Rising wealth hub drives demand for prime shophouses and strata offices - Colliers

Contact

Rising wealth hub drives demand for prime shophouses and strata offices - Colliers

Colliers, a global leader in commercial real estate services, has published its latest research report, which discusses the impact of the rising affluence of Asia and Singapore's increasing popularity as a wealth management hub for family offices.

Colliers, a global leader in commercial real estate services, has published its latest research report, which discusses the impact of the rising affluence of Asia and Singapore's increasing popularity as a wealth management hub for family offices.

Singapore's conducive business environment and government incentives, its availability of talent pool and professional services and its quality of lifestyle have led Singapore to increasingly become the jurisdiction of choice for single-family offices (SFOs).

Tricia Song, Head of Research commented, "We believe family offices are set to grow further with the rising affluence in Asia. This phenomenon bodes well for real estate investments with smaller quantum, such as shophouses (majority SGD3-15) and strata offices (majority SGD1-5 million)".

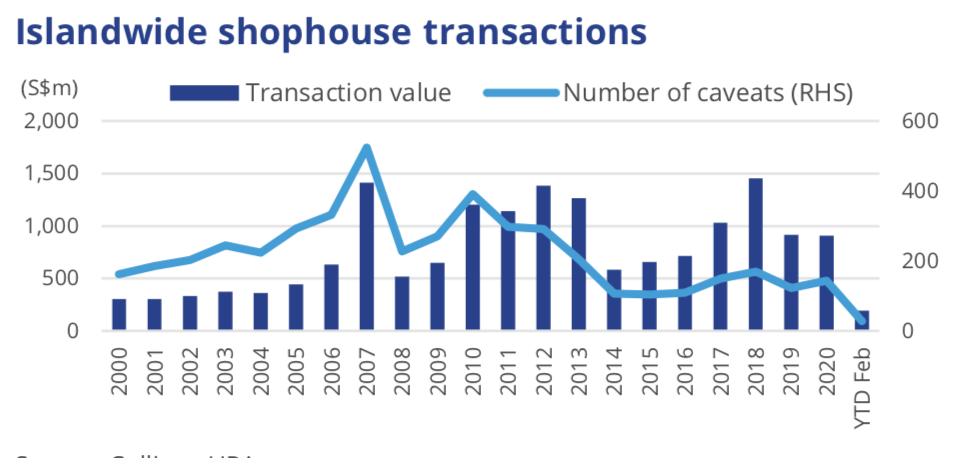

Sales volume of shophouses were down 46.1% YOY in Q2 2020, but Q4 2020 investments jumped 51.1% YOY, reflecting rising demand for repurposing prime shophouses for new work, live, play trends, such as co-living and co-working.

Steven Tan, Senior Director, Investment Services, said, "Shophouses are very versatile, it is flexible in its allowable property usage, which means that owners can redesign and repurpose their shophouse usage strategically depending on the property cycle and market demand, albeit subject to relevant authorities' approvals". Mr Tan added, "Shophouses provide alternative commercial space in the city centre where office rents are high and commercial vacancy remains tight".

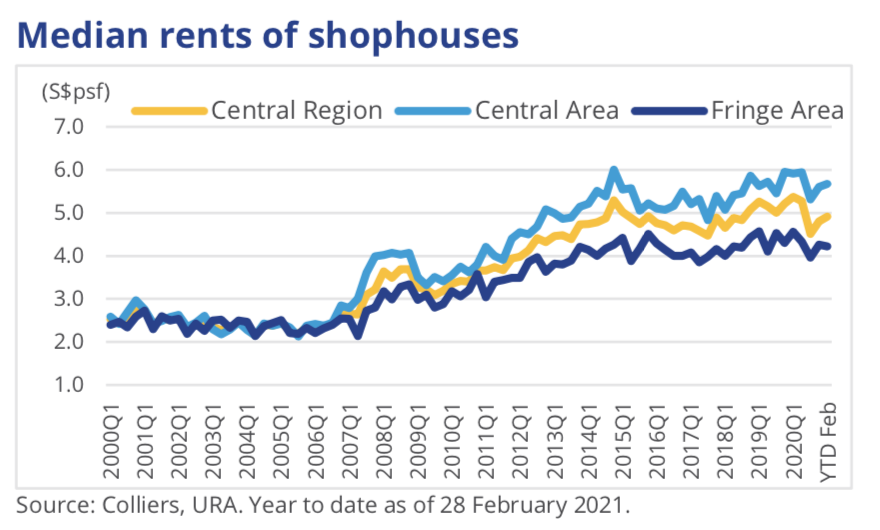

Despite the pandemic, shophouse transactions remained active in 2020, with total investment volume declining only -0.8% YOY to SGD909 million. Most of the deals were transacted between SGD2,000-5,000 per sq ft, translating to a yield of 2.0%-3.0%.

