Demand for office space split on fundamentals and pricing - Colliers

Contact

Demand for office space split on fundamentals and pricing - Colliers

In Asia Pacific Melbourne and Tokyo stand out on the path to value stability and recovery along with Copenhagen, Toronto and San Francisco at the global level.

Colliers’ latest Global Insights & Outlook - Office Report finds that varying return to office approaches post-COVID, underlying fundamentals of city functionality, approaches towards ESG-compliance differences and how markets have reacted to shifts in inflation and interest rates have created significant divergence in office investment volumes, pricing, and appetite globally.

Asia Pacific Highlights

- Melbourne and Tokyo stand out on the path to value stability and recovery along with Copenhagen, Toronto and San Francisco at the global level.

- While core offices remain a top pick for investors in APAC and EMEA, substantiated by current office investment volumes, there is a very different narrative in North America.

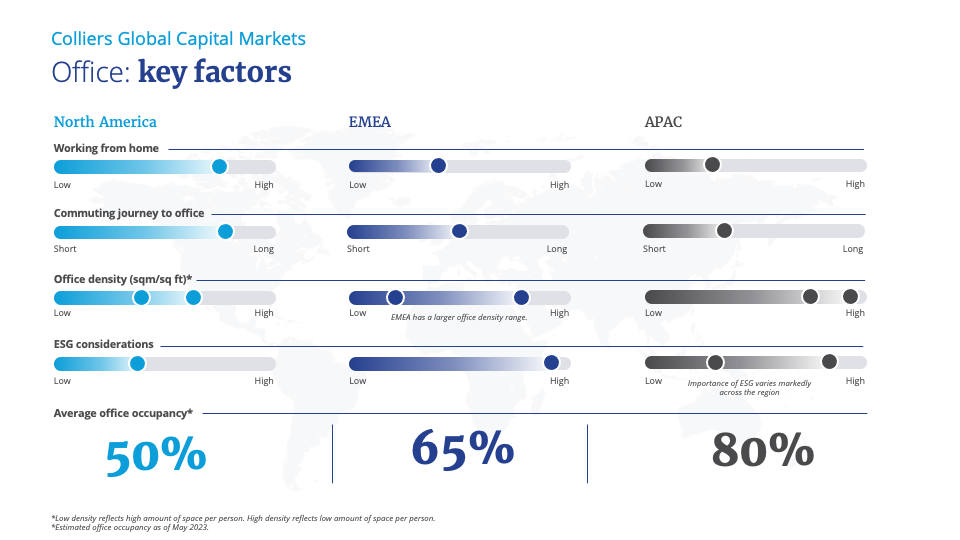

- Office occupancy levels in APAC are averaging 80%, and office density remains high. In Europe, occupancy is back to 65% and in North America, rates are at 50% with signs of improvements across key cities.

- Both Seoul and Singapore recorded net absorption 30% above historical averages with both markets recording falling vacancy rates over 2022, contrary to most major markets globally.

- Although limited sales transactions occurred over Q1 2023, we anticipate market sentiment will recover as an expected peak of the interest rate cycle comes to fruition over H2 2023 and equips investors and vendors with clarity and confidence regarding asset values and the cost of borrowing across the region.

“Even as the office markets globally continue to face short-term challenges, Asia Pacific remains attractive for office investments over the longer term. The strong underlying fundamentals include the diverse range of markets, positive sentiments towards offices from a demand perspective and strong population-led economies presenting more resilient economic growth," said Chris Pilgrim, Managing Director, Global Capital Markets, Asia Pacific.

“The pricing of office assets is moving in sync with key macro factors such as inflation and interest rates, globally. It is also adjusting to market fundamentals where there is a huge divergence in the factors at play,” said Damian Harrington, Head of Global and EMEA Capital Markets Research for Colliers. “Within each region, there is also great diversity in performance and fundamentals across local markets.”

In APAC and EMEA, vacancies sit at a steady 8-10% and office occupancy rates have largely returned to pre-pandemic levels. Office occupancy in APAC is averaging 80%, and office density remains high – a function of short commute times and ease of getting back into the office (Exhibit 1). Meanwhile, occupancy is back to 65% on average across Europe. In North America, rates are sticking at 50% but are showing some signs of early improvement, as longer travel times and more comfortable home working environments support this dynamic. Coupled with weak occupier demand, vacancy rates in North America have climbed to 16%+ on average, and landlord incentives to support rents continue to be stretched.

In contrast, prime rents across Europe are increasing as the demand for higher-quality space, particularly for assets that are ESG compliant, is significant. “We are seeing pressure to repurpose space that doesn’t meet contemporary demands as a growing proportion of buildings face obsolescence,” said Luke Dawson, Head of Global and EMEA Capital Markets at Colliers. “This is driving a shift in value-add plays across key markets, especially where high importance is placed on ESG, such as the UK and Australia.”

Capital values have been negatively impacted in the past 12 months, as interest rate hikes have forced yields/cap rates out. While most locations are nearing the end of the rate hike cycle, further price adjustments on the capital side are expected. The longer-term economic outlook for each city is generally very positive, but rates of growth vary markedly. Overall, this means some markets stand out as having a first mover advantage on the path to value stability and recovery.

Chris Pilgrim added that the office sector remains the number one focus for APAC capital with 68% of investors in the region highlighting office as their investment focus for 2023. “The positive sentiment towards office in the region is also highlighted within transaction volumes so far this year, as whilst overall volumes have been on the decline globally, APAC office investment volumes have held out at a much higher proportion rate (38%) compared to EMEA (35%) and North America (15%),” he said.

“Investing in office real estate has become more complex as the factors influencing markets are so diverse. While broader pricing continues to adjust, it will take time for appetite in offices to re-balance,” Damian Harrington concluded.

Exhibit 1

To find out more, read Colliers Global Capital Markets Insights & Outlook - Office Report here.