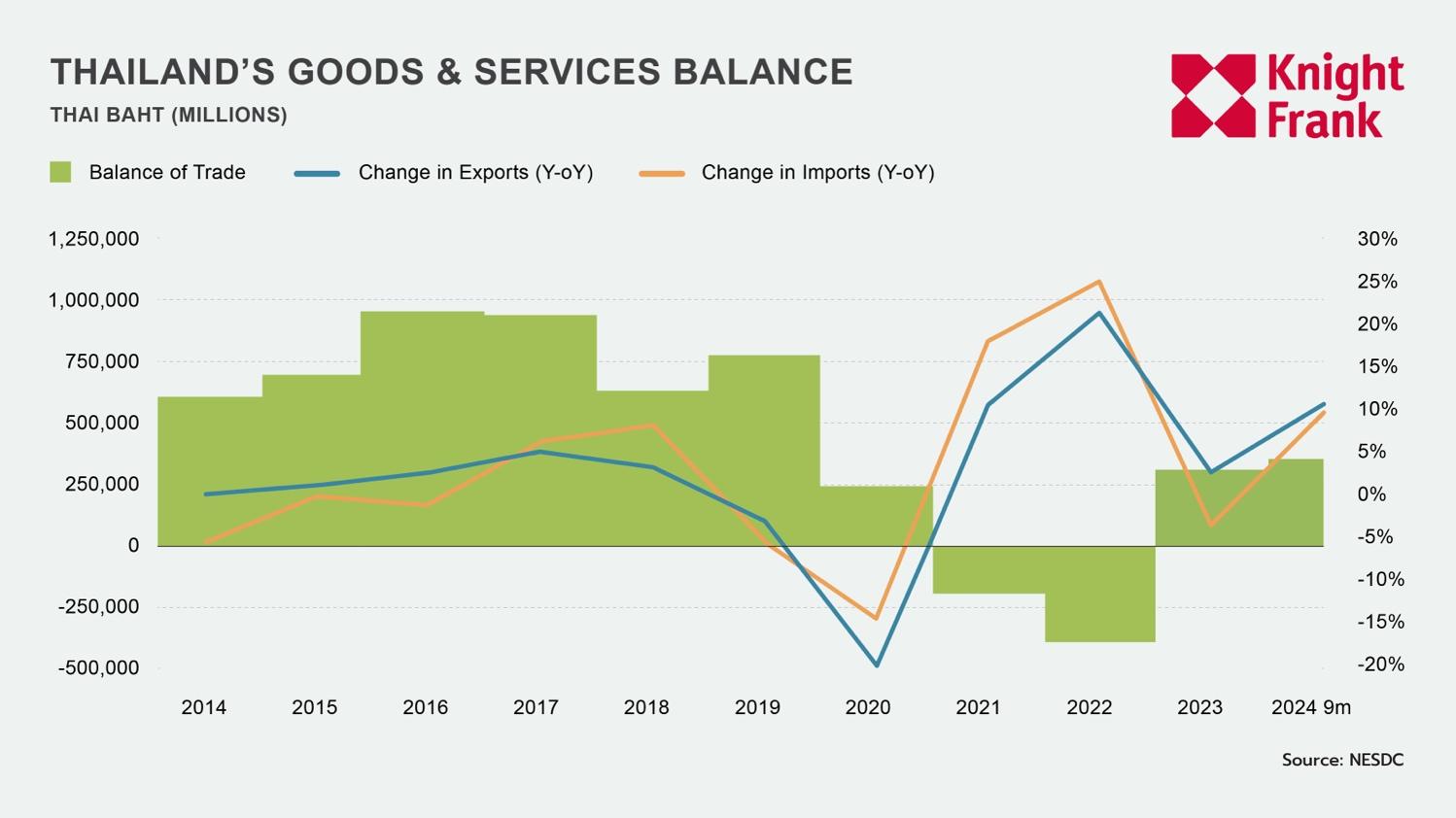

In the first nine months of 2024, Thailand maintained a positive trade balance, driven by a 10.6% increase in exports of goods and services, which outpaced the 9.8% growth in imports. Private consumption slowed down with a growth of 1.7%, attributed to tighter credit conditions, delayed consumer decisions, and an ongoing decline in spending on durable goods, including a sharp contraction in automobile purchases amid ongoing price competition in EVs. Government expenditure also experienced a 1.6% increase, driven by government spending stimulus measures, especially the first phase of the 10,000 Baht project, along with a 1.1% increase in employee compensation. Meanwhile, fixed capital investment contracted by 1.7%, primarily due to an investment reduction in automotive and private construction. This decline in fixed capital investment, partly due to tight credit standards and reduced lending for equipment and construction, reflects broader financial constraints and weakening business sentiment.

Inflationary pressures in Thailand remained subdued during H2 2024, with headline inflation averaging just 0.6%. This moderation was largely attributed to declining energy costs, as electricity and fuel prices fell, alongside easing food prices driven by improved domestic supply conditions. The government’s continued subsidies on diesel and electricity played a key role in maintaining affordability for households and businesses. However, core inflation remained slightly higher due to persistent price increases in particular non-food categories, reflecting structural cost pressures. Thailand’s inflation rate in the latter half of the year was among the lowest in the region, underscoring the country’s relative stability amid global economic uncertainties.

