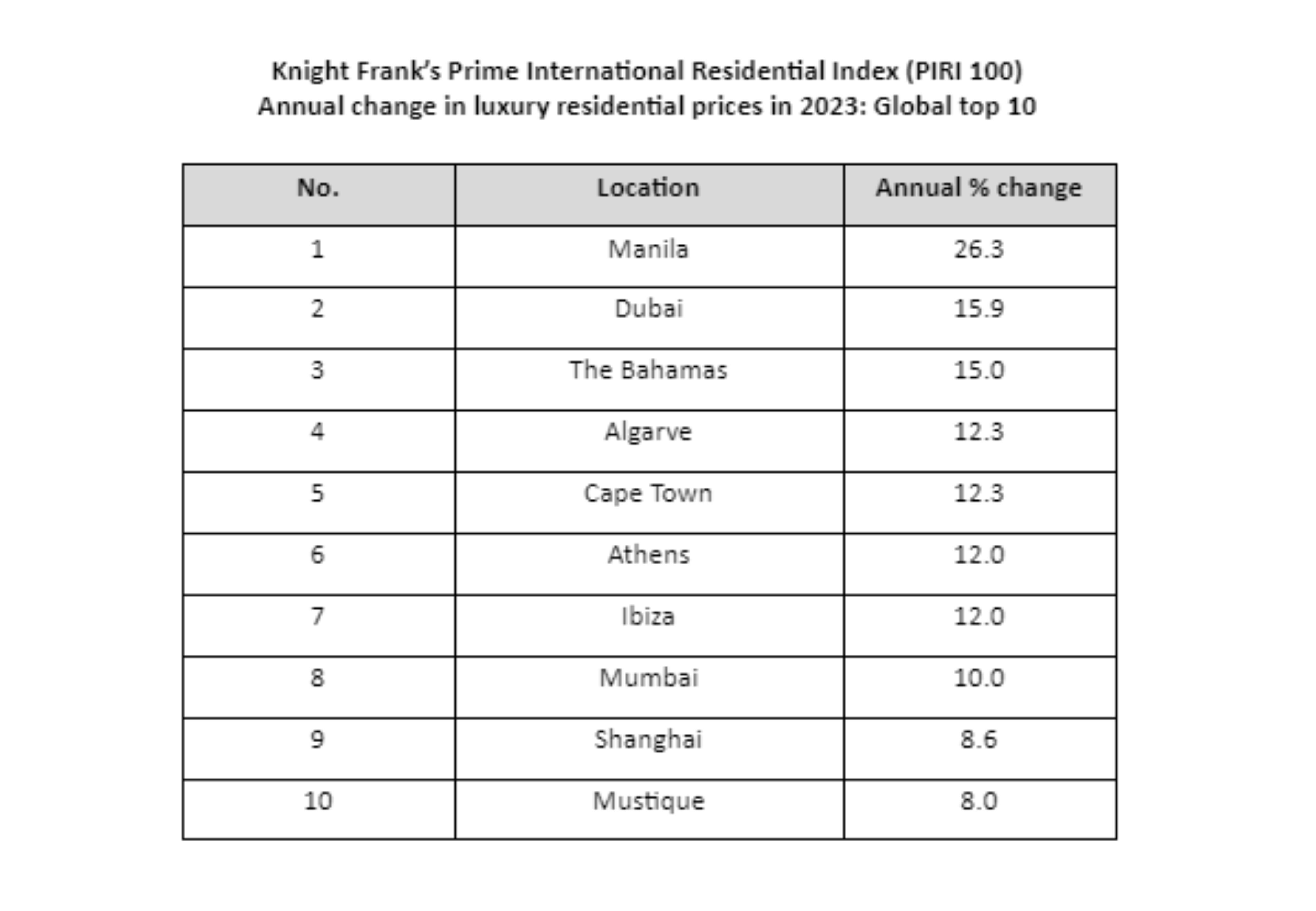

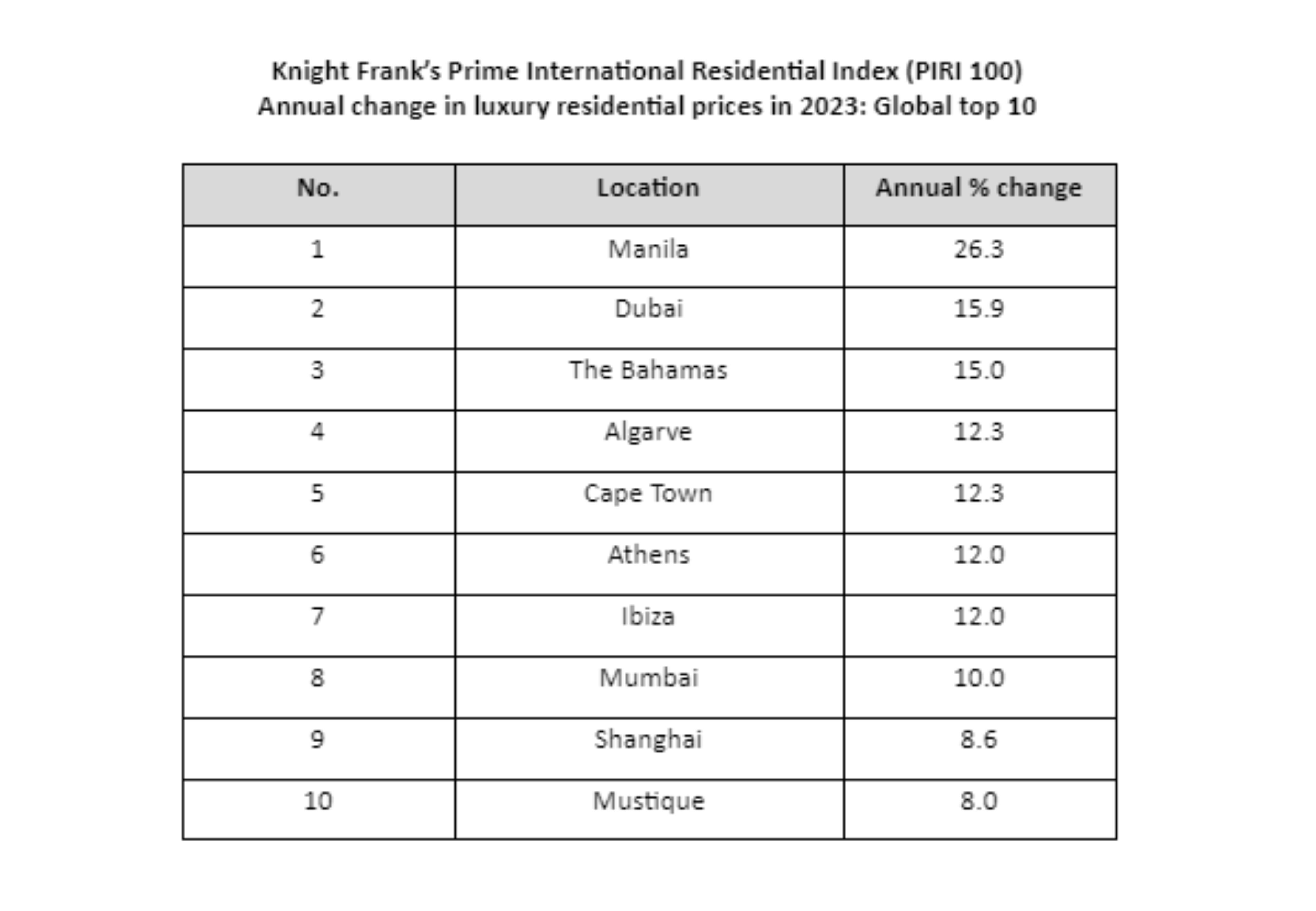

According to the latest edition of The Wealth Report, Knight Frank’s flagship report – prime residential prices surprised on the upside in 2023. Of the 100 markets tracked in Knight Frank’s Prime International Residential Index (PIRI), 80 recorded flat or positive annual price growth, showcasing the resilience of luxury residential markets in 2023 despite successive interest rate hikes.

