Shanghai and Beijing cool as Wuxi, Zhengzhou and Changsha remain in the top 10 fastest housing price growth markets

Contact

Shanghai and Beijing cool as Wuxi, Zhengzhou and Changsha remain in the top 10 fastest housing price growth markets

The Knight Frank Global Residential Cities Index Q2 2017 shows China’s growth is slowing for the first time in five quarters after further purchase restrictions and lending curbs.

Knight Frank, the independent global property consultancy, launched the Global Residential Cities Index for Q2 2017 which tracks the performance of mainstream house prices across 150 cities worldwide, 47 of which are from Asia-Pacific, based on official house price data published by either National Statistic Offices or Central Banks.

Results for Q2 2017

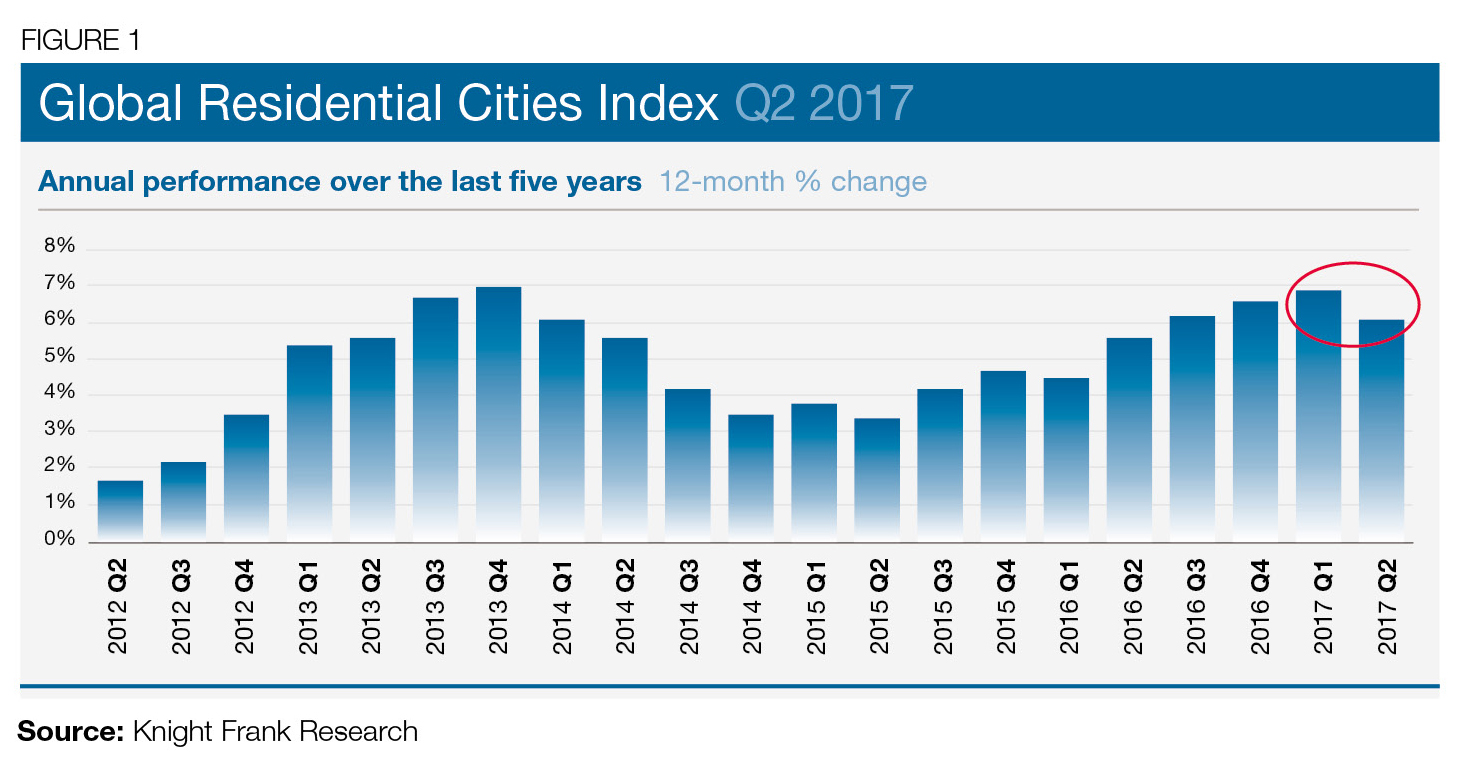

- House prices increased by an average 6.1% in the quarter that ended June 30 from a year earlier, down from 6.9% the quarter before, the index’s first decline in the rate of growth since the start of 2016.

- Only three Chinese cities – Wuxi, Zhengzhou and Changsha – remain in the top 10 fastest housing price growth markets, down from seven last quarter. However, this is a deceleration rather than a crash. Prices are still rising on a year-on-year basis in all 20 of the Chinese cities we track within the index. The outliers have reduced in number and the lower tier cities are now outpacing first-tier cities such as Shanghai and Beijing, which have seen the most stringent cooling measures.