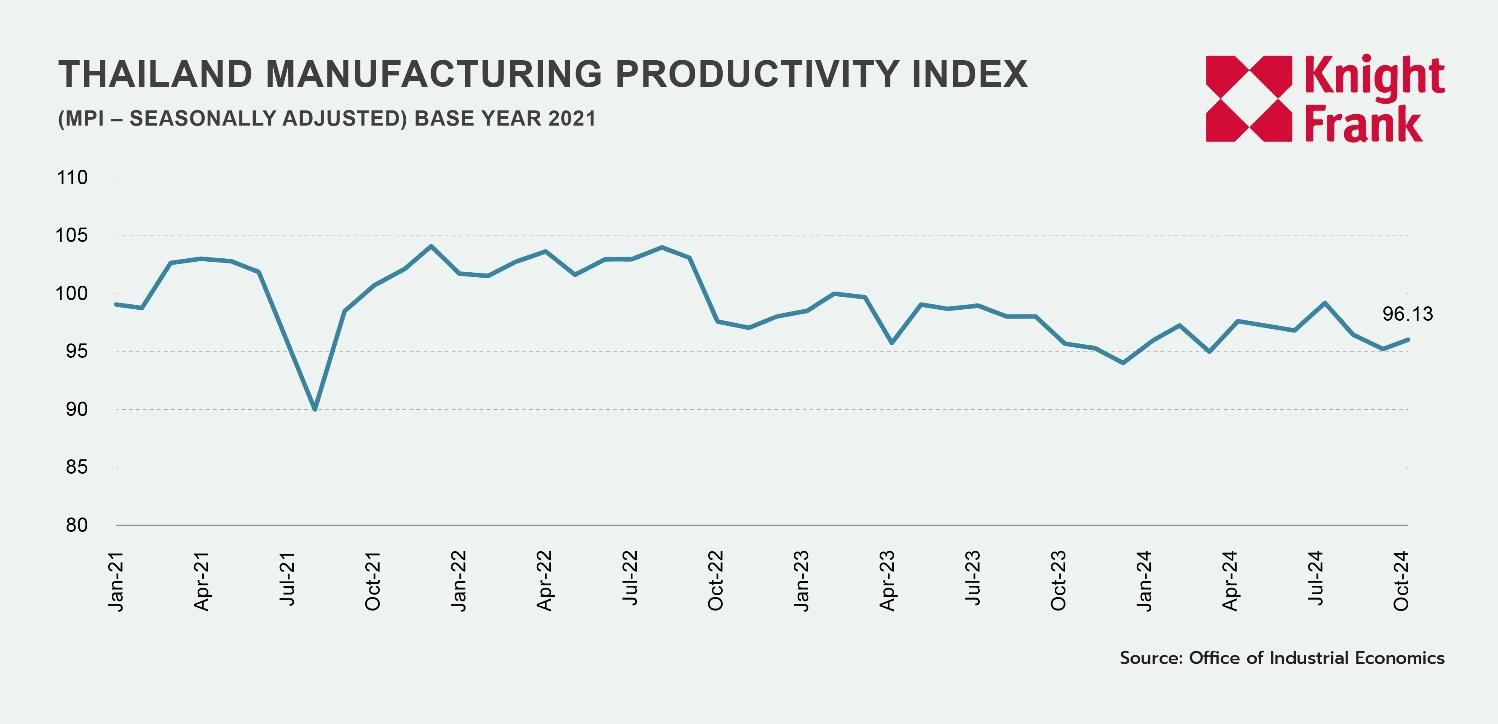

In October 2024, Thailand’s manufacturing productivity index (MPI), after seasonal adjustment, remained steady at 96%, showing stability compared to the mid-year figure. This level reflects an ongoing recovery in the manufacturing sector despite ongoing challenges, including a lack of domestic purchasing power and an influx of cheaper imported goods into Thailand, shifting consumer preferences away from buying local products. Additionally, tightened credit approval significantly impacted key industries, such as the automotive sector, leading to a notable contraction in production from pickup trucks, small passenger cars, and hybrid cars.

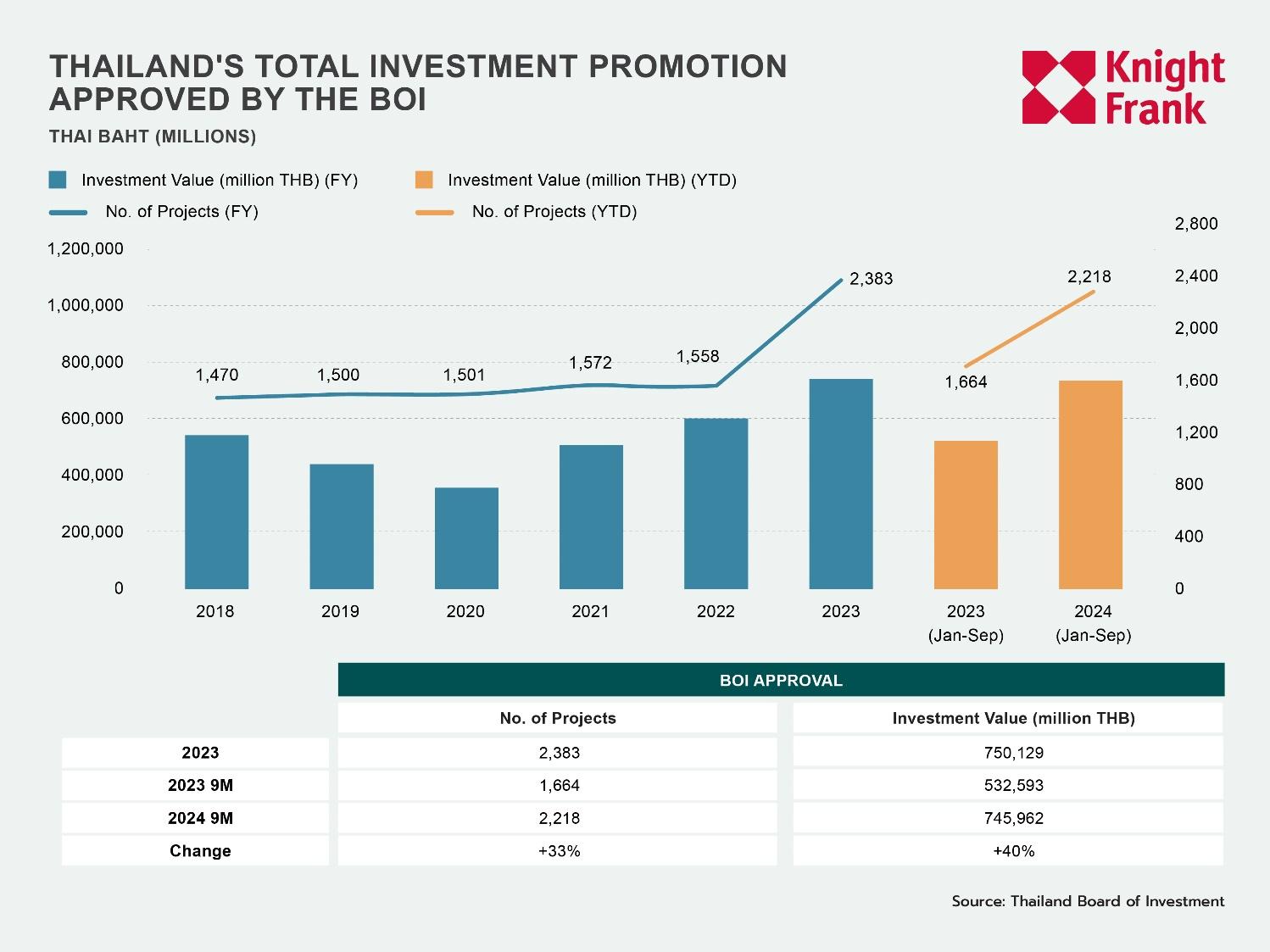

According to the BOI report, the total number of foreign and local applications for investment promotion approvals from January to September 2024 showed a notable increase of 33%, with 2,218 projects approved compared to last year. The investment value also experienced a significant rise of 40%, reaching 745,962 million Baht, up from 532,593 million Baht in the previous year. Foreign Direct Investment (FDI) played a critical role in driving this growth with 1,420 projects recorded during this period, reaching 546,680 million Baht. Of these, the highest foreign contributor to the investment value was in the Electronics and Electrical Appliances sector, with 253 projects accounting for over one-fourth of the total approved investment value.

