Asia Pacific commercial property markets with strong domestic fundamentals, such as South Korea, Japan and China, are holding up better in the current environment, a new report has found.

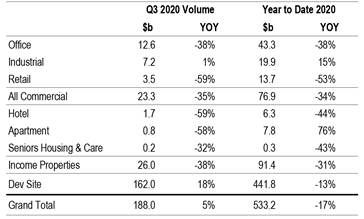

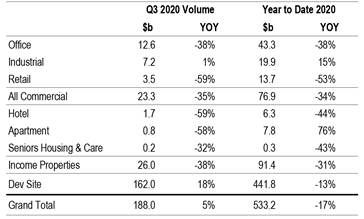

Real Capital Analytics' Asia Pacific Capital Trends report indicates commercial sales across the major income-producing property types in the region dropped to US$26 billion in the third quarter, down from US$33 billion in the second quarter of 2020 and US$42.2 billion a year ago.

The data revealed the industrial sector as the only asset class where activity matched the levels of a year ago, with all other key property types declined, with hotel and retail sales showing the sharpest drop.

According to the report, transactions involving individual properties increased from the prior quarter to total US$23.0 billion, boosted by a smattering of high-value deals.

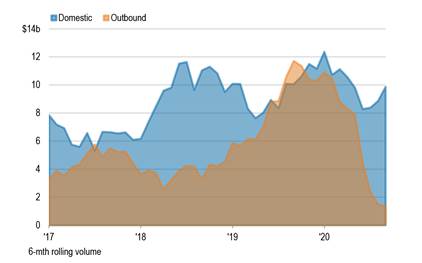

The most active markets in the Asia Pacific. Source: Real Capital Analytics

In contrast, the research showed portfolio sales fell to levels last seen during the Global Financial Crisis, with deal volume of this type is down 48 per cent from a year ago.

But RCA Asia Pacific Managing Director David Green-Morgan said there had been growth in the sales of development sites, which principally take place in China, which recorded a deal volume of US$162.0 billion, an 18 per cent year-over-year increase.

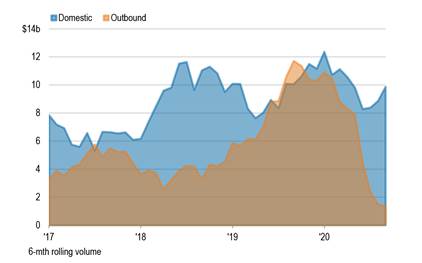

“The global pandemic continues to hamper dealmaking for a swathe of cross-border investors, and the clouded economic outlook in many markets still presents uncertainty that puts many investors on hold," he said.

"Domestic players seem to hold the advantage at the moment."

South Korea’s Robust Third Quarter Sets It Apart From Other Major Markets

RCA identified South Korea as a standout in the third quarter, with sales activity growing by 22 per cent compared with a year ago, boosted by sales of office buildings.

Mr Green-Morgan said a record US$5.0 billion of offices were traded in a single quarter and, at the end of September, there were US$9.3 billion of pending deals in the pipeline – more than the total of completed deals in Q4 2019.

"The outlook for South Korea is looking brighter than some other major economies, with a bulging deal pipeline indicating that the third quarter won’t be just a one-off positive story," he said.

