CBRE Thailand, the leading international property consultant, reveals positive signs for large condominium units in Downtown Bangkok’s residential market, which are considered rare, while the Phuket market is growing rapidly for the third consecutive year, with new projects set to launch this year.

Ms. Artitaya Kasemlawan, Head of Residential Sales-Project at CBRE Thailand, summarized the Downtown Bangkok residential market. The average sales rate of ready-to-move-in condominium units reached 93% due to a limited number of new projects launched and the accelerated clearance of completed stock. Additionally, unprecedented demand from foreign customers significantly boosted residential property sales. By the end of 2024, the total number of transferred units nationwide was 14,573, an increase of 5.27% compared to 2023. Reports indicate new project launches in prime locations, with these projects well-developed in terms of design, functionality and quality.

At the end of 2024, only 11 new condominium projects launched in Downtown Bangkok, totaling 3,029 units. Most developers focused on clearing completed stock to maintain liquidity and are cautious about the overall market situation, waiting for positive signals from various sectors. While waiting for the right moment to launch new projects, developers are enhancing their offerings to create significant and tangible selling points that address their target audience's needs. Projects launching in 2025 are expected to be well-designed and developed to highlight unique features and compete effectively in the market. Last year, existing condominium projects in Downtown Bangkok achieved an average sales rate of 93%, with the top three locations being along the Riverside, Central Lumpini and Outer Sukhumvit. Buyers in this segment seek products that match their lifestyles, offer comprehensive services and amenities, provide value, and can serve as assets or rental properties in the future.

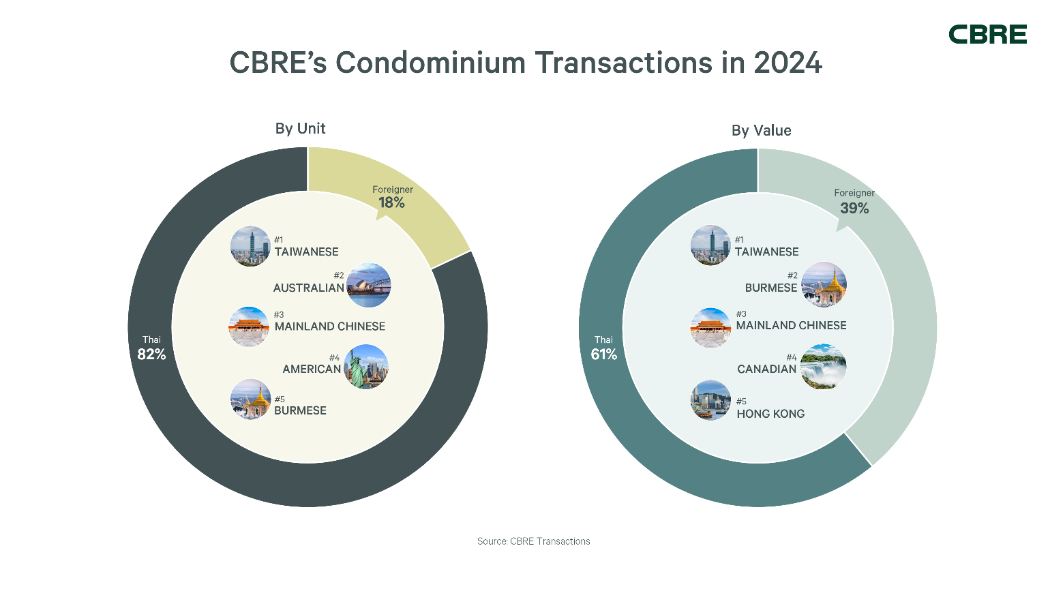

CBRE's 2024 sales of luxury condominium projects showed 82% of units sold went to Thai customers, while 18% went to foreign buyers. Foreign customers with the highest number of units sold were Taiwanese, followed by Australian, Chinese, American and Burmese. In terms of sales value, Thai customers accounted for 61%, while foreign buyers made up 39%, a substantial share. Taiwanese customers also topped the sales value list, purchasing mostly ready-to-move-in luxury condominiums in the Central Lumpini area, followed by Burmese, Chinese, Canadian and Hong Kong buyers. The highest sales value purchased by a foreign buyer was THB 230 million in the Sukhumvit area.

The Central Lumpini area stands out as the most popular location for both Thai and foreign customers, thanks to its amenities and convenient access to BTS and MRT transportation. This popularity has driven strong sales for condominium projects, with The Residences at Dusit Central Park selling more than 85% of its units before completion, next are the Sukhumvit and Silom-Sathorn areas, where 73% of buyers purchase for their own living and 27% for investment. CBRE has observed continuous demand for large luxury condos in the city center, despite a limited supply of large units. This trend is expected to continue into 2025.

The luxury housing market in Bangkok remains of interest but is less vibrant than in previous years, with a sales rate of 59%, indicating a slowdown compared to the previous year. Over the past five to six years, a high rate of new project launches has given buyers more options. According to CBRE's insights on customer behavior, the most popular locations for luxury homes are Downtown Bangkok, followed by Eastern and Northern Bangkok. Buyers primarily purchase for their own living (94%) and investment (6%), seeking homes with four to five bedrooms, more than 400 square meters of living space, and land plots exceeding 100 sq. wah.