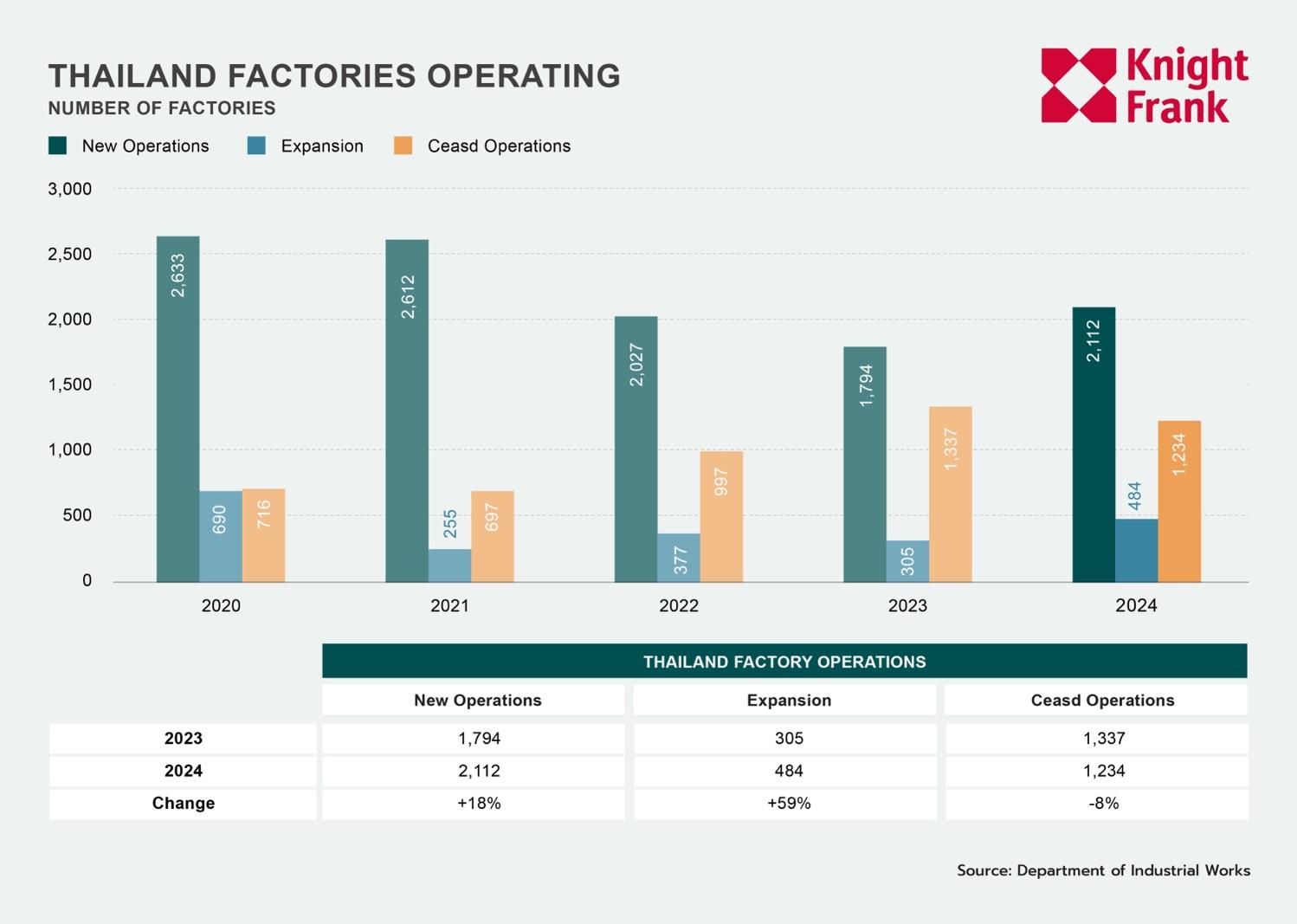

Factory operations in Thailand showed signs of improvement, with a notable shift in 2024 compared to 2023. The number of existing factories that expanded operations surged by an impressive 59%, reaching 484 projects, highlighting the growing confidence in Thailand's industrial sector. New factory operations also showed steady growth, increasing by 18% year-on-year to 2,112, while the number of factory closures declined by 8% to 1,234. Although the sector is still recovering and has yet to reach pre-pandemic levels, the sharp rise in factory expansion projects signals a strong resurgence in industrial investment and a positive outlook for Thailand's manufacturing landscape.

