The Malaysian economy grew 3.9% in the third quarter of the year (3Q2023), supported by stronger domestic demand, improved employment conditions, a rebound in the tourism sector, and increased construction activity. Knight Frank Malaysia, the independent global property consultancy, has released its Real Estate Highlights 2nd Half of 2023 (“REH”) which features insights into the performance of the property markets across Klang Valley, Penang, Johor Bahru and Kota Kinabalu.

RESIDENTIAL SECTOR

Market activity in the country’s residential property market improved in the first nine months of the year, with both transaction volume and value registering a year-on-year (YoY) growth of 1.3% and 3.5% respectively. However, the number of new residential properties offered for sale in the primary market has significantly decline in 2023, effectively addressing concerns related to property overhang and market mismatch.

Developers are increasingly promoting homeownership through collaborations with banks, in addition to offering post-sale services such as hassle-free fit-out, rental programmes and home care services.

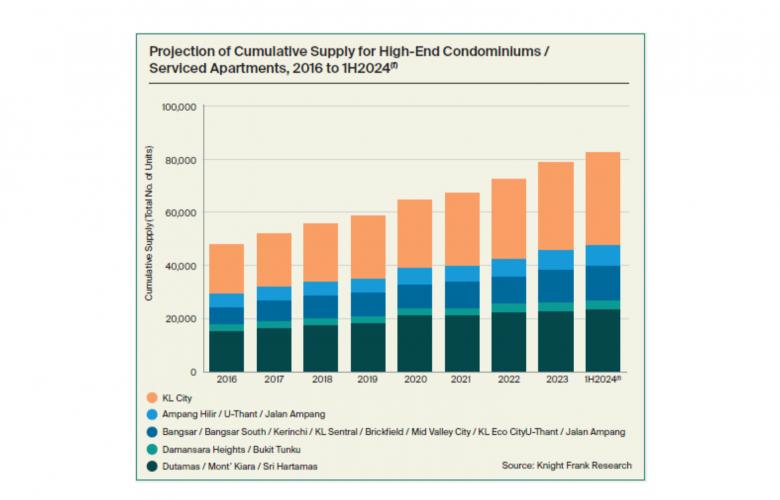

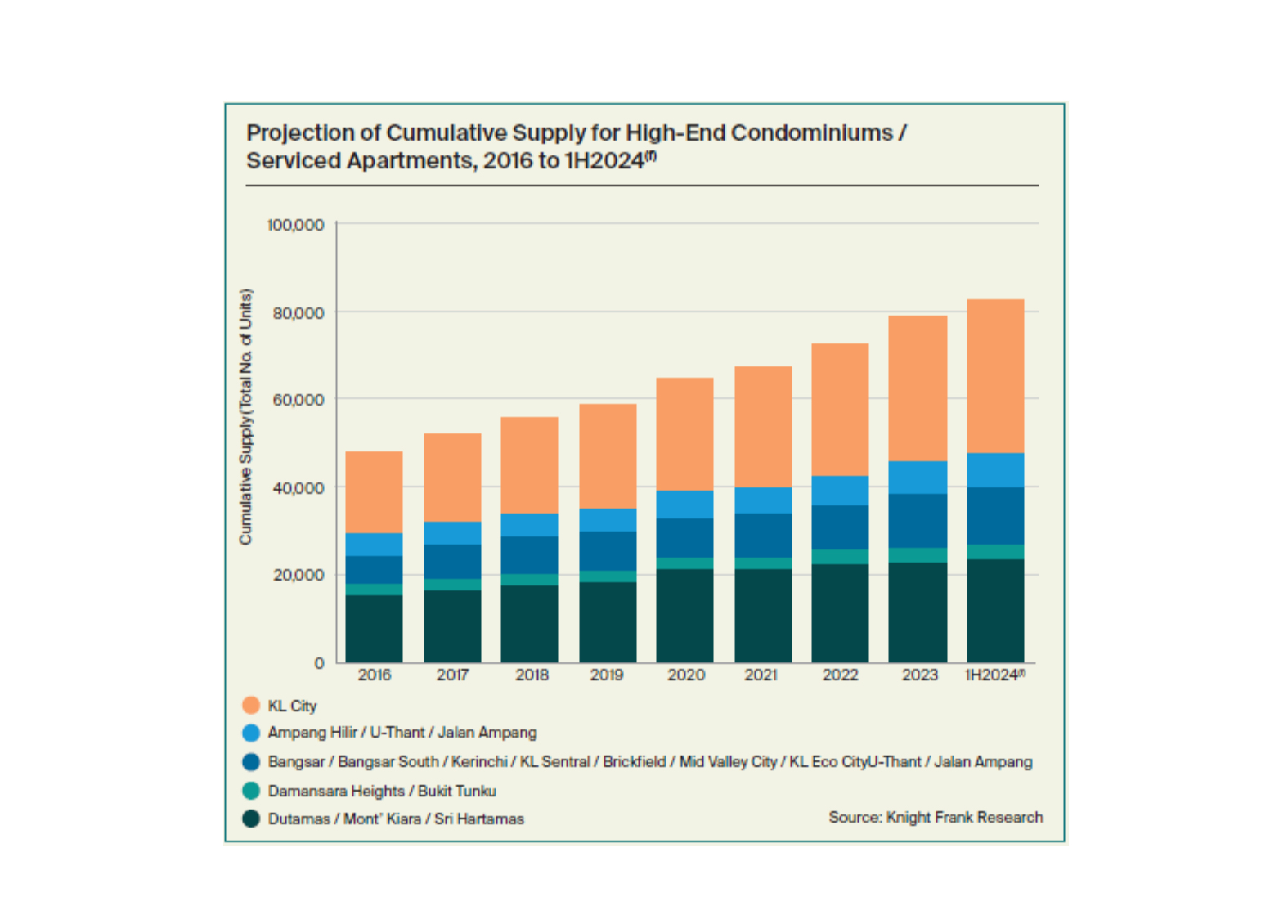

