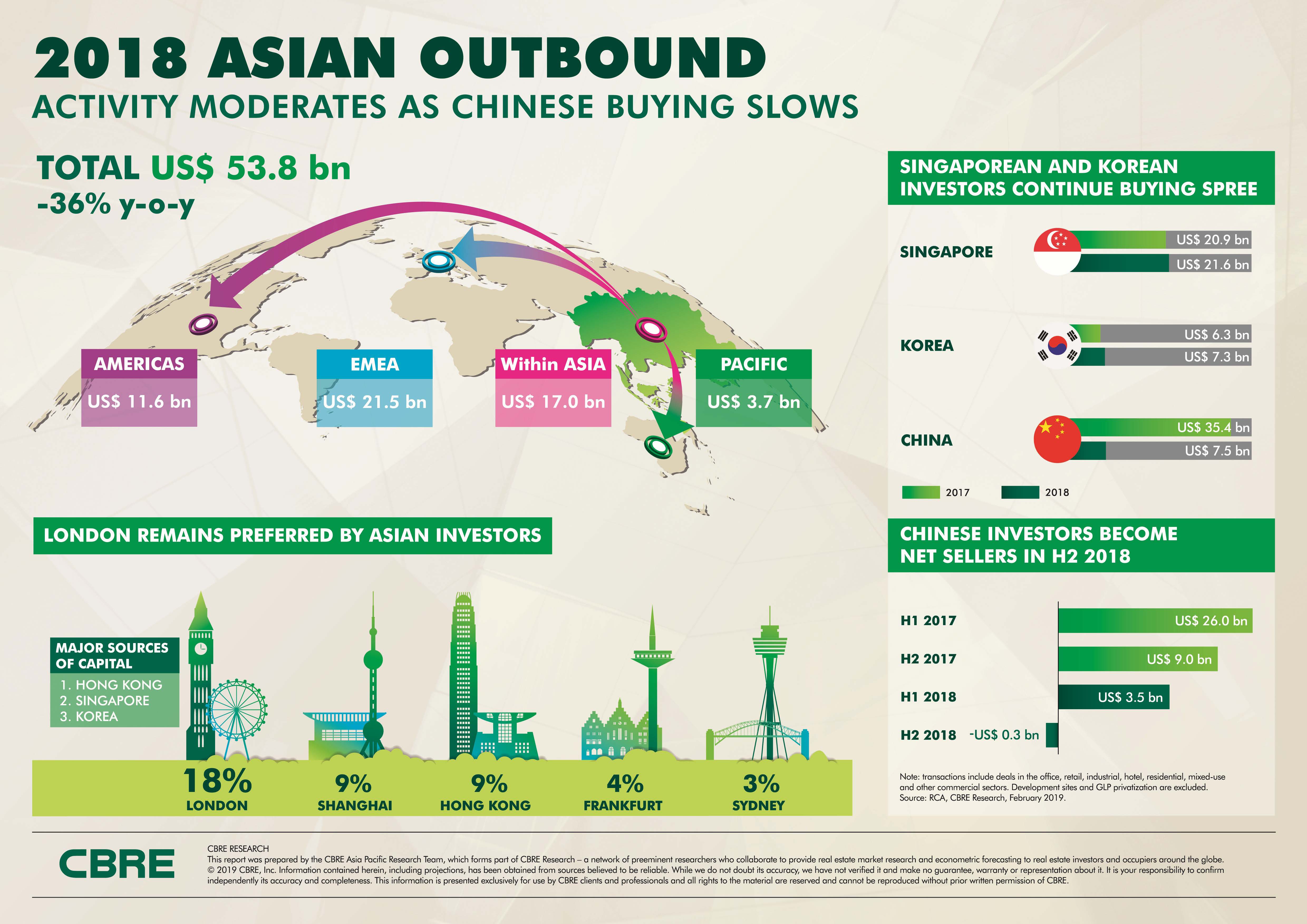

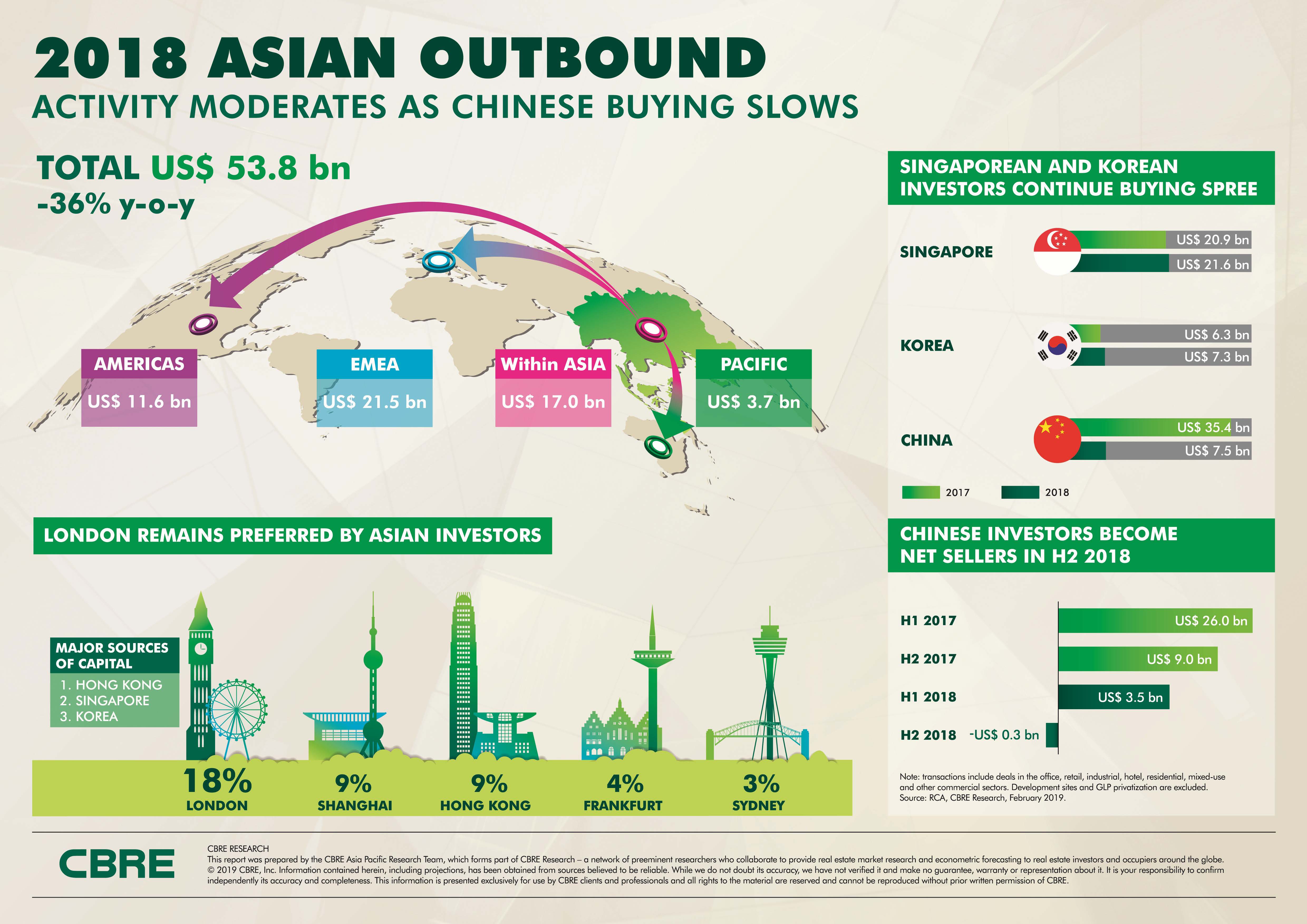

Maintaining its lead in Asian outbound investments in 2H 2018, Singapore-based investors ended the year in top position as the most active group of offshore real estate investors. Overall, Asian outbound real estate investment noticeably moderated for the full year of 2018, driven primarily by re-allocation of portfolios by Chinese investors. In 2018, total Asian outbound investment declined by 36% year-on-year to US$53.8 billion; of which, Singapore investors contributed about 40% (or US$21.6 billion).

Ms Yvonne Siew, Executive Director of Global Capital Markets, Asia Pacific at CBRE, said, “Singapore is the largest source of Asian capital in global real estate investments in 2018. Driven by limited opportunities and compressed yields in the domestic market, Singapore investors will continue to seek enhanced yields offshore to diversify their portfolios and achieve more sustainable growth. We expect the export of capital to continue in 2019, in view of the modest outlook in the domestic market.”

Similar to their Singapore-based counterparts, Korean investors maintained their buying spree overseas, allocating US$7.3 billion in capital in 2018 versus US$6.3 billion in 2017. Investors from Malaysia and India also became more prominent in 2018, selectively investing more capital overseas, up 132% and 291%, respectively.

Meanwhile, Chinese investors deployed US$7.5 billion in capital into offshore real estate investments in 2018, a significant decline from US$35.4 billion in 2017. This is on the back of Chinese investors rebalancing real estate portfolios, transitioning into net sellers of real estate to strengthen balance sheets and recycle capital for deployment into future outbound investments.

Source: CBRE

