Asia Pacific commercial sentiment improving despite drop in investment volume - CBRE

Contact

Asia Pacific commercial sentiment improving despite drop in investment volume - CBRE

CBRE says there is cause for optimism within Asia Pacific's commercial real estate sector, despite new research showing investment volumes in the region have reached their lowest point since 2012.

Asia Pacific commercial markets including Australia, Korea and mainland China can expect investment volume to rebound in the coming quarters as overall sentiment improves but sufficient pricing discounts must be provided, CBRE says.

The firm's latest Asia Pacific Marketview report shows commercial real estate investment volume in the region fell 48 per cent year-on-year to US$17 billion in the second quarter of this year, representing the lowest quarterly turnover since the corresponding quarter of 2012.

According to the report, the office sector has been among the primary drivers of the decline, with net absorption sinking to its lowest total in a decade as occupiers remained in wait-and-see mode or opted for renewals owing to the absence of budgets for capex.

Grade A rents subsequently fell by 1.8 per cent q-o-q.

At a glance:

- CBRE has released its Asia Pacific Marketview Q2 2020, detailing commercial activity across the region in the last three months.

- According to the report, commercial real estate investment volume in the region fell 48 per cent year-on-year to US$17 billion in the second quarter of this year, representing the lowest quarterly turnover since the corresponding quarter of 2012.

- The retail and office sectors both suffered significant losses, while there was a "mild improvement" in industrial sentiment.

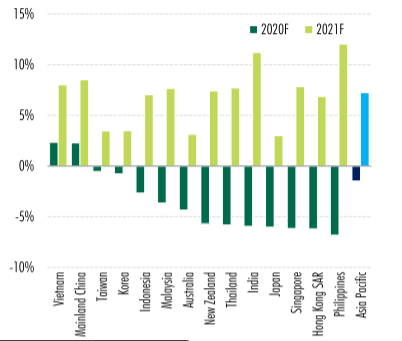

Asia Pacific 2020 and 2021 Growth Forecast (y-o-y). Source: CBRE Research

Retail has also borne the brunt of COVID-19's impact, with the research showing vacancy increased across the region as a "wave of store closures", led by right-sizing and market exits by several global fashion brands, took effect.

Pre-leasing activity in new supply was weak amid subdued overall demand, while rents declined by 2.3 per cent quarter-on-quarter.

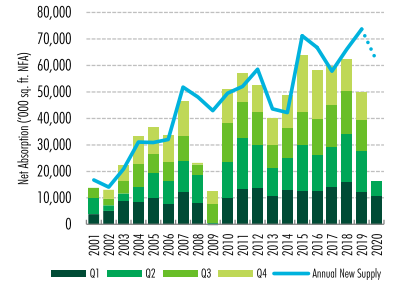

Asia Pacific office net absorption. Source: CBRE Research

The shining light for Asia Pacific commercial markets in the quarter was in the industrial space, which CBRE reported experienced a "mild" improvement in sentiment along with the resumption of industrial activity.

The research indicated warehouse space continued to attract robust demand in most markets- led by e-commerce related platforms- and rents were largely unchanged.

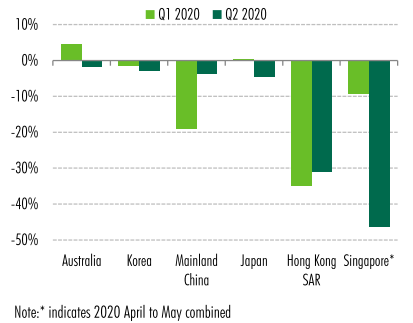

Y-O-Y retail sales growth in selected markets. Source: CEIC, Q2 2020

Going forward, CBRE expects purchasing activity to be driven by local buyers in the remainder of the year as a result of ongoing travel restrictions, adding that overall investment sentiment would improve further, albeit under different conditions.

"Several markets, including Korea, Australia and mainland China, can expect to see investment activity rebound in the coming quarters, with several sizeable deals nearing completion," the report reads.

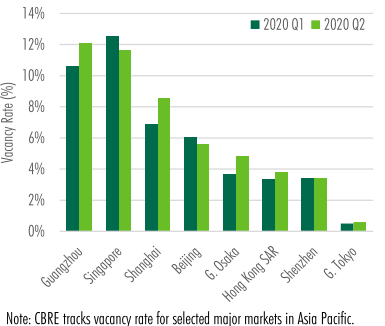

Logistics vacancy rate across various markets. Source: CBRE Research

"While investors are more willing to consider assets with vacancy risk, sufficient pricing discounts must be provided.

"Sellers have lowered prices in recent months, but these reductions are still not aligned with buyer expectations, meaning that the price gap will continue to hinder investment activity."

Click here to view the full report.

Similar to this:

Leasing and investment activity in Seoul 'remains stable' despite pandemic impact - CBRE

The effects of Coronavirus on Japan's real estate market

Digital transformation of retail in the Asia Pacific accelerating due to COVID-19 -CBRE Survey