The Office of the National Economic and Social Development Council (NESDC) revealed that the Thai economy expanded by 2.3% YoY in Q2, increasing from 1.6% recorded in the previous quarter. However, growth was unevenly distributed. Tourism remained the primary growth engine, driving activity in the service sector and contributing to increases in employment and private consumption. Merchandise exports, excluding gold, rose in tandem with improved manufacturing production. However, some industries faced challenges in exports and production due to high inventory levels and structural issues related to declining competitiveness. Private investment in machinery and equipment grew, while government spending saw a significant boost following the enactment of the 2024 Budget Act. On the economic stability front, headline inflation was recorded at 0.62%, driven by higher energy prices as government subsidies were gradually lifted, along with reduced supply of vegetables and pork. Core inflation, however, eased to 0.36% due to lower prices of prepared foods and personal care products. The labor market continued to improve, primarily due to stronger employment in the service sector.

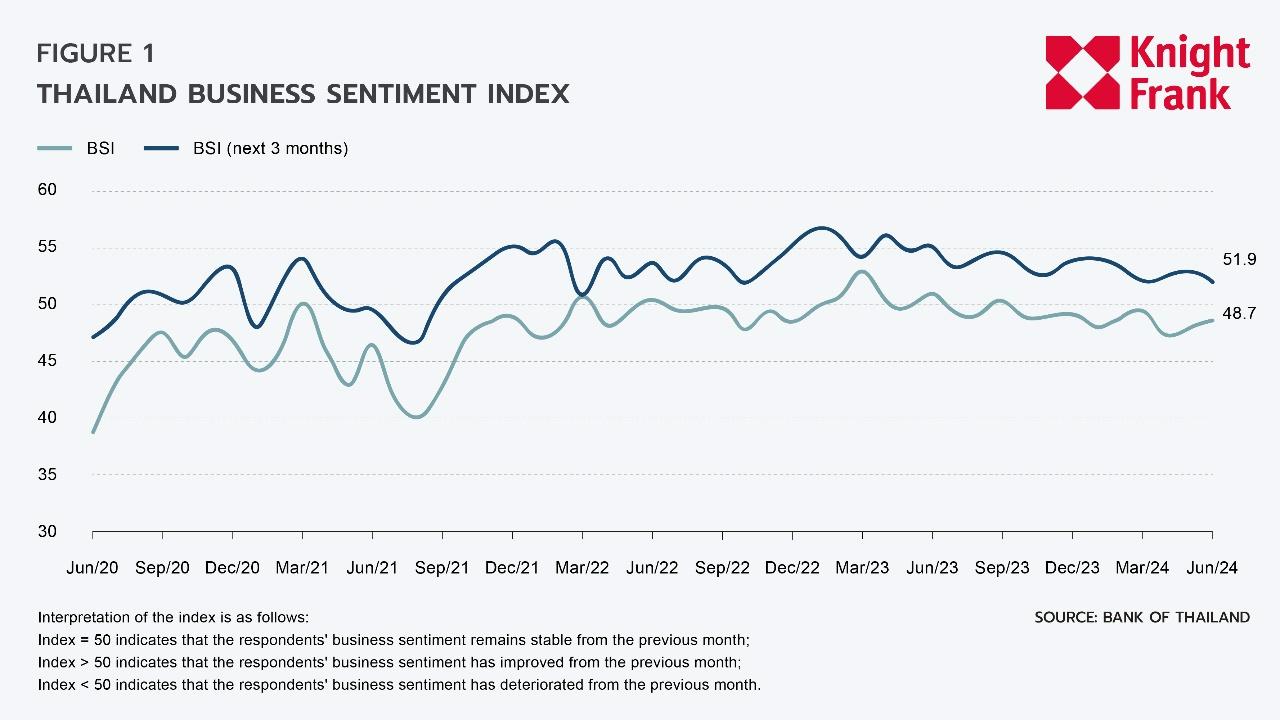

In June, the Business Sentiment Index (BSI) rose but stayed below 50, indicating an uncertain business recovery, with a gradual improvement in manufacturing but a decline in non-manufacturing. Despite the 3-month expected BSI remaining above 50, overall confidence has decreased since last year, driven by lower confidence in the non-manufacturing sector, while manufacturing confidence remained stable.