Serviced Industrial Land

Supply

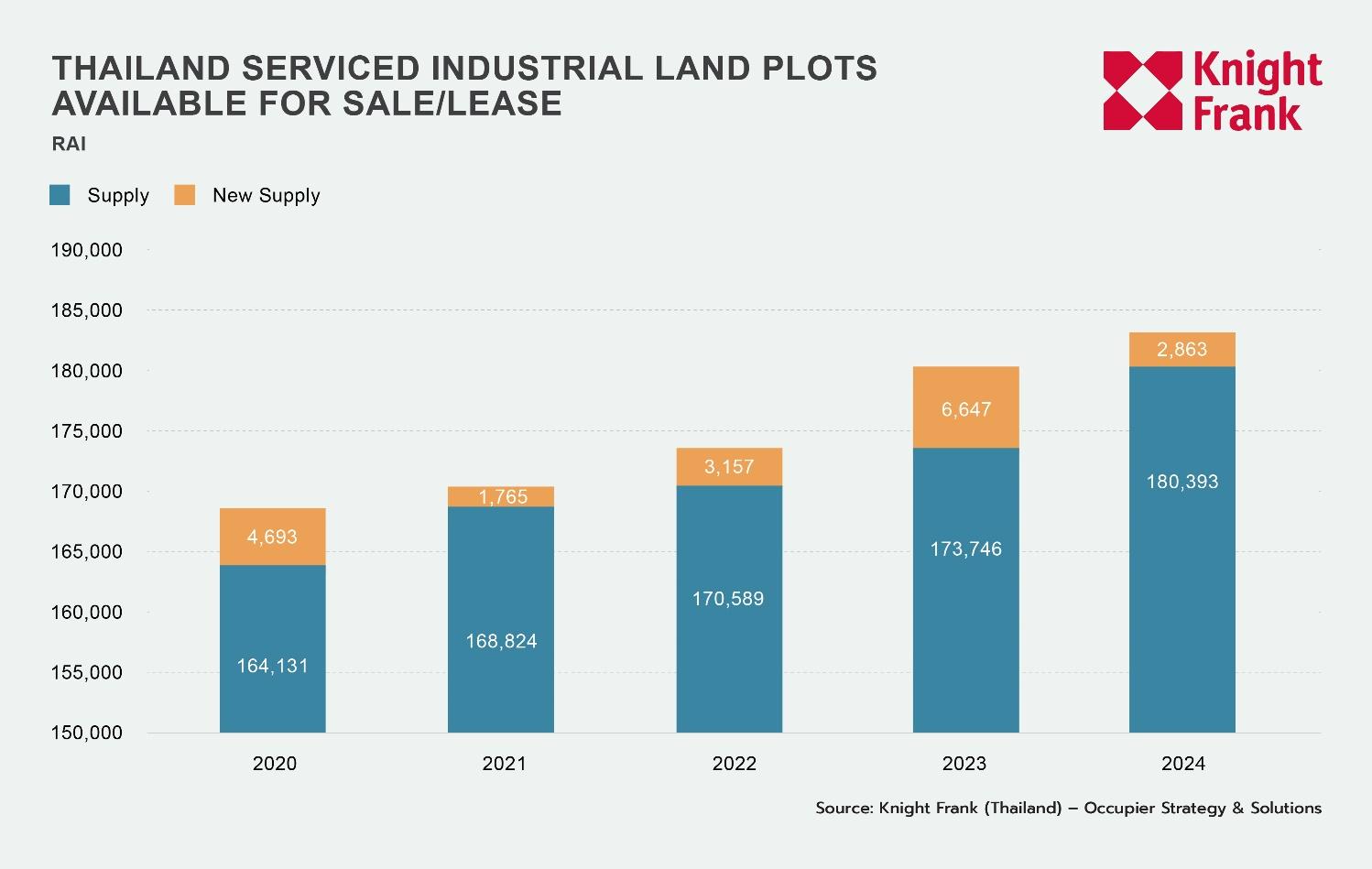

In H2 2024, the total amount of serviced industrial land plots (SILP) for sale or lease in industrial estates, zones, and parks grew by 1.6% half-on-half, or 2,863 rai, reaching a total of 183,256 rai. This increase was supported by the launch of the new Amata Chonburi 2 project, which contributed to the expanded supply. Over the past five years, the SILP supply has increased by steady 1 to 4% each year. Despite the rising Foreign Direct Investment (FDI), the availability of larger plots for manufacturing or industrial estates has become increasingly scarce, creating a bottleneck for investors seeking expansion opportunities. The limited supply of sizable industrial land plots in strategic locations presents a significant challenge, potentially slowing the growth of industries that rely on large-scale operations.

