Five Australian cities make top 30 luxury list

Contact

Five Australian cities make top 30 luxury list

Knight Frank's Prime Global Cities Index includes five Australian cities.

Knight Frank has released its global Prime Global Cities Index for the third quarter this year.

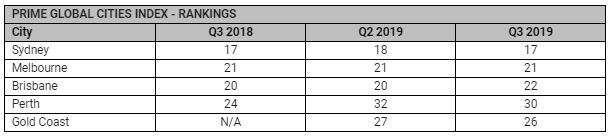

The list includes five Australian cities that rank in the top 30 globally for luxury residential price growth.

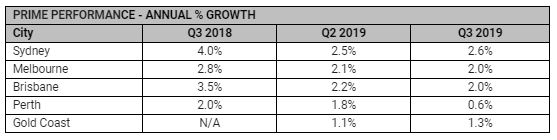

Sydney ranks 17th (2.6 per cent annual growth), Melbourne ranks 21st (2.0 per cent), Brisbane ranks 22nd (2.0 per cent), the Gold Coast ranks 26th (1.3 per cent) and Perth scrapes in at 30th (0.7 per cent).

Four of these cities (Sydney, Melbourne, Brisbane, Gold Coast) all recorded growth in luxury residential prices higher than the overall average annual prime price growth of 1.1 per cent across the 45 global cities in the 12 months leading up to the end of September this year.

At a glance:

- Sydney, Melbourne, Brisbane, the Gold Coast and Perth have made it into the top 30 list for luxury residential growth worldwide.

- Four of these cities recorded growth higher than the average annual prime price growth.

- Sydney improved its global ranking and is in the top spot for Australia.

The index tracks the movement in prime residential prices (the top 5 per cent of the housing market in most cities, by value) across 45 cities worldwide.

Sydney improved it’s global ranking, and remains in the top spot for Australia, while Melbourne maintained its ranking from the previous quarter.

The Gold Coast, which was included in the Prime Global Cities Index for the first time in Q2 2019, moved up the rankings to 26.

Source: Knight Frank

Knight Frank’s Head of Residential Research Australia Michelle Ciesielski said while the Australian mainstream residential markets were progressively being corrected by tightened lending measures, the prime property market continued to experience positive growth given the prestige end of the market was less impacted by funding restrictions throughout this time.

"In fact, the major east coast cities of Sydney, Melbourne, Brisbane and the Gold Coast have now recorded 25 quarters, or more, of positive annual growth," said Ms Ciesielksi.

“Growth in prime property prices closely follows the performance on the stock exchange – and there have been some significant gains made on the Australian sharemarket in 2019.

"Collectively the Australian prime market has continued to see sustainable growth of 2 per cent in the year ending September 2019, whilst the sharemarket recorded a 7.7 per cent return.

Ms Ciesielski said with equities on an upward growth trajectory, its likely this will follow through to further growth in prime property prices.

Source: Knight Frank

The Prime Global Cities Index increased by 1.1 per cent in the year to September 2019, down from 3.4 per cent in 2018, with slower prime price growth attributable to mounting economic headwinds.

Knight Frank’s Head of Prestige Residential Deborah Cullen said they were currently seeing the top end of the market show more consideration and time in transacting.

"There is still strong interest from local and expat buyers for blue ribbon areas and for “best in class” assets, in particular the waterfront areas of Sydney," said Ms Cullen.

The Knight Frank Prime Global Cities Index Q3 2019 found Moscow was the city with the strongest rate of annual price growth globally, recording a 11 per cent 12-month increase.

This was followed by Frankfurt (10.3 per cent), Taipei (8.9 per cent), Manila (7.4 per cent) and Berlin (6.5 per cent).

Similar to this:

Brisbane, Sydney, Melbourne and Perth make Knight Frank Prime Global Cities Index

Hobart leaps to 11th place on Knight Frank price growth index

Sydney, Melbourne make top 20 for Knight Frank Prime Residential Index