Knight Frank Thailand release “Office Market Q3 2023" Report

Contact

Knight Frank Thailand release “Office Market Q3 2023" Report

Mr. Panya Jenkitvathanalert, Executive Director of Office Strategy and Solutions at Knight Frank Thailand, has noted that "The office market has seen a notable uptick in activity, energized by the completion of new buildings that offer businesses a wider array of choices. At the same time, the trend towards sustainability and well-being continues to grow, becoming key considerations for companies when setting up new offices or making relocation decisions."

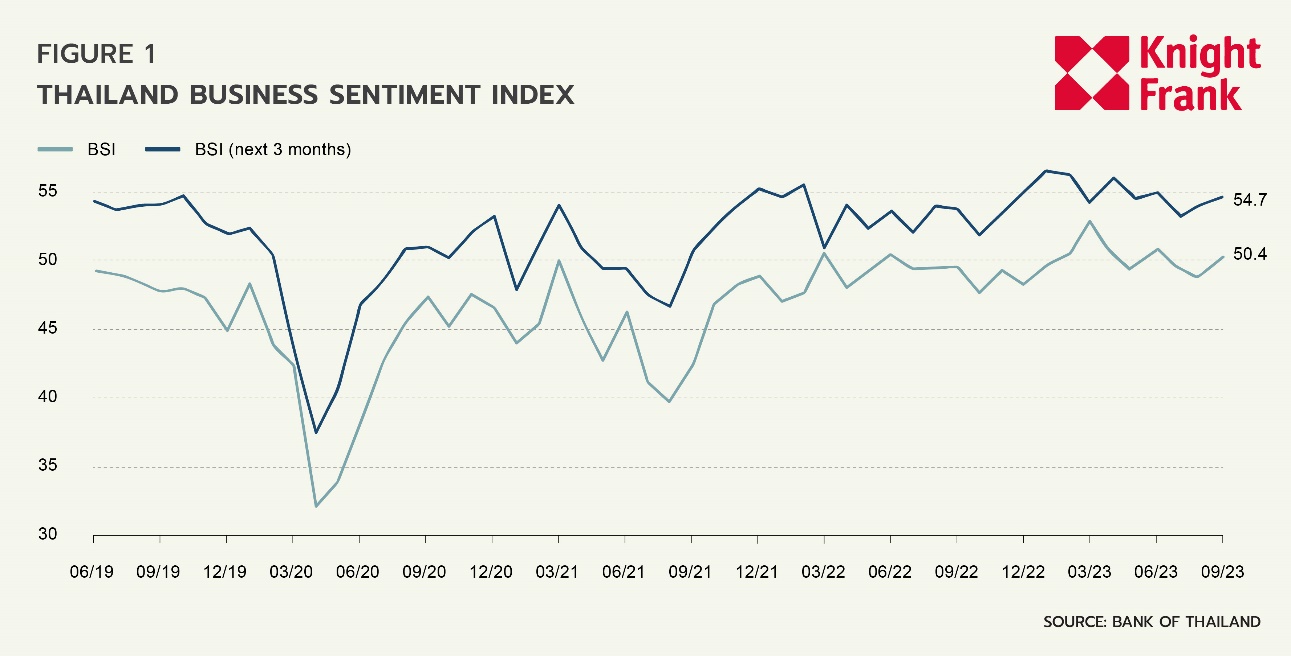

Thailand's economic growth softened in Q3, with the country experiencing the first decline in inflation in over two years.

According to Knight Frank Conditions for Q3 of 2023, Thailand's growth moderated following significant expansions in prior periods. Private consumption and the service sector remained positive, bolstered by a surge in tourist-related activities, with international tourist numbers hitting 20 million in the first nine months. Besides tourism, the labor market exhibited positive trends, with employment under section 33 up by 3.9% from the end of 2022. Regarding other GDP components, private investments and government expenditures saw a decrease, while the trade balance improved as imports fell more significantly than exports.

On the financial stability front, the prime rate, measured by the average minimum lending rate (MLR) of the six largest banks in Thailand, increased to 7.0%, up from 6.0% at year-end 2022. Meanwhile, headline inflation in October 2023 has decreased by 0.31 percentage points compared to the previous year, with declines observed across all major components, including core inflation, raw food, and energy. This represented the first monthly decrease in price levels in 25 months, as reported by the Ministry of Commerce.

