Knight Frank, a leading global property consultancy, forecasts a significant rebound in cross-border real estate investments in Asia-Pacific for the second half of 2024.

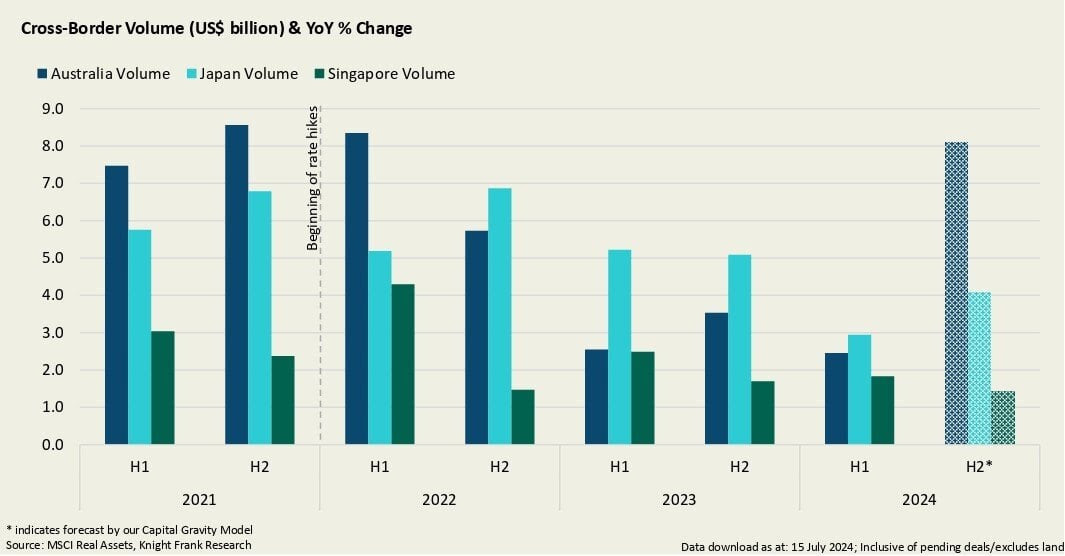

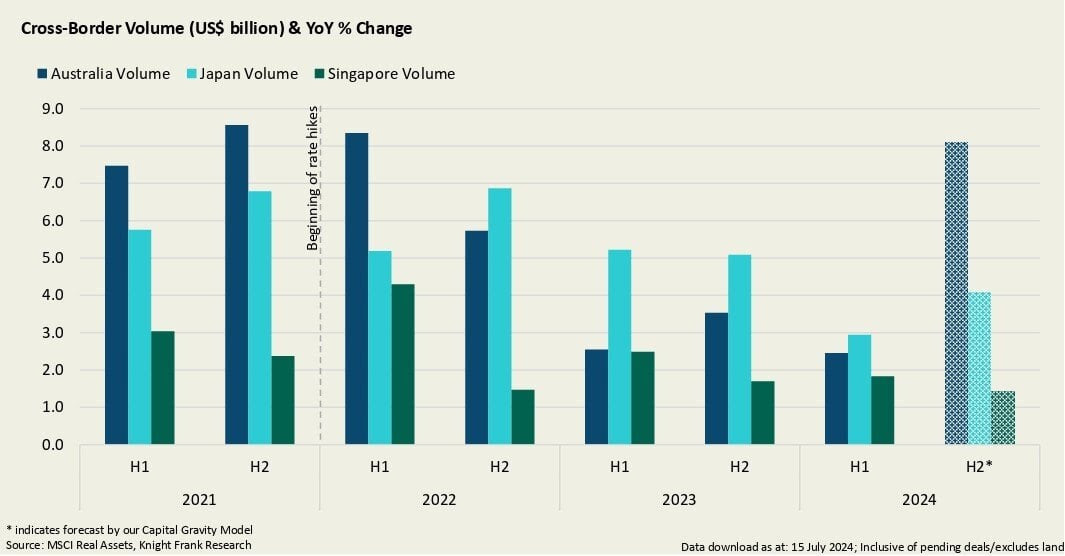

According to the firm's latest research, Horizon Report III – Look Beyond the Norm, cross-border investment volumes are expected to rise by more than 33% compared with the same period in 2023. The anticipated increase is largely driven by potential Federal Reserve rate cuts, which bode well for commercial real estate investments.

Christine Li, Head of Research at Knight Frank Asia-Pacific and author of the report, says, “Historical analyses of previous crises, including the Global Financial Crisis, the Chinese economic slowdown, and the Covid-19 pandemic, demonstrate that transaction volumes in the region typically normalise within 30 months.

Currently, we are in the 24th month of the high-interest-rate-induced downturn, suggesting the second half offers a prime investment window for undervalued assets. Early indicators of recovery are already observed in Australia and South Korea.”

Australia is projected to be the top destination for cross-border investment volumes in the second half of 2024, representing a 129% increase from the same period a year ago. For the full year, Australia is expected to attract 36% of total cross-border flows.

Neil Brookes, global head, capital markets, Knight Frank, says, "Australia stands out as a prime destination for cross-border investments due to higher-than-average re-pricing compared to the rest of the region. While the adjustment may still have further to go, the gap between valuations and buyer sentiment has narrowed and the outlook for relative returns across asset classes is shifting back in favour of offices.