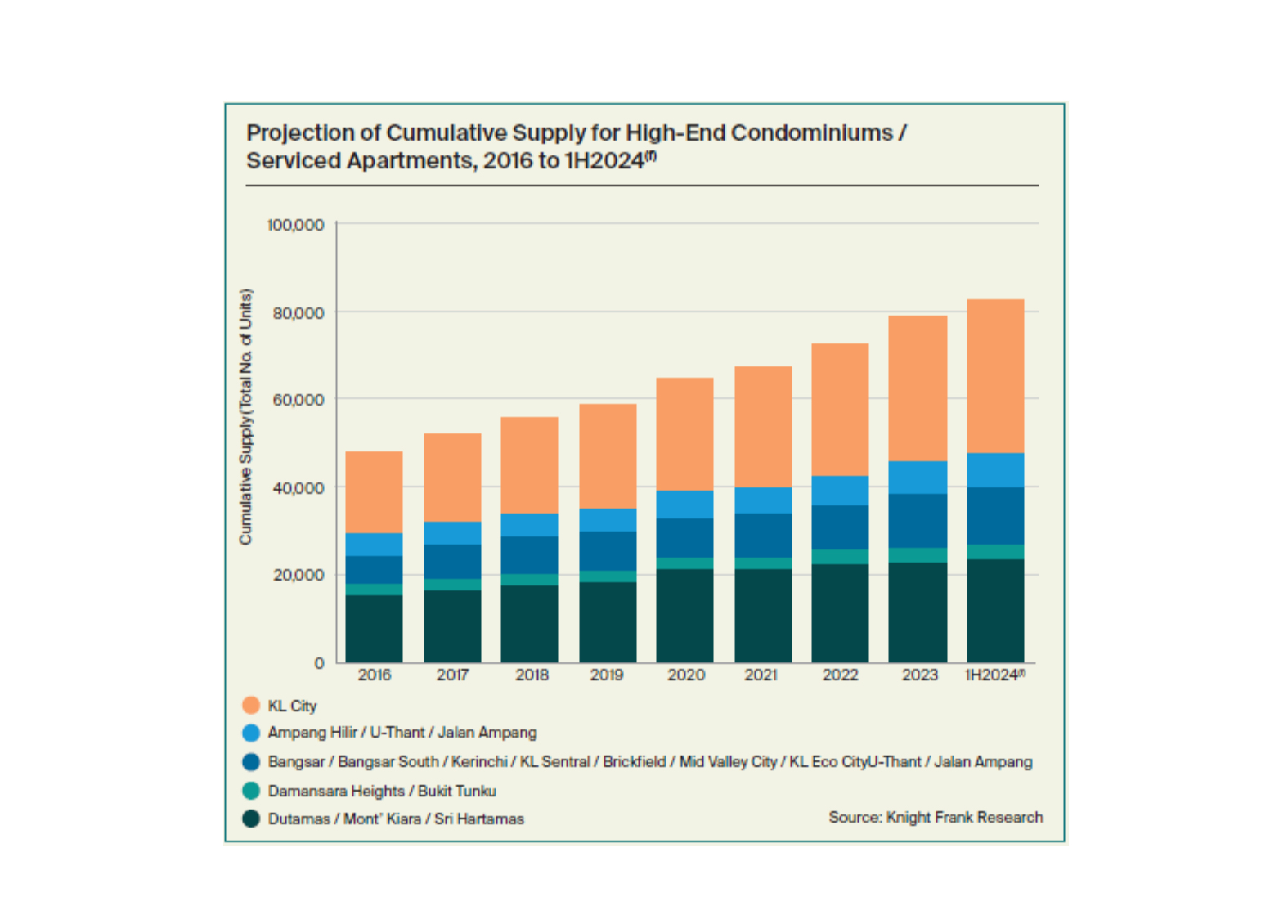

Figure 1 Projection of Cumulative Supply of High-End Condominiums / Serviced Apartments,

2016 to 1H2024(f)

According to Judy Ong, Senior Executive Director of Research and Consultancy, Knight Frank Malaysia, “Despite the inflationary pressures and elevated OPR, the residential property market appears to be moving in a positive direction, marked by increased sales volume, new property launches and successful completions.

This is further supported by the government’s initiatives and incentives to encourage homeownership among the Rakyat and coupled with the recently relaxed criteria for the MM2H Programme, the residential market maintains a cautiously optimistic outlook as it enters 2024”.

Enoch Khoo, Managing Director at Knight Frank Property Hub, has expressed a positive outlook on Budget 2024, emphasising a significant measure aimed at positively influencing local land and property markets. He highlights that the imposition of a flat 4.0% stamp duty on Memorandum of Transfer (MOT) for non-citizens and foreign-owned companies, effective from January 1, 2024, holds great potential to contribute to the stabilisation and control of land and property prices for the benefit of local residents.

OFFICE SECTOR

During the review period, Klang Valley recorded the completion of four new office developments, collectively adding circa 3.0 million sq ft of leasable space to the market. The KL City sub-office market continues to face increased pressure due to continued supply-demand imbalance, while the office markets in KL Fringe and Selangor exhibit resilience, characterised by steady leasing activities, particularly in prime locations featuring Grade A buildings.

Five notable office deals in KL City and Selangor with a collective value of RM837.8 million were announced during the review period. This slight uptick in office transactional activities and heightened interest suggest returning confidence, with corporate entities looking to take up additional office space to fulfil growth needs.

Teh Young Khean, Executive Director of Office Strategy and Solutions, Knight Frank Malaysia said new government initiatives aimed at attracting venture capital and fostering startup incubation, coupled with the growing presence of major multinational corporations in Klang Valley are anticipated to generate additional interest and activity in the office market.”

