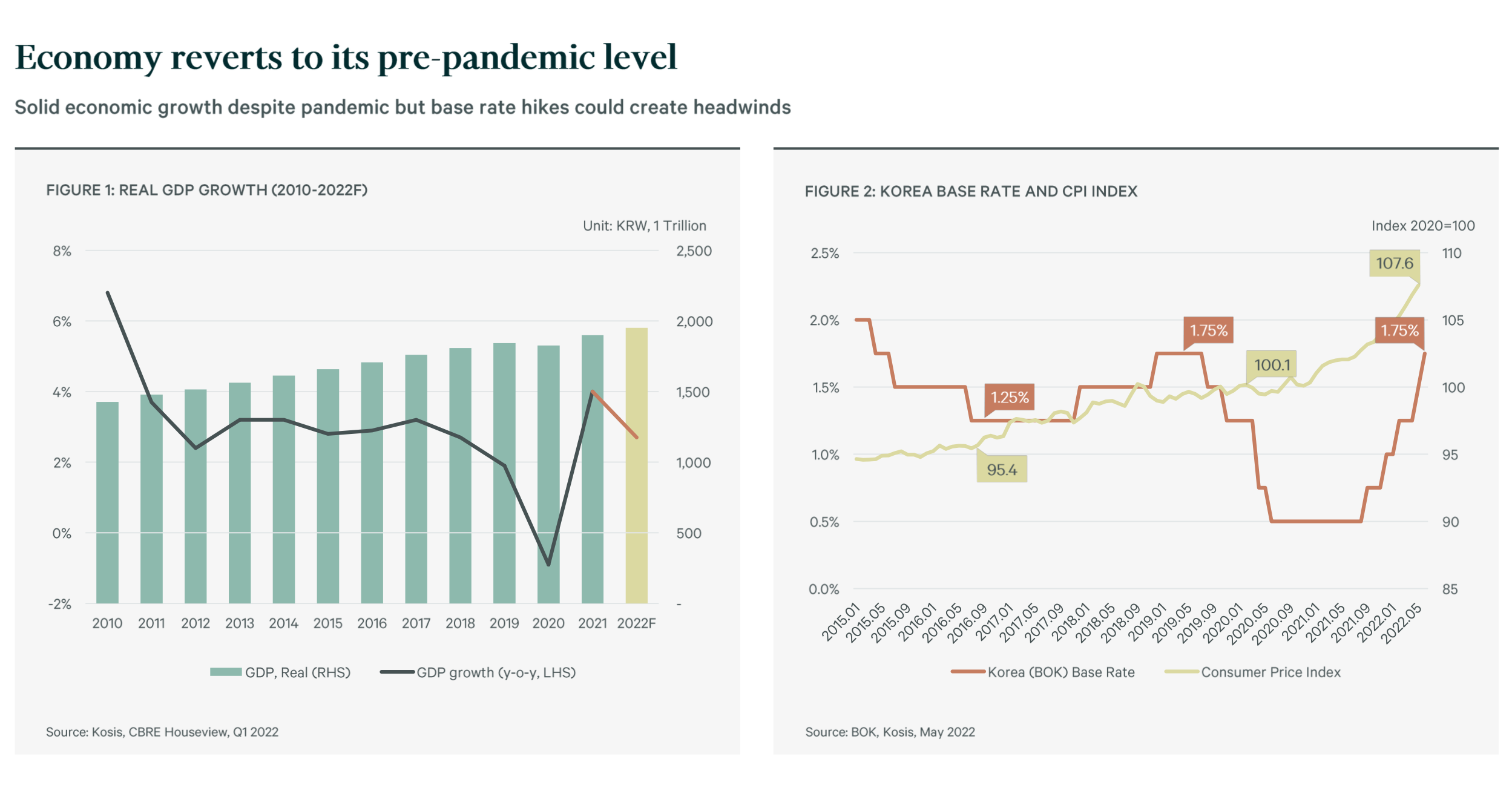

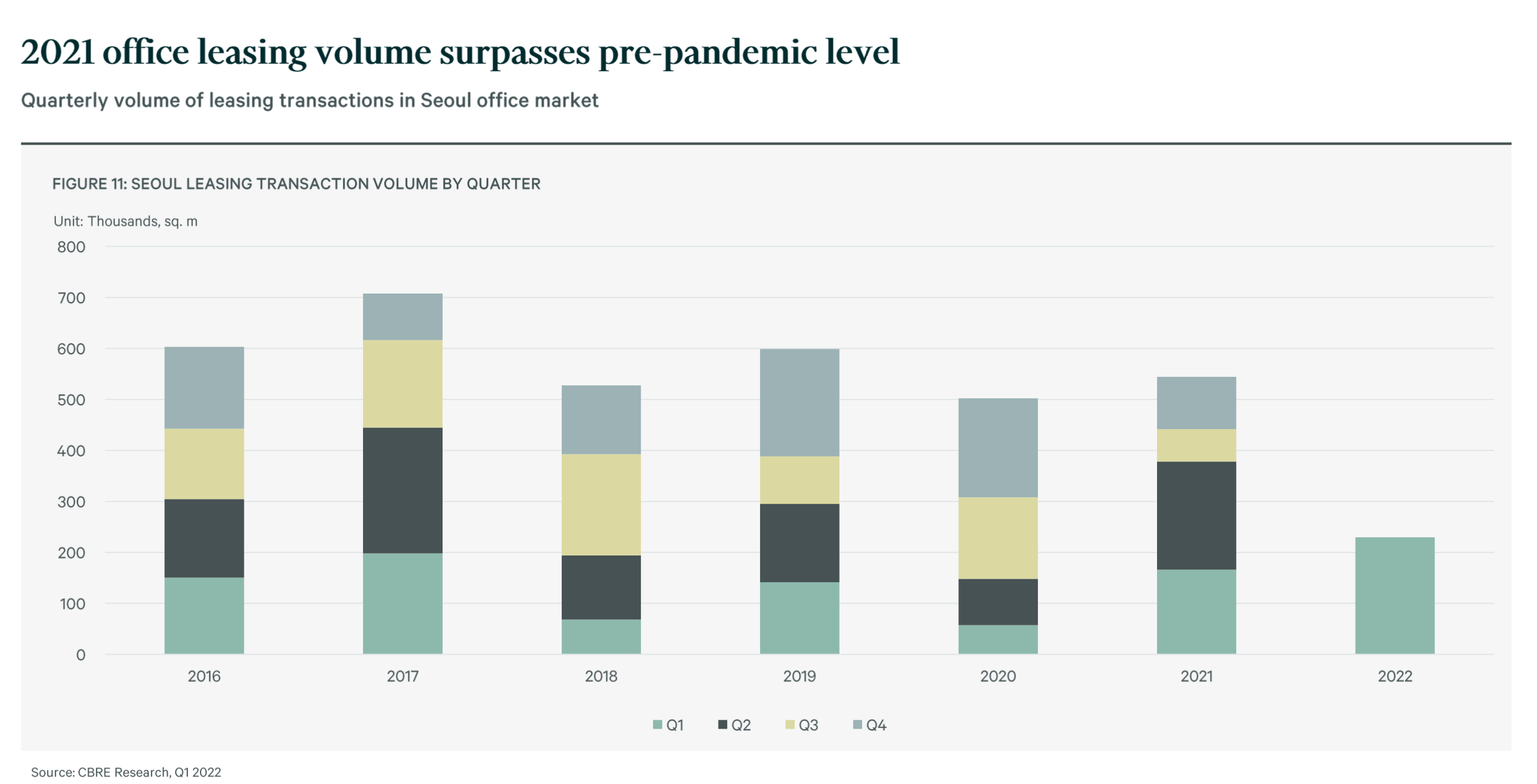

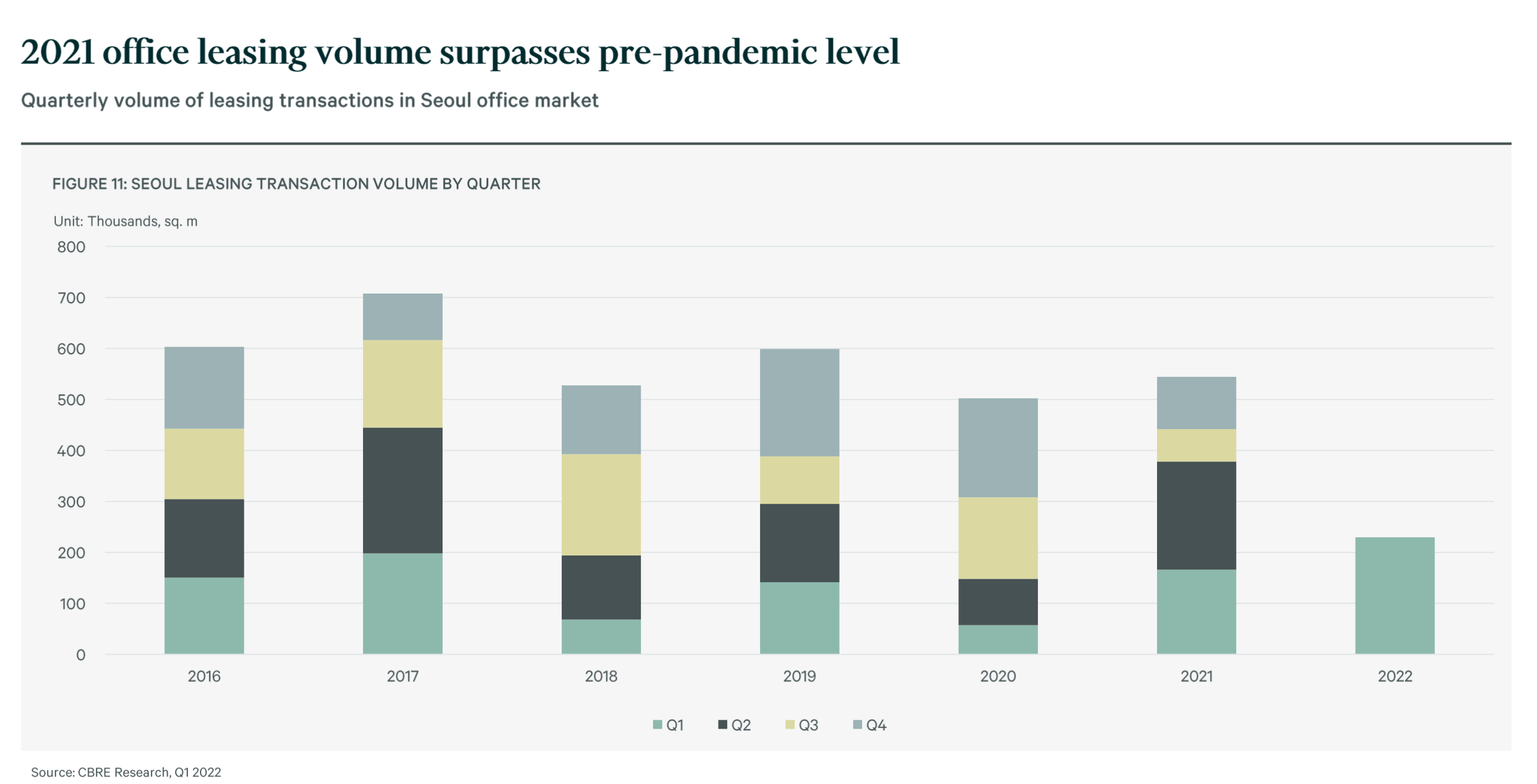

Global commercial real estate services company CBRE released its 2021 Seoul Office Tenant Profile and Outlook report. According to the report, leasing activity volume recovered significantly starting in the second half of 2020, backed by aggressive expansion activities by companies, and Seoul’s Grade A office market recorded the highest net absorption of 555,000 sq. m. in 2021 despite the ongoing pandemic. For the study, 614 office buildings were analyzed in Seoul’s three major districts— Central Business District (CBD), Gangnam Business District (GBD) and Yeouido Business District (YBD)—along with office buildings in Pangyo Technology Valley, Magok and Seongsu.

