Amid a challenging business environment which sees a reduction in sentiment among corporate real estate leaders, the Asia-Pacific offshoring market is forecast to more than double to USD 185.1 billion by 2032. This growth is expected to drive an additional office demand of between 4.7 and 5 million square metres per year for the next three years. This insight is drawn from Knight Frank's Asia-Pacific Horizon: Harnessing the Potential of Offshoring, which studies the essential factors that define the region's appeal as the best location for offshore services and sheds light on the significant changes in the industry.

In the global context, the market is forecast to grow to USD 544.8 billion in 2032, reflecting an 8.5% compound annual growth rate (CAGR). Although North America will continue to retain its dominant market share, Asia-Pacific is expected to record the highest CAGR globally at 10.2%.

Asia-Pacific capitalising on global trends to take the offshoring spotlight

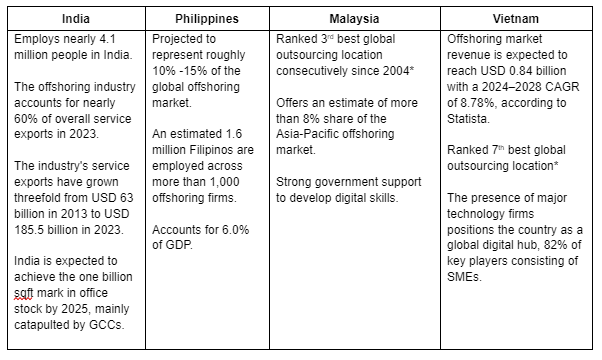

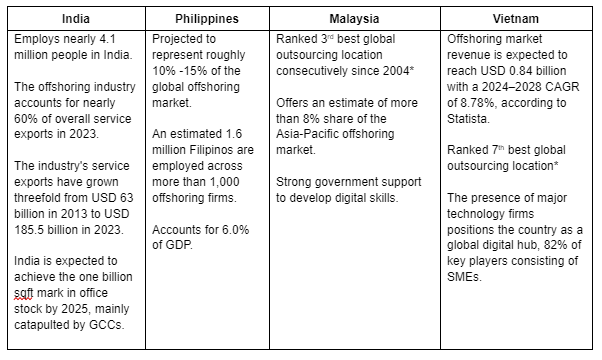

Tim Armstrong, Global Head of Occupier Strategy and Solutions, Knight Frank, says the Asia-Pacific offshoring industry is witnessing an unprecedented growth momentum. Leveraging global economic trends, the region has transformed into a thriving hub for offshoring. Within the region, India, Philippines, Malaysia and Vietnam have established themselves as offshoring centres worldwide.

“Companies today face a multitude of challenges, including cost management, sustainability and talent retention and attraction. At a time when companies worldwide are looking to increase performance, efficiency and innovation whilst also prioritising cost control, Asia-Pacific offers considerably lower operating costs, at nearly 70% less than the US, based on Knight Frank research. For every square foot of office space, occupiers can expect to save on average USD 70.86 in the four cities compared with mature markets. This translates to a staggering 54% cutback in occupancy costs annually.”

Tim adds, “Globally the office sector is going through a generational shift with three distinct flights to quality taking place - a flight to sustainable buildings, a flight to amenity-rich offices, and a flight to offices that can provide greater flexibility. With the decline in confidence towards the office sector, most pronounced in the US, occupiers are turning to Asia-Pacific. High-quality premium office space in city centres and ESG-compliant buildings remain highly sought after by occupiers in this region as they prioritise 2030 net-zero targets. Moreover, the highly educated, versatile, and multilingual talent pool in the region's developing markets is well-equipped to deliver high-quality customer service, positioning them ahead of the curve.”

Resilience and appeal of Asian offices

Global companies increasingly seek cost-effective solutions to minimise expenses, and a growing number are now looking towards offshoring functions as a strategic avenue. Within the region, these markets offer the best offshoring locations around the world.