Supply

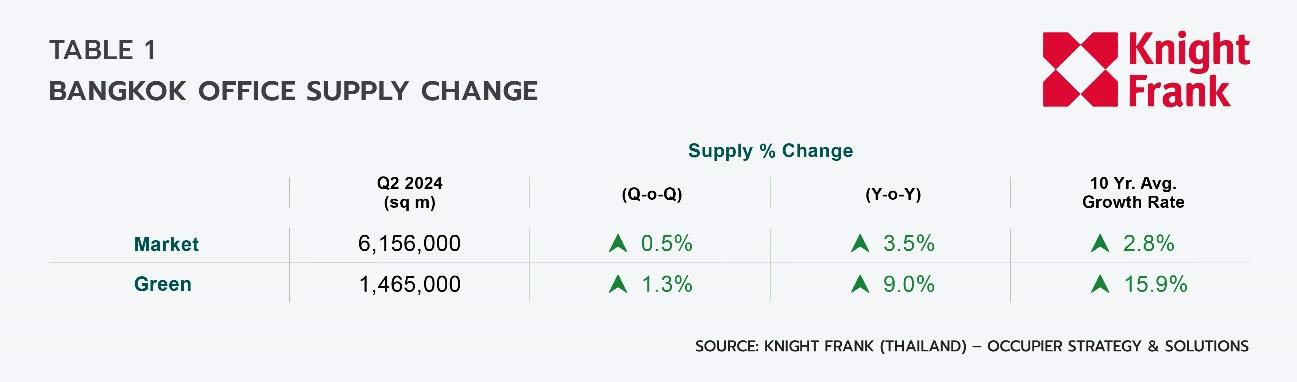

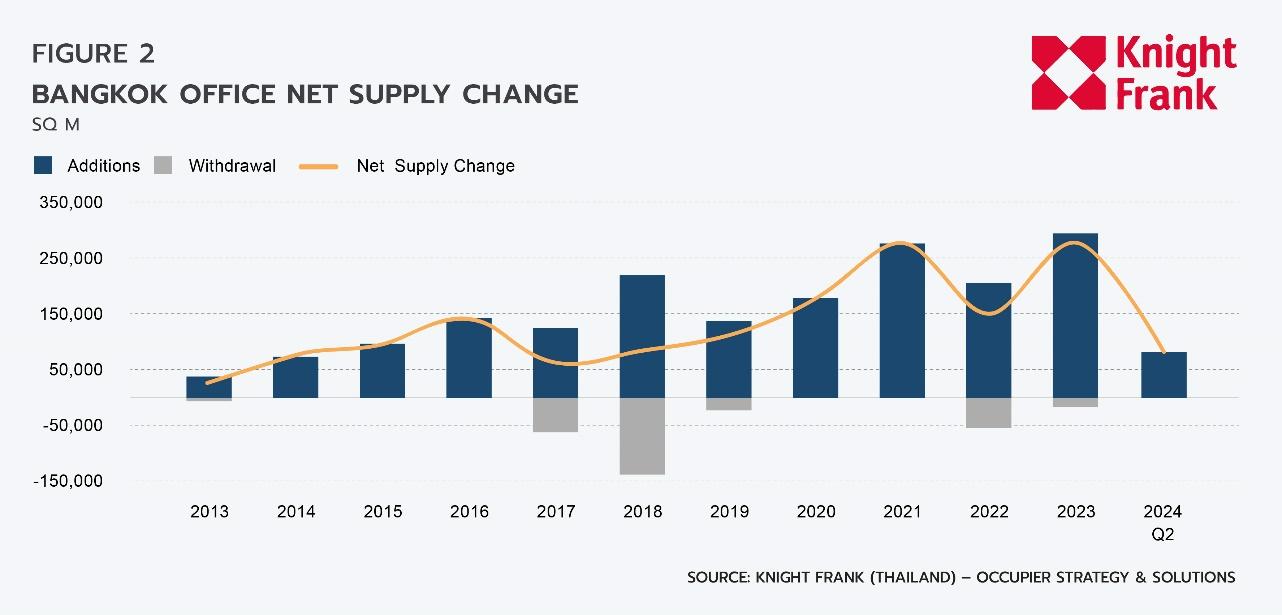

Bangkok's total supply of office space expanded this quarter by 29,200 sq m, or by 0.5% QoQ, to 6.16 million sq m following the completion of Supalai Icon Sathorn and Ratchayothin Hills. Currently, green buildings represent 24% of total supply.