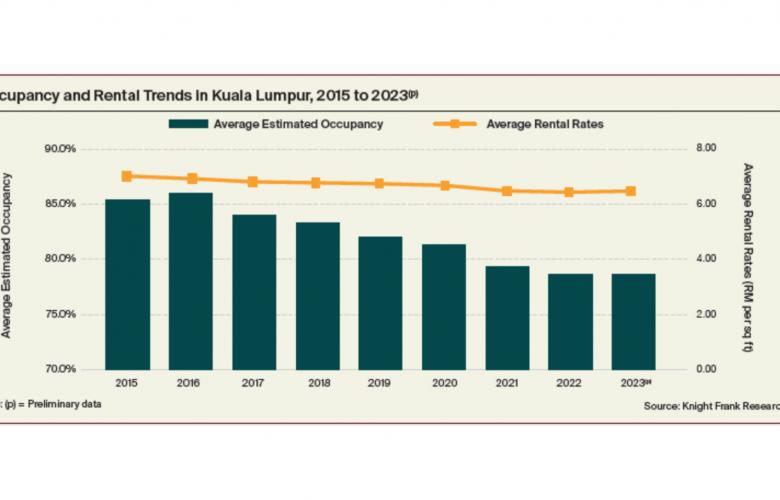

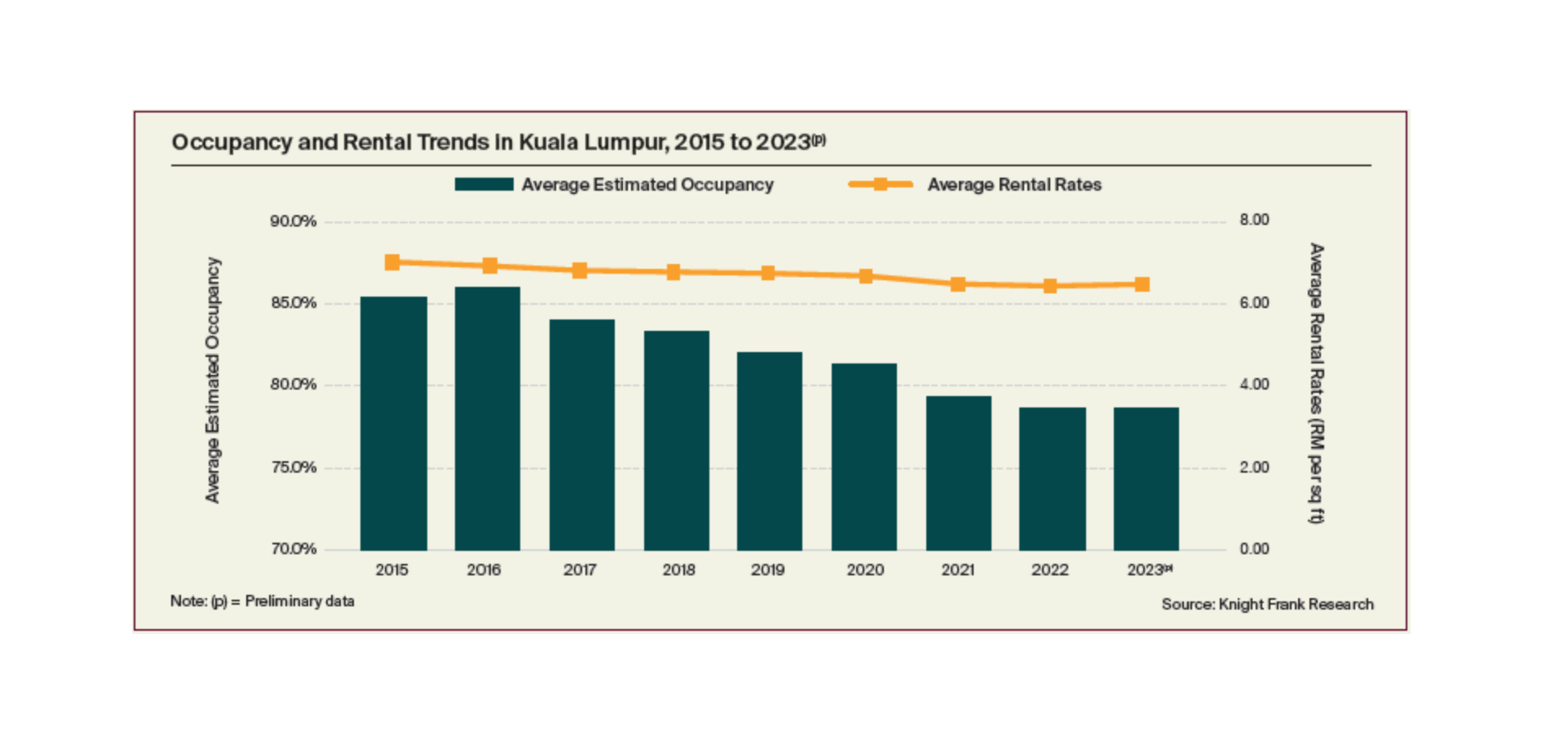

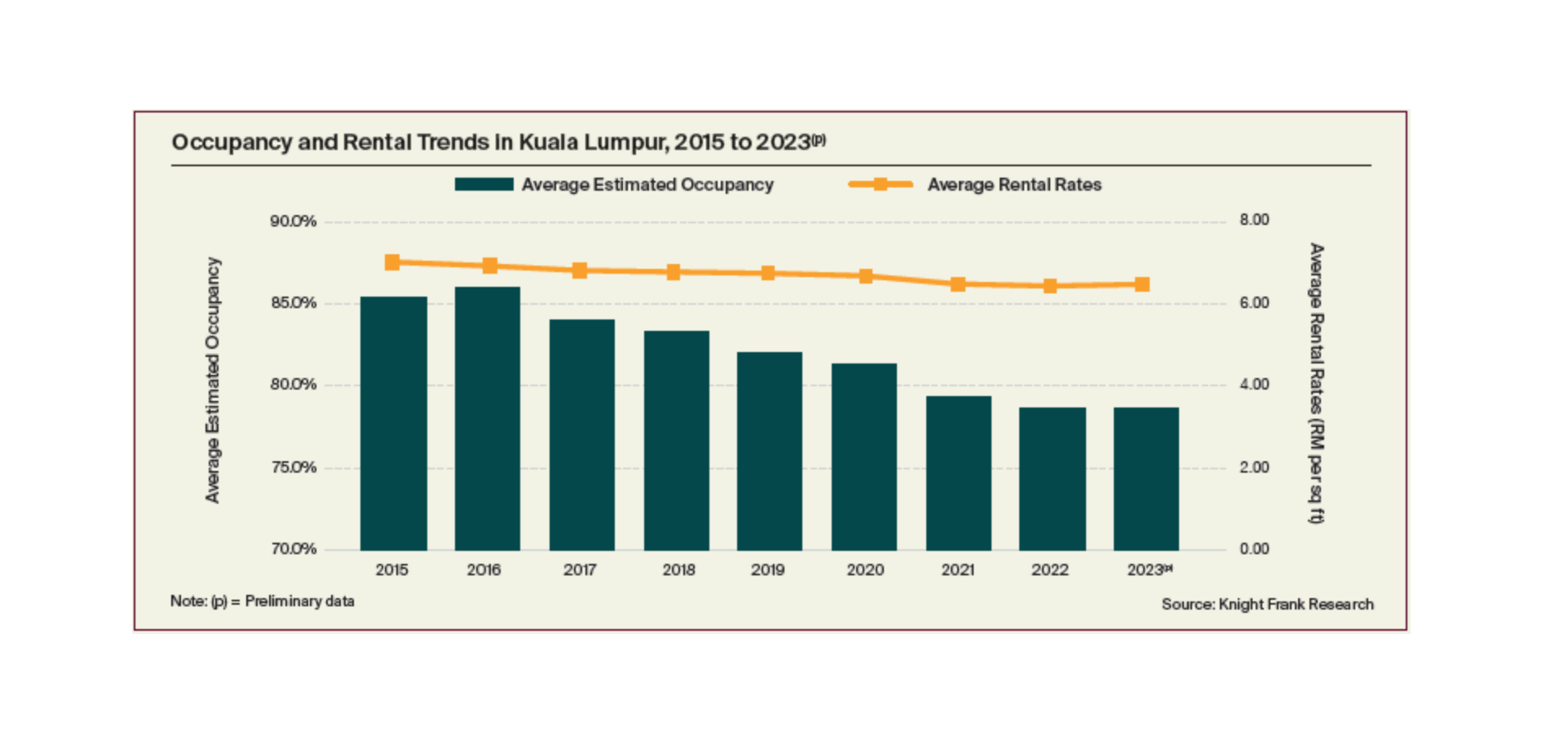

Figure 2 Occupancy and Rental Trends in Kuala Lumpur, 2015 to 2023(p)

RETAIL SECTOR

In the second quarter of 2023, Malaysia’s retail sales fell below market expectations, contracting 4.0% YoY. Aside from the high base effect, the decline is attributed to consumers’ weakening spending power amid elevated inflation. For the full year of 2023, the country’s retail sales growth has been revised downwards to 2.7% from the earlier projection of 4.8%.