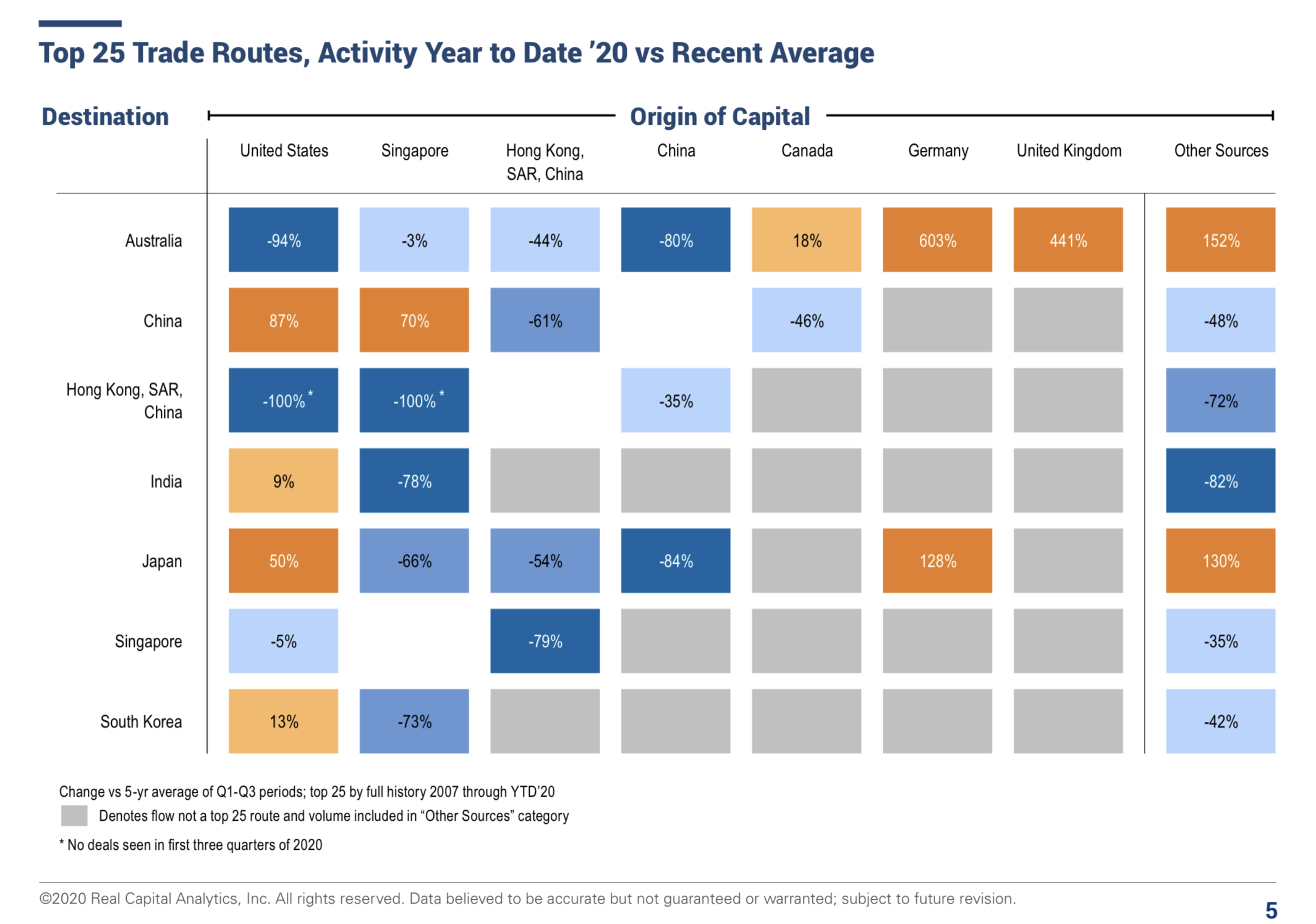

"Major investors have curtailed their spending overseas, which had been ratcheting higher prior to the pandemic.”

Acquisitions by property type. Source: Real Capital Analytics

Activity Dives in Singapore, Less Than US$500 Million Worth of Properties Change Hands

The report revealed sales activity in Singapore contracted at the fastest rate of all the major APAC markets in the third quarter and the market is also the worst performing for the year to date, with activity down 74 per cent year-over-year and behind that of Taiwan.

Just US$405 million of properties changed hands in the third quarter.

Ebbing Cross-Border Flows Hurt Australia in Q3

According to RCA, Australia’s third quarter was one to forget, with local lockdowns having stymied dealmaking and international travel restrictions have hampered cross-border investors.