Future Supply

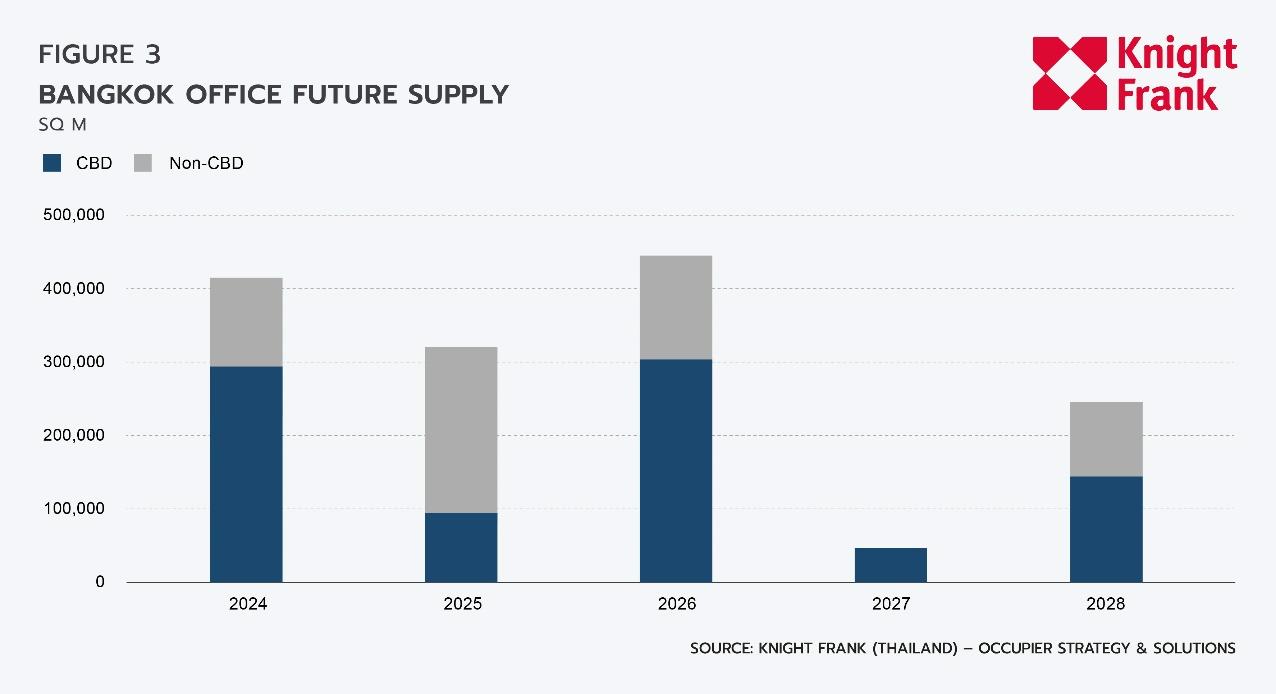

With no new projects announced, the total lettable area for upcoming developments has decreased to 1.46 million square meters, representing 24% of the current office space supply. The CBD remains the primary focus, with 60% of the forthcoming supply concentrated in central areas. Over the next 2.5 years, the anticipated additional office space supply is projected to be 410,700 sq m in the latter half of 2024, 316,000 sq m in 2025, and 440,400 sq m in 2026.