Supply Distribution

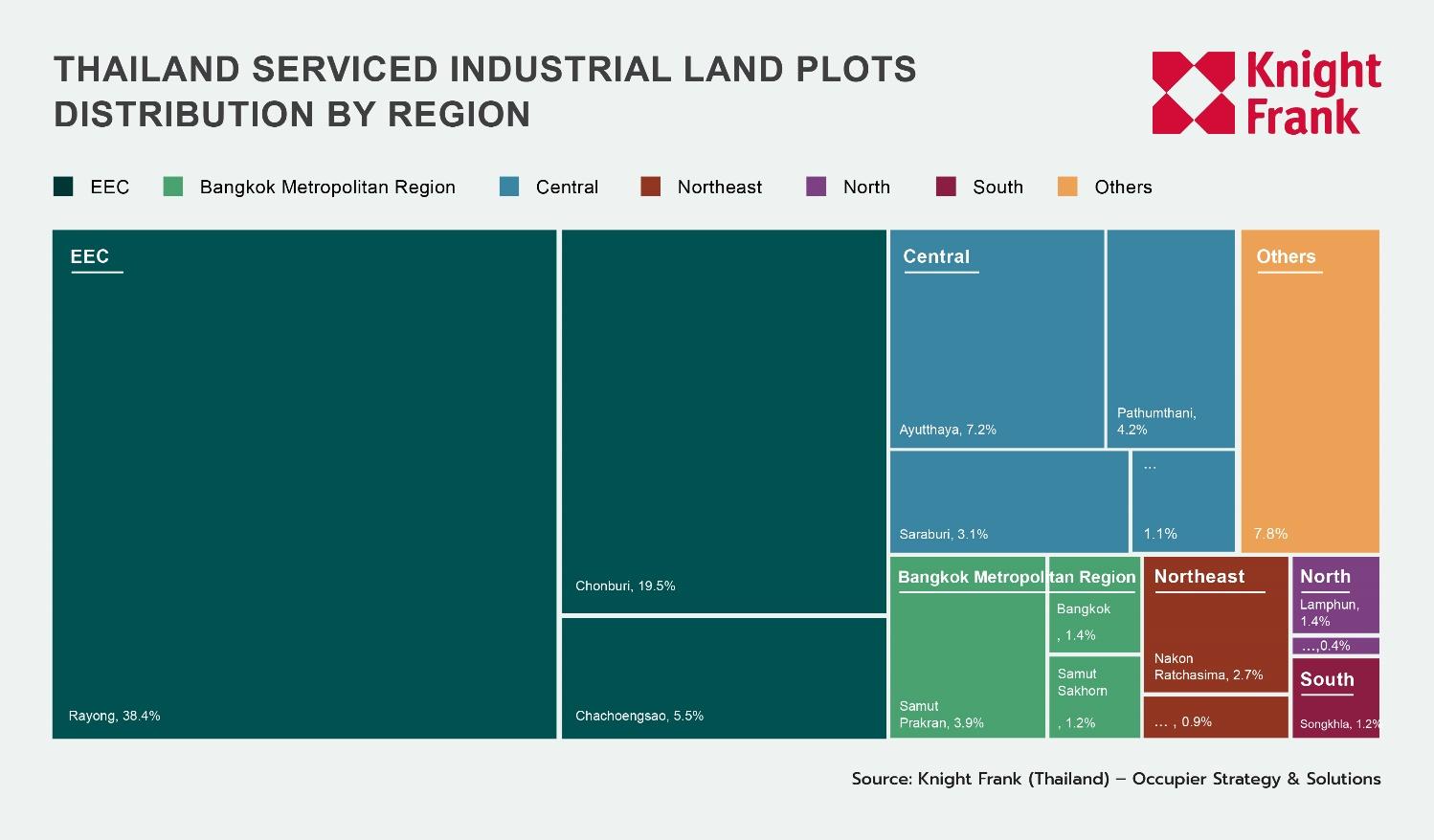

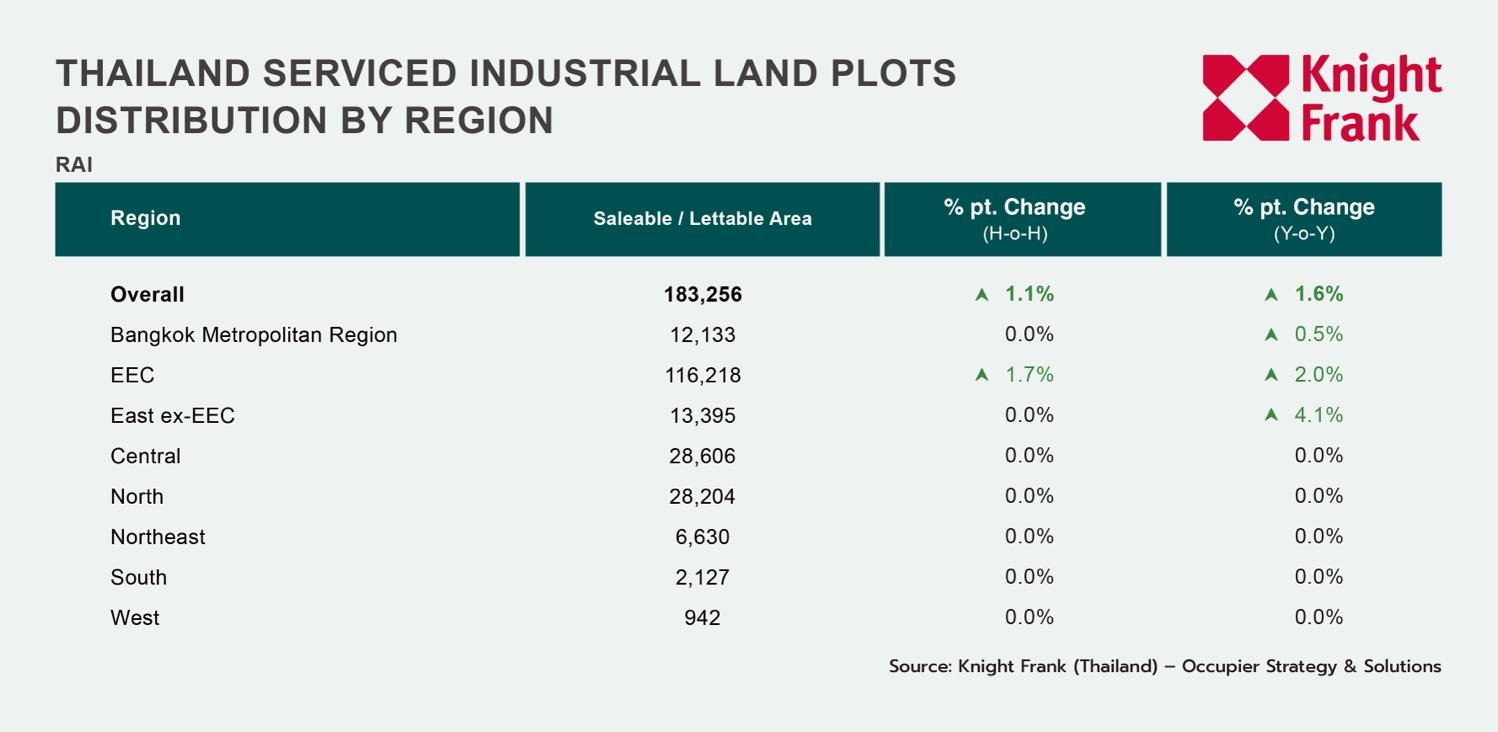

The Serviced Industrial Land Plots (SILP) in Thailand remain heavily concentrated in the Eastern Economic Corridor (EEC), accounting for 64% of the total market share. Within the EEC, Rayong leads with a significant 38.4% share of the total SILP supply, followed by Chonburi at 19.5% and Chachoengsao at 5.5%. These provinces serve as critical hubs for key manufacturing industries, including automotive, electronics, and petrochemicals. Strategically located near Laem Chabang Port, the EEC benefits from robust infrastructure, making it a pivotal driver for Thailand's export-oriented economy. In H2 2024, the supply in the EEC increased by 1.7% half-on-half (H-o-H), reaching 116,218 rai, driven by the official launch of the Amata City Industrial Estate 2 in Chonburi.

The Central Region, comprising Ayutthaya, Pathum Thani, and Saraburi, accounts for 15% of the total SILP supply. Ayutthaya leads this region with a 7.2% contribution, followed by Pathum Thani at 4.2% and Saraburi at 3.1%. The region remains attractive for industrial investments due to its accessibility and ongoing infrastructure development. Meanwhile, the Bangkok Metropolitan Region came in third place with no change in the total SILP, contributing 6% of the SILP supply, with Samut Prakan accounting for 3.9% and Bangkok contributing 1.4%.

Demand

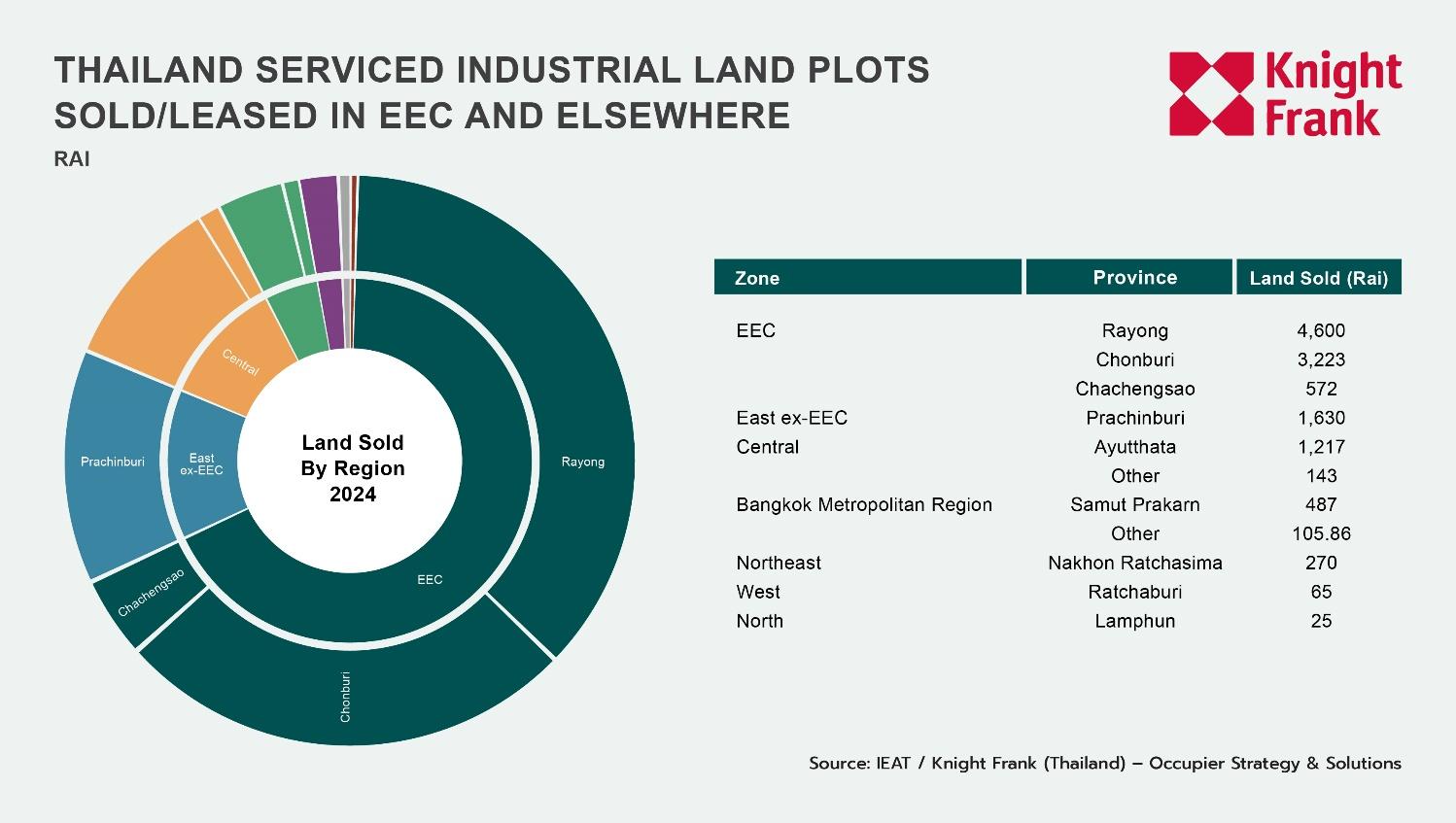

According to the IEAT report and Knight Frank research, the demand for SILP in H2 2024 showed a slight decrease compared to the first half of the year. The total area sold or leased during this period amounted to 4,263 rai, contributing to an annual total of 12,340 rai for 2024. This represents a 39% increase compared to 2023, highlighting the continued interest in Thailand’s industrial land market, driven by key industries such as automotive, electronics, and data centers.

