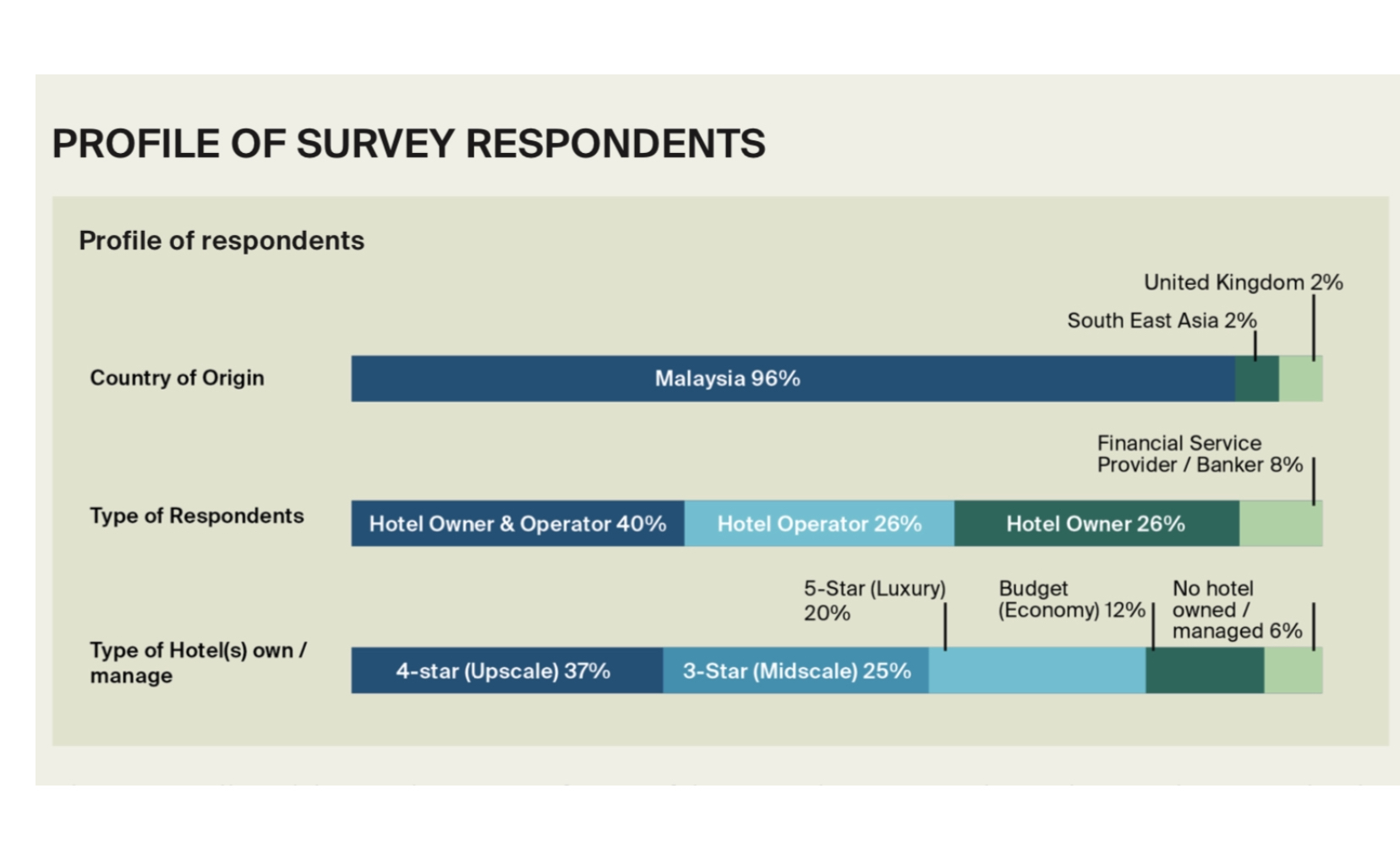

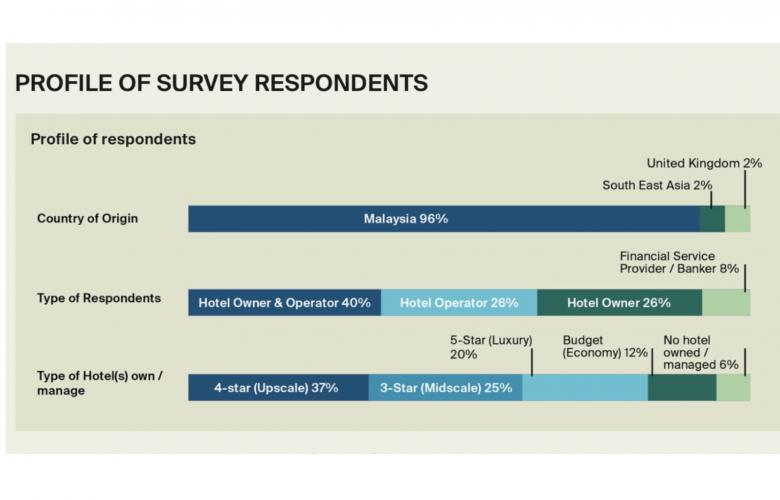

Knight Frank Malaysia, the independent global property consultancy, unveil the findings of latest survey, the Malaysian Hospitality Investment Intentions Survey for 2023. This comprehensive analysis examines the investment perspectives of hotel owners, operators, and owner-operators, providing valuable insights into the ongoing recovery of the Malaysian hospitality industry. The survey delves into various aspects, including investment demand, preferences, and overall sentiment towards the sector, allowing for a meaningful comparison with our previous surveys. Recently, the industry encountered difficulties due to the COVID-19 pandemic, affecting key aspects such as hotel occupancy rates, average daily rates, and investor confidence. However, as recovery gains momentum, a positive shift is evident.

James Buckley, Executive Director, Capital Markets Investments of Knight Frank Malaysia said, “The impact of the covid-19 pandemic has somewhat declined and investors are enthusiastic about acquiring hotels. Recent transactions in Malaysia would indicate that it is often more cost effective to acquire an existing hotel rather than developing a new one. Not only does the relationship between development cost and purchase price often support this investment strategy, the other benefit is that it allows investors to immediately take advantage of the recovery in the sector instead of the time to develop and stabilise a new hotel.”

20% of the hotels owned or operated / managed by the respondents are located in the capital city of the country, Kuala Lumpur. Penang, known for its cultural allure, is home to 14% of the respondents’ hotels. Additionally, Langkawi Island has captured a modest 9% of the respondents’ presence.

Within the next 6 months, 20% of the respondents are considering increasing their investment in this sector which suggests that there is relatively short-term interest and confidence in the potential returns and opportunities available within the Malaysian hospitality industry. Another 20% of the respondents plan to increase their exposure within the next one year. This indicates a slightly longer-term perspectives, with investors looking at the medium-term prospects and developments in the Malaysian hotel market.

The largest proportion of respondents, 31%, expressed their intention to increase their exposure to the Malaysian hotel sector within the next 2 years. This reflects a more cautious and strategic approach, taking into consideration the long-term growth potential and anticipated market conditions over a slightly extended timeframe. This shows a positive sentiment towards the Malaysian hospitality sector, with a significant portion of investors expressing a desire to increase their exposure. The varying timeframes mentioned by respondents suggest different investment strategies and risk appetites.

The largest proportion of respondents, 31%, expressed their intention to increase their exposure to the Malaysian hotel sector within the next 2 years. This reflects a more cautious and strategic approach, taking into consideration the long-term growth potential and anticipated market conditions over a slightly extended timeframe. This shows a positive sentiment towards the Malaysian hospitality sector, with a significant portion of investors expressing a desire to increase their exposure. The varying timeframes mentioned by respondents suggest different investment strategies and risk appetites.