Demand

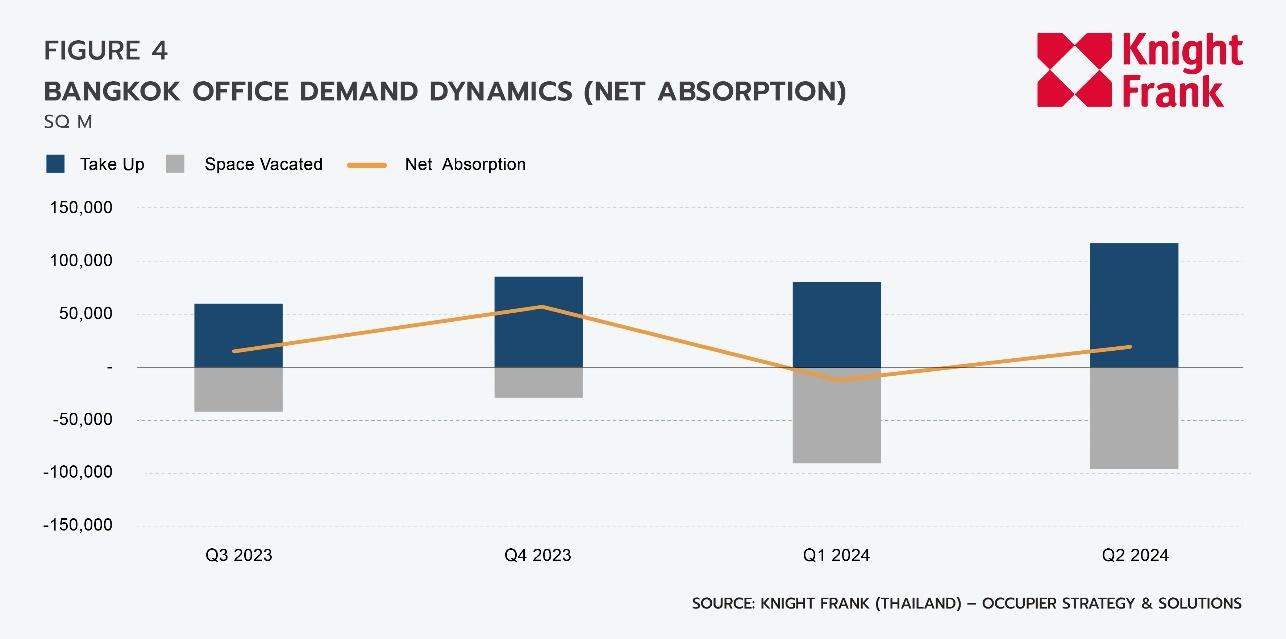

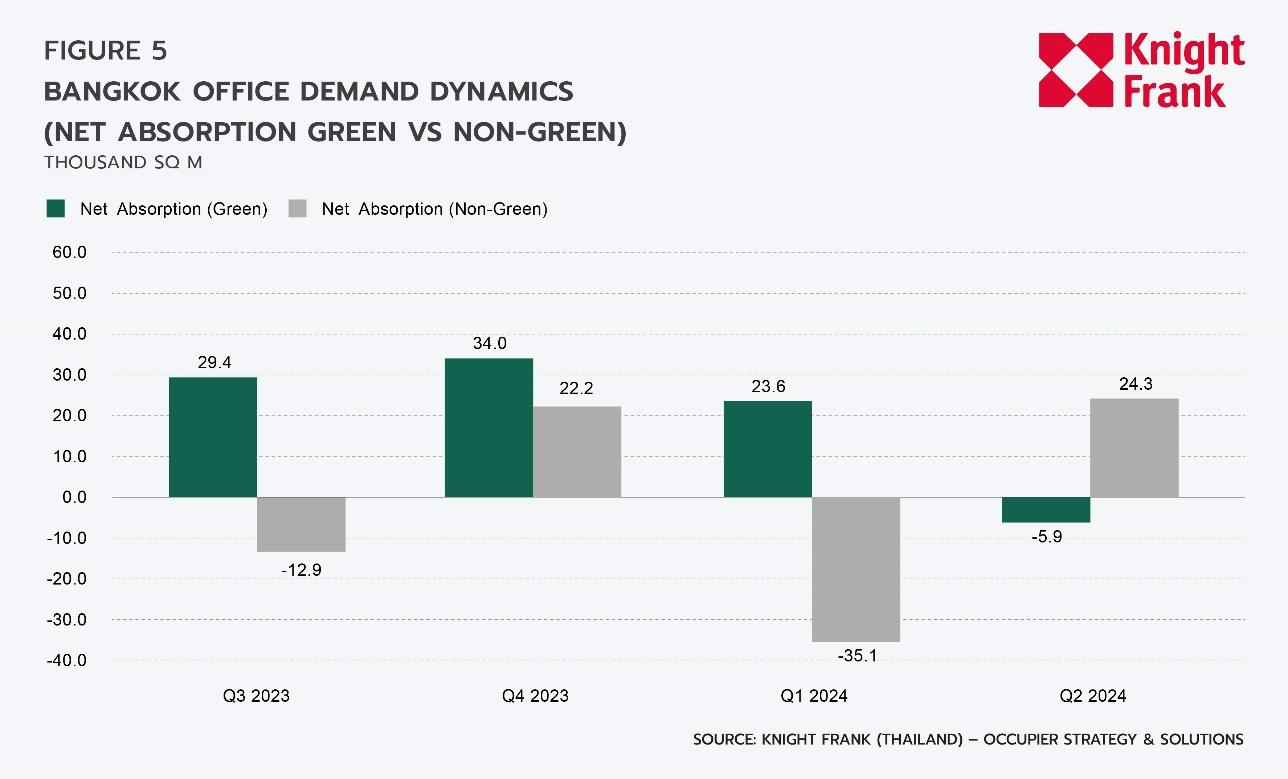

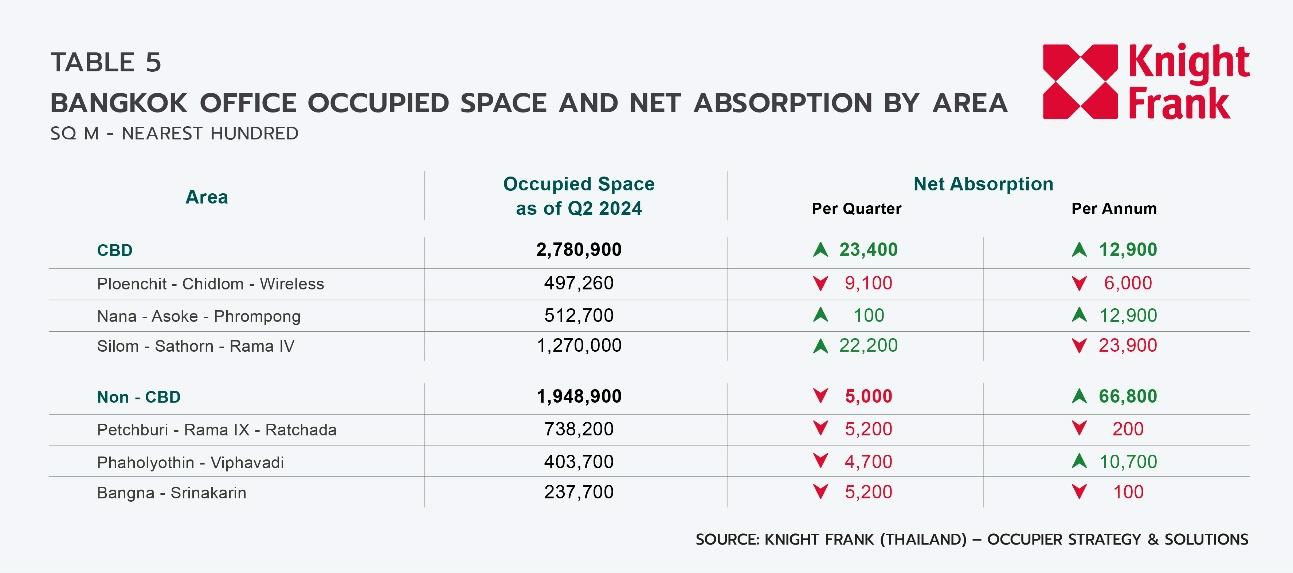

The office market this quarter recorded a positive net absorption figure of 18,400 sq m, rebounding from negative figures in the previous quarter. This resulted in total occupied space increasing by 0.4% QoQ to 4.73 million sq m. For the first time since Q1 2022, net absorption for green properties was negative, declining to -5,900 sq m while it increased by 24,300 sq m for non-green office spaces. Despite this quarter's figures, the broader trend indicates that sustainability remains an important driver in the office market, with net absorption for green properties likely to rebound in the coming quarters. Demand for office space in the CBD grew, reflected by 23,400 sq m of net absorption. Meanwhile, the non-CBD market contracted slightly with -4,950 sq m net absorption.

