In our previous quarterly write-up, we had anticipated investment sales to come in between S$30 and S$35 billion in 2020.

However, we believe that the range may have to be reduced significantly to S$20 to S$25 billion, not because of any deterioration in buyer sentiment but rather coming into the new year, there are hardly any large seller’s mandates.

Owing to the sudden crimp in supply, it is creating a condition where buyers, as the year progresses, face greater pressure to invest, and may end up stretching their offers.

This may result in generally higher prices in some asset classes, especially the office, retail and hospitality sectors.

Since H2/2019, the China region has been experiencing a brew of issues.

Beginning with the HK protests, the entire Chinese continent has, at the time of writing, sunk into a quagmire of uncertainties.

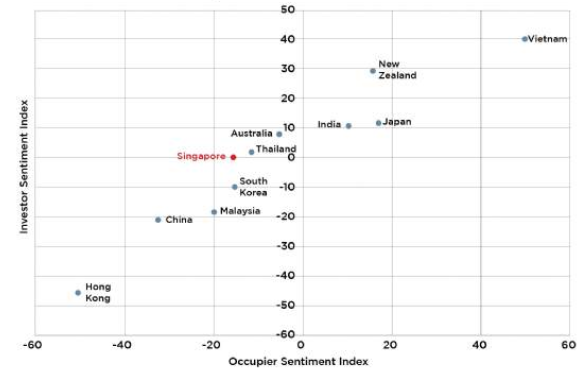

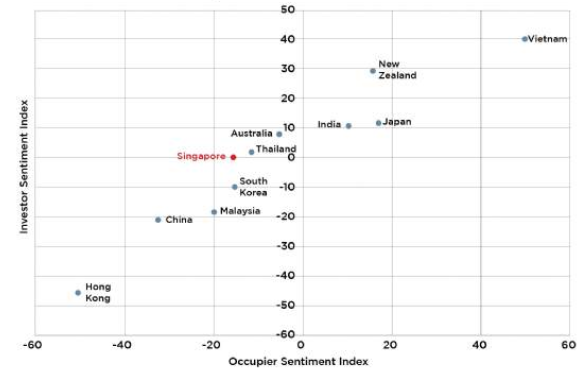

Graph 1 shows the output of the RICS investor and sentiment index survey for Q4/2019.

We believe that, come Q1/2020, not only will both indices fall further but also that Hong Kong and China will fall relatively greater compared to other Asian cities.

However, in the backdrop, liquidity is piling up and those with an Asian mandate will have to find relative safety in a sea of uncertainty stemming from the outbreak of COVID-19.

Using Q4/2019’s indices as a guide, within the China, Hong Kong and Southeast Asian region, both investors and occupiers’ sentiments towards Singapore had been relatively strong and had placed the country above previously popular markets in China and Hong Kong.

We believe that 2020 may turn out to be a year where the channel of investment flow bifurcates sharply with a pool heading towards North Asia ex-China (Japan and South Korea), and another moving down to Singapore and Vietnam.

All this is due to the relative risk of being affected by the direct and indirect fallout from the COVID-19 outbreak and the need to find an abode for both institutional and family capital.

Whilst there is still a lack of visibility with regards to large sell side mandates in Singapore, the weight of money looking for relative safety may force bring about off-market transactions at record prices.

Nevertheless, even if record prices are set, but because of a dearth in selling mandates and the chasm in the bid-ask spread, total investment values this year may still come in below 2019’s.

Graph 1: RICS survey of Investor and Occupier Sentiments for Asia, Q4/2019. Source: RICS, Savills

If the virus becomes the new norm

Our approach to looking at the future of our investment sales market is based on the various scenarios that may take place.

