Leading diversified professional services and investment management firm Colliers (NASDAQ and TSX: CIGI) today releases its Q2 2024 Singapore Office Market Report and Outlook.

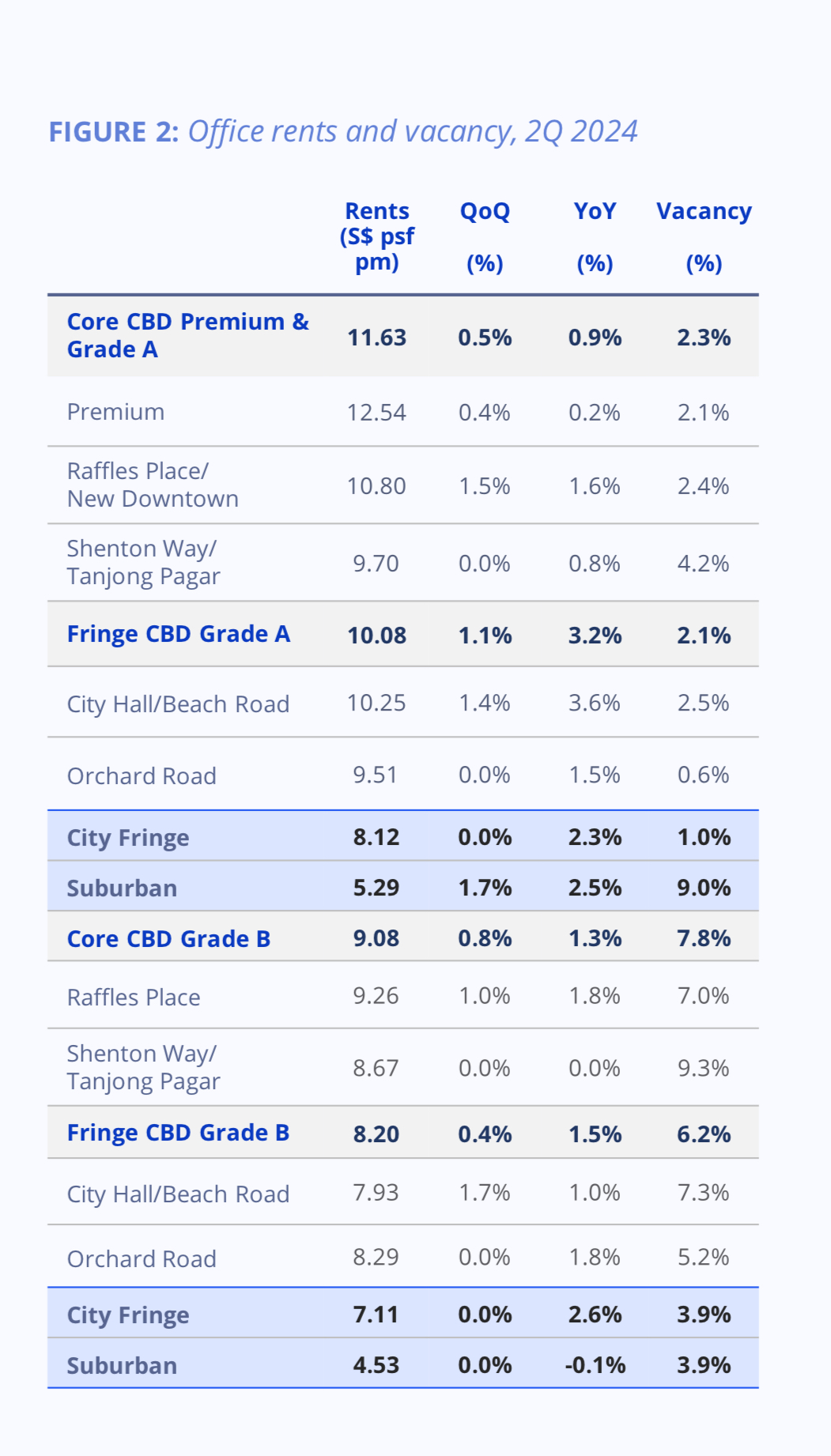

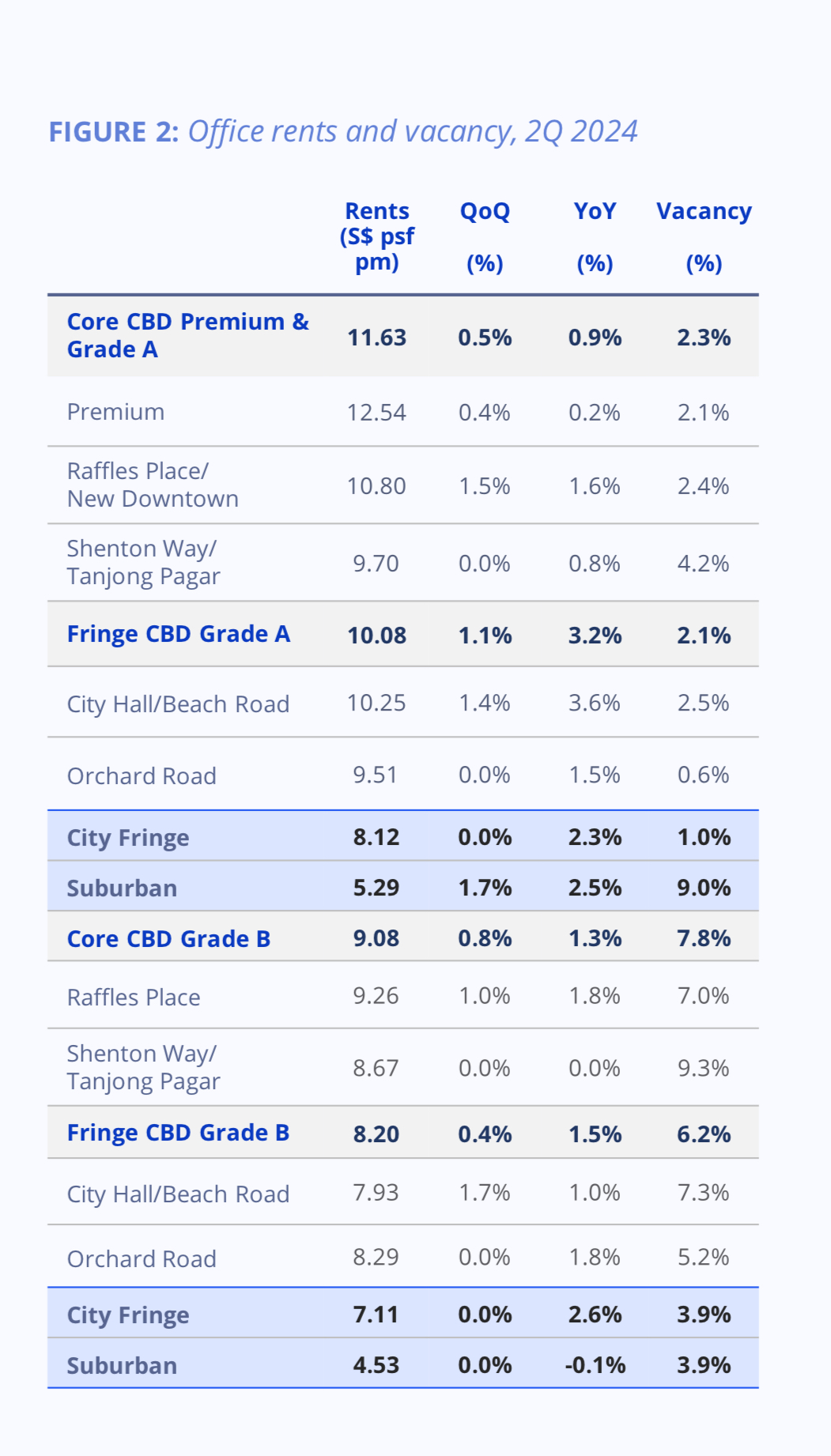

Core CBD Premium & Grade A office rents grew 0.5% QOQ during 2Q 2024, continuing its growth in the previous quarter to SGD 11.63 per sq ft, demonstrating the strength and resilience of the market.

This growth in rents was driven by the Grade A segment, particularly those at Raffles Place/New Downtown. Landlords of quality buildings have been able to maintain, or even increase their asking rents, leading to renewals signed at higher rates. Good quality and well-located secondary spaces have also been backfilled quickly.