The Business Sentiment Index (BSI) dropped to 50.4, down from 51.0 last quarter, attributed to diminishing total order books and lower production levels. Similarly, the 3-month projected BSI mirrored this trend, dipping to 54.7 from 55.2 in the previous period.

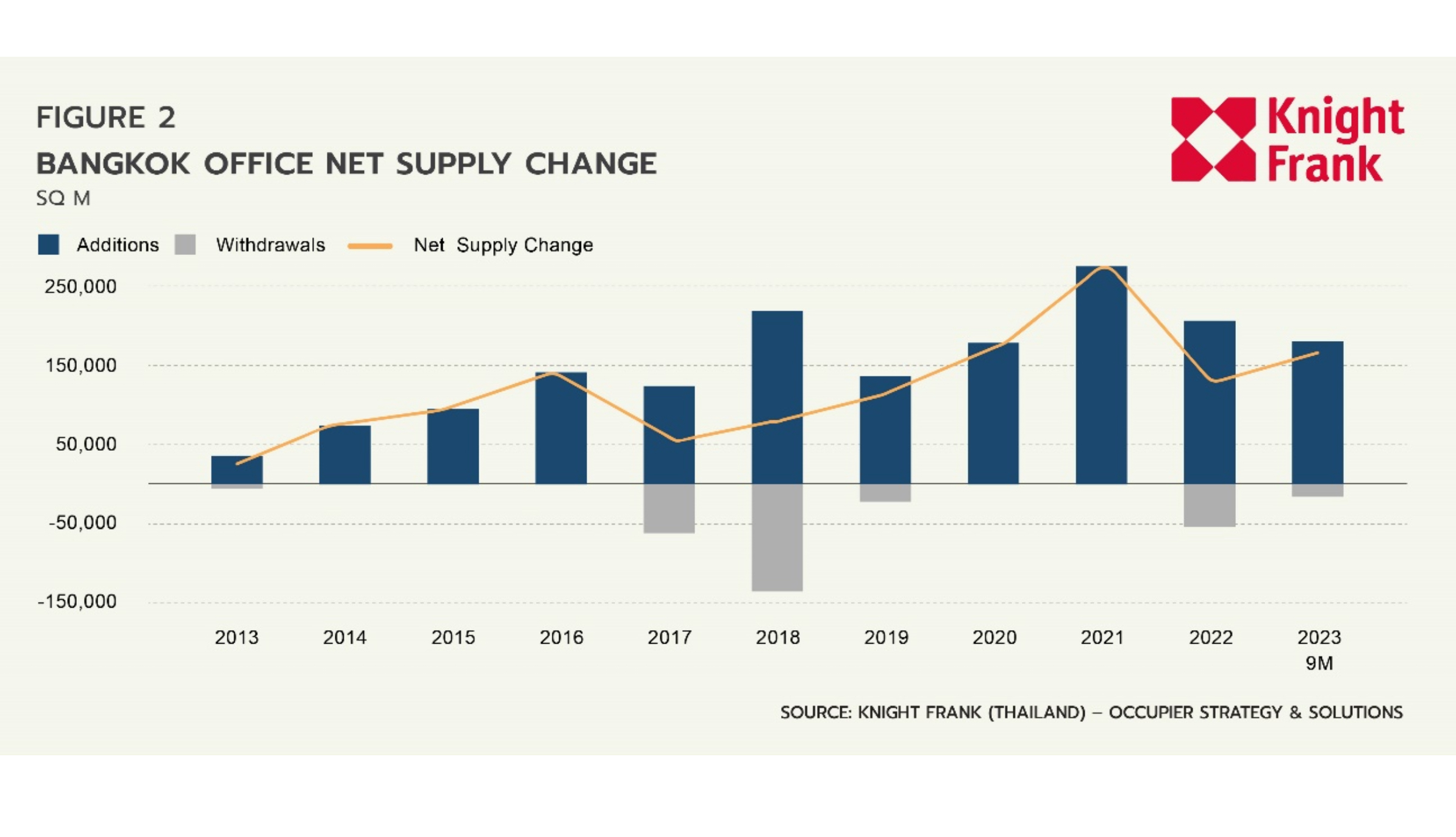

Supply

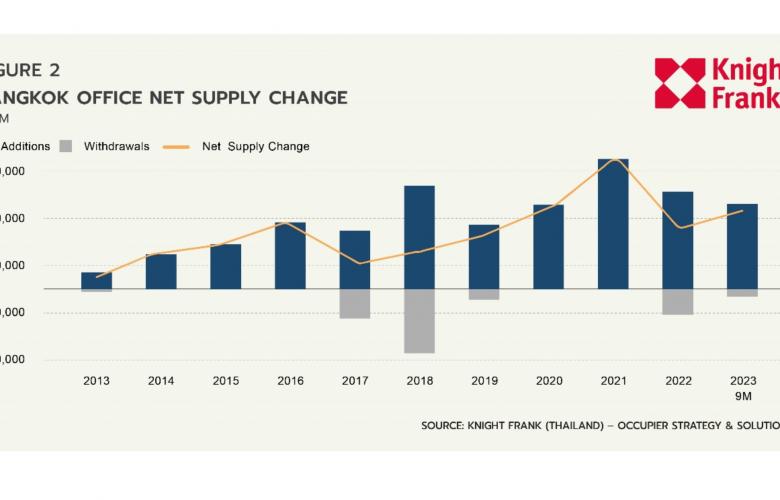

Bangkok's total supply of office space this quarter expanded by 25,000 sq m or +0.4% Q-o-Q to 5.99 million sq m. Three new buildings were launched in Q3, including Quant S25 at the mouth of Sukhumvit 25 Road, P23 inside Sukhumvit 23 Road, and Sukhumvit Hills, located between Onnut and Bangchak BTS stations. Of the total office space, the total lettable area of green office buildings remained unchanged this quarter at 1,344,000 sq m, making up 22% of the total market.

Future Supply

In Q3, two new developments were unveiled in Upper Sukhumvit, within the central business district (CBD). These projects include One Origin Sukhumvit 79 and Project O, which is situated adjacent to Tesco Lotus Sukhumvit 50 and on the opposite side of the former. Looking into the future, the anticipated office space supplies for the years 2023, 2024, and 2025 is projected to be 345,000 sq m, 480,000 sq m, and 302,000 sq m, respectively. The combined lettable area of these upcoming developments is forecasted to reach 1.62 million sq m, comprising 27% of the current office space supply. Within this upcoming supply, 62% is concentrated within the CBD.

