Savills Vietnam Quarterly Market Briefing Q2 2018 reveals Hanoi's residential market, across the serviced apartment, apartment and villa and townhouse sectors performed well, with strong unit supply forecasted for the remainder of 2018.

Macro indicators 1H 2018, at a glance

- GDP growth was 7.1% in 1H, 2018, the highest 1H growth over the last seven years. Industry and construction were the main contributors, followed by the service sector.

- Trade balance was positive with a surplus of USD $2.7 billion due to strong export value of USD $114 billion. The USA and EU remain the main export markets.

- Registered FDI was over USD $20 billion in 1H 2018 with Japan being the largest contributor. Disbursed FDI reached USD $8.4 billion, up 8% YOY.

- International visitors were robust with 7.9 million, up 27% YOY.

Serviced apartment sector: "dynamic supply wave"

Total stock from 50 projects decreased -3% QOQ but rose 13% YOY due to new launches, renewed units and a deactivated project.

Source: Savills Vietnam

From 2018 onwards, 1,860 units from 15 projects are expected to become available.

Average occupancy was stable 101 and down -3 ppt YOY. Average room rates (ARR) increased 1.3% QOQ but dropped -2.2% YOY.

In 1H 2018, registered FDI to Ha Noi was USD $5.9 billion, 59% higher than the inflow into Ho Chi Minh City (HCMC).

Apartment sector: "new supply and higher sales"

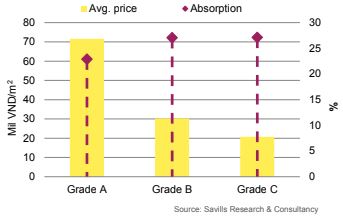

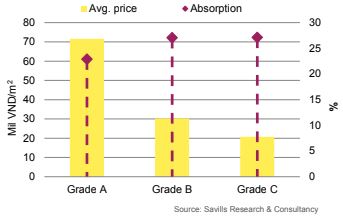

In Q2 2018, eleven new projects and next phases of 31 projects launched 9,760 units, up 77% QOQ and 43% YOY. The primary supply was 28,000 units, up 17% QOQ and 14% YOY.

Source: Savills Vietnam

Sales were up 31% QOQ and 11% YOY. Absorption rate increased by 3ppts QOQ but decreased -1 ppt YOY to 27%.

The average asking prices was USD $1,160/sqm, down -7% QOQ and -12% YOY.

Grade B accounted for nearly 60% of total share, followed by Grade C with 38%.

In 2H 2018, more than 14,300 units will enter the market from 20 projects, most of which are Grade B and Grade c.

Villa/townhouse sector: "stable performance"

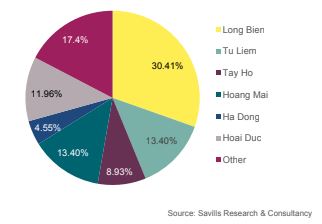

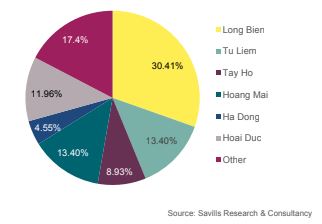

Total stock was 42,609 dwellings, increasing 3.7% QOQ and 12.8% YOY.

Source: Savills Vietnam

Seven new projects and eight new phases supplied nearly 1,064 dwellings. Primary stock was approximately 3,451 dwellings, up 8.2% QOQ but down -12.9% YOY.

Sales were up 48% QOQ but down -9.4% YOY. Absorption was 34%, up 9.2 ppts QOQ and 1.3 ppts YOY.

From Q3 2018 to 2019, projects such as Vincity Gia Lam by Vingroup and Smart Town by BRG-Sumitomo are expected to enter the market.

Click here to view Savills Vietnam Quarterly Market Briefing Q2 2018.

For more information or to discuss the report, phone or email Do Thu Hang, Associate Director of Research Hanoi, or Troy Griffiths Deputy Managing Director at Savills Vietnam via the contact details listed below.

Similar to this:

FDI in Vietnam reaches USD318.72 billion over last 10 years

Resort-style real estate development launched in Hanoi

Ho Chi Minh City registers positive growth in Q2 - JLL