Hong Kong face a shortage of private student accommodation: JLL

Contact

Hong Kong face a shortage of private student accommodation: JLL

The report by JLL highlights a shortage of student beds in Hong Kong, estimating a demand for 22,300 private bedspaces in the next four years.

Hong Kong is transforming into an international hub for post-secondary education. JLL today released its “Unlocking student accommodation market in Hong Kong” report and estimated the influx of non-local post-secondary students and tightened available in university hostels will create additional spillover demand of 22,300 bedspaces into private accommodation market in coming four years, which will fuel private student accommodation to be a new investment asset and boost the investment value for purposing assets, particularly hotels and residential, into student accommodation.

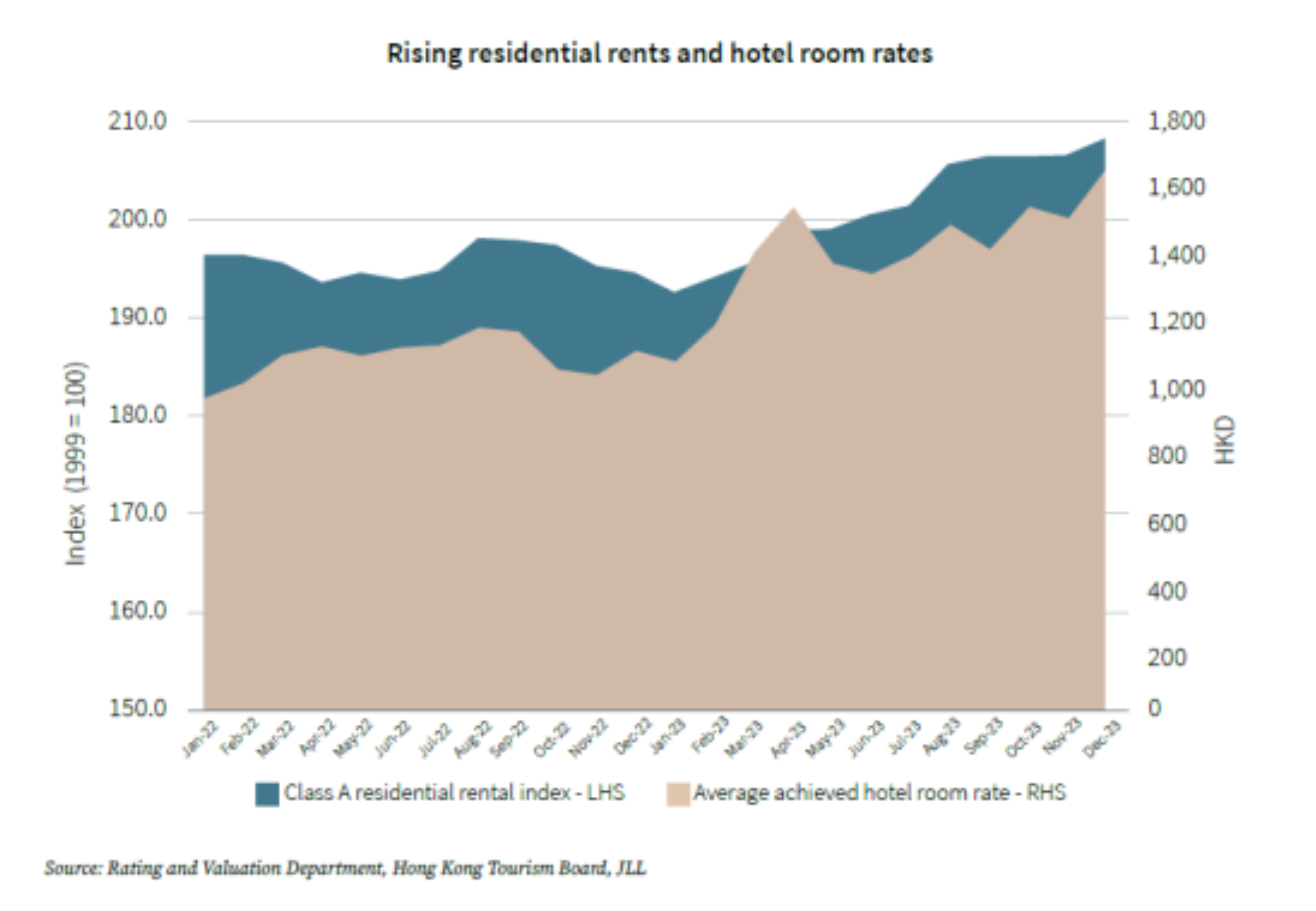

Oscar Chan, Head of Capital Markets at JLL in Hong Kong, said: “Rental prices in Y83, the largest private student accommodation in the city, recorded an annual growth rate of over 10% since 2022. We observed that the rents of private student accommodation are soaring at an accelerated pace in the last 12 months and reached 15%, the highest. Residential rents have increased by 7.0% since the borders reopening in early 2023, while the room rates of hotels also increased. The rents of private student accommodation are expected to grow further as the demand for student accommodation is currently underserved and the population of non-local student is growing rapidly. Private student accommodation will be a new investment property asset,”

In the 2022/23 academic year, post-secondary student enrolment in Hong Kong reached 253,000 and the eight University Granted Committee (UGC)-funded universities, along with Hong Kong Shue Yan University and Hong Kong Hang Seng University, collectively provide approximately 39,000 units of student accommodation, while the student accommodation market (university and private) could accommodate only 16%.

Cathie Chung, Senior Director of Research at JLL in Hong Kong, said: “We estimated that around 37,200 non-local students currently opt for private accommodation and expected to expand to 59,500 in the next four years. The provision of university hostels has consistently fallen short of the growing student population, and it appears unlikely to meet the overall student accommodation demand in the foreseeable future. It is primarily due to the lengthy construction cycle required for purpose-built hostels, as well as the difficulty in finding suitable sites for new university hostel developments. We believe that the tightened availability in university hostels will create additional spillover demand of 22,300 bedspaces into the private accommodation market by the 2027/28 academic year,”

Private student accommodation is an emerging segment in Hong Kong, currently providing around 1,000 leasable spaces in total. When set against the backdrop of the overall student enrolment, the private student accommodation provision rate in Hong Kong is a mere 0.4%. This figure is considerably lower than the average provision rate observed in the European countries, which stands at an average of about 5%. It supported the private student accommodation projects in Hong Kong have maintained impressive occupancy rates between 98% to 100%. Each leasable space within these student accommodations commands a robust monthly rental ranging from HKD 5,200 to HKD 14,800.

Chan said the attractive and stable return offered by student accommodation is attracting investor attention.