Mr Tan commented, "We see an increasingly stronger institutional interest from property funds and investment firms, apart from the usual boutique investors. Shophouses offer room for capital appreciation, given its scarcity, cultural heritage, relative affordability, and increasing capital allocation to alternative asset classes."

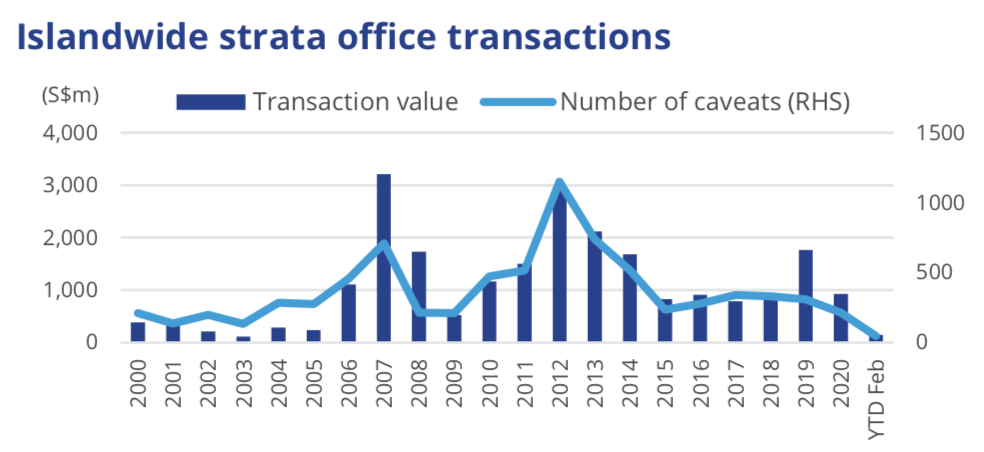

Transaction volumes in strata offices declined in 2020 due to the uncertainties in the office market from telecommuting trends. However, Colliers Research expects the office market to recover by the end-2021, driven by tech occupiers and shrinking new office stock. Longer-term drivers such as CBD Incentive Schemes and Greater Southern Waterfront should support the CBD office market outlook.

Mr John Bin, Senior Manager, Investment Services, commented, "Although strata offices are relatively scarce and represent less than 20% of the total office stock, especially in the CBD, those type of assets offer investors exposure to the wider Singapore office market at an affordable investment quantum of about SGD1-5 million, with yields of 2.0-3.0%. These will also mitigate the risk of fluctuating rents or being forced to move by landlords."

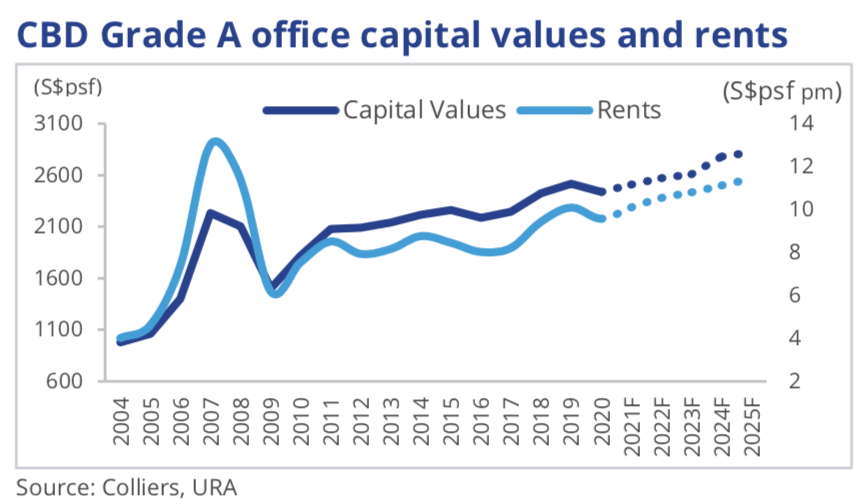

Capital values of CBD Premium and Grade A office properties have appreciated 62% (4.5% CAGR) to SGD2,436 per sq ft in 2020 since 2009. Rents have also risen 55% to SGD9.57 per sq ft over the same period. Colliers research forecasts a 5-year rent and capital value annual growth of 3.7% and 3.0% respectively over end-2020 to 2025, on growing occupier demand from Singapore's position as a top business location in Asia, and benign new supply.

Click here to register and download the report.

Similar to this:

A pair of freehold shophouses Kampong Glam Conservation Area for sale - CBRE

Colliers International strengthen its Occupier Services team with two senior key appointments