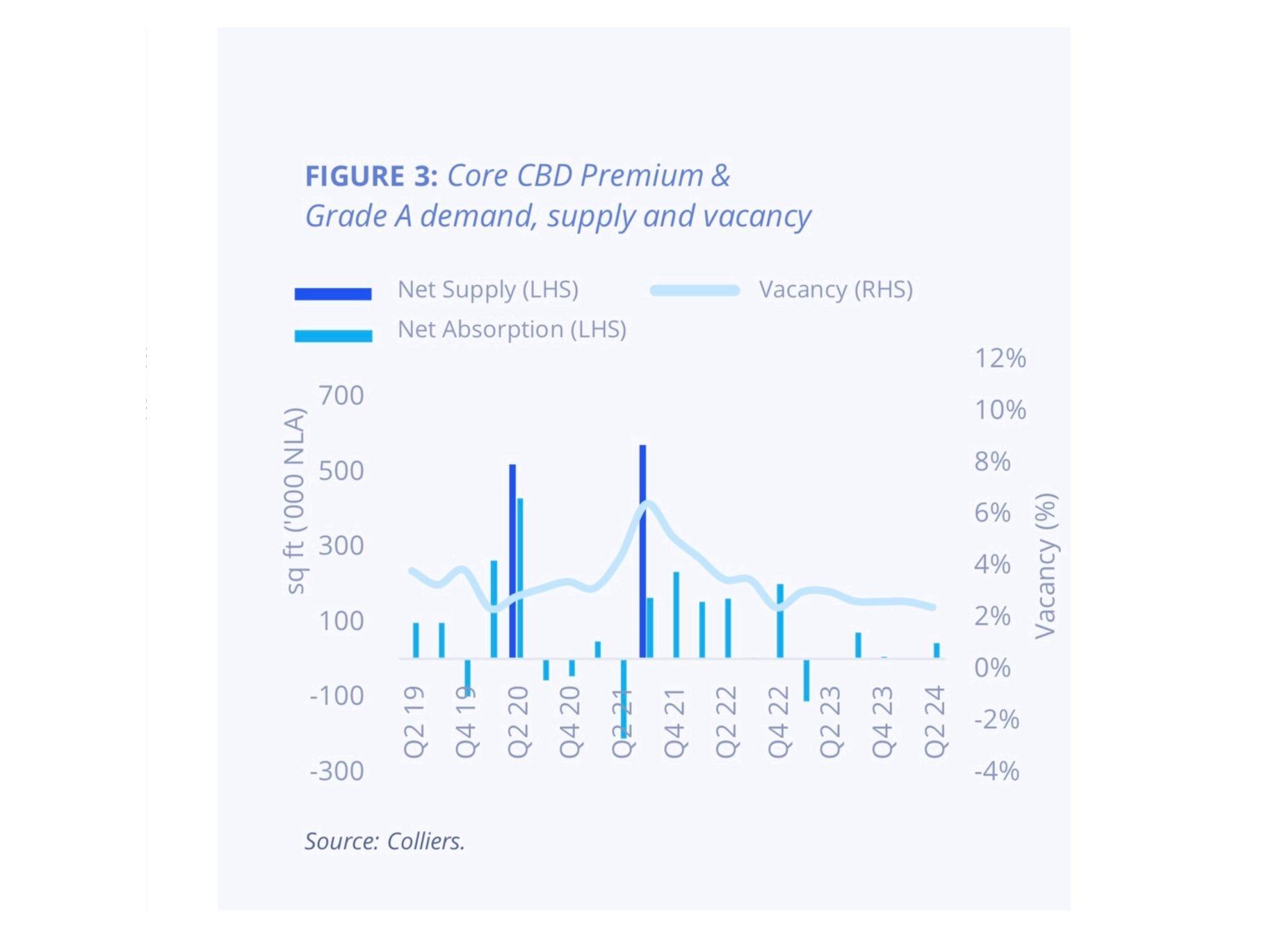

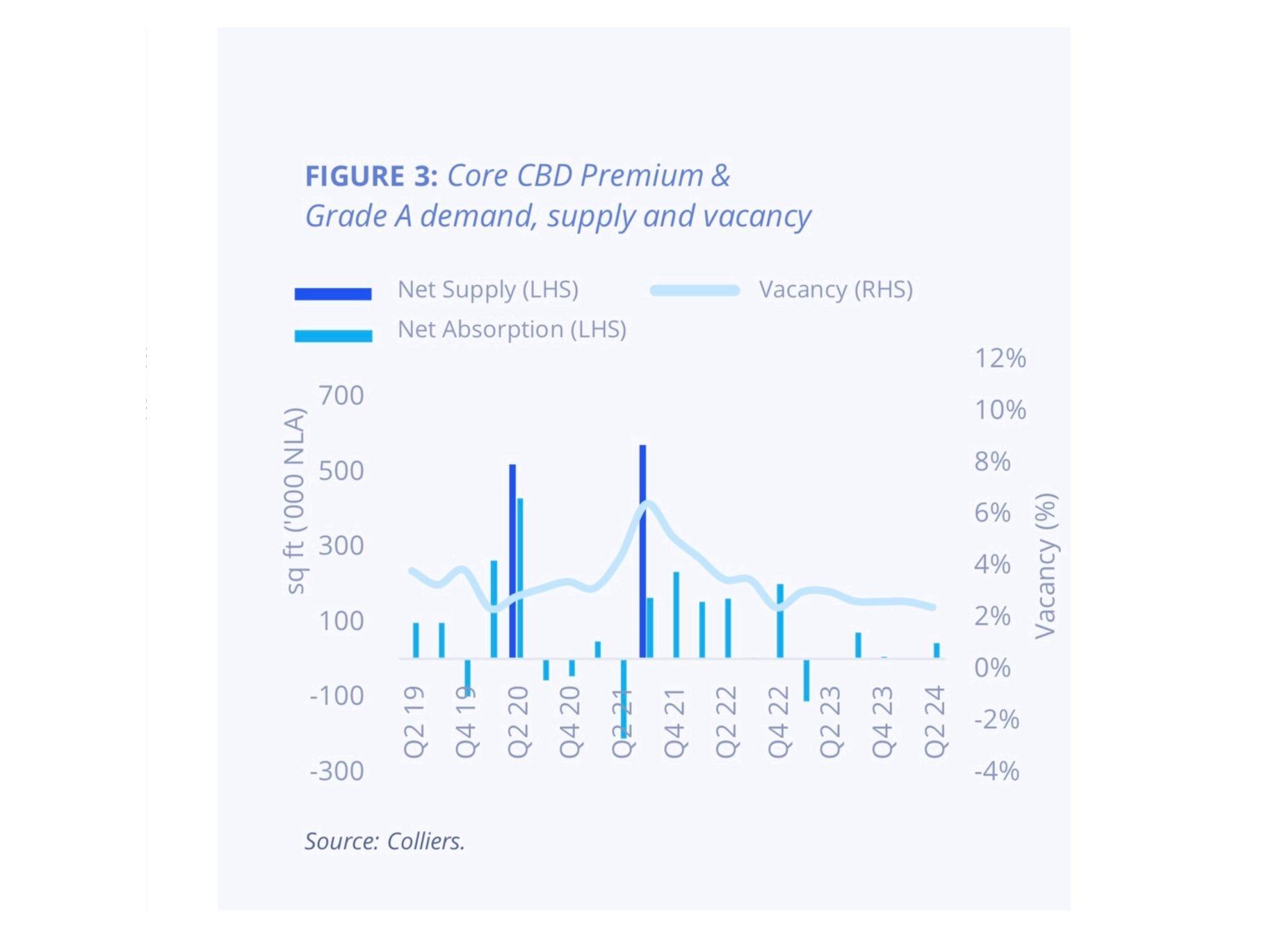

Core CBD Premium & Grade A demand, supply and vacancy

Source: Colliers

Q2 2024 Office Rents and Vacancy

Source: Colliers. Note: Average gross effective rents are benchmarked to a full-floor space in mid-zone level; conservative figure towards lower-end of rental range for a property. Effective rent refers to average rate payable over the lease term after accounting for incentives.

Ms Tridiana Ong, Head of Occupier Services | Singapore, Colliers said: ““Moving forward in 2H2024, well-informed tenants should leverage the increasing competition as space availability builds up from both the primary and the secondary market. Recognizing capex as the major barrier to prospective tenants' relocation, more landlords are open to discuss various forms of fit-out support. “

Rental growth in the Core CBD Premium & Grade A segment will likely slow in the later part of the year due to increasing competition and tepid demand.

Landlords may face increasing competition with more upcoming supply; apart from 1.26 mil sq ft of prime office space coming on stream from IOI Central Boulevard Towers in the next quarter, Labrador Tower at the city fringe has seen healthy interest from government agencies. These new builds are likely to attract tenants with their modern and ESG-compliant specifications.