The Eastern Economic Corridor (EEC) remains the dominant sub-market, accounting for 64% of the total transactions for 2024. Rayong led with 4,600 rai, followed by Chonburi with 3,223 and Chachoengsao with 572 rai, driven by strong infrastructure and proximity to ports. Notably, a major land sale agreement was signed with Google, a global technology company planning to establish a data center and cloud region in Chonburi. Outside the EEC, transactions totaled 3,944 rai, with Prachinburi, Ayutthaya, and Samut Prakarn seeing notable activity.

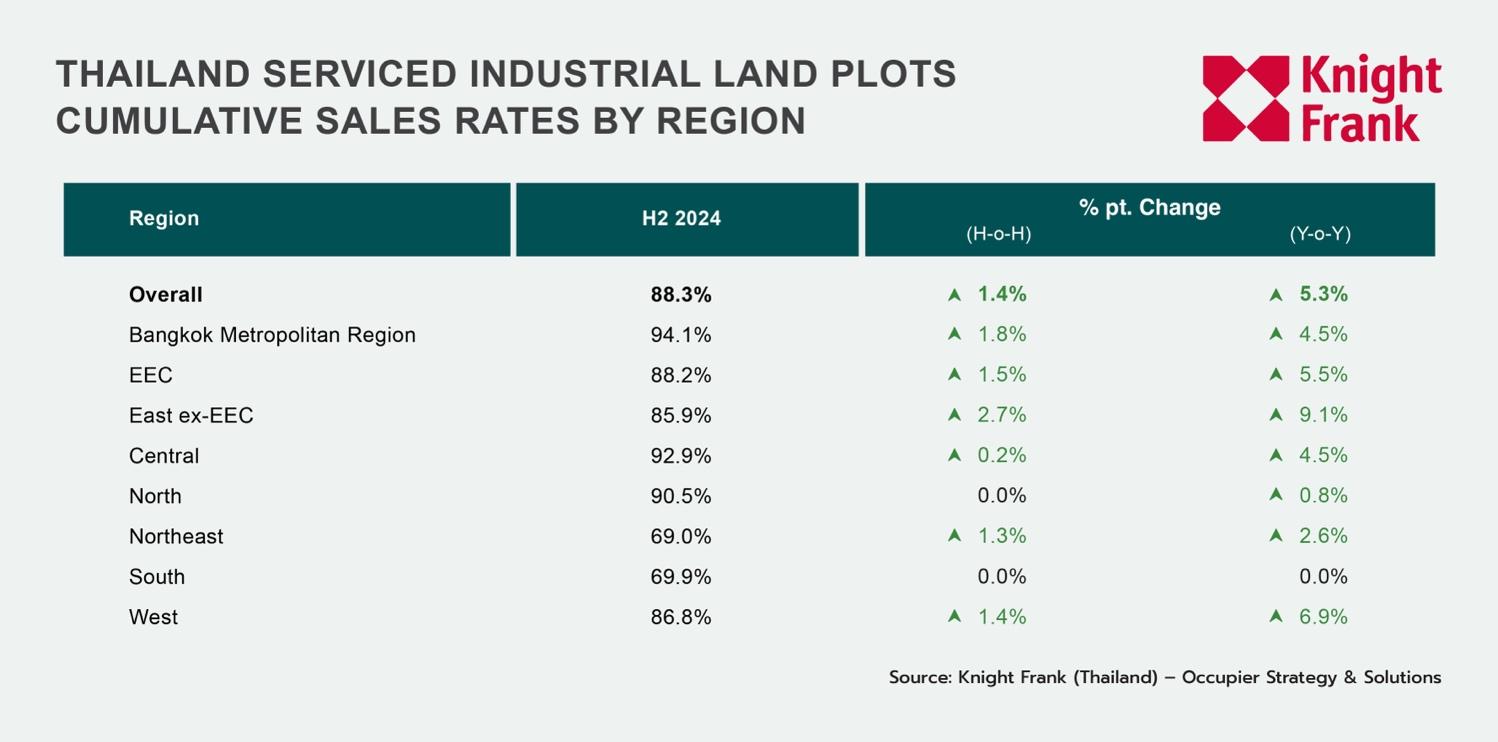

The market’s cumulative sales rate showed a positive increase of 1.4% H-o-H, reaching 88.3% in H2 2024. Notably, all regions maintained or improved their sales rates during this period. The Bangkok Metropolitan Region recorded the highest sales rate at 94.1%, followed by the Central at 92.9% and the North Region at 90.5%. The East ex-EEC zone demonstrated the most significant improvement, with an increase of 2.7% H-o-H, reaching 85.9%. Meanwhile, the Northeast region, despite having the lowest sales rate at 69.0%, showed steady growth with a 1.3% H-o-H increase.