“The Asian outbound investment story in 2018 was on one hand characterized by a clear moderation from China but on the other hand, represented cyclical portfolio rebalancing and strategically preparation for future activity. The pullback from China’s investors was not entirely unexpected but encouragingly created opportunities for new strategic investors to amplify offshore investment activities,” said Mr Leo Chung, Associate Director, Research, Asia Pacific CBRE.

Geographically, allocations remained consistent year-on-year, in terms of percentage of annual capital deployed. EMEA remained the leading destination for Asian outbound capital in 2018. The region attracted US$21.5 billion in total capital from Asian investors in 2018. Intra- Asian investments finished 2018 at US$17 billion, followed by the Americas at US$11.6 billion and Pacific at US$3.7 billion.

London remained the top destination for Asian capital, owing to strong fundamentals and its established standing as the preferred metropolitan area for first time buyers to invest. Investors from Hong Kong, Singapore and Korea were the major buyers, accounting for over 85% of the investment activities. In 2018, 18% of total Asian outbound capital was deployed to London, up from 13% in 2017. The appetite for gateway cities was also reflected in Hong Kong (9%), Shanghai (9%) and Frankfurt (4%), growing or maintaining their percentage of total investment deployed for 2018.

“Asia-based investors remain hungry for offshore acquisitions, but will employ a more selective strategy in their overseas purchase activities. The hedging costs into certain countries are also impacting investment flows for many outbound Asian investors,” said Mr Tom Moffat, Head of Capital Markets, Asia, CBRE.

Source: CBRE

Similar to this:

Singapore Peace Centre expected to sell for $688 million

St Thomas Ville launched for sale in Singapore

"Singapore total real estate investment sales projected to increase marginally in 2019 to SGD38.3 billion"