Singapore's flexible work sector is becoming more sophisticated, allowing the country's tech industry to extend its reach in the office market, new research has found.

Colliers International Singapore's Office Snapshot for the third quarter indicates flexible workspaces continue to be driver of office leasing demand, with WeWork and JustCo set to open their branches at 30 Raffles Place (82,000 sq feet) and Centrepoint (60,000 sq feet) respectively in Q4 2020.

The Great Room will also occupy 37,000 sq feet of space at the new 70 per cent pre-committed Afro-Asia i-Mark building after its completion in Q4 2020, while The Executive Centre plans to move and expand into the two highest floors in One Raffles Quay North Tower in 2021.

Colliers International Singapore Q3 Office research - At a glance:

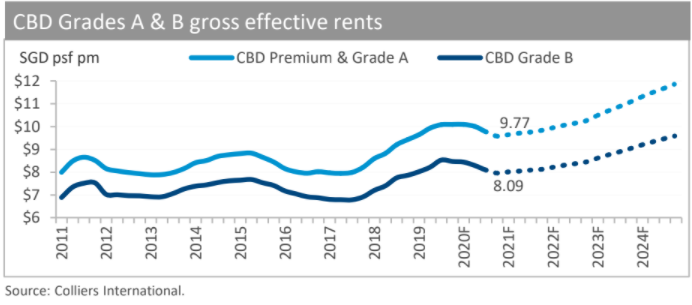

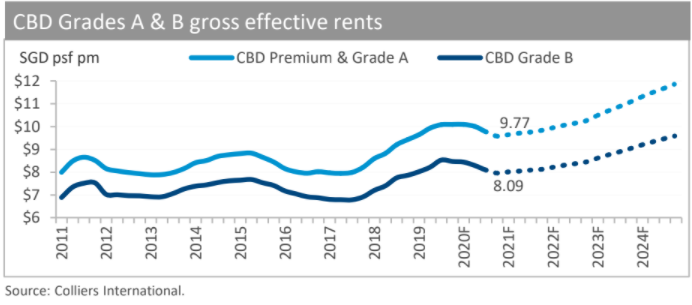

- There was an acceleration in CBD grade A rents, which fell to 2.3 per cent QOQ in Q3 2020 to reach SGD 9.77 per sq foot, versus1.2 per QOQ in Q2 2020.

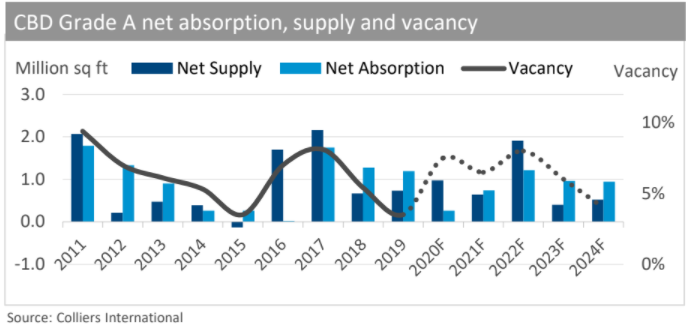

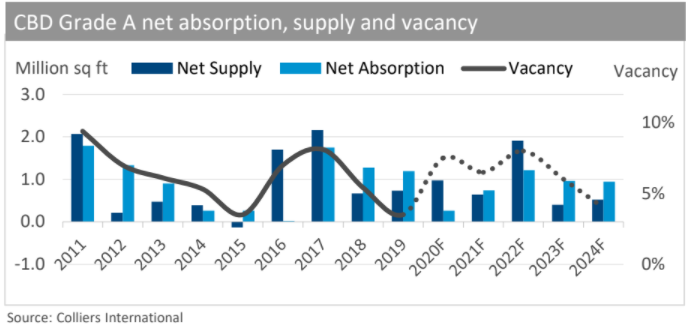

- CBD grade A vacancy rate increased 0.3pp to 4.9 per cent as certain sectors hit hard by the pandemic had to return or reduce space.

