Based on the data released by the Urban Redevelopment Authority on 18 April, developers’ sales in March recovered by 20.7% month-on-month (MOM) to 654 new private homes sold (excluding Executive Condos, or ECs) from February’s 542 units sold. On a year-on-year (YOY) basis, developers’ sales declined 49.5% from the 1,296 units transacted in March 2021. This brings the total developer sales (excluding ECs) year-to-date (YTD) to 1,880 units, down -46.0% compared to the same period last year.

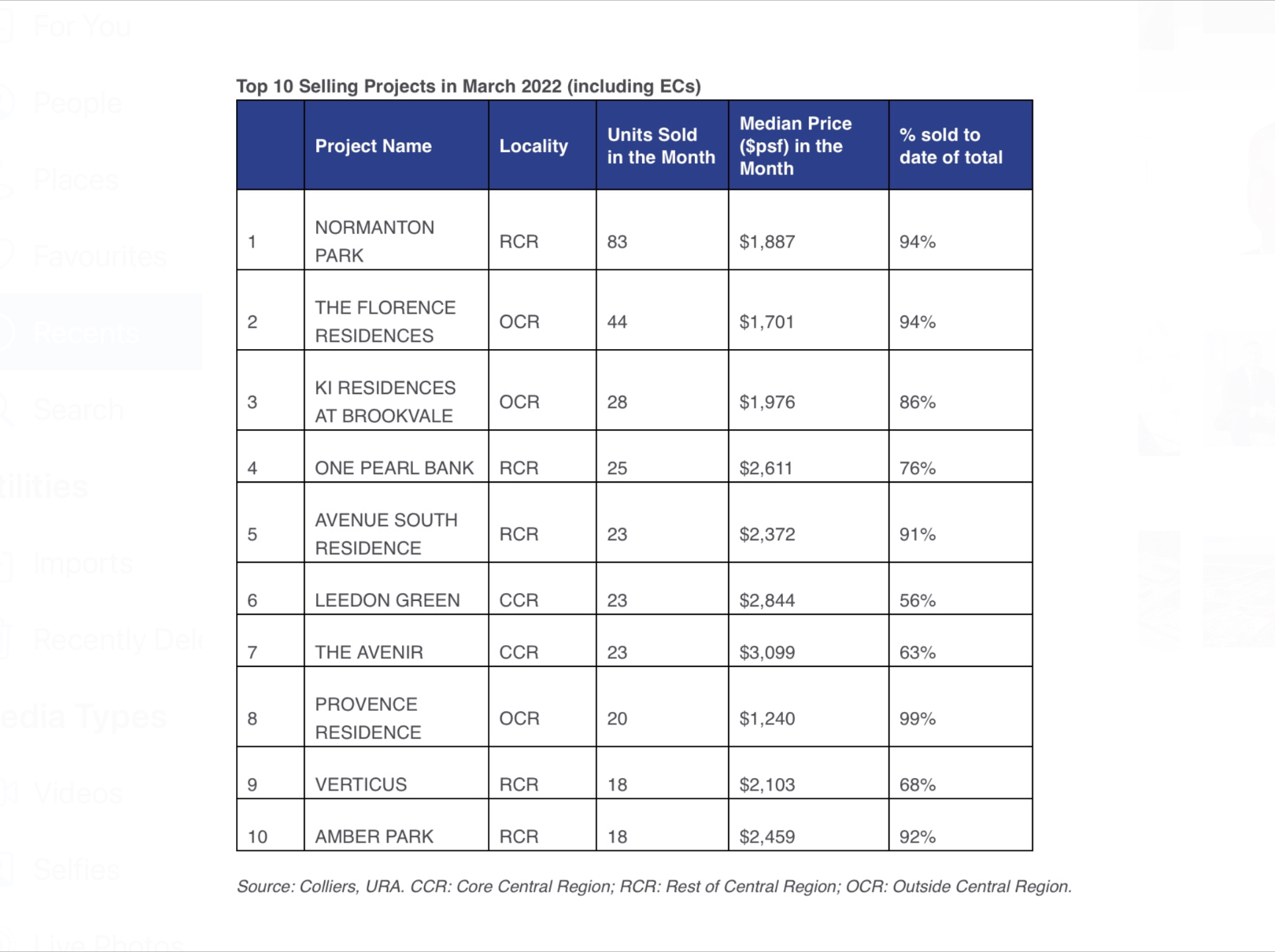

Top 10 Selling Projects in March 2022 (including ECs)

Source: Colliers, URA. CCR: Core Central Region; RCR: Rest of Central Region; OCR: Outside Central Region.

Source: Colliers, URA. CCR: Core Central Region; RCR: Rest of Central Region; OCR: Outside Central Region.

Analysis

Developers’ sales kept pace with a commendable 654 units sold, despite there being no first-time launches. This suggests that buyers have already taken the cooling measures in their stride, and that demand remains intact.

With take-up far exceeding units launched, it also implies that previous launches are still selling well. Notably, One North Eden, 3 Cuscaden, and The Jovell have sold out in March. Normanton park has also continued its impressive sales cadence with only 114 units out of 1,862 units left since launching in January last year (ie an average of 124 units sold per month).

On the other hand, sales in the CCR segment have been lagging (at just 23.4% of overall sales) probably due to a lack of launches this year, and investors sitting by the sidelines post-cooling measures and budget. However, this is expected to improve as borders reopen to foreigners, said Catherine He, Head of Research for Colliers Singapore.

Outlook

Executive condominium sales are expected to make up the bulk of sales in the coming months with the launch of the 616-unit North Gaia at Yishun Close, as it would be the ideal offering for upgraders in the vicinity. In addition, the launch of major projects such as the 407-unit Piccadilly Grand and 298-unit LIV@MB would further boost sales and prices in the RCR.

The re-opening of borders might also prompt more demand from relocation on the back of Singapore’s effective handling of the pandemic. We expect foreigner demand to recover, especially for higher-end properties where they are able to manage the higher taxes and duties.

Catherine He, Head of Research for Colliers in Singapore added, Nevertheless, with the higher additional buyer stamp duties, new home sales should come from genuine occupier demand. Potential buyers might also be motivated to lock in rates now before mortgage rates see a significant increase.

As such, new home sales should moderate 20-30% from the 13,027 units recorded in 2021 to around 10,000 units. Further, momentum in private home prices is expected to moderate and rise by just 3-5% in 2022, tracking the projected growth in GDP.

Source: Colliers, URA. CCR: Core Central Region; RCR: Rest of Central Region; OCR: Outside Central Region.

Source: Colliers, URA. CCR: Core Central Region; RCR: Rest of Central Region; OCR: Outside Central Region.