Market Dynamics by Segment

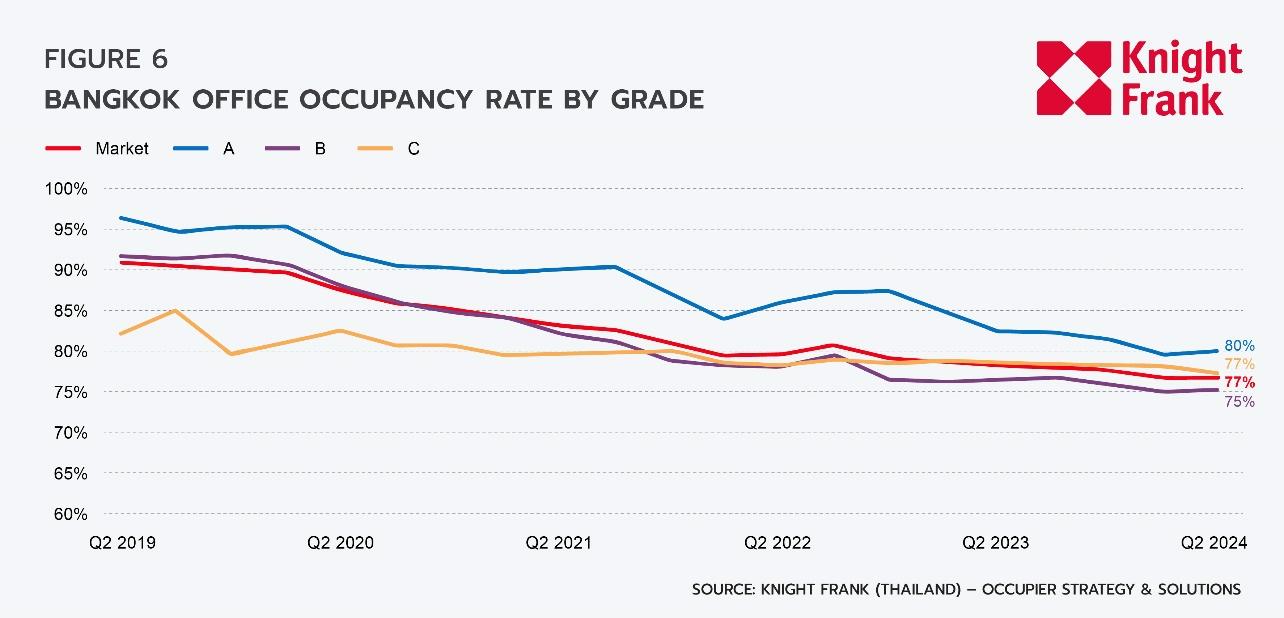

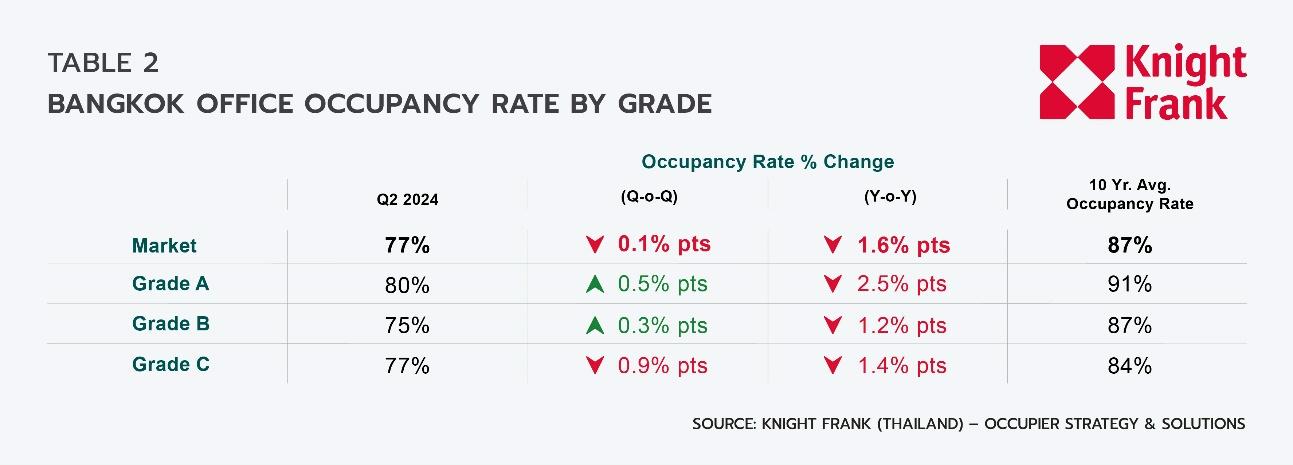

The overall market occupancy rate held steady at 77%, consistent with the previous quarter. Among the different office grades, Grade A offices showed resilience, maintaining the highest occupancy rate at 80%, despite a year-over-year decrease of 2.5% due to ongoing supply-side pressures. Grade B offices saw a slight improvement, with occupancy rising by 0.3% pts. Meanwhile, Grade C properties faced a decline, with the occupancy rate dropping by 1% pts. to 77%.