Demand

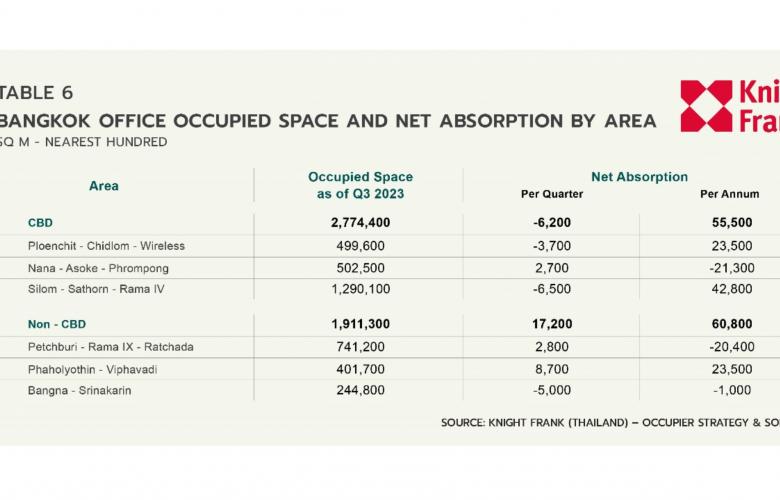

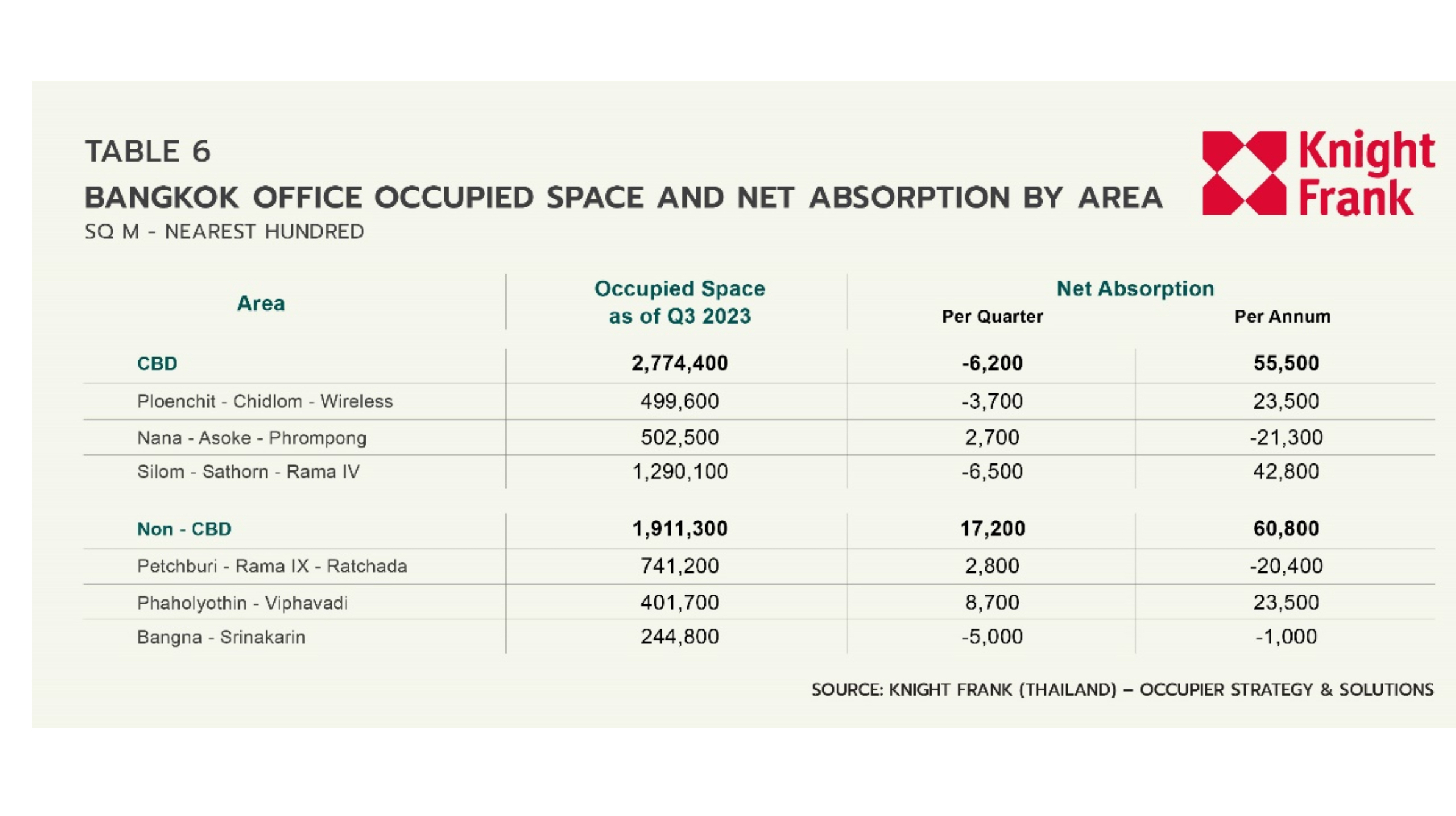

The office market this quarter demonstrated a net absorption figure of 11,000 sq m, which was slower compared to the 53,000 sq m recorded in Q2 2023. Net absorption for green office space remained positive at 27,900 sq m, while that for non-green office space turned negative at -16,900 sq m. This indicates that some occupiers are transitioning from conventional office space to green space.