- New demand in Q3 was mainly driven by flexible workspace operators, with Tech giants making Singapore their regional hub, boding well for sentiment.

Colliers International Head of Occupier Services in Singapore, Rick Thomas, said some tech giants were planning to either expand their footprint or establish their presence in Singapore.

"Dance is reportedly planning to invest billions of dollars and recruit hundreds in Singapore as part of its global expansion," he said.

"At the same time, Tencent intends to open a new office in Singapore that will be its regional hub for Southeast Asia.

"Other tech companies such as Twitter and Rackspace also plan to expand their headcount in Singapore.

“While some of the tech giants have a small presence in Singapore now, we can expect them to bloom in the years to come and improve the tech sector representation of the overall occupiers in Singapore.”

According to the report, CBD Grade A vacancy expanded to 4.9 per cent in Q3 2020, from 4.6 per cent in Q2 2020, as incremental new take-ups in recently completed buildings were negligible, while vacancies edged up in all micro-markets except Raffles Place/New Downtown’s premium buildings.

Colliers Research noted that CBD Grade A gross effective rents continued to moderate further by 2.3 per cent QOQ to SGD9.77 per square foot in Q3 2020, while Grade B rents slid 2.4 per cent QOQ.

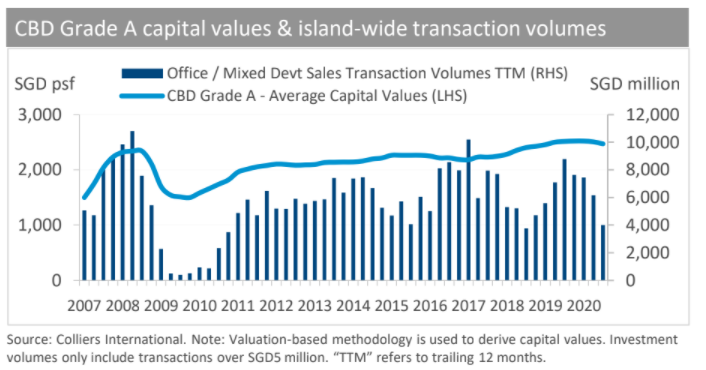

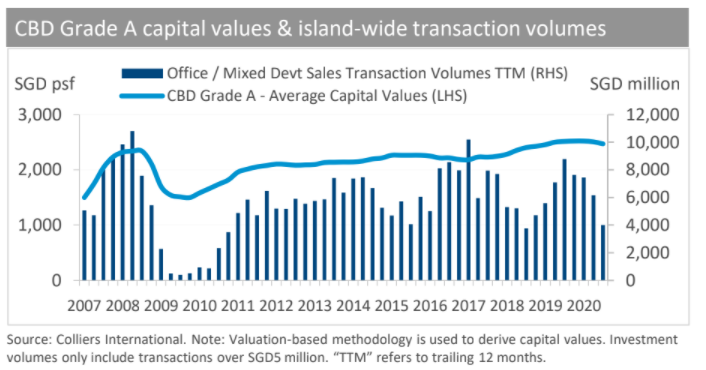

Mr Thomas said Singapore remained attractive to investors despite a 35.8 per cent QOQ decline in the total office or mixed office investment volumes to SGD846 million in Q3 2020, which brought the rolling 12-month volume to SGD4.0 billion, a 34.5 per cent decline QOQ.

“With the recent government relaxation of work from home restrictions, occupiers who have already started strategising and rationalising their real estate portfolio will now act," he said.

Meanwhile, landlords are more willing to negotiate, and occupiers are in search of greater value.

"We are optimistic and expect increased activity in the office leasing market over the next few months.”

Click here to view full report.

Similar to this:

'Marginal' rental declines across Singapore residential leasing market during second quarter - report

Asia Pacific property markets demonstrate resilience in Q2, set for 'gradual' rebound as investors return - Colliers International

Office and logistics assets offer best combination of yield and income growth in APAC markets- Colliers