KL City holds its position as the top choice for hotel investment, reflecting the continued appeal and potential for growth in the capital city’s hospitality sector. Penang, known for its vibrant culture and attractions, remains a strong contender, securing the second spot in 2023, moving up from the third position in 2022.

Investment Intentions

According to the findings, the main preferences of respondents revolve around city hotels and beach/highland resorts, each capturing 40% of their interest.

Integrated developments offer the potential for greater diversification and broader appeal, while standalone hotels provide a focused and tailored experience. Ultimately, the choice between the two depends on the specific investment strategy and objectives of the investor in the hotel sector.

Return Expectations

Expected average overall net yield for 4 to 5-star hotels

In the year 2022, 3% of respondents anticipated returns below 3%. However, in 2023, this figure dropped to 0%, indicating a significant shift towards optimism among investors. This change illustrates that investors have become less willing to accept minimal returns and are actively seeking more favorable opportunities.

“The category of 5 to 6% saw a substantial increase in 2023, rising from 19% in 2022 to 37%. This upward trend indicates growing confidence among investors in achieving higher net yields, possibly due to positive market conditions, increased tourist demand, or improved operational efficiencies,” said James Buckley.

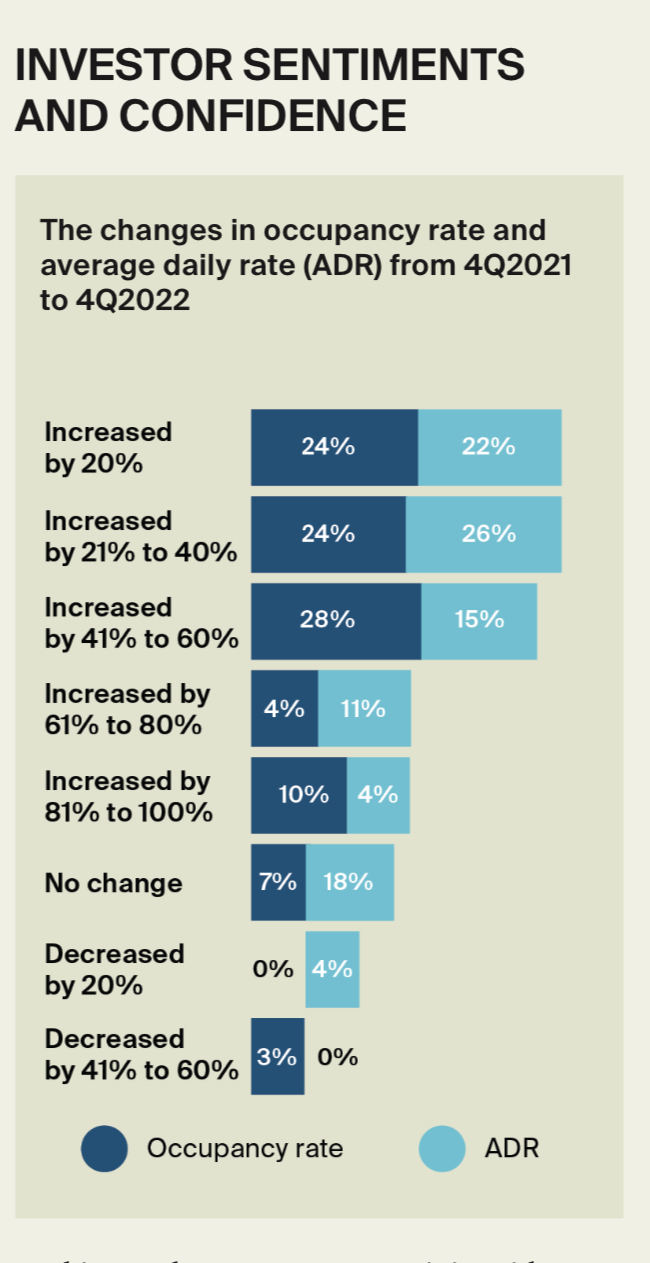

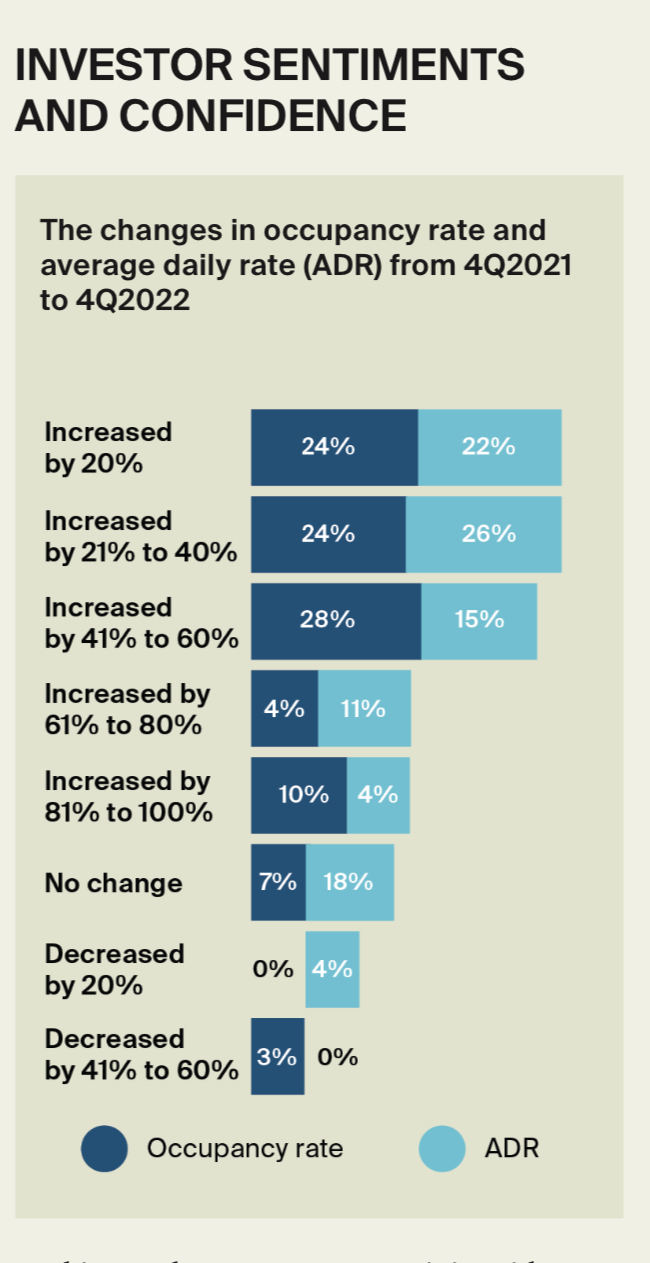

The significant percentage of respondents reporting improvements in hotel occupancy in 2022 compared to 2021 suggests positive momentum in the industry. The range of improvement percentages indicates a varied degree of growth across different establishments. The highest proportion of respondents reported an increase of about 10% to 30%, indicating a moderate yet steady improvement in occupancy levels.

The largest proportion of respondents, 31%, expressed their intention to increase their exposure to the Malaysian hotel sector within the next 2 years. This reflects a more cautious and strategic approach, taking into consideration the long-term growth potential and anticipated market conditions over a slightly extended timeframe. This shows a positive sentiment towards the Malaysian hospitality sector, with a significant portion of investors expressing a desire to increase their exposure. The varying timeframes mentioned by respondents suggest different investment strategies and risk appetites.

The largest proportion of respondents, 31%, expressed their intention to increase their exposure to the Malaysian hotel sector within the next 2 years. This reflects a more cautious and strategic approach, taking into consideration the long-term growth potential and anticipated market conditions over a slightly extended timeframe. This shows a positive sentiment towards the Malaysian hospitality sector, with a significant portion of investors expressing a desire to increase their exposure. The varying timeframes mentioned by respondents suggest different investment strategies and risk appetites.