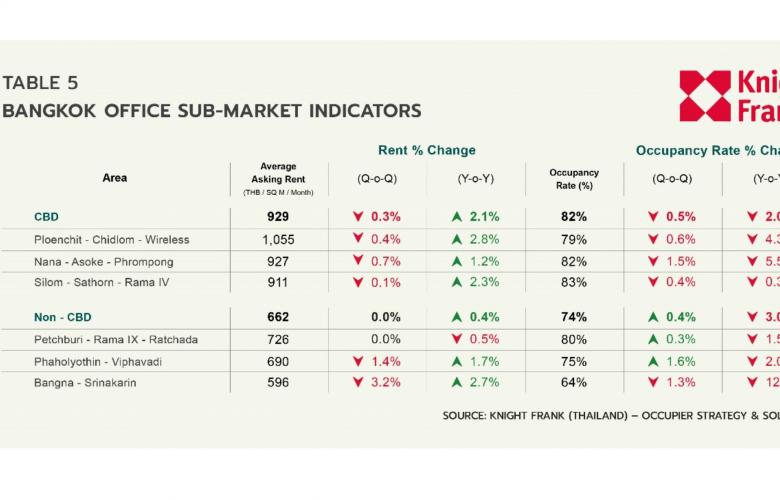

In this quarter, there was an increase in demand for office space in the non-central business district (non-CBD), primarily due to demand for new buildings. Net absorption for properties in the non-CBD reached 17,200 sq m, marking a 70% increase from the previous quarter. On the other hand, activities within the CBD are found to be more focused on relocating and optimizing workspace, leading to a decrease in total occupied space and a negative net absorption of -6,200 sq m.