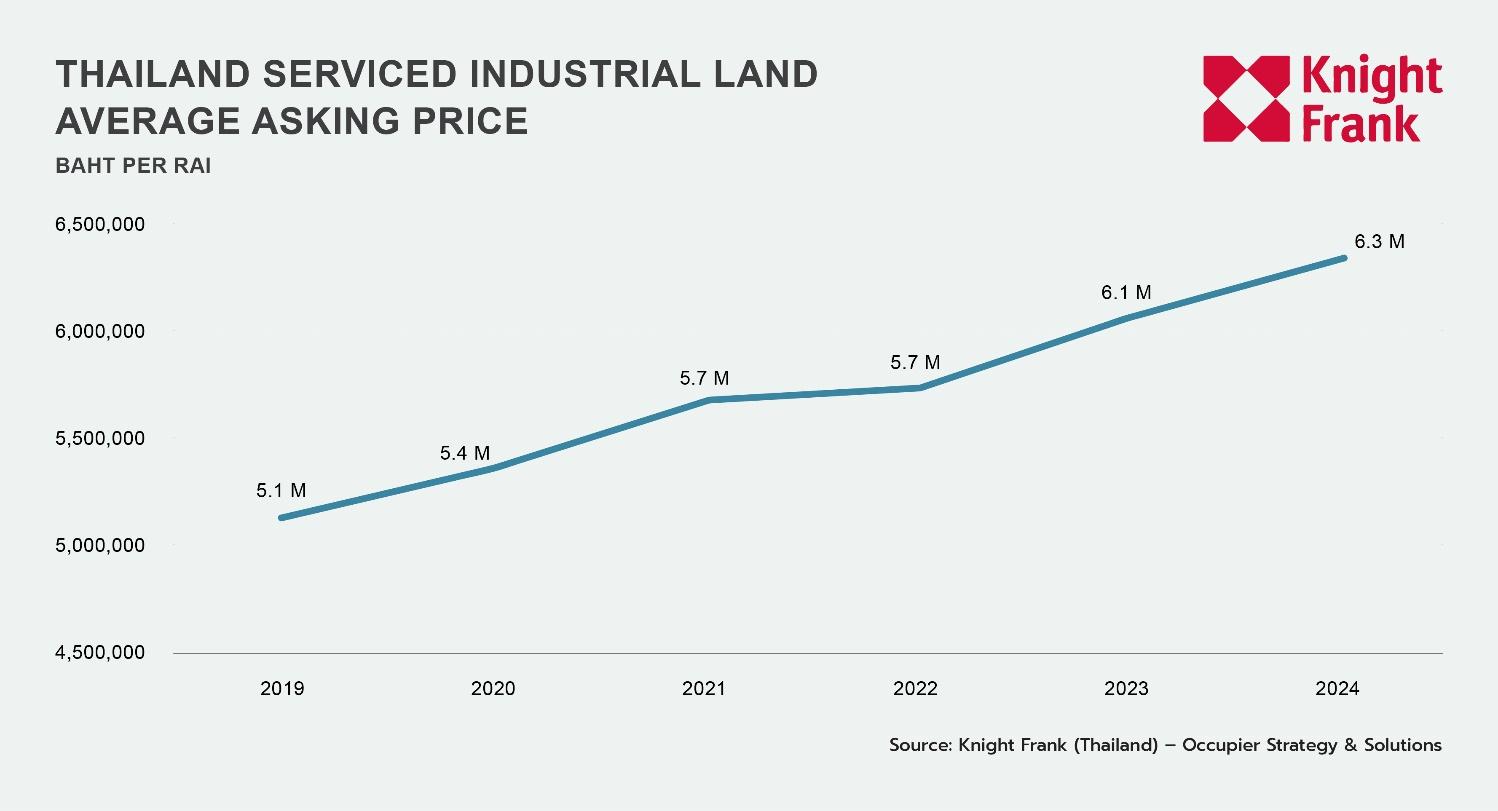

Asking Prices

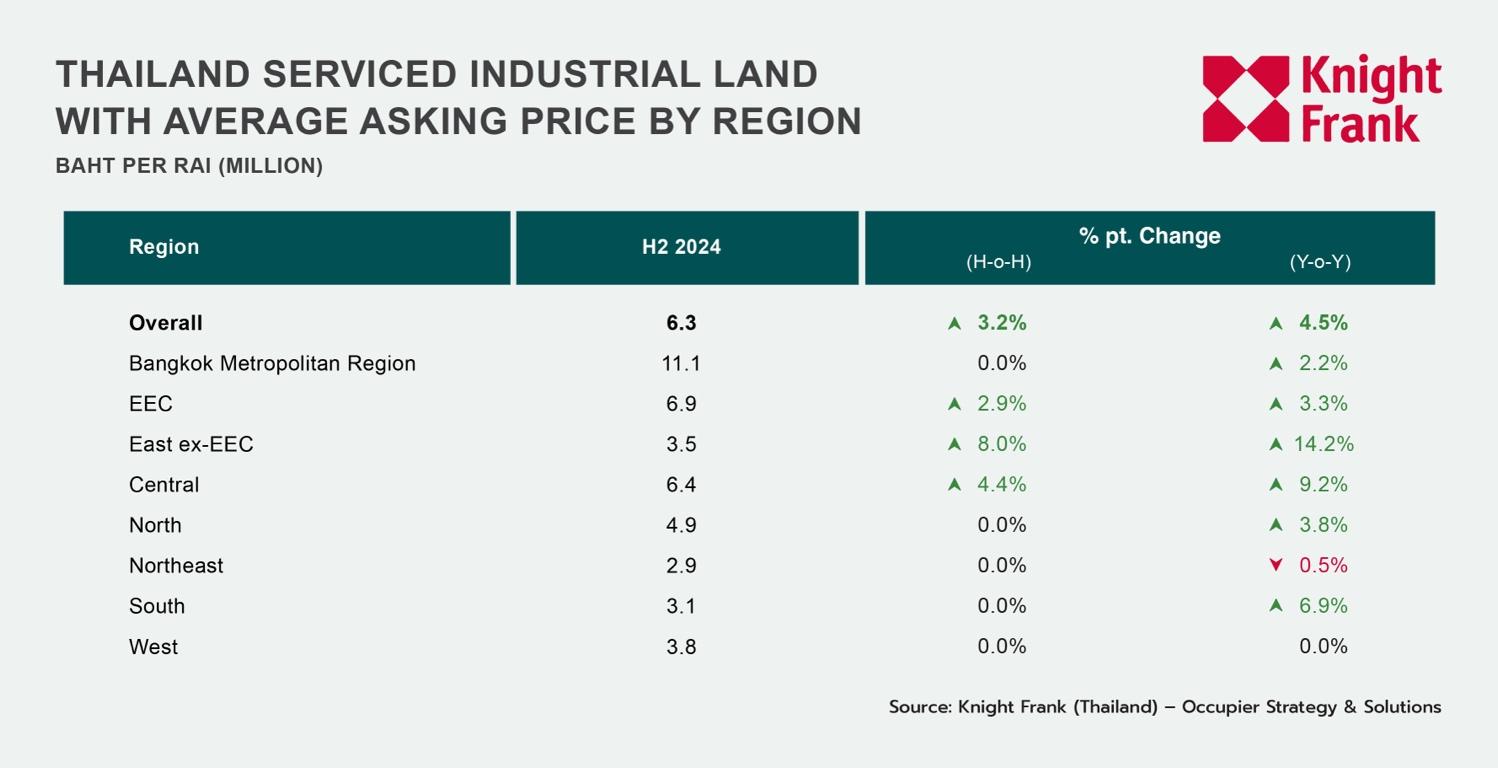

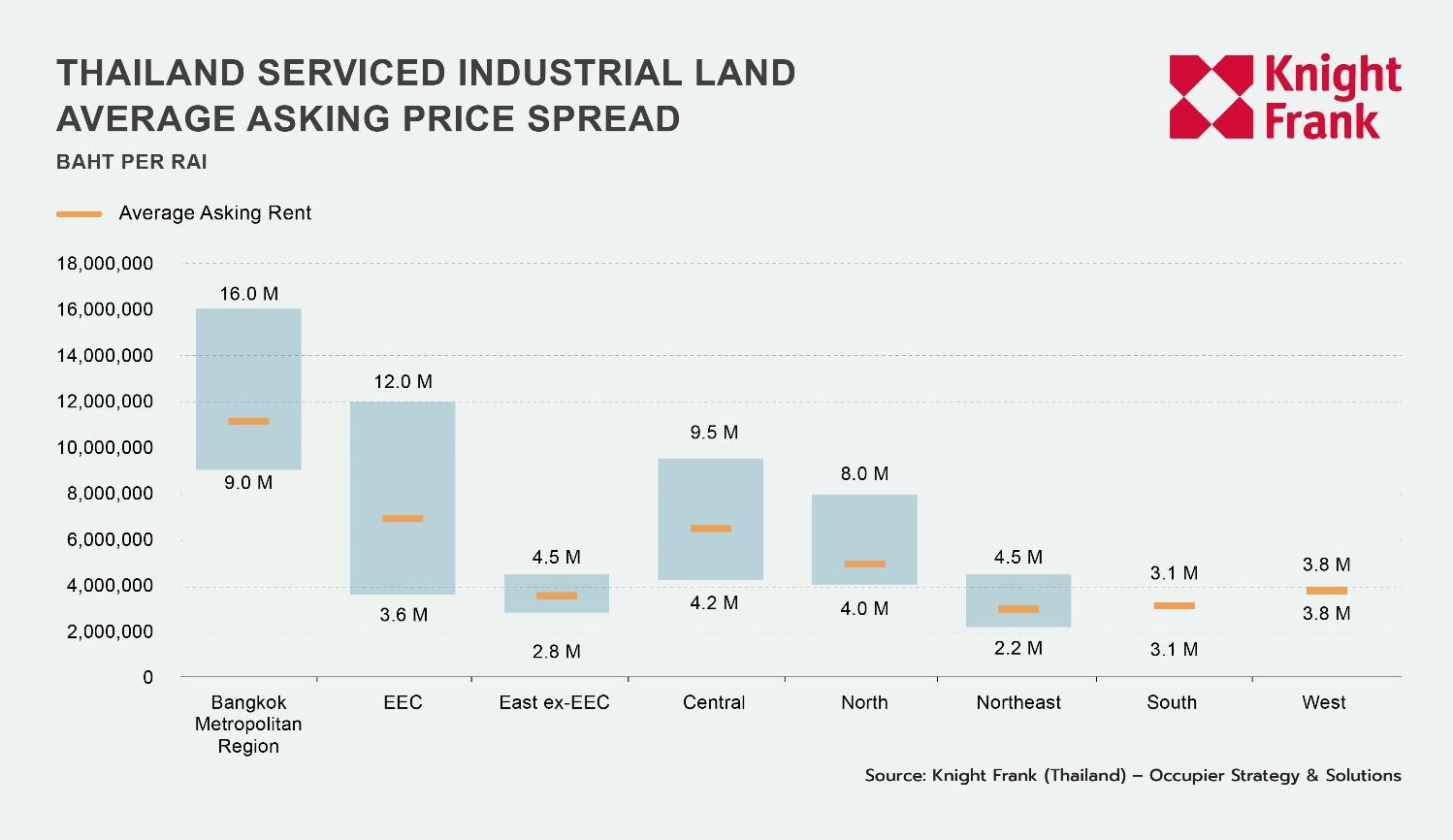

In the second half of 2024, the average land price in Thailand rose by 3.2% H-o-H, reaching 6.34 million baht per rai. The Bangkok Metropolitan Region (BMR) continued to command the highest price at 11.1 million baht per rai, followed by the Eastern Economic Corridor (EEC) at 6.9 million baht and the Central region at 6.4 million baht. The East ex-EEC saw the most notable price increase of 8.0% H-o-H, while the EEC experienced a steady rise of 2.9% H-o-H. Within the EEC, asking prices varied widely, ranging from 3.6 to 12.0 million baht per rai, with industrial estates near major ports such as Laem Chabang and Map Ta Phut reaching the higher end of the spectrum. In contrast, the lowest prices, under 3 million baht per rai, were recorded in the Northeast region, reflecting lower demand compared to the major industrial hubs.

Review & Outlook

In the second half of 2024, Thailand's manufacturing property market experienced steady growth in serviced land sales, driven by continuous interest from foreign investors. This is reflected in the total industrial land sales or leases, which reached a record-breaking 12,340 rai, marking a new high for the second consecutive year and demonstrating the exceptionally high demand for land in industrial estates. Notably, the Board of Investment (BOI) statistics reveal a remarkable 40% year-on-year increase in investment promotion applications during the first nine months of 2024. These applications came from electronics manufacturing factories and EV supply chain manufacturers. However, the limited increase in serviced industrial land supply—just 1%—raises concerns about future availability, as rising costs could deter foreign investors from establishing or expanding their operations in Thailand.

In addition, Google's announcement to invest in Thailand underscored the country's potential and readiness in the digital industry, particularly in the Data Center and Cloud Service sectors. This announcement highlighted Thailand's strengths in digital infrastructure, such as high-speed internet, reliable energy supply, and skilled labor. The latest investment promotion approvals include 46 projects with a total investment value exceeding 160 billion baht. These investments not only enhance the country's digital infrastructure but also contribute to increased demand for industrial land, particularly in regions with advanced logistics networks like the Eastern Economic Corridor (EEC).