Redefining the luxury retail landscape, The Exchange TRX, home to over 500 experiential stores, made its debut on 29 November 2023, featuring a roster of first-to-market foreign brands including Gentle Monster, Maison Kitsune, Alo Yoga and Drunk Elephant. The centre piece of The Exchange TRX – its 10-acre park is the largest rooftop public park in Kuala Lumpur. Earlier, on 9 October 2023, Phase 1 of the mall within the larger integrated development of Pavilion Damansara Heights, opened with a committed occupancy rate of 80.0%. In 2024, three more shopping centres/supporting retail components with a collective retail space of circa 1.7 million sq ft, are scheduled for completions/openings.

Sunway Group continues to be at the forefront of ESG practices. Its mall group has launched the Sustainability Collaboration Alliance Network (SCAN) to facilitate various collaboration as well as introduced a 3-tier learning programme, known as ReX (Retail Extended Learning) to enable retailers to gain knowledge.

Yuen May Chee, Director of Property Management, Knight Frank Malaysia said that the impending Sales and Service Tax (SST) rate hike, from six to eight percent effective from 1 March 2024, coupled with the introduction of a five to ten percent luxury tax and restructuring of subsidies, may dampen growth in the retail market. Retailers experiencing higher tax liabilities will see rising operational costs, potentially eroding their profit margin and this may lead to price adjustments, which ultimately will impact consumers.

Nonetheless, the government is committed to ease the burden of rising cost of living and has further allocated RM200 million for the ongoing ‘Payung Rahmah’ initiative. The government also continues to allocate cash assistance and incentives to boost consumer spending with a 25.0% increase from the previous year to RM10 billion. Backed by vibrant tourism-related activities, healthy institutional and foreign investments, and steady growth in wage and employment, the local retail market is expected to sustain in the coming year.

INDUSTRIAL SECTOR

For the first nine months of 2023, the industrial property market recorded a higher sales value of 7.6%, albeit with a lower transaction volume of circa 4.6% on an annual comparison. This indicates increasing large ticket size transactions took place within the observed period, suggesting that the industrial sector has remained relatively stable.

Allan Sim, Executive Director of Land & Industrial Solutions, Knight Frank Malaysia comments, “Amid the global occurrences, the industrial market is seen to be under pressure, impacted by the overall growth and economic stability in the region. The ongoing geopolitical tensions, including trade disputes between the United States and China, conflicts between Russia and Ukraine, and the outbreak of military conflict in the Middle East, appeared to have affected Malaysia’s overall growth. Investors continue to be on their toes, staying cautious. The upcoming elections, particularly the presidential elections in the United States, Indonesia, and Taiwan may impact the development of economies in the region and certain investment or new development decisions may be deferred.”

Allan further elaborates, “Industrial manufacturing relocation, to mitigate the challenging global trend that could disrupt the global supply chain, a trend since COVID-19, will continue despite all economic challenges. Southeast Asia emerges as one of the highly favourable relocation destinations due to factors such as access to raw materials, cost advantage, availability of skilled labour, political stability, market population, and economic growth, amongst others.”

With the subsidy-rationalisation programme under the newly launched national Central Database Hub (PADU), the government will be deploying more resources into the country’s growth. In addition, a positive outlook for the country’s FDI is anticipated in view of the strong track record of our incoming new king, Sultan Ibrahim Sultan Iskandar as evidenced by the exponential growth in the Johor real estate investment landscape over the past decade. “We believe with the shift in the global landscape and the country’s latest strategic vision, we foresee a similar trend in 2024, where the industrial landscape will continue to anchor the real estate scene at a moderate pace,” Allan concludes.

