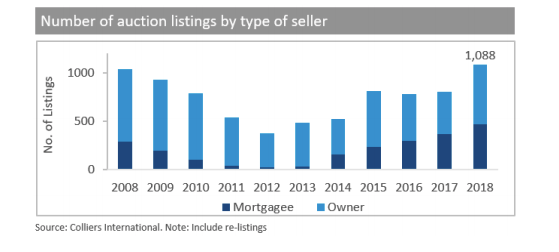

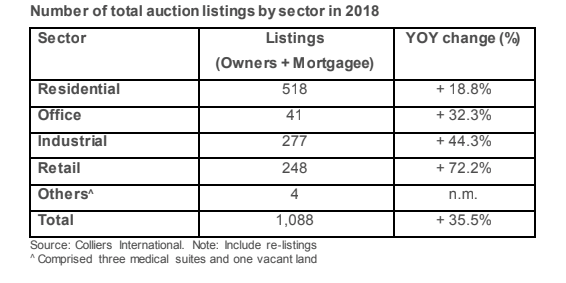

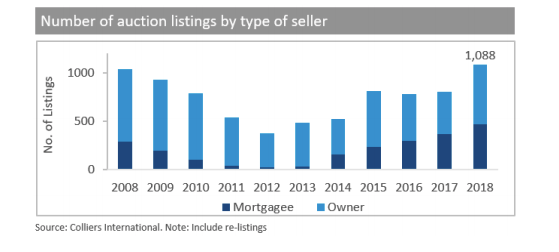

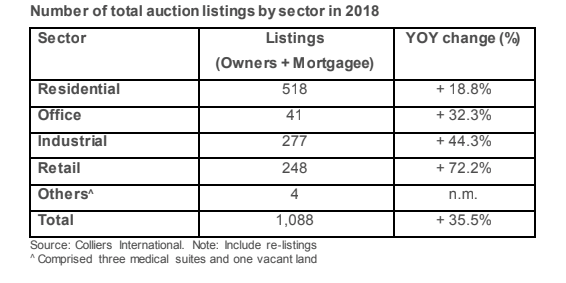

Based on Colliers’ research, the properties put up for auction in H2 2018 totalled 634 listings (including re-listings), up by 40% from the first half (H1) and 47% year-on-year (YOY). This took total auction listings in 2018 to 1,088 (including re-listings), an increase of 35% over 2017 and the highest annual level since the start of Colliers’ database in 2008.

At a glance:

- 1,088 property listings (including re-listings) in 2018, representing a 35% increase over 2017

- Residential properties continued to account for the lion’s share of listings, making up 48% of the full-year total in 2018

- Colliers expects property auction listings and sales to grow in 2019 as residential cooling measures continue to bite, and interest for non-residential properties grows

The annual growth was driven mainly by residential and industrial listings, and a record number of properties being put up for mortgagee sales by banks. Of the 1,088 listings in 2018, 43% (or 472 listings) of them were mortgagee listings – this represents a 27% rise in mortgagee listings from 2017. Meanwhile, owners’ listings also witnessed strong growth with 616 listings in 2018, up 43% YOY.

Ms. Tricia Song (宋明蔚), Head of Research for Singapore, Colliers International, said “Going by our data, the number of mortgagee listings has risen gradually in the last five years, possibly stemming from the bull run in the market in 2011, 2012 and 2013 where some buyers might have snapped up units at elevated prices, and subsequently found themselves unable to service the mortgage payments. This year, we expect property auction listings – both owners’ and mortgagee listings - and sales to grow as cooling measures continue to bite for the residential segment and more owners putting up non-residential properties for sale.”

Fewer transactions in 2018 as residential sales slowed With the 14 properties sold via auction in H2 2018, the total number of auction sales in 2018 rose to 35 properties – down by 27% YOY from 48 properties transacted in 2017.

Mr. Steven Tan (陈添裕), Director of Capital Markets & Investment Services at Colliers International, said, “We notice that the success rate of properties sold at auction dropped from 6.0% in 2017 to 3.2% in 2018, reflecting investors’ cautious approach and a widening price gap between buyers and sellers.”

Mr. Steven Tan (陈添裕), Director of Capital Markets & Investment Services at Colliers International - Supplied: Colliers International

Of the 35 auction sales in 2018, 10 transactions – comprising eight non-landed residential properties and two industrial units – valued at a combined SGD12 million were closed in Colliers’ auction. Colliers’ largest deal in 2018 was the sale of a condominium unit at Botanic Gardens Mansion for at SGD2.65 million.

Due to fewer properties transacted, the aggregate value of properties sold at auctions in H2 2018 dropped 56% from H1 2018 and 74% YOY to SGD15.7 million. Total aggregate value of auction sales in 2018 stood at SGD51.0 million, less than half of the SGD107.2 million transacted in 2017.

Mr. Tan added, “With more varied assets up for auction, we expect successful auction sales volume and value to grow in 2019. In addition, we could see rising demand from many collective sale beneficiaries who have sold their property in the past two years turning to the auction market for immediately-available replacement homes. We would recommend auction as a good platform to list or buy properties for optimal exposure and pricing.”

*Note: Figures include results from all auction houses in Singapore. Re-listings are included in auction listings. Properties sold before or after the auction are not included in auction sales.

Similar to this:

16-storey Singapore office building for sale at 139 Cecil Street

Singapore tops Asian outbound real estate investment in 2018

"Singapore total real estate investment sales projected to increase marginally in 2019 to SGD38.3 billion"