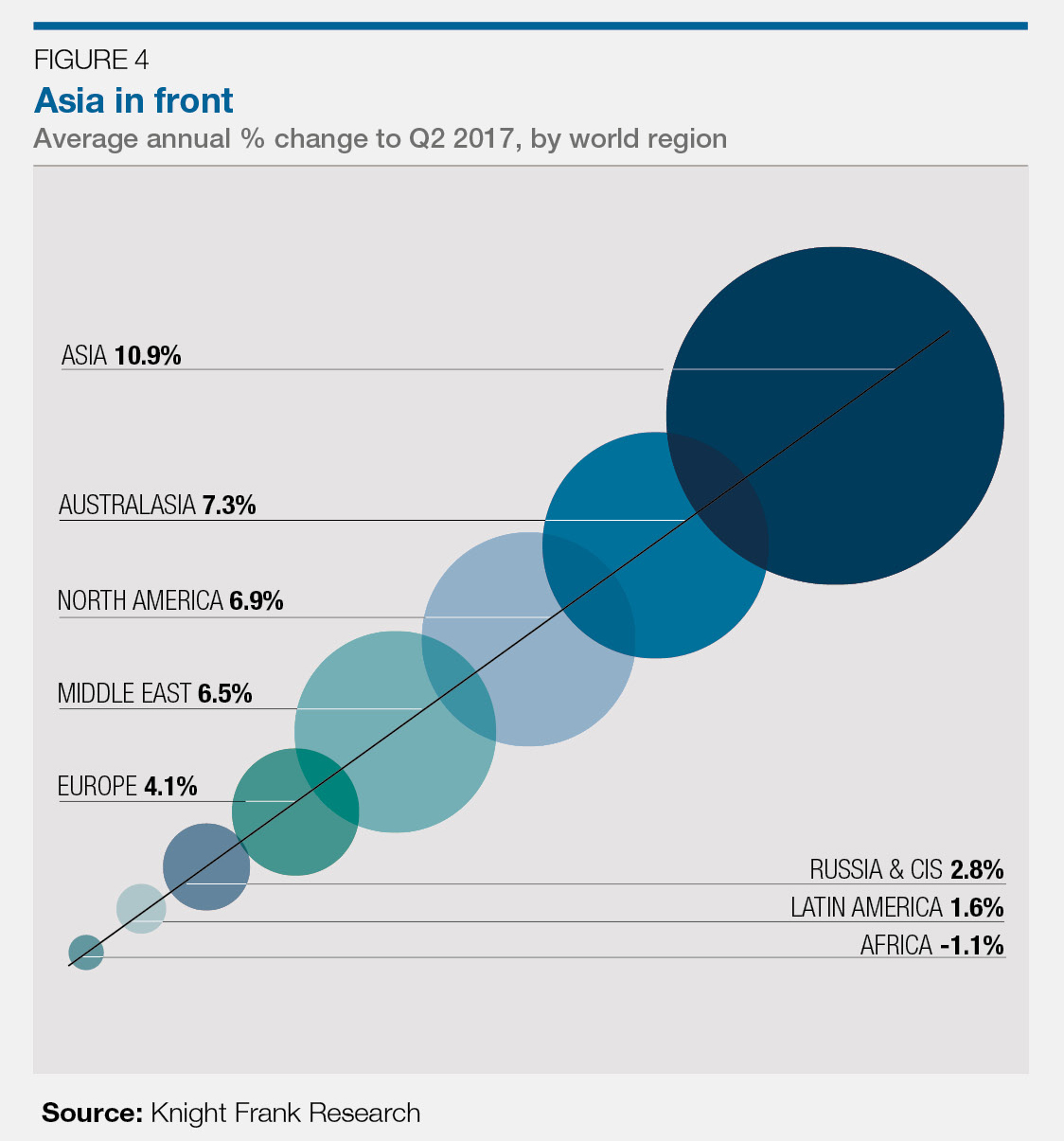

- Indian cities are among some of the notable climbers in the rankings, with the Kerala port city of Kochi ranking second with its 27.3% increase in housing prices. A year ago, the ten Indian cities tracked by our index averaged 3% annual price growth, today this figure has jumped to 12%.

- Toronto leads the rankings this quarter with prices ending the year to June 29% higher. Following the introduction of a new tax on foreign buyers in April of this year, Toronto may follow Vancouver’s path and see price growth moderate in the coming months.

- The number of cities registering declining house prices year-on-year remains static at 27 but European cities are increasingly well-represented at the bottom of the table, particularly those in the southern European economies such as Greece, Cyprus and Italy.

Nicholas Holt, Head of Research for Asia-Pacific, Knight Frank Asia-Pacific, says, “There are now six Indian cities in the top 20 ranking compared to just one in Q1 2017 – a translation of the recovery in market sentiment triggered by various factors including expected clarity on policy issues, the upcoming festive season, strong growth in the economy and tamed inflation. Chinese cities, on the other hand are continuing to feel the pressure of cooling measures, including the impact of the recently introduced stricter sales restrictions across eight cities.”

Kate Everett-Allen, Partner, International Residential Research, says, “Although the index covers the period to the end of 2016 but already in March, we have seen a new round of lending curbs and purchase restrictions across China’s main cities which has brought price growth in several cities to an abrupt halt.”

Click here to download the Knight Frank Global Residential Cities Index Q2 2017

For more information or to discuss the report email or phone Mr Nicholas Holt, Asia-Pacific Head of Research Knight Frank via the contact details below.

Similar to this:

“Houses are built to be inhabited, not for speculation” President Xi

Real estate tycoon Xu Jiayin is China's new richest man

As China cracks down on outbound acquisitions, Belt and Road acquisitions surge