PENANG PROPERTY MARKET

Penang’s high-rise residential sector recorded better performance, particularly in the serviced apartment category, resulting in higher annual volume and value of transactions as of 3Q2023. This was primarily due to improved market activity in the majority of districts in the State, particularly in Timur Laut District. In the condominium / apartment category, however, despite registering higher sales volume (1.4%), the corresponding sales value was lower by 4.7% (3Q2023: 1,077 transacted units valued at RM642.7 million / 3Q2022: 1,062 transacted units worth RM674.2 million).

On the office front, rental and occupancy levels of selected privately-owned purpose-built office buildings continue to maintain.

Sunshine Tower, an upcoming office tower in Air Itam, is physically completed and pending issuance of Certificate of Completion and Compliance (CCC), expected in 1Q2024. The office tower forms part of Sunshine Central, a mixed-use project that consists of serviced apartment, office, retail and hotel components.

Two other buildings scheduled for completion next year are GBS by The Sea, the third Global Business Services (GBS) project by Penang Development Corporation in the State after GBS@Mayang and GBS@Mahsuri in Bayan Baru and the commercial tower within The Light City, a large scale integrated mixed-use waterfront development on the eastern coast of Penang Island.

According to Mark Saw, Executive Director of Penang Branch, Knight Frank Malaysia, “the retail segment in the State is slowly getting back to pre-pandemic level as the overall occupancy rate continues to improve. The impending completion of Sunshine Mall in 1Q2024 is expected to contribute circa 820,000 sq ft of retail space to the existing supply.”

Penang recorded RM38.9 billion worth of approved manufacturing investments from January to September 2023, four-fold higher YOY. Demand for new industrial parks is anticipated to grow further following encouraging take-up rates such as in Penang Technology Park. As of September 2023, the developer, Ideal Capital Bhd, has secured 23 local and foreign companies, reflecting a sales rate of 35.0% for the first phase of the industrial park. This is expected to generate circa RM500 million or 12.0% of the entire industrial park’s GDV. Some 20 other companies are expected to sign sales and purchase agreements with the developer over the next two months.

JOHOR PROPERTY MARKET

As of 11 October 2023, the construction of the Johor Bahru – Singapore Rapid Transit System (RTS) Link is progressing well at 52.0% completion and it is well on schedule for full completion by December 2026. The high-rise residential sector in Johor Bahru has seen improvements, marked by launches of new projects that have attracted significant interest. Purchase enquiries have been increasing, particularly for high-rise developments near the RTS Link project while the strong demand for landed residential properties continues to sustain, especially for those located in established townships.

During the review period, the asking rental rates for office space in Johor Bahru City Centre, Johor Bahru City Fringe and Iskandar Puteri remained stable. According to Lee Kun Thye, Director of Johor Branch, Knight Frank Malaysia, “the recent progression of RTS project has attracted eyeballs from property players and investors not only from central and up north Malaysia, but also from Singapore. Aside to the development lands which are hot in demand, we see rising enquiries for office space, especially fitted or co-working space, as well as green buildings.”