The substantially higher capitalisation rates in Australian offices mitigate near-term risks and pave the way for strong risk-adjusted returns, which attract international investors.”

In Q2 2024, Australia received US$1.9 billion worth of international capital, a 2.5-fold increase compared with Q1 2024, signaling renewed confidence among foreign investors.

The office sector was the main driver of this rise, accounting for 63% of total transactions, highlighting the enduring appeal of Australian commercial real estate to international investors, especially those from Japan.

Mitsui Fudosan’s acquisition of a 66% stake in 55 Pitt Street for US$879.4 million was a stand-out transaction. This significant transaction not only highlights the continued interest of Japanese investors in Australian commercial assets but also reinforces Australia's position as a top destination for cross-border real estate capital in Asia-Pacific.

Neil adds, “The second half of 2024 is expected to witness a narrowing bid-ask spread, which should encourage more deal-making activity as cross-border investors reappraise this new outlook. Japanese investors have shown a strong appetite for Australian commercial property assets, exemplified by Mitsui Fudosan’s recent acquisition. This pattern is expected to persist as Japanese firms continue their hunt for higher-yielding assets in overseas markets.”

Japan to attract 23% of total cross-border flows in 2024

International investors are gradually re-entering the Japanese market, capitalising on favourable long-term prospects. This is most evident in established players seeking opportunities in prime locations and high-quality assets that offer stable yield spreads.

For instance, BentallGreenOak acquired Honmachi Garden City in Osaka, a mixed-use building, from Sekisui House REIT for US$422.9 million in May 2024. The deal cap rates at 3.0% for the hotel component and 3.4% for the office component reflect the premium placed on well-located, high-quality assets in Japan's major cities.

While the living sectors continue to draw investors' interest, cap rate compression has led to investors' increased selectivity in multifamily asset acquisitions. Interestingly, some investors are expanding their focus to include the senior living sector. This shift is strategic, capitalising on Japan's demographic trends toward an aging population.

Neil notes, “We expect 23% of the total cross-border flows to target Japan in 2024. As Japanese companies accelerate the shedding of property assets, more motivated sellers are unlocking extensive opportunities in the country. Japan remains a safe spot for global capital due to the Bank of Japan's cautious approach. The Central Bank monitors market conditions, prioritising sustainable wage growth and moderate inflation before significant rate hikes. A short-term 10-30 basis point rise is possible with minimal impact on value-add players.

Singapore maintains appeal with 11% of total cross-border trade

Despite a general retreat from both domestic and international investors, Singapore’s real estate market continues to demonstrate healthy appeal to global capital. In H1 2024, cross-border investments accounted for a substantial 48% of total real estate investment volume, surpassing the 10-year average of 43%.

Although both domestic and international investors retreated, the proportion of cross-border capital remained substantial at 48% in H1 2024, exceeding the 10-year average of 43%, and indicating that Singapore continues to attract significant cross-border investment.

Total cross-border volume amounted to US$756.8 million in Q2 2024, supported mainly by PAG’s acquisition of Mapletree Anson, an office building, from Mapletree Pan Asia Commercial Trust for US$567.5 million. Overall investment activity increased by 63.8% compared with the same period a year ago.

Christine adds, “Interest in Singapore's real estate assets can be attributed to its macroeconomic stability, business-friendly environment, and politically neutral stance, which persistently instill confidence in investors seeking portfolio diversification and wealth preservation. This positions Singapore at third place in capital flow predictions for the Asia-Pacific region in 2024, attracting about 11% of the cross-border capital.”

These factors not only highlight Singapore's appeal but also reflect broader trends in the Asia-Pacific investment landscape. For 2024, the office sector is expected to attract the most cross-border investment volume at 30%.

Asia-Pacific investment volume by sectors

Office: 30% of all transaction volumes

- Australia and Japan are forecast to experience a rebound, with full-year volumes nearly doubling from 2023 levels

- Singapore is expected to receive 15% more volume from this sector this year

- Greater China may witness significantly lower volumes in 2024 than in previous years

Industrial: 29% of all transaction volumes

- Expected to recover to below 5-year average (2028-2022)

- Greater China volumes are projected to fall by over a third year-on-year in 2024, making it the lowest since 2018

- India is set to achieve its second-best year after 2021

- Activity in Singapore is expected to rise above the long-term average, similar to the peaks seen in 2017/2018

Living: 18% of all transaction volumes

- Projected to recover to above 5-year average (2018-2022)

- Top locations are Japan, Australia, and Greater China

- Australia is expected to see its best year on record

Despite Q2 2024 cross-border volume reaching US$6.2 billion, which is nearly one-third lower than the same period in 2023, the slowing rate of decline suggests that the market may be approaching its trough.

Combined with the anticipated Federal Reserve interest rate cuts in September and December, these factors contribute to a more conducive investment environment.

Christine adds, “Cross-border investments have experienced a harsh retreat since interest rates started to hike aggressively in the second half of 2022. With yields not expanding fast enough, and assets still being repriced, investors have exercised caution, focusing on opportunities within their national boundaries rather than pursuing ventures in foreign markets."

Related Readings

Singapore received the highest proportion (45.6%) of overseas investment among Asia-Pacific markets in Q1 2024 – Knight Frank | RE Talk Asia