On 16 October 2023, the Urban Redevelopment Authority (URA) released the data on developer sales for the month of September 2023.

A summary of the launches and sales is provided in the Appendix.

Ms. Chia Siew Chuin, Head of Residential Research,Research & Consultancy at JLL

谢岫君, 私宅市场研究部主管 (新加坡) commented:

Overall Observations

September’s primary market sales of private homes (excluding executive condominiums or ECs) fell by 44.9% month-on-month (m-o-m) to merely 217 units. The thin level of market activities was the result of the Hungry Ghost month from 16 August 2023 to 14 September 2023, as well as greater buyer prudence amid a slower economy and market cooling measures. This is the lowest sales recorded by developers since December 2022, when 170 were sold.

Compared to September 2022, when developers sold more units on the back of the strong take-ups at the popular launches of Lentor Modern and Sky Eden@Bedok, new home sales plunged by 78.0%.

With this, developers sold a total of 2,024 units in 3Q23, down 4.8% quarter-on-quarter (q-o-q) and 7.5% year-on-year (y-o-y). The new home sales tally declined y-o-y despite 93.4% more new units launched in 3Q23 compared to a year ago. This reflects softer buyer demand in the face of market headwinds. Buyers have also become notably more discerning in their choices in view of the plethora of options available in the market.

Year-to-September 2023, primary home sales have now reached 5,407 units, marking a 15.6% fall compared to the same period in 2022. This year's 9-month tally is at the lowest since the period 1Q-3Q16, when the 5,656 units were sold.

Project Launches and Sales

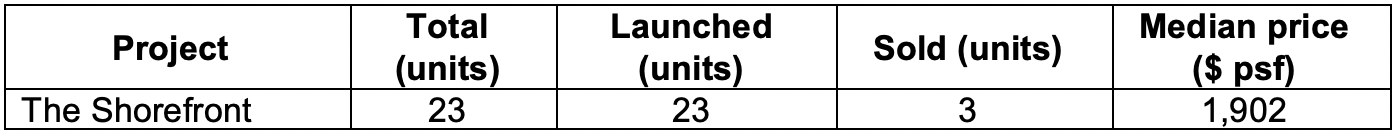

Only one project was newly launched in September 2023. The Shorefront, a small 999-year leasehold, 23-unit non-landed project located in Jalan Loyang Besar in the eastern part of the outside central region (OCR) was released for sale. Three units were sold at a median price of $1,902 psf.

Other developers refrained from launching new major projects during the month and focused on previously launched projects. Collectively, developers released another 45 units from earlier launches and sold another 214 units from ongoing projects.

By market segments, the core central region (CCR) led the way with 76 private new home units sold, followed by 71 units in the rest of central region (RCR) and 70units in the OCR.

An analysis of available caveats from the URA, showed that developers sold 13 units to foreigner buyers in September 2023, up from 10 units in August. Of the 13 units sold to foreigners, 12 new units were from the CCR, an improvement from the six to seven units registered in each of the three months from June to August this year.

Although the specific nationalities of these foreign buyers remained undisclosed as of the time of analysis, it is likely that they are nationals or permanent residents of countries like the US, benefiting from tax treatments akin to those of Singaporeans. Regardless of their origins, these astute buyers remain keen on CCR homes as they recognise the value offered by these homes in terms of high-quality urban living experience and value arising from the narrowed price gap between CCR and RCR homes.

Outlook

In the next few months, buyer sentiment will remain guarded in the light of weak macroeconomic conditions, market cooling measures, and elevated interest rates. Given that buyers are largely cost-conscious, sensitive pricing by developers for upcoming project launches in 4Q23 could support sales volume. However, there will not be significant price cuts as developers had committed to earlier capital outlays. Private new home sales in 2023 are expected to hover at around 6,500 – 7,000 units, slightly below the earlier projection of 7,000 – 7,500 units and the total of 7,099 units sold in 2022.