On the other hand, Thailand's automotive industry faced significant challenges in 2024, with total vehicle sales declining sharply by 33% to approximately 518,000 units. This downturn was primarily driven by economic stagnation, high household debt, and tightened credit approval processes, which reduced consumer purchasing power. The pickup truck segment, a major driver of the domestic market, was particularly hard hit, with sales from key manufacturers like Isuzu and Ford plummeting by 43.7% and 42.7%, respectively. The electric vehicle (EV) market, which previously showed resilience, also experienced a slight contraction, with registrations dropping from 76,314 units in 2023 to around 70,000 units. As production targets and sales reduced, manufacturers scaled back expansion plans, while many EV-related factory projects that previously drove land demand were completed. Consequently, industrial estate developers may face a normalization period, with slower growth in automotive-driven land sales. To counter this, developers must diversify their tenant base by targeting high-growth sectors like electronics, renewable energy, and digital industries to sustain demand.

Regarding the macro outlook of Thailand, the Thai economy in 2025 is projected to grow within the range of 2.3 – 3.3%, with increased government consumption and investment, the continual recovery of the tourism sector, and the sustained expansion of exports. The manufacturing property market will still benefit from steady demand since the expansion of production bases by foreign investors is expected to remain consistent, though at a slower pace. The main contributors to this demand will be global supply chain manufacturers, particularly from the electronics sector, which continues to seek strategically located industrial land to support production and export activities.

Mr. Marcus Burtenshaw, Partner - Head of Industrial Strategy & Solutions, said “"Thailand’s industrial market has once again demonstrated its resilience and attractiveness, with industrial land sales hitting a record high and FDI surging by 40%. However, shifting global trade policies, particularly the proposed U.S. reciprocal tariff system, could reshape supply chains and impact key export industries like automotive and electronics. At the same time, Thailand continues to benefit from the diversification of manufacturing away from China, reinforcing its role as a regional production hub. To stay ahead, the country must focus on expanding Free Trade Zones, improving logistics efficiency, and investing in smart warehousing and multimodal transport. By strengthening its trade infrastructure and supply chain adaptability, Thailand can sustain its industrial growth and solidify its position as a leading logistics and manufacturing hub in the region."