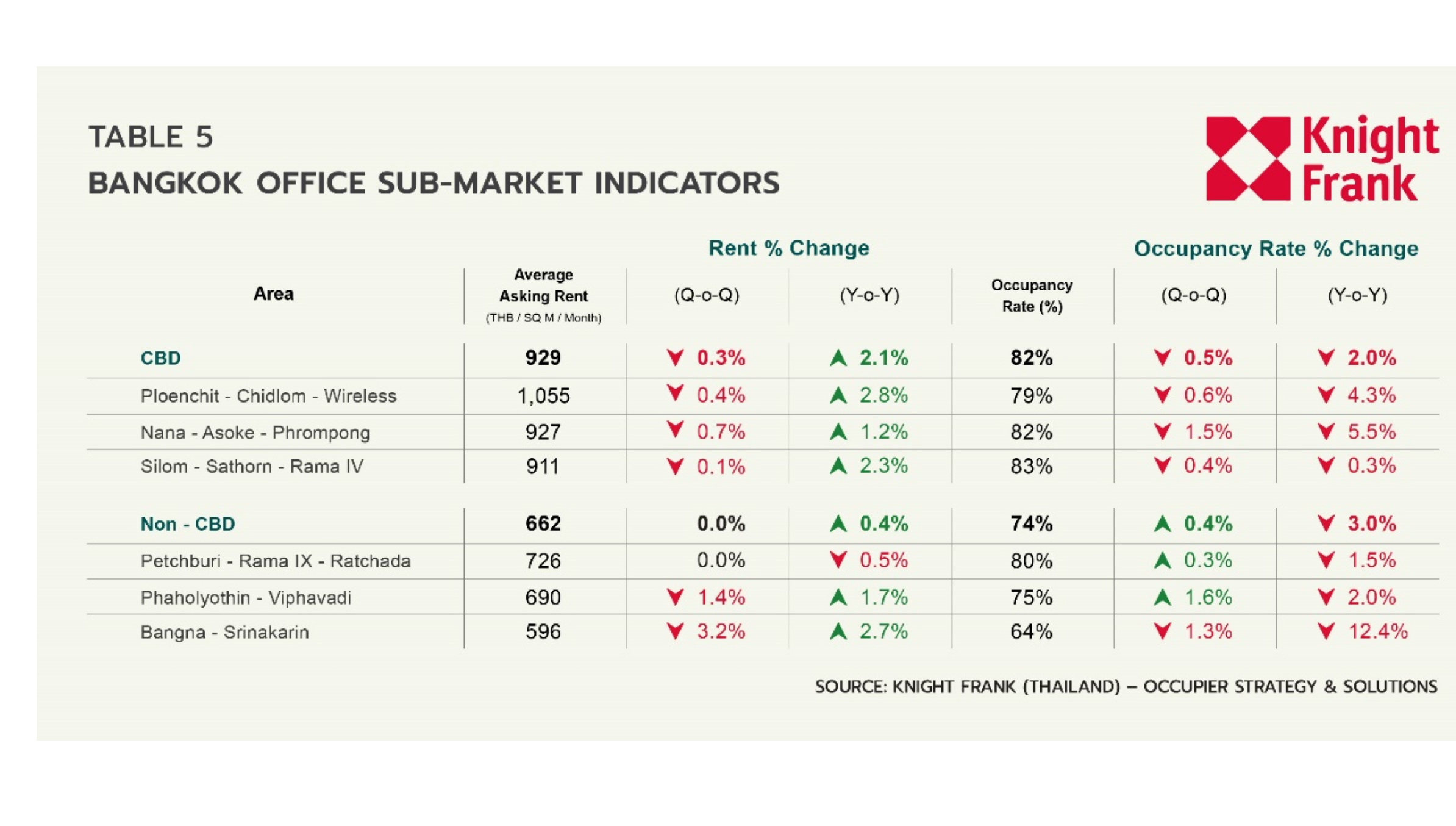

Market Dynamics by Segment

Grade B demonstrated the best performance this quarter by showing an improved occupancy rate, even with the introduction of new space. The overall market occupancy rate experienced a slight decline of -0.2% pts Q-o-Q to 78% in Q3. Grade A witnessed the most reduction among all grades, declining by -0.6% pts Q-o-Q and -5.4% pts Y-o-Y to reach 82%. Grade B saw a very slight improvement in occupancy rate by 0.1% Q-o-Q, but over the past year, it fell by almost -3% pts, similar to grade A. Lastly, the occupancy rate for grade C saw the most stable performance compared to other segments, decreasing by 0.4% pts Q-o-Q and 0.5% pts Y-o-Y, settling at around 78%.

Looking at the pure demand side, the total occupied space in the Bangkok office market increased by 11,000 sq m, reaching a total of 4.68 million sq m. Grade A experienced minimal changes in total occupancy space since most of the recent transactions involved relocations. Grade B, on the other hand, witnessed a significant increase in occupied space, with a quarterly net absorption of 20,100 sq m, primarily driven by new lettings in newly completed buildings. This contrasts with Grade C, which had the lowest net absorption this quarter. We observed certain existing tenants moving away from Grade C properties towards newer, higher-grade properties, particularly those with low occupancy. This type of building aimed to quickly fill in their vacant space by reducing their effective rental rates.

Outlook

For Q3 2023, the Bangkok office sector experienced a marginal decline in average asking rent of 0.3% Q-o-Q, settling at THB 813/sqm/month. While the rent remained relatively stable, there was an uptick in rent-free periods and more attractive incentives on offer. The market occupancy also saw a slight decrease of 0.2% Q-o-Q, reaching 78%. We observed significant leasing momentum, especially from businesses in the manufacturing, information technology, and business services sectors. In addition, green buildings still continue to outperform traditional buildings in terms of demand. Looking ahead to future supply prospects, the total space for office projects currently under construction or in the pipeline amounts to approximately 1.62 million sq m, and this quarter alone has seen an addition of 48,000 sq m.

