Data Centre – The Way Forward - Colliers Report

Contact

Data Centre – The Way Forward - Colliers Report

The lifting of the moratorium on new data centres in Singapore could prove challenging for industry players to navigate.

Leading professional services and investment management firm Colliers (NASDAQ and TSX: CIGI) has released its data centre report The Way Forward today, providing a timely interpretation of Singapore’s data centre landscape and the prevailing trends.

As one of the major data centre hubs in Asia Pacific, Singapore continues to attract demand from hyperscalers, digital content providers as well as global financial players. However, the evolution of the data centre market scene, especially with the new landscape and regulations, could prove challenging for industry players to navigate.

With the lifting of a keenly awaited and highly anticipated two-year moratorium on new supply expected this year, albeit with new requirements to adhere to, the report puts forth Colliers’ recommendations, addressing some of the more pertinent challenges that are likely to be faced by the various industry players, which include operators, end-users and investors.

Stringent efficiency guidelines to be implemented with the lifting of data centre moratorium

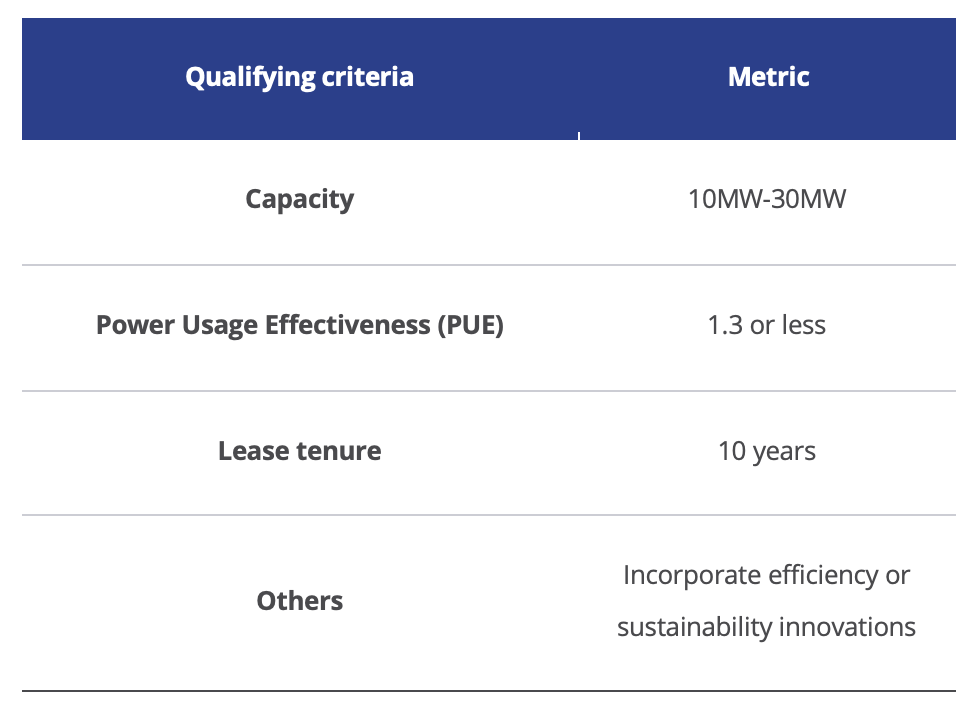

New data centre applications must adhere to stricter qualifying criteria with the lifting of moratorium. This is to ensure that the growth of new data centres is done in a sustainable manner that is aligned with Singapore’s climate change commitments.

In addition to providing recommendations to industry players on how to maintain their competitive advantage, the report also identifies some key operational challenges industry players might face and suggestions to address them.

Conditions for new applications:

Some key highlights from the report:

Singapore remains a highly favourable location for data centres

Despite a two-year moratorium, the Singapore data centre market remains one of the major hubs in Asia Pacific. Many firms view Singapore as a gateway to South-East Asia, which is projected as one of the fastest-growing data centre markets in the world.