Enoch Khoo, managing director of Knight Frank Property Hub Malaysia said: “Market conditions have significantly improved compared to a year ago. Inflation remains largely under control, and it's a matter of when, not if, interest rates will be reduced. Our labour markets are robust, and forced sellers are notably scarce. Moreover, constrained housebuilding has mitigated price fluctuations, while pandemic savings continue to bolster economies in certain advanced nations. Asia-Pacific played a noteworthy role, contributing to the region's overall growth rate of 3.8%, this underscores Malaysia's position as a potential key player in the luxury real estate sector.”

Dominic Heaton-Watson, associate director, international residential, Knight Frank Property Hub Malaysia stated: “Luxury prices climbed 3.1% on average in 2023 – a solid gain overall. Asia-Pacific (3.8%) pipped the Americas (3.6%) to the title of the strongest-performing world region, with Europe, the Middle East and Africa trailing (2.6%). Manila (26.3%) leads the rankings, followed by Dubai (15.9%) in terms of global rankings.”

Sun locations continue to outperform city and ski markets, up 4.7% on average. Ski resorts are close behind (3.3%), and prime prices in the city market tracked have risen 2.7% on average.

Kate Everett-Allen, head of international residential and country research at Knight Frank, said: “At the start of 2023, economists were expecting a much weaker outcome across global residential property markets. Stock markets were heading for more pain, inflation was veering out of control and the pandemic-fuelled property boom was set to end in tears as borrowing costs hit 15-year highs in some markets. However, that never happened – we’ve seen a much softer landing in terms of price performance around the world.”

As markets adjusted to the higher cost of debt, sales took a bigger hit than prices. In London, New York, Dubai, Singapore, Hong Kong and Sydney, luxury sales declined on average by 37% year-on-year. Some markets corrected after strong falls due to rapid rate hikes (Auckland, Seoul), while others moved up the rankings in part due to supply shortages (Sydney, Singapore). Some were influenced by policy and tax shifts, easing (Hong Kong), or tightening (Los Angeles), and some markets benefited from significant wealth inflows (Dubai, Miami).

Kevin Coppel, managing director at Knight Frank Asia-Pacific, shared: “The Asia-Pacific region is demonstrating an underlying optimism heading into 2024. However, shifting rules and regulations in various markets may potentially impact buyers’ preferences. For example, Hong Kong SAR is reducing ad valorem and buyer's stamp duty rates for non-permanent residents from 30% to 15%, while the Chinese mainland is implementing new housing policies in first-tier cities. New Zealand has reinstated mortgage interest deductions for rental income and reduced the holding period to two years for capital gains tax exemptions. By contrast, Australia has tripled fees for foreigners buying existing houses and doubled taxes for vacant dwellings owned by non-residents to curb foreign speculation and address housing affordability concerns.”

Christine Li, head of research at Knight Frank Asia-Pacific, added: “The Asia growth story continues to underpin price growth momentum in key markets benefitting from safe haven status such as Singapore, or the outsourcing boom in Philippines and India. As a result, there remains a persistent imbalance between demand and supply in the high-end residential sector, especially fuelled by the rising affluent demographic.”

On an annual basis, Knight Frank provides a guide to how much space you can buy for US$1 million.

On an annual basis, Knight Frank provides a guide to how much space you can buy for US$1 million.

Dominic Heaton-Watson, associate director, international residential, Knight Frank Property Hub Malaysia says: “There is a significant variation in prime prices across luxury residential markets. Prime prices in Dubai may sit 134% higher than at the start of the pandemic but are still noticeably lower than in more established markets. US$1 million buys 91 sq m in Dubai, four times the equivalent in Hong Kong.”

Dominic Heaton-Watson, associate director, international residential, Knight Frank Property Hub Malaysia says: As almost 70 countries go to the polls in 2024, the implications for wealth flows and property markets could be significant. Politics is likely to upstage economics as the downside risk for real estate in 2024.”

DOWNLOAD THE WEALTH REPORT 2024 HERE

On an annual basis, Knight Frank provides a guide to how much space you can buy for US$1 million.

On an annual basis, Knight Frank provides a guide to how much space you can buy for US$1 million.