'Unprecedented' times to explore hotel opportunities in Hong Kong - Colliers International

Contact

'Unprecedented' times to explore hotel opportunities in Hong Kong - Colliers International

The potential re-introduction of regular travel between Hong Kong and Mainland China provides optimism for the recovery of the Hong Kong hotel market after 12 months of unrest, according to a new report by Colliers International.

The introduction of international travel restrictions and the closing of the border with Mainland China has forced Hong Kong hoteliers and investors to consider whether to buy, sell or hold, a new report from Colliers International says.

According to Unprecedented times to explore hotel opportunities, while efforts have been made to create a ‘staycation’ market, 12-months of disruption has seen COVID-19 compound the negative impact of social unrest.

Unprecedented times to explore hotel opportunities (Colliers report) - At a glance:

- Hong Kong’s hotel sector has been challenged in the last 12 months with COVID-19 compounding the effects of city-wide social unrest.

- Hoteliers and investors with a long-term vision should take this opportunity to revisit strategies and establish or expand their footprint in the city.

- Conversions from hotels into other uses provide viable options for owners and investors.

However, Colliers International Senior Director for Capital Markets, Shaman Chellaram, told WILLIAMS MEDIA the potential re-introduction of regular travel between Hong Kong and Mainland China provided optimism for recovery as pre-COVID-19 figures demonstrated cross-border travel contributed to 80 per cent of the city’s inbound tourism.

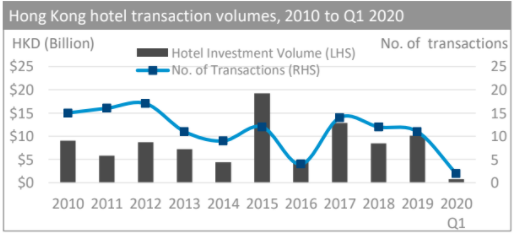

"Uncertainty in the market is creating the potential for owners, investors and private families to consider their position in the sector" he said.

Source: Colliers International

"Any stakeholders with a long-term investment horizon and scalable portfolios could use current momentum as a trigger to expand their footprint, seek to partner with strong operators, or even consider M&A opportunities.”

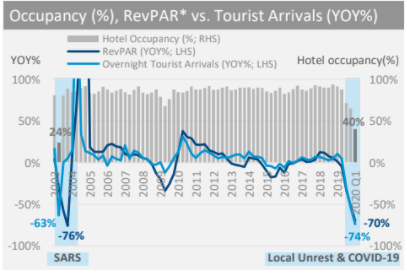

Figures from Colliers indicate tourist arrivals were down 81 per cent YOY for Q1 2020, causing a drop in Hong Kong hotel occupancy rates, which fell to 32 per cent in March 2020.

Colliers Senior Manager of Valuation and Advisory Services, Pureanae Jang, said although Hong Kong would recover, the uncertainty of the timeframe would be a major factor in the decision-making process.

“Now is a good time for owners and investors to revisit strategies," she said.

"As the market goes through a downcycle, the uncertainty will impact investor’s returns and future vision."

Source: Colliers International

She added that now could be a good time for independent hotel owners and operators to reposition assets, especially if they own ageing stock.

“Investment in alternative uses could be considered," she said

"Traditionally this would mean office space, but we are seeing growing interest in co-living or serviced apartments.

"We have recently witnessed transactions in the market and receiving an increased number of requests to support valuations and feasibility for related projects."

Click here to download the full report.

Similar to this:

Climate causing 'hesitation' among Hong Kong investors

Long-term opportunities still being generated by Asia Pacific property markets - Colliers

Hong Kong commercial real estate market expected to 'walk out of the shadows' in 2020