In this highly competitive leasing landscape, we have seen a growing number of landlords expand their products and services to differentiate themselves and address the evolving needs of their prospective tenants. There is a rising trend among landlords offering a built-to-suit (BTS) solution, primarily targeting larger and more established companies that can commit to long-term leases. This arrangement allows tenants to design specific amenities and optimise their space right from the outset, ensuring that their unique business requirements and long-term objectives are satisfied. Moreover, the costs associated with the build-out are distributed throughout the lease term, enabling tenants to sidestep significant upfront capital expenditures.

Apart from the build-to-suit solution, the ready-to-move-in model is another concept increasingly adopted by landlords. This option is geared towards businesses that might have previously chosen co-working spaces due to their flexibility, convenience, and easy setup process. Ready-to-move-in spaces are typically designed to align with modern and hybrid workstyles and are aimed at smaller or newer businesses seeking more privacy than co-working spaces can offer. In addition, these move-in-ready units help simplify the complexities of office setup, reduce the substantial capital expenditure required for the fitting out, and provide businesses with the flexibility to scale their operations in response to market demands. However, this convenience comes with a higher rental charge, usually in the range of 40-50% above the standard rates.

Mr. Panya Jenkitvathanalert, Executive Director of Office Strategy and Solutions at Knight Frank Thailand, has noted that "The office market has seen a notable uptick in activity, energized by the completion of new buildings that offer businesses a wider array of choices. At the same time, the trend towards sustainability and well-being continues to grow, becoming key considerations for companies when setting up new offices or making relocation decisions."

By Mr. Panya Jenkitvathanalert, Executive Director of Office Strategy and Solutions at Knight Frank Thailand,