The Odyssey Japan Boutique Hospitality Fund is a culmination of two years of strategic planning, selection of key partners, capital raising and execution by the Japan CRE team.

The Fund has now successfully closed on 31st March, 2020 with over US$50 million of gross assets under management and is ready to acquire additional quality assets to the portfolio.

Leveraging on a situation where there is dislocation and a lack of supply in the Japanese boutique hospitality market sector is no mean feat.

However, the Odyssey Japan Boutique Hospitality investment strategy aims to do just that by focusing on access to unique properties that can be repositioned into high-yielding , income-producing boutique luxury hospitality real estate assets.

These assets need to embody the beauty and refinement of Japanese culture and design and in turn, attract the affluent domestic and international traveller.

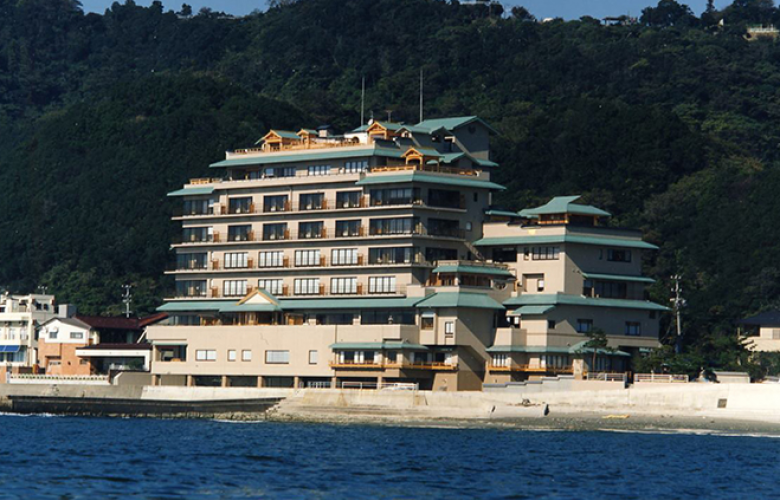

The 3rd Acquisition - Hanaya - Onsen Ryokan in Tottori

The primary real estate the Fund targets are:

1. Ryokans, or traditional Japanese inns in key tourism destinations with high demand from both domestic and international tourists

2. Historical & heritage buildings that can be converted into boutique hotels

3. Machiyas or townhouses primarily in the Kyoto region

4. Existing boutique hotel assets in key cities with growth and optimisation potential

Fund Timeline. Source: Odyssey

The Fund’s investment strategy leverages the following key investment thematics and underlying market factors:

· Long term structural drivers supported by "Abe-nomics" and Japanese government initiatives.

· The Japanese hospitality market is one of the few developed-economy real estate markets still delivering attractive yields.

· Limited supply of boutique hotel lodgings to meet both domestic and international market demand.

· The Fund targets a +15% IRR (levered), which includes an 8% preferred dividend paid bi-annually.

· The fund presents a great alternative solution that is price on the NAV of real assets and uncorrelated to the equity markets.

2nd Acquisition - Project Falcon - Machiya portfolio conversion in Kyoto (completion date in Q2 2020). Source: Odyssey

View the fund presentation here.

Who is Odyssey:

The Odyssey Group Ltd is Asia’s leading mid-market Alternative Asset Manager providing differentiated and bespoke investment solutions across multiple asset classes, including alternative credit, real estate, private equity, and hedge funds. The Firm’s primary focus is to seek out undervalued investment opportunities to co-invest with its clients.

The Odyssey team comprises over 40 experienced asset managers, lawyers, private bankers, trust & tax planning specialists and experienced investors, each with an average of 25 years of financial, execution and operational experience across the Asia Pacific, Europe, and North America.

Similar to this:

Odyssey Japan Boutique Hospitality Fund & Shinhan Announces Acquisition of Owan Hotel

Fund to convert Japan's historic architecture into luxury boutique hotels

Tokyo overtakes London as world's busiest real estate market