The coming years will accelerate shifting supply chains, with manufacturing and production locations diversifying across Southeast Asia. JLL (NYSE: JLL) reports that Southeast Asia and other developing economies in the APAC region stand to be net beneficiaries of this trend.

Over the past few years, Chinese companies have begun exploring the expansion of manufacturing outside of China. “In Asia Pacific, this near/re/friend shoring trend has resulted in the China+1 strategy where companies add additional manufacturing bases outside of China to hedge against supply chain disruptions by reducing heavy reliance on a single country,” said Yin Hong, Head of Logistics & Industrial, JLL China.

At the same time, we see as Chinese companies are also expanding their footprint in the region to build on opportunities offered by Southeast Asian economies.

- China is transitioning towards strategic emerging industries, e.g. high-end equipment manufacturing, semiconductor, electronics & IT, medical, life science, EV, and new energy etc reflecting the country's broader strategic direction. This shift places a greater focus on value-added sectors. Malaysia with its skilled labour and developed manufacturing sector offers a unique opportunity to build on the expansion strategy.

- The China+1 strategy is gaining traction, with companies adding manufacturing bases outside China.

- Chinese companies seeking expansion overseas can benefit from this global trend.

- Countries such as Malaysia and other nations in SEA are viewed as complements to China, rather than competitors. This approach underscores the importance of mutual benefit and cooperation.

- Malaysia is emerging as a particularly attractive destination for investors.

The driving force behind this trend is not only the need for supply chain diversification, but also to capitalise on the strong economic fundamentals of this region, including a large and growing population and labour pool, favourable costs, and various incentives. From manufacturing investment perspective, these factors position SEA and other emerging economies as major manufacturing hubs for global markets.

JLL estimates China holds the lion’s share of manufacturing FDI in the region. However, this dominance is gradually diminishing as Southeast Asian countries and other developing economies in the Asia-Pacific are experiencing faster growth in FDI inflows compared to China. This shift is partly attributed to Chinese investors increasingly expanding their investments abroad, contributing to the narrowing gap in FDI distribution across the region.

"Chinese companies are considering Malaysia due to several factors that contribute significantly to a manufacturing company's long-term success and sustainability. These include skilled labour, infrastructure, environmental regulations, proximity to suppliers and customers, and political stability. JLL recommends careful evaluation of these non-cost or qualitative factors as crucial to making an informed decision and laying a strong foundation for future growth," says Yulia Nikulicheva, Head of Research & Consultancy, JLL (Malaysia).

Malaysia's manufacturing sector has attracted a significant amount of Foreign Direct Investment (FDI) in recent years, particularly in the Electronics and Electrical (E&E) segment. The country is home to 6 out of the top 12 global semiconductor manufacturers, contributing to 7% of Malaysia's GDP. Additionally, Malaysia ranks 7th globally in E&E exports. Other sectors such as pharmaceuticals, chemicals, and machinery and equipment are also experiencing increased investment volumes.

Overall, Malaysia offers competitive business costs compared to other countries in the Southeast Asia region. It also boasts a skilled workforce proficient in English, as well as a significant Mandarin-speaking population. Furthermore, Malaysia's developed road, seaport, and airport infrastructure, along with its business-friendly environment, make it an attractive location for potential investors. The country's legal system, which shares similarities with British law, saves investors time in familiarizing themselves with local legal intricacies. All these factors combined make Malaysia one of the most attractive hotspots in the Southeast Asia for Chinese investors.

Looking at specific industries forming Malaysia's industrial landscape is diverse and robust, with several key sectors contributing to its manufacturing prowess. The rubber industry plays a crucial role in Southeast Asia, with Malaysia being the sixth-leading producer of natural rubber in the Asia Pacific region. The country excels in producing gloves, tyres, thread, automotive components, and seals & O-rings.

The machinery and equipment (M&E) sector has shown significant growth, with exports increasing by 25.5% from January to July 2022, reaching USD 8.34 billion year-on-year. Malaysia produces industrial machinery, electrical equipment, and construction and mining machinery.

In the food industry, Malaysia aims to become one of the largest global suppliers of Halal products. The Global Islamic Economy Indicator forecasts that the global halal market will expand from USD 2.09 trillion in 2021 to almost USD 3.27 trillion by 2028. The country focuses on processed and canned foods, dairy products, beverages, and snack foods.

The chemical industry is also a significant contributor to Malaysia's economy, accounting for 6% of the nation's GDP and employing 292,969 workers, which is 12.5% of the total manufacturing employees. Key products include petrochemicals, oleochemicals, plastics and polymers, and agrochemicals.

