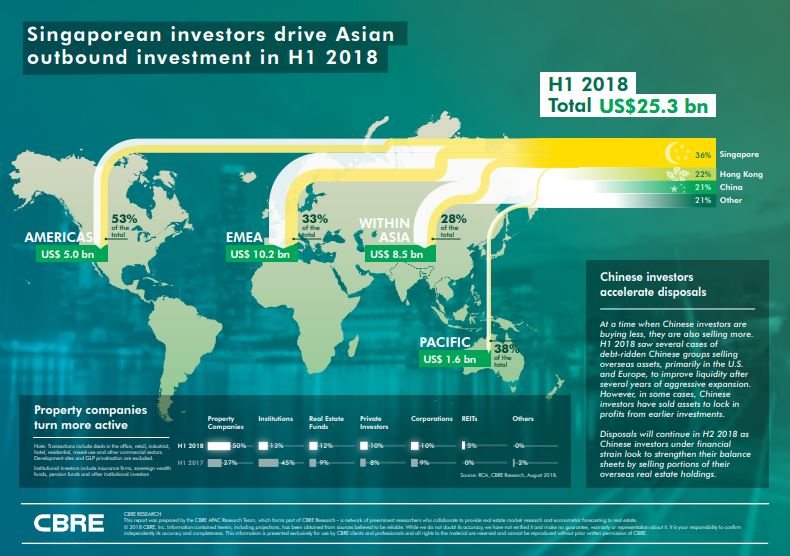

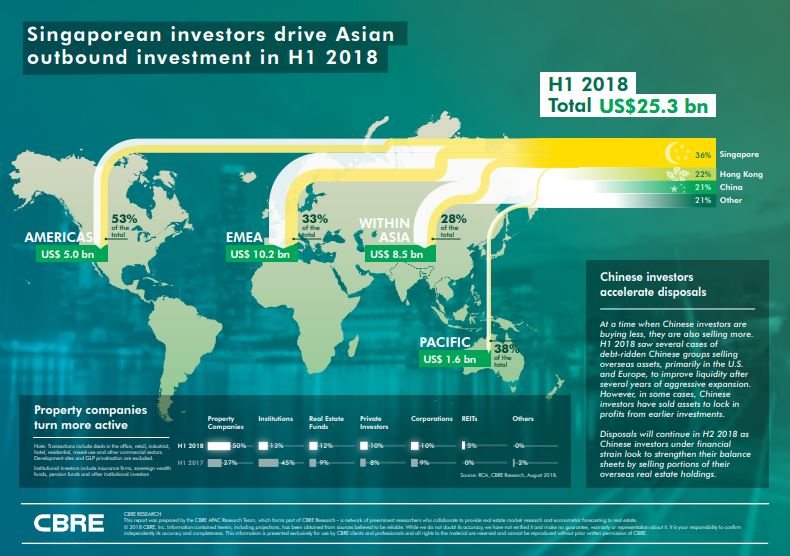

Asian outbound capital deployment remains robust amid a recent slowdown of Chinese outbound real estate investment. In the first half of 2018, outbound investment activity totalled USD $25.43 billion, led by Singaporean capital, which accounted for 36% of the region’s total, according to recent data compiled by CBRE.

At a glance:

- Asian outbound investment remained strong in 1H 2018. Activity was led by Singaporean groups, which accounted for 36% of the total.

- Europe attracted the largest share of Asian capital, with several big-ticket transactions and portfolio deals completed during the period. London remained the preferred city destination.

- Property companies were the most active investor type. Major transactions included the purchase of a large logistics portfolio by a Singaporean property company for USD $2.3 billion. REIT's also turned more active in overseas markets in search of higher yield.

- Chinese investors are buying less and selling more. The period saw several Chinese groups dispose of properties in the US and Europe, either to improve their balance sheets or to lock in profits from earlier investments.

Tom Moffat, Head of Capital Markets, Asia at CBRE, told WILLIAMS MEDIA "Intra-Asian capital flows accounted for almost one-third of global outbound investments by Asian capital markets in the first half of 2018 at USD $8.5 billion.

"The biggest beneficiaries of these capital flows were Hong Kong, China and Japan, but we expect several high profile transactions in Singapore in the second half of the year," he added.

APAC outbound investment infographic. Source: CBRE

This year, London continued to be a preferred channel for Asian investors, accounting for 26% of the region’s total outflows. Substantial funds flowed from both Hong Kong and Singapore into London to capitalize on the more favourable yields and longer rental periods presented by commercial properties that are unattainable domestically.

Singaporean investors favoured Europe as a location for portfolio diversification, investing USD $3.4 billion into the region in the first half of 2018. Singaporean investors were also active in the U.S logistics sector, building a portfolio to the tune of USD $2.27 billion during

the period.

Despite the deceleration in Chinese outbound activity, it is expected that Asian investors will continue to be active abroad. Moffat believes, “Asia Pacific investors are becoming increasingly recognised players and continue to expand portfolios strategically. The slowing of Chinese investment has prompted the emergence of more diverse capital sources, which illustrates the depth of liquidity and appetite for offshore deployment.”

Property companies were the most active investor class and accounted for half of total Asian outbound investment, compared to 27% in the first half of 2017. REITs also accelerated outbound investment with two Singaporean REITs having their first investment in Europe. On the contrary, institutional investors, who accounted for 45% of the region’s total outbound activity in the first half of 2017, were less active this year and comprised 13% of the total.

“Overall, we anticipate that Singaporean, Korean and Hong Kong investors’ strong investment appetite, particularly in Europe and the U.S, will continue to be a key propellant of Asian outbound investment in the medium to long-term,” added Henry Chin, Head of Research, Asia Pacific at CBRE.

For more information or to discuss the infographic, phone or email Tom Moffat, Head of Capital Markets, Asia at CBRE or Henry Chin, Head of Research Asia Pacific at CBRE, via the contact details listed below.

Source: CBRE

Similar to this:

Strong price momentum and increases in launches and sales for Q2, Singapore

Asia Pacific overtakes Europe and US as top source of cross-border real estate capital

In Singapore "overall real estate investment sales remained healthy" during Q2