CBRE Releases "In and Out Japan 2019" Report

Contact

CBRE Releases "In and Out Japan 2019" Report

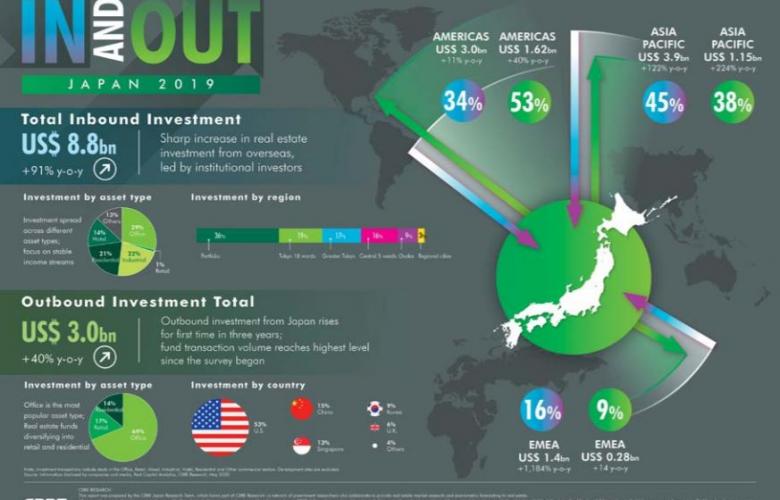

CBRE reports Japan inbound real estate investment inreases by 91 per cent and outbound investments increases by 40 per cent.

CBRE today released its "In and Out Japan 2019" report that summarizes overseas investors’ investment in Japanese real estate (inbound) and Japanese investors’ investment in overseas real estate (outbound).

Inbound real estate investment

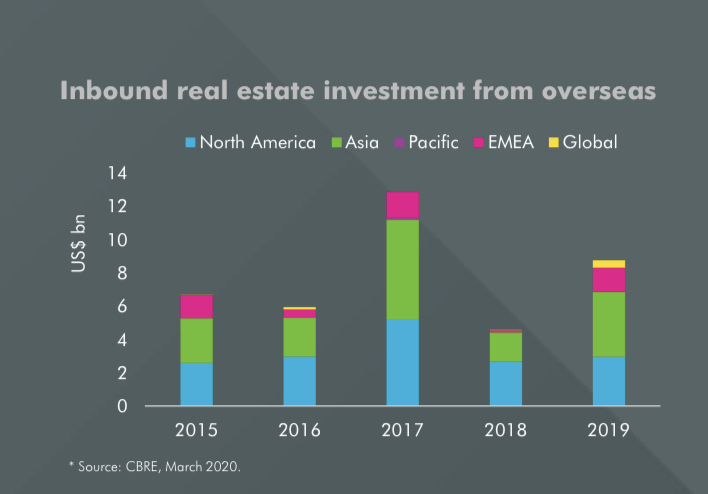

There has been a sharp increase in real estate investment from overseas, especially from Asia.

In 2019, investment by overseas investors in Japanese real estate totaled US$ 8.8 billion (JPY 955 billion), a substantial increase of 91 per cent y-o-y, with Asia up 122 per cent y-o-y.

At a Glance:

- Overseas investment in Japanese real estate totaled US$8.8 billion

- Asia accounted for 45 per cent of total transaction volume

- Outbound real estate investment rose by 40 per cent

Excluding the Pacific, transaction volume increased from all regions.

Asia accounted for 45 per cent of total transaction volume, with Korean investors comprising around 40 per cent of this figure.

There was a rise in transaction volume, especially by institutional investors.

By investor type, real estate funds accounted for the largest portion of transaction volume at US$ 4.4 billion (JPY 486 billion), representing 51 per cent of the total.

Institutional investors accounted for US$ 2.8 billion, around a 10-fold increase from the previous year.

Investors focus on asset types that provide stable income streams.

Transaction volume for residential, logistics, and hotel properties rose in 2019.

As many investors believe price growth is nearing an end, residential and logistics facilities are attracting strong demand due to their ability to provide stable income streams.

Outbound real estate investment

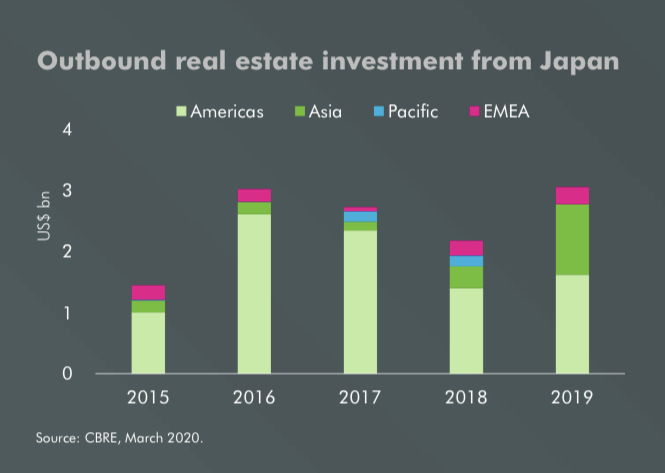

Outbound real estate investment rises for first time in three years Japanese outbound real estate transaction volume rose by 40 per cent y-o-y to US$ 3.0 billion in 2019, the first increase since 2016.

By country, the U.S. received the most investment at US$ 1.6 billion, accounting for 53 per cent of the total.

Offices are the most popular asset type; real estate funds adopt Core (Core-plus) strategy.

Most Japanese outbound real estate investment was in the office sector, accounting for 69 per cent of total transaction volume.

Real estate firms and trading companies invested 88 per cent of their funds in this sector.

More funds were seen to be investing in diversified asset types, with a focus on Core or Core-plus.

Similar to this:

Odyssey fund closes with US$50 million in gross assets

Tokyo home to most UHNWI while Beijing leads investment volume- report

Liquidity, fixed rents to support Japan market through coronavirus - Colliers