Several buildings in the CBD Grade B segment have also undergone major Asset Enhancement Initiatives (AEI), and thus are able to command higher rents and provide viable alternatives to tenants looking to be centrally located.

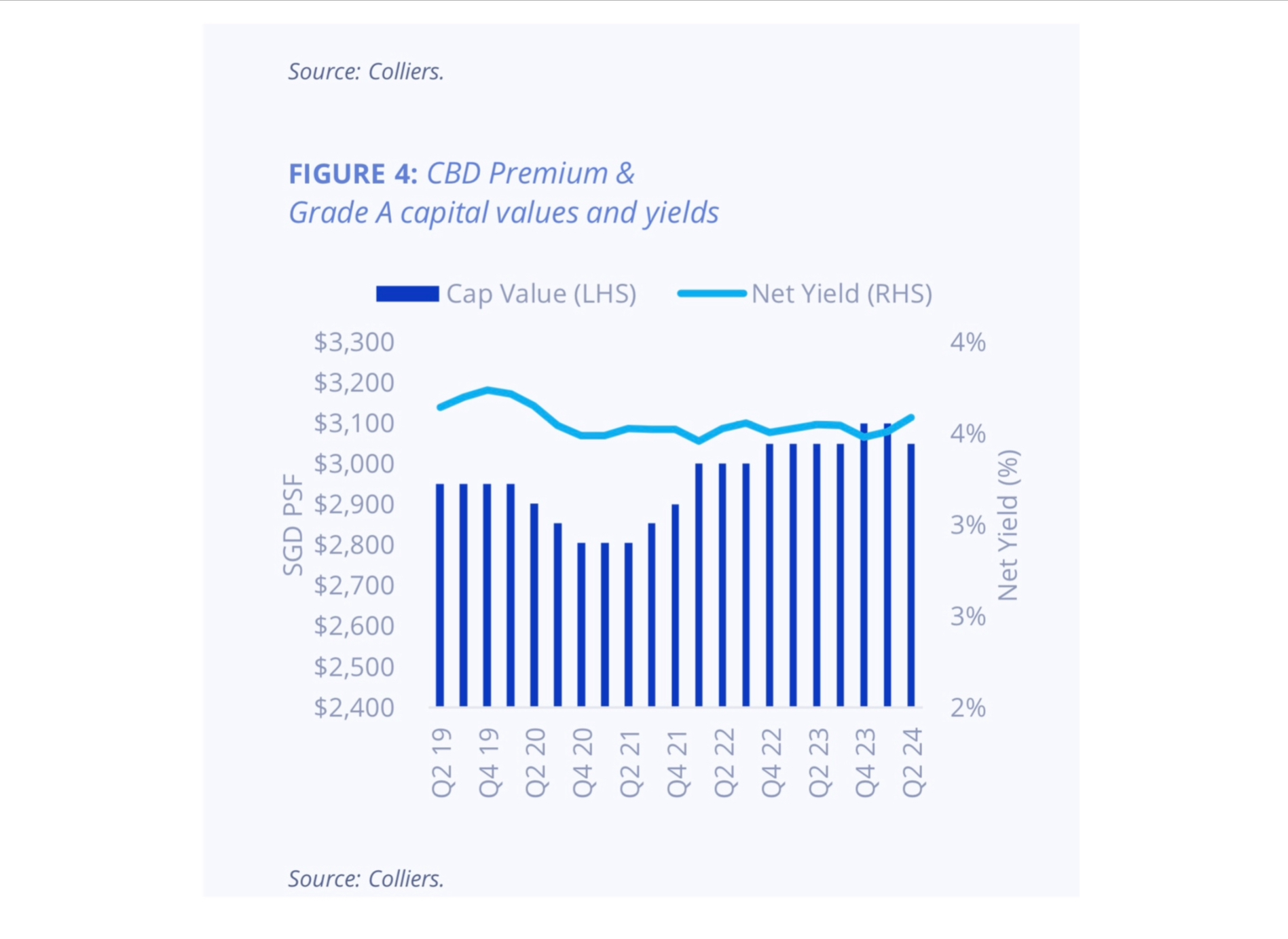

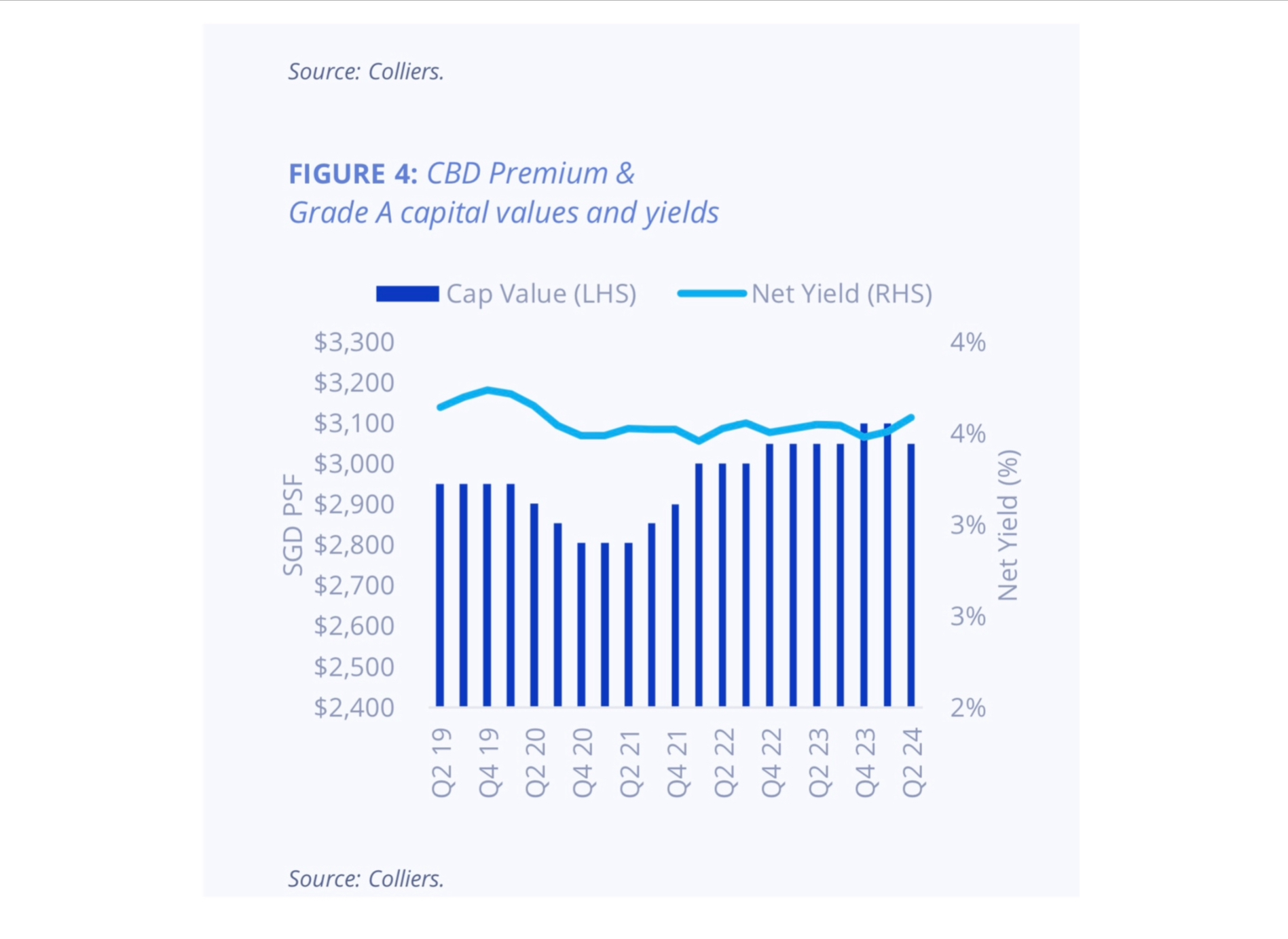

Ms Catherine He, Head of Research | Singapore, said: “Mapletree Anson transacted this quarter was an example of an opportunistic purchase from a REIT selling to reduce gearing and could lead to further pressure on Singapore office values. With the weight of capital waiting by the sidelines, this could also pique the interest of investors into relooking at office assets. Nevertheless, in the longer term, office capital values are expected to remain resilient and well supported by the ample liquidity in the market as well as the impending easing of interest rates.”

To request a copy of the Colliers Office Market Report and Outlook, in Q2 2024 or further information, please contact Tridiana Ong, Head of Occupier Services, Colliers Singapore and Catherine He, Head of Research Colliers Singapore via the contact details below.