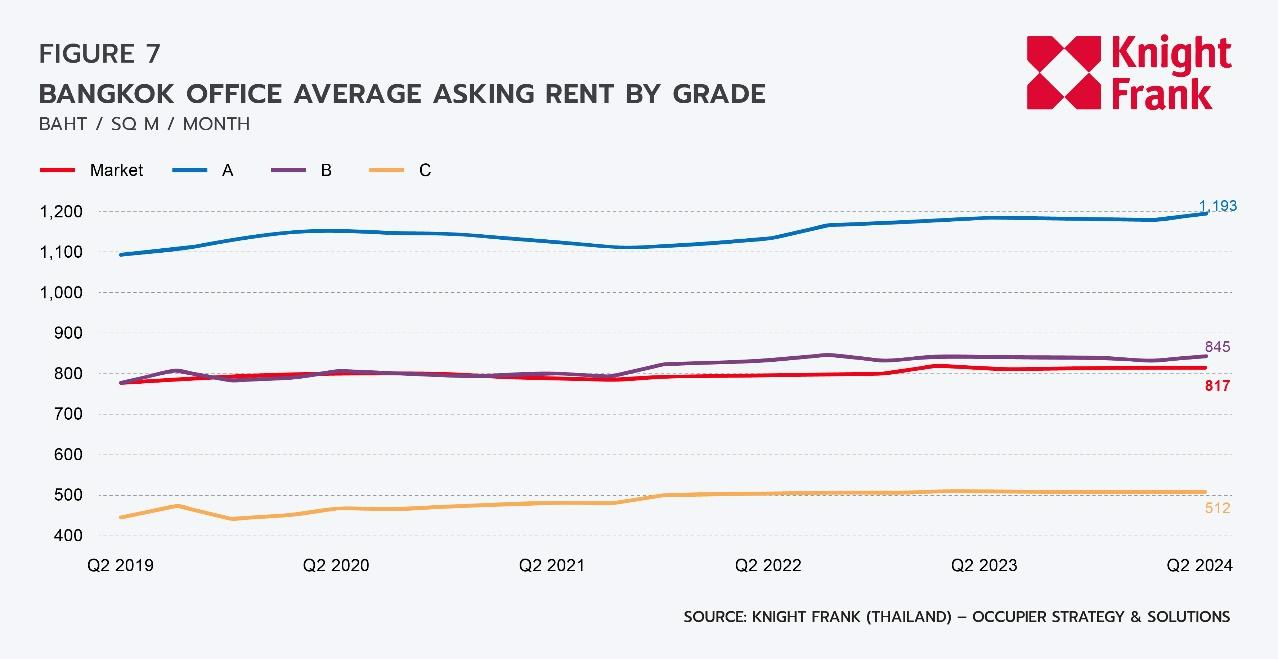

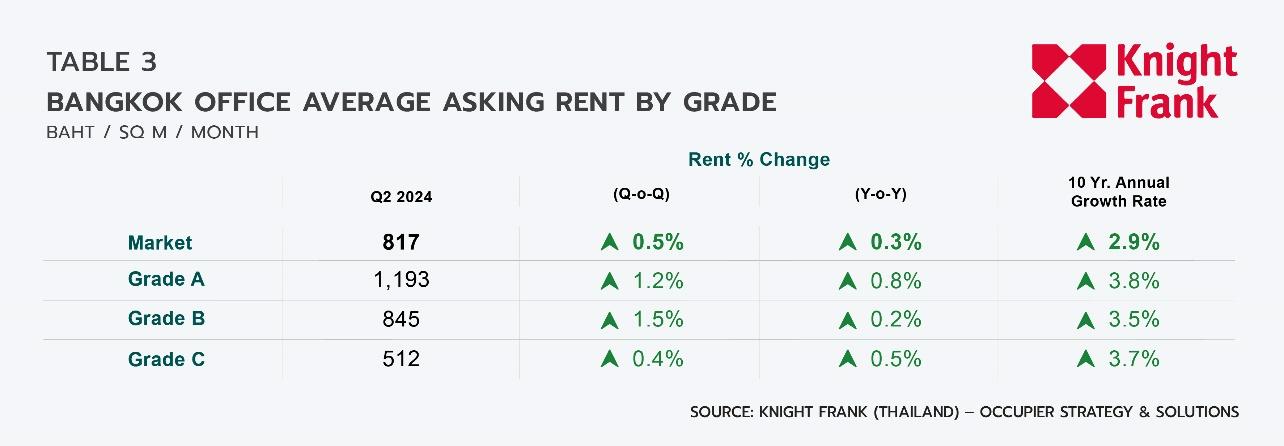

In Q1, the office sector in Bangkok reached an average asking rent of THB 817 per square meter per month, increasing by 0.5% QoQ and 0.3% YoY. The average asking rent increased across all three building grades. Despite the overall upward trend, most properties have opted to maintain their asking rates steady