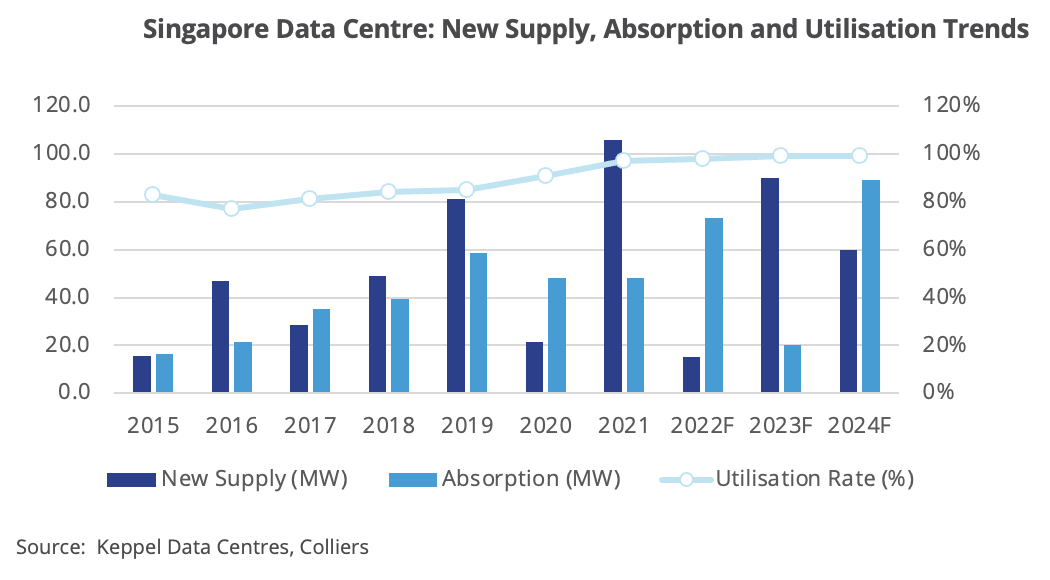

COVID-19 has caused delays in the construction of new data centres. More supply is expected to come onto the market in 2022 and this will moderate in 2023 when supply is regulated at a cap of 60 MW per year. Utilisation rates are expected to remain high as a result of pent-up demand and increasing requirements from new entrants. This includes retail demand from cryptocurrency and Web3 related activity to hyperscaler demand from Chinese technology platforms.

On the back of robust demand and limited supply, rents are expected to continue their upward trajectory

Led by the demand from network and IT services, followed closely by the growth of hyperscalers, demand for data centre space has continued unabated. The ongoing shift to hybrid working and business digitalisation will continue to support the demand for this asset class. New sources of demand for data centre are also emerging with the rapid growth of crypto-trading and blockchain activities, online gaming and the Metaverse. In addition, there are requirements for more edge data centres near urban areas to reduce latency.

Amidst strong demand as well as limited availability, the upward growth trajectory in rents is expected to continue, with retail co-location leases likely to experience the largest increase due to rising energy costs and tight vacancies.

Ensuring data centre sustainability has become even more pressing

The lifting of the moratorium comes with conditions to ensure new data centre are aligned with Singapore’s climate ambitions of halving carbon emissions by 2050. Another development with an impact on the operation of data centres would be the revision to carbon taxes, with a five-fold increase in carbon tax by 2024. As such, the impetus to mitigate the data centre sector’s growing carbon footprint becomes ever more pressing. The report puts forward some suggestions to help advance the greening of the data centre sector.

Mr Lynus Pook (卜星元), Executive Director and Head of Industrial Services, Singapore at Colliers says, “The data centre industry has evolved to support the rapid adoption of new technology brought about by the Covid-19 pandemic, where the ways of working, living and learning have changed with both speed and scale.”

“Singapore, despite its relatively small size, remains an attractive location for data centres in the Southeast Asia region and is ranked second among data centre markets globally. The lifting of the moratorium on new supply is seen as a welcome development but industry players must contend with higher standards, as Singapore aims to further reduce our emissions intensity to address climate change.

“Only the most sustainable data centres will thrive. As such, it is imperative for industry players to make a conscientious effort to design and implement energy-efficient solutions to successfully navigate the stringent guidelines. Partnering with a dedicated operator or enlisting an advisor with demonstrated data centre expertise will allow one to compete efficiently in this unique market and overcome the challenges that characterise this exciting emerging asset class,” adds Mr Pook.

Read the full report here.