Offshoring emerges as crucial catalyst for surging office demand

Christine Li, Head of Research, Asia-Pacific, Knight Frank says, “Offshoring has emerged as a critical driver propelling office demand in these four hubs as they steadily expanded their footprint. We anticipate the potential cost savings to encourage offshoring activities. We have already observed this in India. From 2022 to 2023, leasing transactions involving Global Compatibility Centre’s (GCC) proportion increased by 10%, accounting for 35% of the total market share. This trend was similarly observed in the other three key markets, the Philippines, Malaysia, and Vietnam where offshoring is playing an increasingly significant role in driving demand for office spaces.”

Teh Young Khean, Executive Director of Office Strategy & Solutions, Knight Frank Malaysia says: "Malaysia's offshoring industry, encompassing Shared Services & Outsourcing (SSO) and Business Process Outsourcing (BPO), has witnessed substantial growth, particularly in the mid-90s with the establishment of major international players like Intel, IBM, DHL, and Fujitsu. This growth was fueled by the government's Multimedia Super Corridor (MSC) initiative. Today, the landscape has transformed into a thriving Global Business Services (GBS) sector, boasting 607 companies in Malaysia as of 2021, with 58% being foreign direct investments. Notably, around 30% of these entities represent Forbes Global 2000 and/or Fortune 500 companies."

Teh further mentions, “With the new Malaysia Digital (MD) status announced by the government, GBS players have a wider option of buildings to choose from, and Malaysia has observed many GBS companies setting up across various sectors. The expansion reflects Malaysia's dynamic approach to fostering a conducive environment for business growth and innovation."

Market recovery for Asia-Pacific markets as corporate occupiers prioritise offshoring functions

According to the Knight Frank Asia-Pacific Q4 2023 Office Highlights report, overall rents for the region declined 2.4%, with the average vacancy rate increasing by 1.24% for 2023. Although there has been a gradual improvement in market sentiment, it remains susceptible to changes in the economic landscape.

Christine adds, “Occupiers are still cost-conscious due to the challenging macro environment. The silver lining is that corporate occupiers continue to prioritise offshoring functions, fuelling headcount growth in regions that offer growth and innovation at a lower cost while maintaining efficiency in pricier locations. As such, occupiers concentrate on boosting office demand in these strategic locations while reducing real estate needs elsewhere. This strategic resource allocation helps mitigate rental declines in markets such as Vietnam and the Philippines, while rents have even strengthened in Malaysia and India despite higher vacancies.”

Outlook for the prime office markets of the four offshoring centres in Asia-Pacific

Average Indian Tier 1 Cities

- Vacancy rate improved marginally throughout 2023 from robust demand, despite an increase in supply. The growing share of GCC in total leases will remain supportive of office market demand in 2024.Manila

- Although rent contracted 11.7% in 2023, vacancy rate remained resilient, with demand stemming from traditional and outsourcing firms adopting flight-to-quality and flight-to-cost measures.

Kuala Lumpur

- A strong flight-to-quality trend is underpinning resilient rental growth in prime office stock Kuala Lumpur amid tight new supply. Tenants took the opportunity to relocate to newer, technologically advanced buildings, resulting in a rise in rental prices.

- Rental rate for prime grade building is expected to continue holding strong, supported by good demand in prime grade buildings.

Ho Chi Minh City

- Rents in Ho Chi Minh City continue to adjust to the high volume of completions, as some landlords offer more competitive asking rents to maintain occupancy rates. Substantial supply is expected in 2024, pressuring rents further.

Keith Ooi, Group Managing Director of Knight Frank Malaysia, concludes: "The Malaysian government is committed to advancing the nation's digital realm with strategic initiatives like the National IoT Strategic Roadmap and MyDIGITAL, a comprehensive 10-year plan spanning three phases. Incentives such as the National Fourth Industrial Revolution (4IR) Policy and Industry4WRD are geared towards expediting digital transformation, facilitating industry evolution, and enhancing supply chain efficiency. The recent establishment of the Digital Ministry in January 2024 further underscores the government's steadfast dedication to driving forward digitalization endeavors. In essence, Malaysia stands poised at the forefront of the digital revolution, propelled by a resolute commitment to innovation and progress."

For further information, please contact Keith Ooi, Group Managing Director of Knight Frank Malaysia and Teh Young Khean, Executive Director of Office Strategy & Solutions, Knight Frank Malaysia as the details below.