After peaking in 2020, new Grade A supply in Seoul began to decline in 2021. This trend is expected to last until 2024, with the volume of new stock in the CBD and GBD set to fall particularly sharply. Amid strong demand and limited new supply, average Grade A office vacancy in Seoul is anticipated to fall to about 3.6% this year. With limited space constraining leasing activity this year, the proportion of industry demand is expected to remain relatively unchanged. Financial firms will continue to dominate, particularly in the CBD and YBD, with solid expansion by small- and medium-sized fintech start-ups expected to be observed in the YBD and GBD. Demand from manufacturing and IT-based wholesale companies will also remain solid. Especially, pharmaceutical retail companies have emerged in the major Greater Seoul region, underpinned by steady growth in the pharmaceutical market and online consumption during COVID-19.

Claire Choi, Head of Research for CBRE Korea, said, “In 2020, the emergence of COVID-19 along with the highest supply ever raised concerns over large vacancies and rents forecast in the Grade A office market.

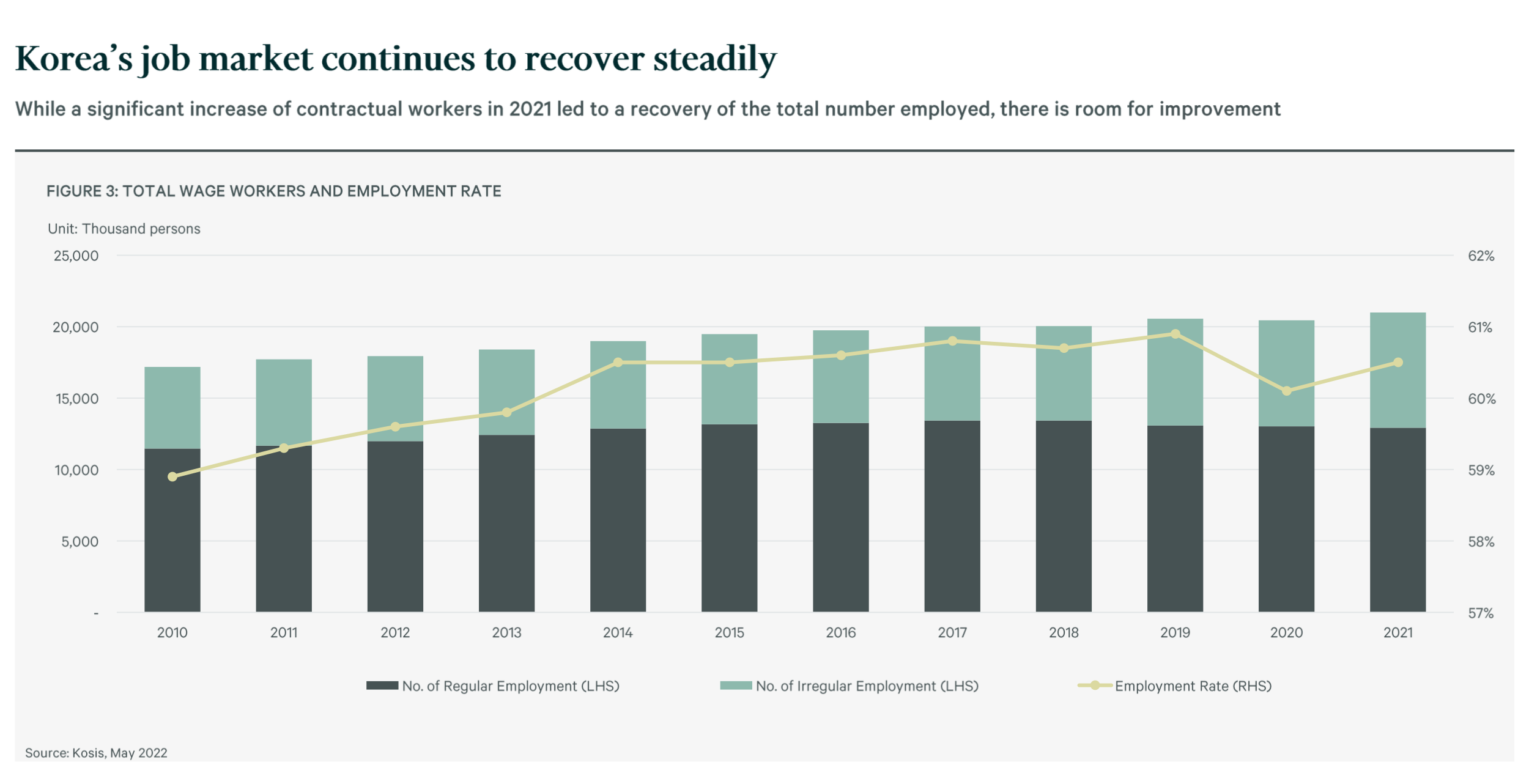

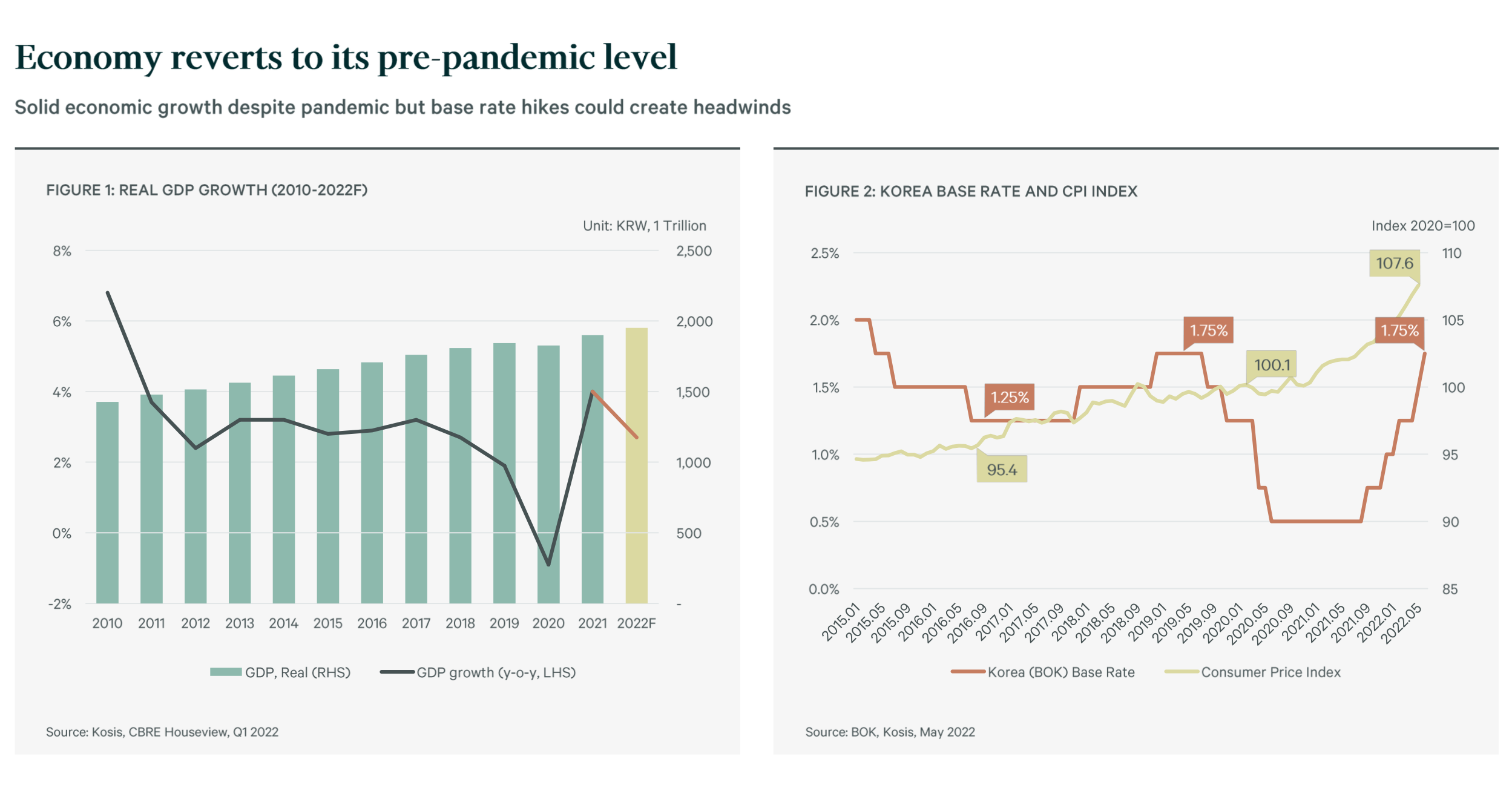

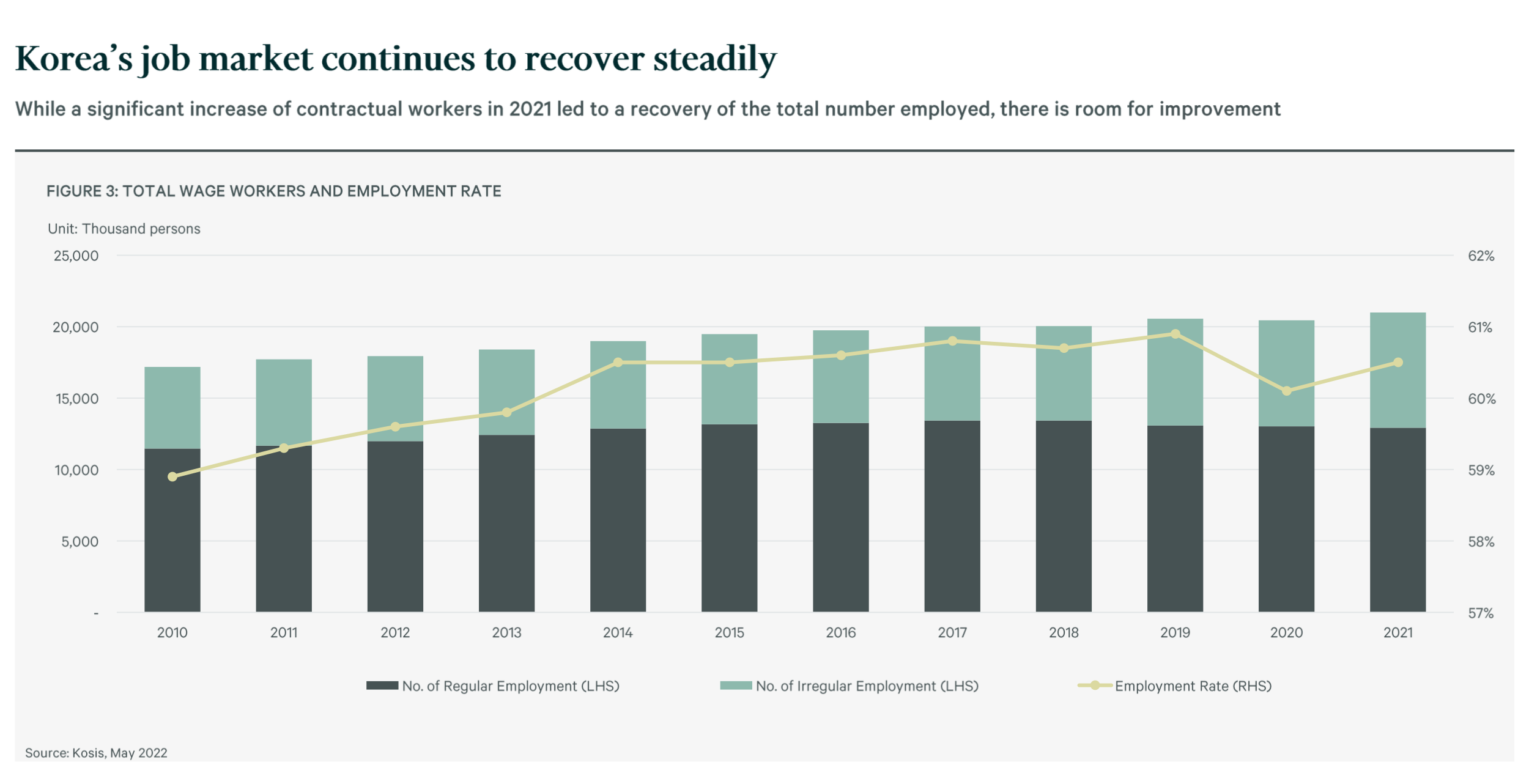

Contrary to concerns, tenants’ expansion and relocation activities have recovered significantly since the second half of 2020, and economic resilience persisted corporate economy and the office market to remain stable.

In addition, about 75% occupancy level of domestic companies in the Grade A office market and one-third of chaebol in tenant proportion enabled flexibly managing the prolonged pandemic and solid demand from domestic companies was observed. Strong demand and rental growth in the office market are expected to continue.”

Analysis of leasing demand trends in each of Seoul’s three major districts (CBD, GBD and YBD) and the Pangyo, Seongsu and Magok districts:

Central Business District

The finance industry occupies around one-third of office space in the CBD, the highest among Seoul’s major business districts. However, the finance industry’s share of Grade A CBD office space, including prime assets, fell slightly in 2021. In contrast, the professional service