Asia’s Billionaire Population Fastest Growing Globally

Contact

Asia’s Billionaire Population Fastest Growing Globally

Asia’s billionaire population growth is set to outpace other regions between 2018 and 2023, according to data prepared exclusively for the 13th edition of The Wealth Report - Knight Frank

According to Knight Frank The number of billionaires from the Asian region will rise by 27%, surpassing growth in North America (17%) and Europe (18%), reaching 1,003 in the next 4 years – more than a third of the world’s total billionaire population of 2,696.

At a glance:

- Asia outperforms in global wealth growth, but the pace is set to slow

- 8 of top ten UHNWI growth markets to come from Asia by 2023

- Political and economic uncertainty may hamper wealth creation in 2019

However, this growth is at a slower pace compared with the last period measured from 2013 to 2018 when the number of billionaires in the region more than doubled from 363 to 787.

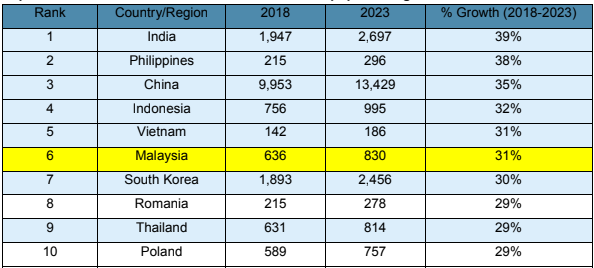

Distribution of Ultra-High Net Worth Individuals (UHNWIs)

Echoing the trends seen in previous editions of The Wealth Report, Asian countries will also see the fastest growth in UHNWIs, defined as those with net assets of US$30 million or more, in the period between 2018 and 2023. Of the 59 countries and territories in Knight Frank’s forecasts, 8 of the top ten countries by future growth are in Asia.

Top 10 countries/territories with the fastest UHNWI population growth

Source: Global Data WealthInsight

Nicholas Holt, Head of Research, Knight Frank Asia Pacific, says, “Despite softening momentum in the region’s economies, growth prospects in Asia remain favourable in the medium term. While China’s economy is expected to slow, emerging markets such as India and the Philippines will deliver some of the strongest growth over the coming years.”

Though the forecast for long-term wealth creation remains positive, UHNWIs in Asia-Pacific are less optimistic about growing their wealth in 2019, according to the Attitudes Survey. Against the prospect of continued higher interest rates and with the ongoing China and US trade tariffs, wealth advisors in Asia (excluding Australia and New Zealand) were among the least optimistic globally about their clients’ ability to create wealth in 2019.

“The uncertainty around US-China trade tensions, a Chinese economic slowdown and Brexit have all dampened regional sentiment for the next twelve months. While a deterioration in any of these situations could further impact sentiment, Asia remains one of the key growth engines of the world economy,” says Holt.

Click here to view the 13th edition of The Wealth Report - Knight Frank

For more information about the report phone or email Nicholas Holt, Head of Research, Knight Frank Asia Pacific via the contact details below.

Similar to this:

Asian Investors sticking to core London markets in times of uncertainty

Bangkok home price among the cheapest in the key global cities - CBRE