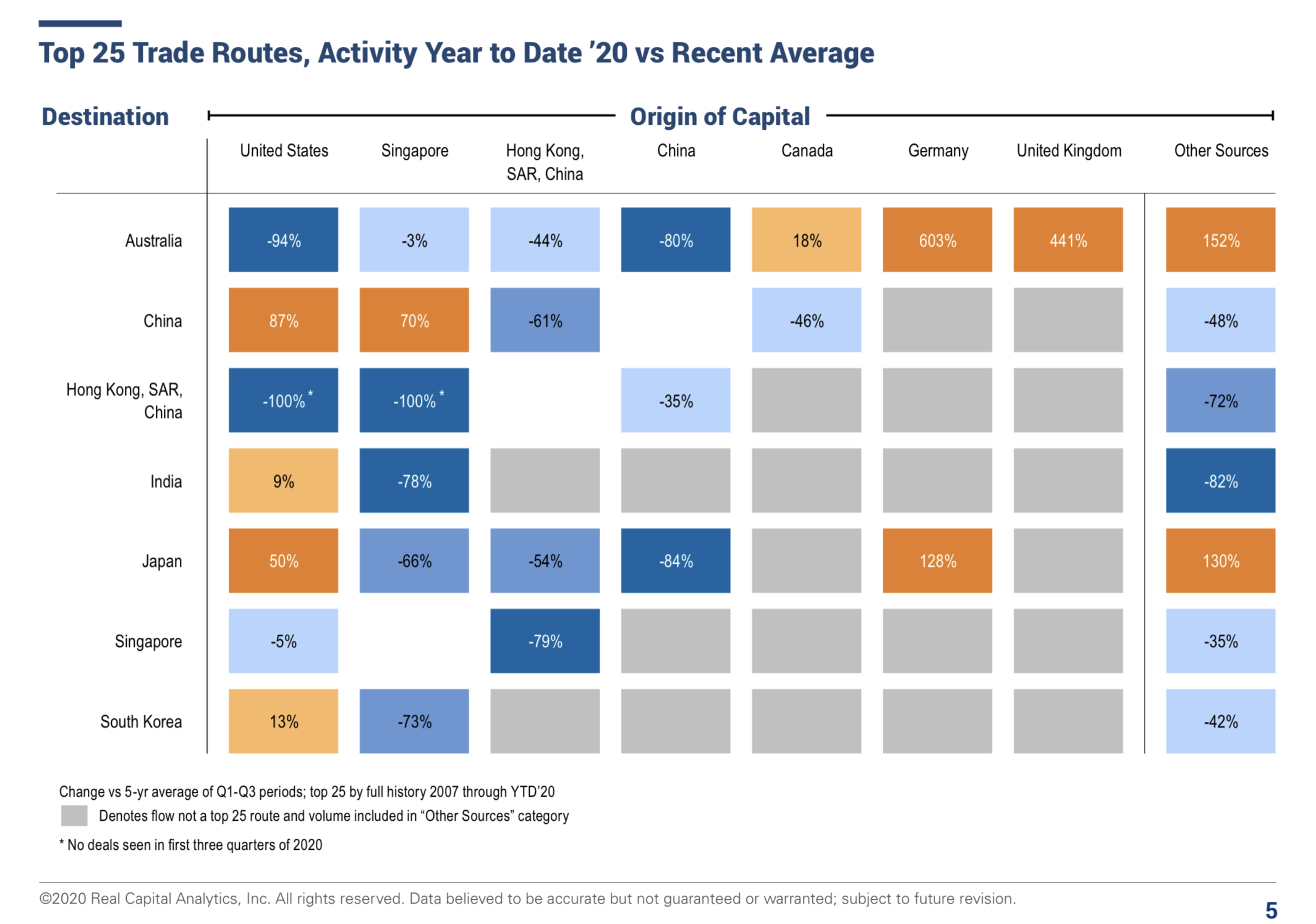

The company notes that while Some big deals led by European groups have closed this year, other investors have been notably absent, with US capital into Australia is down 94 per cent from the average of recent years.

The data shows there was a bright spot in industrial sector sales volume, which jumped to make Sydney the most active Asia Pacific market for this property type in the quarter.

South Korean Investor Deal Activity at Home and Overseas. Source: Real Capital Analytics

Taiwan Is The Sixth Largest Asia Pacific Market in 2020 So Far

Taiwan’s third quarter volume got a boost from the sale of a Taipei hotel for nearly a billion dollars, but activity was also seen in the industrial sector, with robust trading of high-tech manufacturing facilities.

The market climbed ahead of Singapore on the leaderboard of most active markets in the Asia Pacific, with deal volume of US$3.9 billion notched in the first nine months of the year.

China Forges On With Domestic Investors

With its strong domestic investor base, China has held up better than APAC markets that are more dependent on flows from cross-border groups, according to the report.

Despite some big acquisitions in the data centre sector, the RCA data shows cross-border investors turned net sellers of Chinese commercial real estate in the quarter, breaking a seven-quarter streak of acquiring more than they sold.

Activity continues to centre on Tier 1 cities, with large offices changing hands in Beijing and Shanghai during the quarter.

Source: Real Capital Analytics

Similar to this:

Investors eyeing Asia Pacific corporate sale and leaseback opportunities as owners look to unlock capital - JLL

Asian investment in Central and Eastern Europe

Opportunity areas remain amidst geopolitical and economic uncertainties in Asia