industry’s share registered a significant increase. The presence of conglomerates is relatively higher in the CBD compared to other districts. The share of retail space in office assets remained the highest in the CBD among major business districts, despite falling slightly from 2019.

Gangnam Business District

Demand from the manufacturing, wholesale and IT industries is more prominent in the GBD compared to other major districts. In the Prime office market, the proportion of services and IT is higher than in other districts. Demand from IT companies for space in the GBD will remain strong as they look to recruit new talent and create synergy with related companies. While the finance sector retained a 20% share of occupied space in the GBD’s Grade A office market, this was the industry’s lowest share in the major districts.

Yeouido Business District

Reflecting the YBD’s status as Seoul’s financial hub, the financial and insurance industries occupy about 58% of total office space in the area, well above that in the city’s other districts. The proportion of office buildings in the YBD allocated for self-use is relatively high, with many domestic securities firms and other financial companies maintaining headquarters in the district. Other industries with a strong presence in the YBD include manufacturing, professional services, science and technical activities, with their footprints varying across different office grades. The presence of domestic companies in the YBD’s Grade A office market increased significantly over the course of 2021.

Other Business Districts

The relatively new business districts of Pangyo and Magok are government-led development cities specializing in the high-tech and future technology industries. The IT and manufacturing sectors are most prominent in Pangyo, while the manufacturing sector occupies more than half of office space in Magok. In Seongsu, the manufacturing, IT, wholesale and retail sectors are most prominent, with strong growth from these sectors hastening the development of the district into a new office market that is absorbing demand from the GBD and CBD. The finance and insurance industries account for less than 5% of occupied space in these three minor business districts.