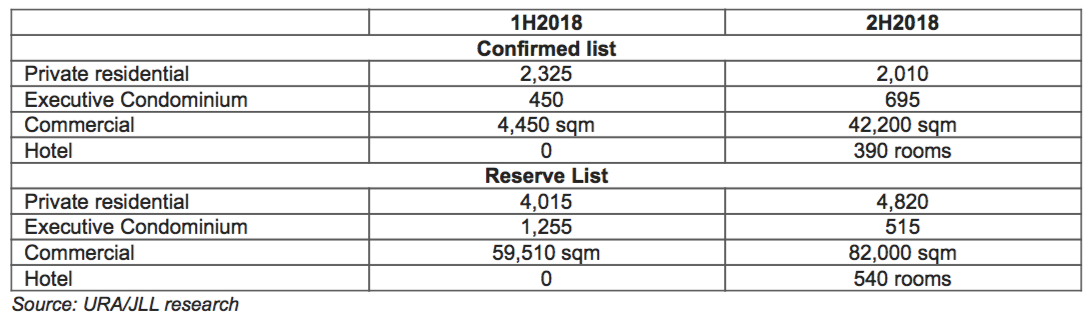

The URA announced the second half 2018 Government Land Sales (GLS) programme which is tabulated below with the first half GLS programme for easy comparison.

Source: URA/JLL Research

Residential

In the 2H2018 confirmed list, there are only 3 private residential sites and a white site supplying 2,010 units, a 14% decline from the 2,325 units supplied by 5 private residential sites under the 1H 2018 confirmed list. The moderation is probably due to concerns of oversupplying the market since the buoyant collective/en bloc sales market is generating the bulk of future supply. Between 2H 2016 and 1H 2018, GLS sites will generate about 30% of the units to be developed while some 70% will be from collective/en bloc sites.

WILLIAMS MEDIA spoke with Ong Teck Hui, National Director of Research and Consultancy at JLL Singapore about the GLS Programme who explained, "The GLS Programme and collective/private land sales market complement each other."

"In the last one and a half years, when demand for residential land was strong, the land supply from GLS was inadequate and developers resorted to buying land from private sources, particularly collective sale sites," he said.

"In that period, GLS sites accounted for one-third of the total value of residential sites sold, while collective sale sites accounted for two-thirds."

The confirmed list of private residential sites are at Kampong Java Road and Middle Road which are in the Core Central Region (CCR) and Sims Drive which is in Rest of the Central Region (RCR). There are no private residential sites in Outside Central Region (OCR) in the 2H 2018 confirmed list although the white site at Pasir Ris will generate private residential units.

The focus of the 2H 2018 residential GLS seems to be in the central region which accounts for 79% of collective sale sites sold in 1H 2018 to-date. Although the three GLS sites could help to meet demand from developers, it is uncertain as to whether they will mitigate optimistic land prices. They are also unlikely to dilute demand for collective sale sites, especially those in the prime districts for which there is keen interest.

Commercial

A white site at Pasir Ris Central has been included in the 2H 2018 confirmed list, capable of generating 35,900 sqm of commercial space and 535 private residential units. Located next to the Pasir Ris MRT station and bus interchange, the development is slated to be a future major retail mall in the area.

Sites for office development remained absent in the confirmed list in spite of the continued strengthening of CBD office rents. The government is likely to be hoping for demand to spill into the decentralised market in an effort to bring job opportunities closer to homes. This is reflected in the placement of a white site capable of yielding minimally 50,000 sqm gross floor area of office space in Woodlands Square/Woodlands Avenue 2 in the Reserved List.

Hotel

A site for hotel development (390 rooms) is in the 2H 2018 confirmed list. The last time a site with a hotel component was included in the confirmed list of the GLS programme was 7 years ago in 2H 2011. The current hotel site comes on at a time when the economy has improved, healthy tourist arrivals have been recorded and the Trump-Kim summit has been successfully hosted.

For more information about the GLS Programme phone or email Ong Teck Hui of JLL Singapore via the contact details listed below.

Source: JLL Singapore

Similar to this:

Transparency Index reveals Asia Pacific shows fastest progress - JLL

Seoul's luxury housing market ranks number 1 globally

The China12 - China's leading cities taking on the world