Appendix

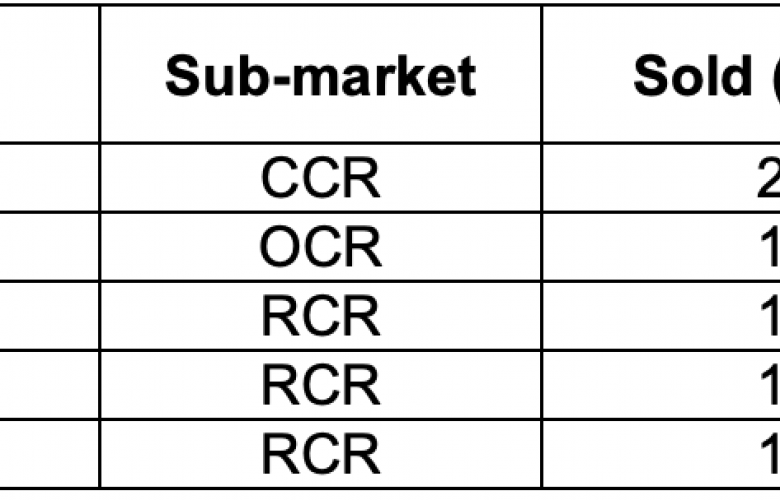

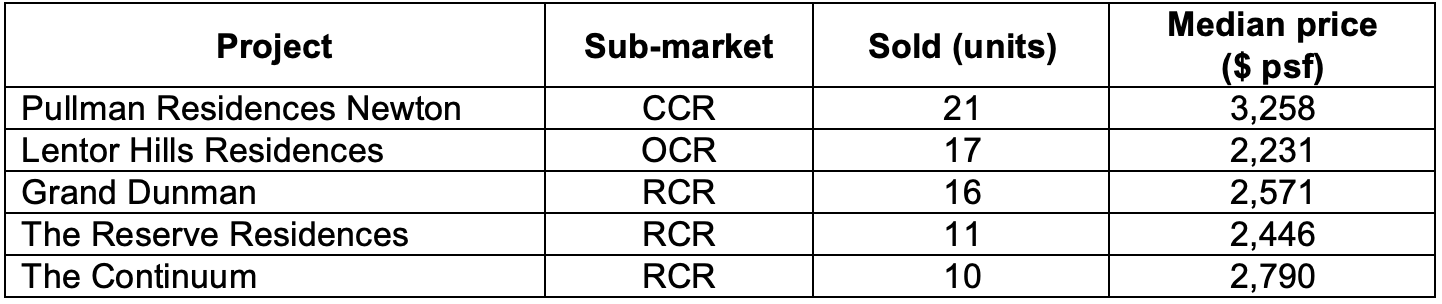

A total of 68 units were newly launched for sale in September 2023, 88.5% down the 590 units launched a month prior, and 92.6% lower y-o-y.

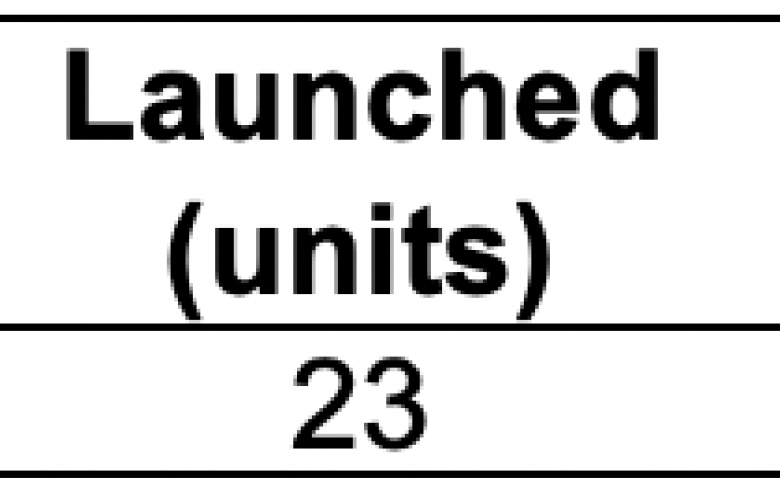

Only one project, The Shorefront, was freshly launched in September. The small-sized project accounted for about 33.8% of total units launched in the month.

Table A – New Launches

Source: URA

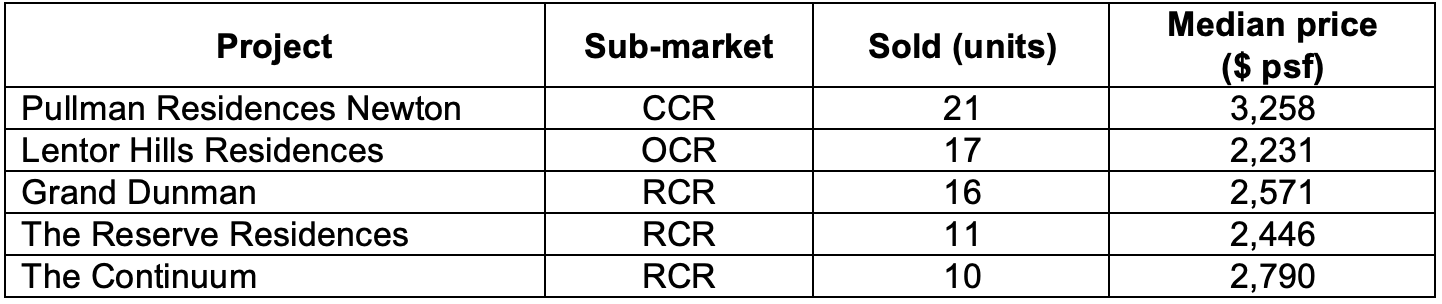

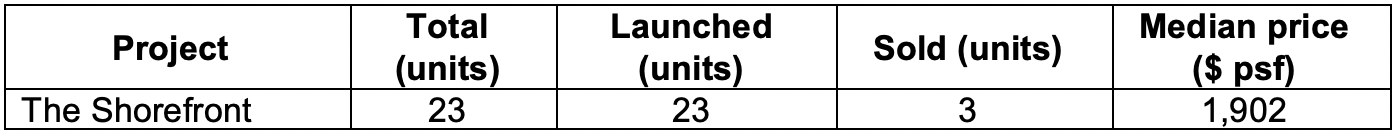

The top selling projects during the month are listed in Table B. The best-selling private residential project in September was Pullman Residences Newton, which sold another 21 units at a median price of $3,258 psf.

Other top selling projects that were launched previously included Lentor Residences which sold 17 more units at a median price of $2,231 psf, and Grand Dunman which moved another 16 units at a median price of $2,571 psf.

Table B - Top Selling Projects

Source: URA