Malaysia has become an attractive destination for global automotive manufacturers. It hosts the first Porsche assembly plant outside of Germany and several regional distribution centres for brands like Volkswagen, Mercedes Benz, BMW, and Volvo's regional EV hub. Local manufacturers such as Proton and Perodua have also established facilities, positioning Malaysia as a potential regional hub for the EV industry.

The electronics & electrical sector has emerged as one of the largest export-oriented industries in the country. It contributes 38% to Malaysia's total exports and 78% to the net trade surplus. The industry produces consumer electronics, electrical appliances, electronic components, and semiconductors.

To conclude, Malaysia industrial strengths include:

- Diverse Industrial Strength: Malaysia excels in rubber, machinery and equipment, food (particularly halal products), chemicals, transportation, semiconductor & electronics and medical manufacturing.

- Strategic Industrial Clusters: The report identifies Penang, Johor, and Greater Kuala Lumpur as key industrial hubs, each with specialized sectors and robust infrastructure.

- Supportive Government Policies: Malaysia's New Industrial Master Plan 2030 (NIMP 2030) and National Fourth Industrial Revolution (4IR) Policy are driving manufacturing competitiveness and innovation.

- Significant Foreign Investment: Major global companies including Infineon, Intel, and Micron have made substantial investments in Malaysia's manufacturing sector, with some projects exceeding $7 billion.

- Sustainability Focus: Malaysia leads Southeast Asia in the Energy Transition Index and aims for net-zero greenhouse gas emissions by 2050.