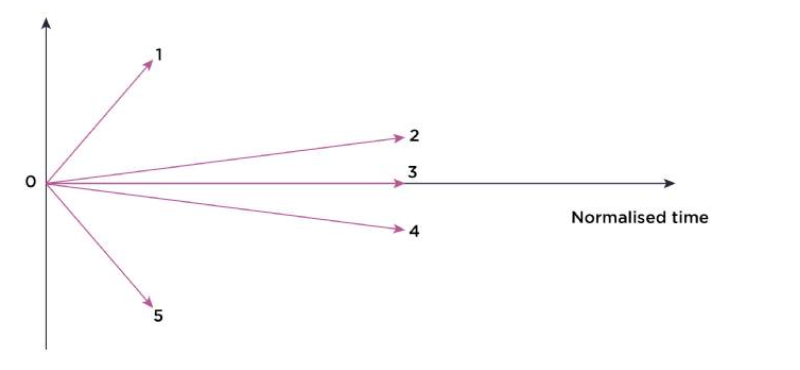

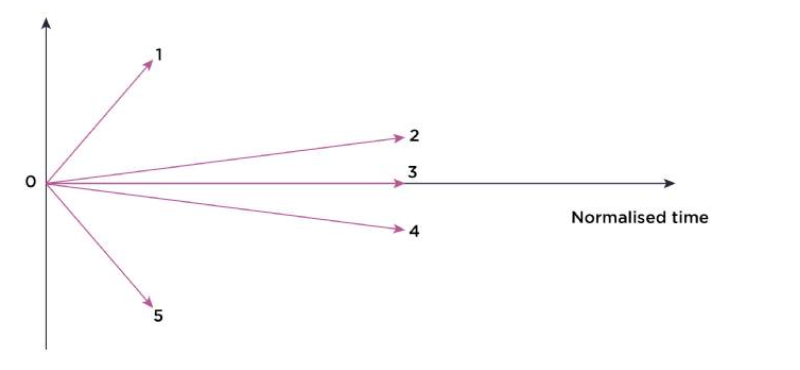

There are four general ways as to how investment confidence may behave ahead.

This is predicated on governments and society accept the presence of COVID-19 in our daily lives as the new norm, or if hope is rekindled with the discovery of an effective vaccine.

Graph 2:Five major directional permutations of investor market sentiments moving forward. Source: Savills

Varying approaches

At the time of this writing, governments around the world have not taken a unified approach to tackling the outbreak.

Some are reporting incredulously low infection numbers, some are conducting selective testing while others are game to their residents having easy access to tests.

Naturally, the various stance adopted would result in differing infection rates.

Also, the degree of border controls appears selective.

Some countries are exercising strict border lockdowns e.g. Mongolia, and many others have selective border controls.

The multichotomous approach adopted by other governments and changing domestic policies on travel that makes it difficult to get a sense of the infection curve profile for any country.

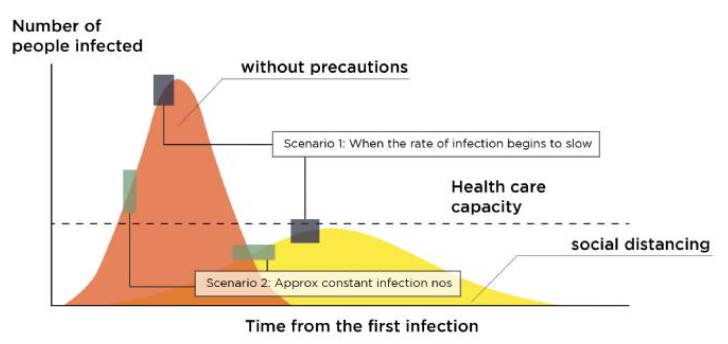

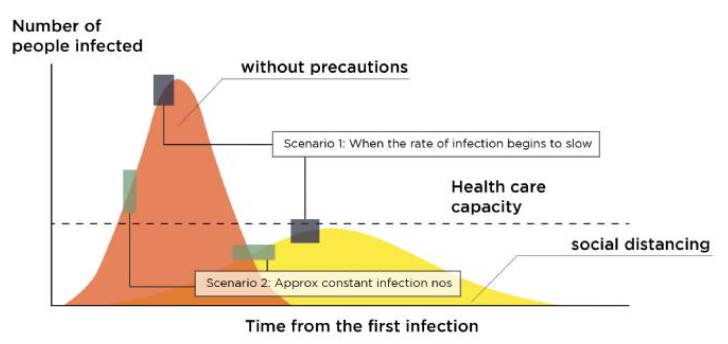

For countries that do not take precautions, it is easy to pick the curve.

Graph 3: Epidemic infection curves with and without social distancing. Source: Johannes Kalliauer/CC BY-SA 4.0

Singapore flattening the curve

Singapore's multi-pronged approach (social distancing, quarantine or stay home orders for those travelling in and barring short term visitors from entering etc.) means rates of infection in the country will be lower but the time for the infections to fall to negligible levels will also be prolonged.

If we believe that the infection numbers follow the stylised curves, we really don’t need to get to the peak in order to find out when things will start to get better. All we need is to get to the point when the infection numbers begin to slow, and the informed will be able to build the math to estimate when the inflexion point is and when the whole episode may end.

Unfortunately, at the time of this writing, for Singapore and the world, that is difficult to ascertain because we are seeing an acceleration of infection rates in some countries, different approaches taken by countries to test for infections and some countries incredulously reporting almost negligible infection numbers.

Also, because of confounding factors, the shape of the infection curve may be distorted.

If there are no surprises then, once the infection numbers begin to lower, we may be able to have an idea of when the worst will be over.

Click here for more Savills insights.

Source: Savills

Similar to this:

Pandemic expected to have 'somewhat short-lived' impact on US commercial market - CBRE

Singapore auction listings rise but sales fall - Colliers

Singapore 2020 Budget 'fit for the times'