CBRE predicts that popular housing projects in 2025 will continue to be those in convenient locations with easy access to Bangkok's CBD and close to amenities, leading universities and international schools. Developers must carefully design products to meet changing customer needs, not only for more living space and higher quality, but also considering price and value, as increased market options lead to more comparisons and choices.

In 2024, CBRE's Residential Sales-Project achieved sold-out status for several projects, including Tonson One Residence, a super-luxury freehold condominium in Central Lumpini, and COMMON TU, a premium high-rise condominium adjacent to Thammasat University Rangsit. CBRE provided marketing and sales management consulting, targeting genuine demand to achieve 100% transfer of ownership, whether for own living, second homes, long-term investment, rental, or asset accumulation for future profit. CBRE also collaborates with partners both domestically and internationally, including those in Taiwan, Hong Kong, China, Japan, Singapore, Cambodia, and the Middle East, as well as partners in various industries such as luxury brands, banks, high-end furniture and leading hospitals. This collaboration enhances business opportunities in offering luxury residences to meet continuous demand from both Thai and foreign investors and residents.

“For 2025, CBRE forecasts a gradual recovery in the residential market for both houses and condominiums in Bangkok. CBRE has been appointed as marketing consultant and sales agent for several projects launching this year and next, including super-luxury condominiums in central Bangkok, branded residences, and luxury housing projects in various locations. Most projects will have distinct characteristics due to thorough development,” Ms. Artitaya added.

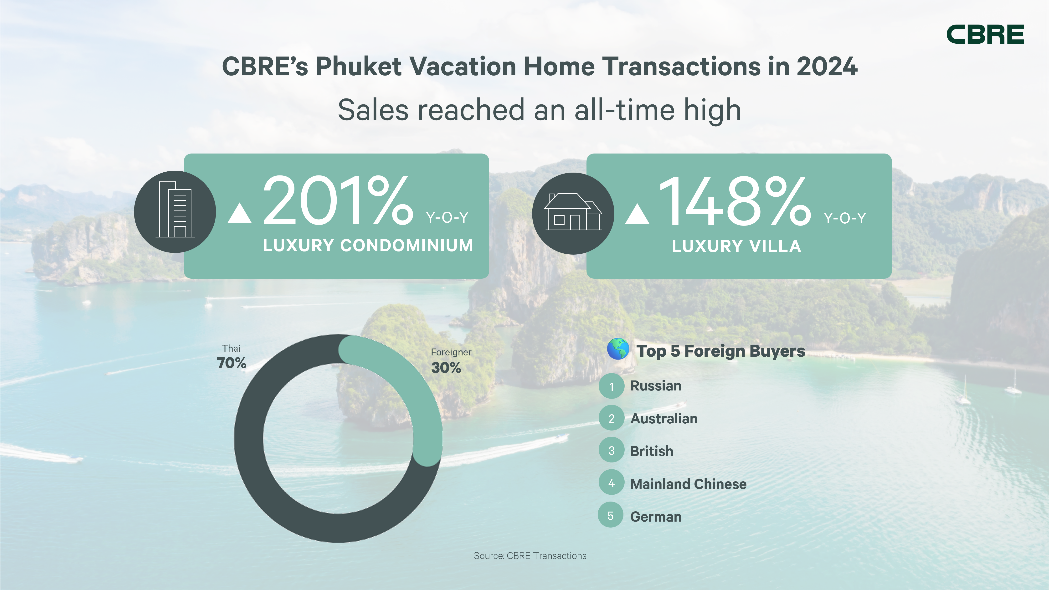

Ms. Prakaipeth Meechoosarn, Head of Phuket Property Sales at CBRE Thailand, revealed that the Phuket vacation home market continues to grow, with local developers dominating the market and Bangkok developers actively investing. CBRE's condominium sales at the end of 2024 increased by over 201% from the previous year, following a 96% rise in 2023 sales compared to 2022. Villa sales also surged by 148% at the end of 2024, the highest on record. Additionally, CBRE sold branded residence villas located on Bang Tao Beach, with a total value exceeding 700 million baht consists of 3 units.

According to Phuket vacation home customer behavior, 75% of purchases are for investment, while 25% are for personal use. Thai customers accounted for 70% of sales, while foreign customers made up 30%, primarily from Europe and Asia, including Russia, Australia, the UK, China and Germany. CBRE noted a diverse range of foreign customers, including Japanese and Swiss customers, purchasing condominiums for both short-term and long-term investment, recognizing the growth potential of Phuket's real estate market. There is also significant interest from Middle Eastern and Indian buyers. CBRE expects Thai customers to remain the largest group in 2025, alongside continued demand from foreign buyers and a more diverse customer base, indicating sustained interest in Phuket's residential market.

Last year, CBRE’s Phuket Property Sales managed several projects, including The Standard Residences, Phuket Bang Tao, which exceeded sales targets by more than 70%; PEYLAA Phuket Bang Tao, a luxury resort-style condominium; and Sri Panwa Lagoon Phuket, a new mixed-use mega project in Bang Tao. Other well-received projects include Veranda Villas and Suites Phuket, with has only three units remaining, Ms. Prakaipeth added.