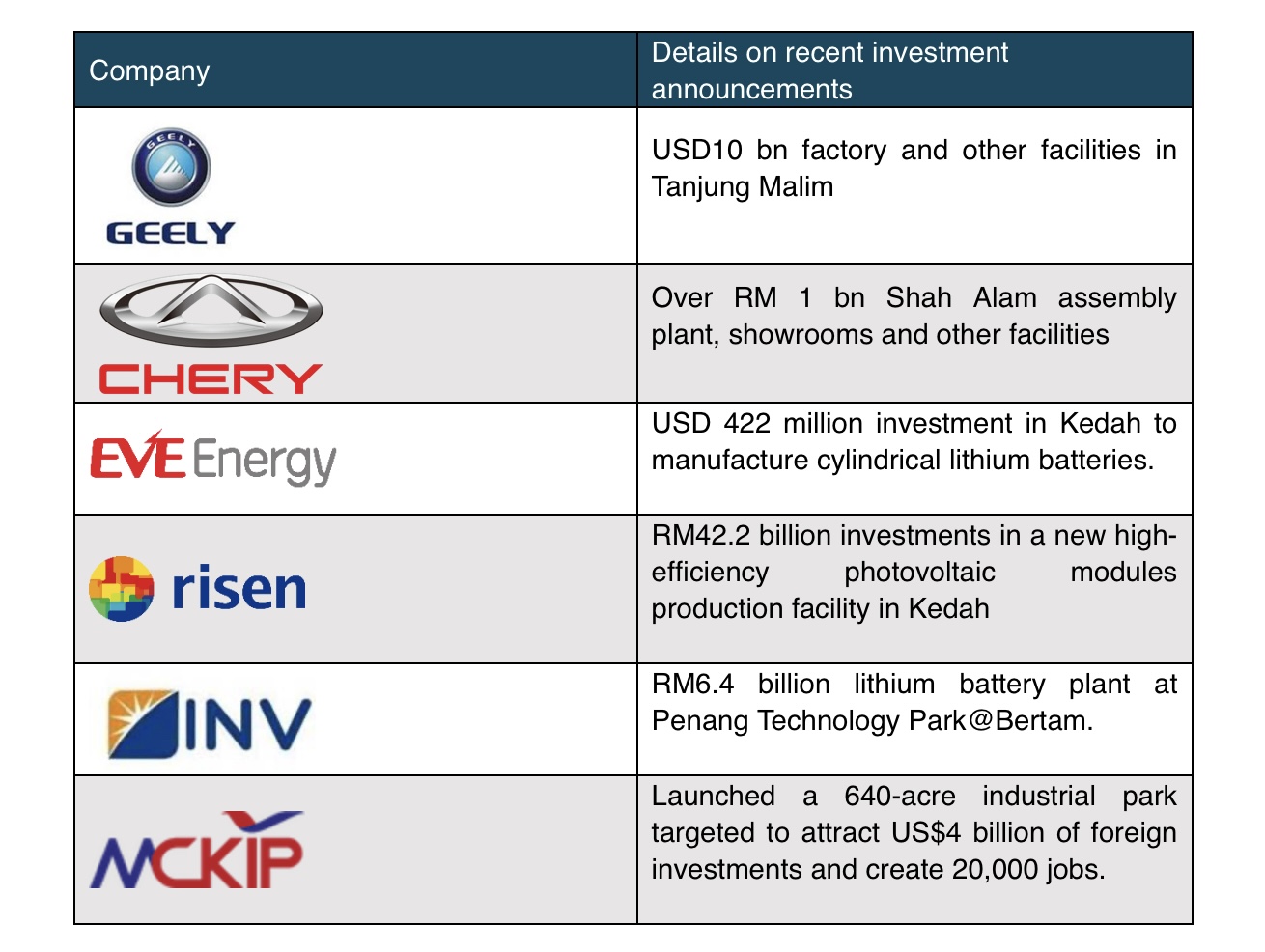

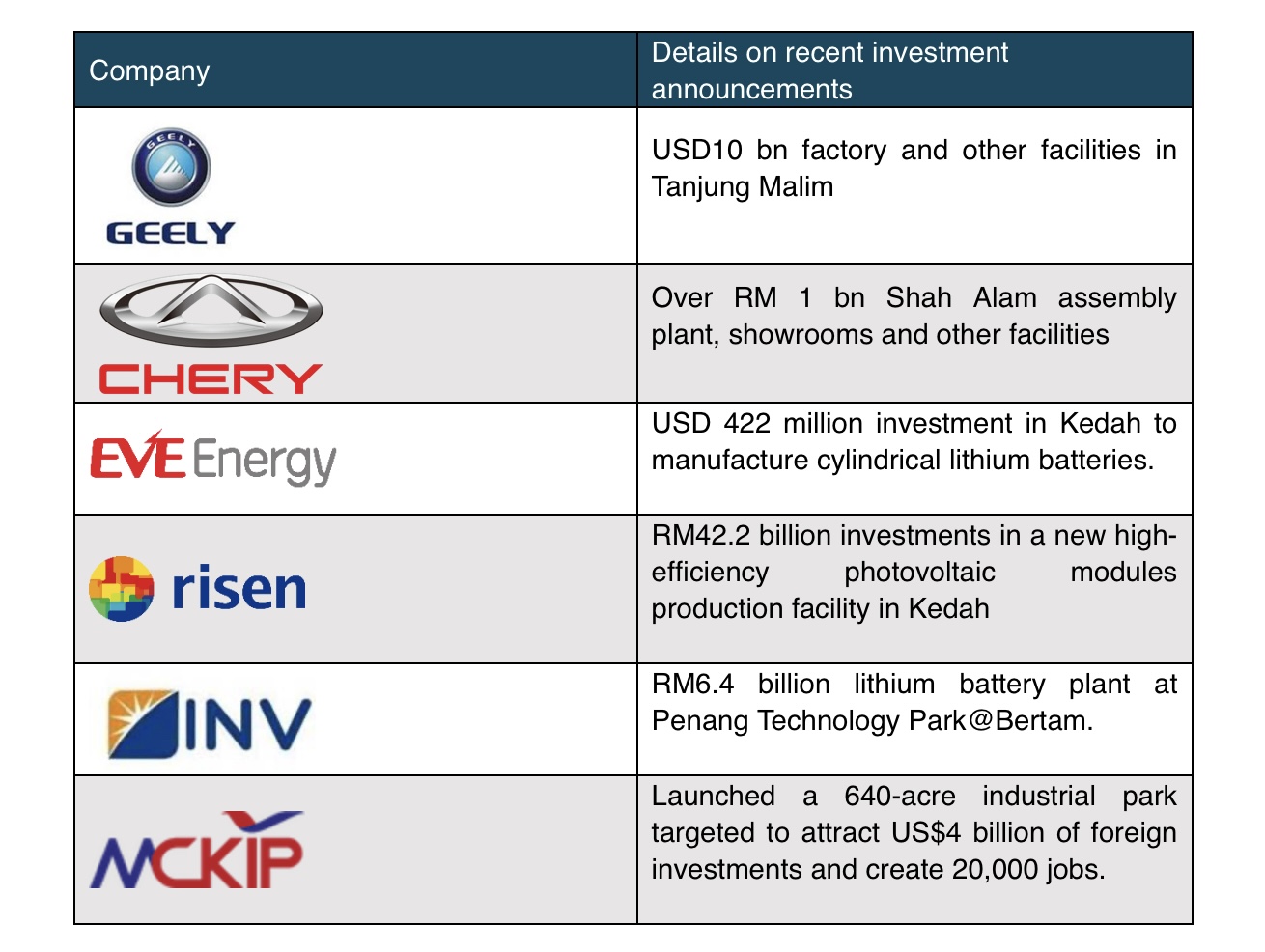

When focusing specifically on Chinese investments into Malaysia, a few recent investment announcements are worthwhile mentioning:

Notable Chinese Investments in Malaysia (2022-2024)