Market Dynamics by Area

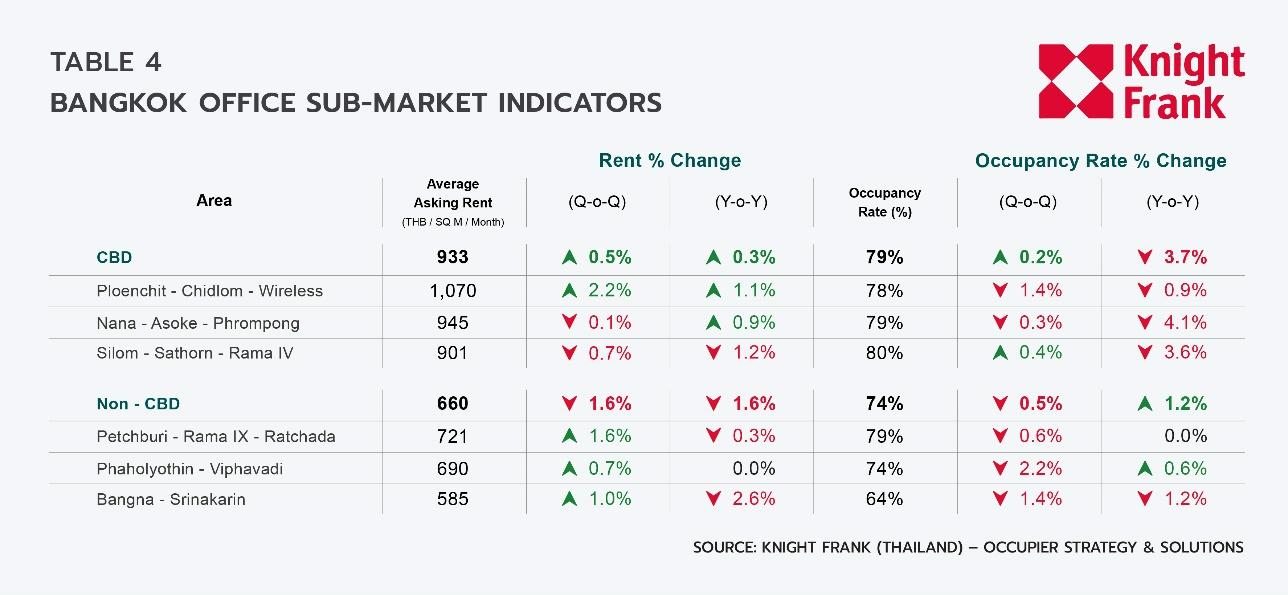

In the Bangkok CBD, the average asking rent increased by 0.5% QoQ to THB 933 per sq m per month, while the average occupancy rate remained stable at 79%. Contrary to recent trends, Silom-Sathorn-Rama IV was the primary driver of leasing activity in the CBD. The area experienced significant growth as net absorption increased to 22,200 sq m, causing the area’s occupancy rate to rise by 0.4% QoQ. Rental rates declined slightly, falling by 0.7% QoQ.

In contrast to the CBD, the non-CBD market experienced declines for both the asking rent and occupancy rate. The average asking rent by 1.6% QoQ, falling to THB 660 per square meter per month. The average occupancy rate also fell, dropping by 0.5% QoQ to 74%. All three highlighted sub-markets experienced positive rental growth, accompanied by a decline in occupancies.

Review & Outlook

Panya Jenkitvathanalert, executive director and head of office strategy and solutions, said “In the second quarter of 2024, the Bangkok office market expanded slightly, with growth in supply, occupied space and the asking rental rate. Although net absorption turned positive, the market occupancy rate continued to fall as supply continues to outpace demand.” Flight to quality remains a key characterization of tenant movement, although the definition of “quality” continues to evolve. Post-pandemic, many tenants have adapted their office space usage to prioritize flexibility, technology, and adaptability. It has become a lot more essential to create work environments that accommodate diverse work styles and emphasize employee well-being. Panya added “Sustainability and ESG considerations have gained traction for tenants when making real estate decisions. With carbon commitments in place and deadlines looming, some companies will only consider green-certified properties, even if non-certified options come with attractive incentives. As highlighted last quarter, there was a noticeable trend of tenants transitioning from home offices to traditional office buildings, driven by the demand for a wider choice of amenities and greater accessibility. This is another indication of flight to quality occurring market wide.”

Older buildings that do not undergo Asset Enhancement (AE) or make improvements in Facility Management (FM) face even greater threat from the emergence of newer buildings that employ competitive pricing strategies, physical space and services that meet the needs of modern-day tenants. With close to 1.2 million square meters still in the supply pipeline over the next 2.5 years, pressures on occupancies and rents will continue to mount. Going forward, asking rents will become even more unreliable as market indicators, as the gap between asking and effective rental rates continues to widen. In the latter half of 2024, the Silom-Sathorn-Rama IV area is anticipated to see increased leasing activity with the official opening of One Bangkok phase 1, positioning it as the key market to watch as these dynamics continue to unfold.

“Competition in Bangkok's office sector remains intense, however, you can succeed across all building grades if you understand the market and what modern tenants need. Sustainability is now a non-negotiable factor for more tenants, so it’s crucial to have green-building features and emphasize ESG practices to make your property competitive and appealing in today’s market”, Panya concluded.

For further information, please contact Panya Jenkitvathanalert, Executive Director-Division Head, Office Strategy and Solutions, Knight Frank Thailand as the details below.