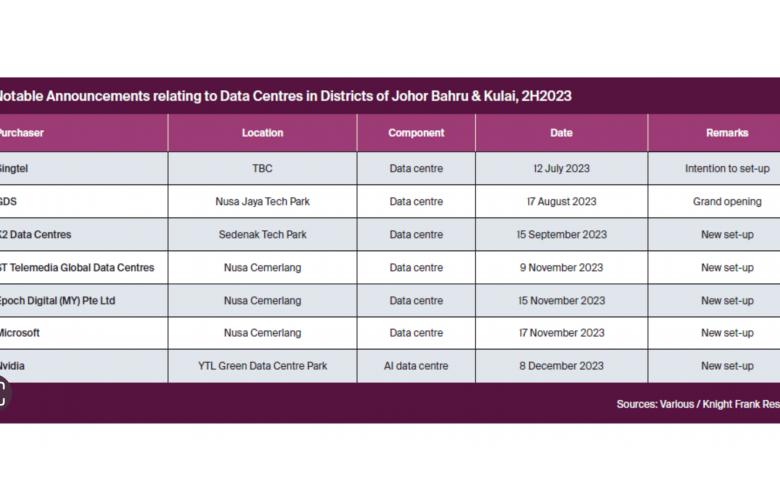

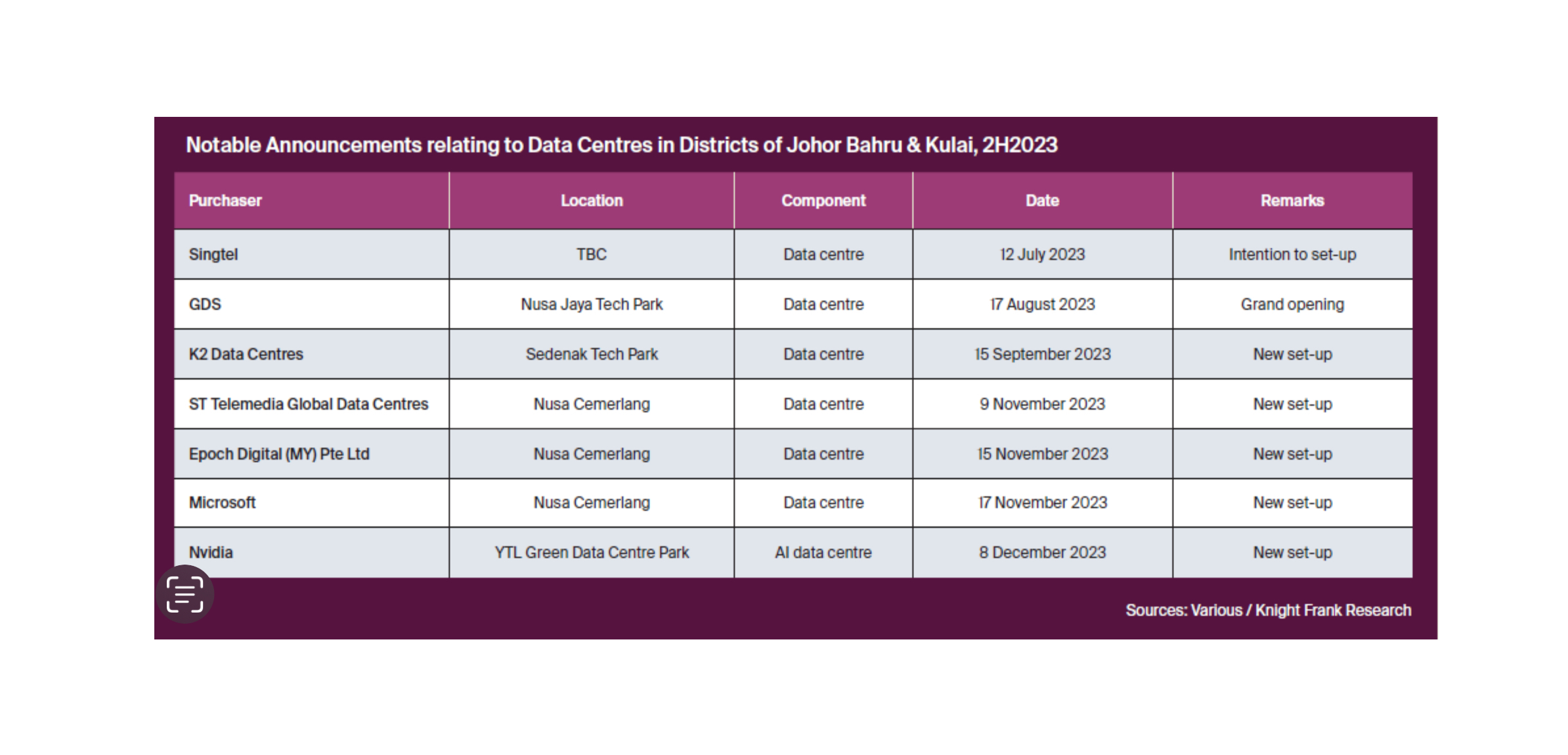

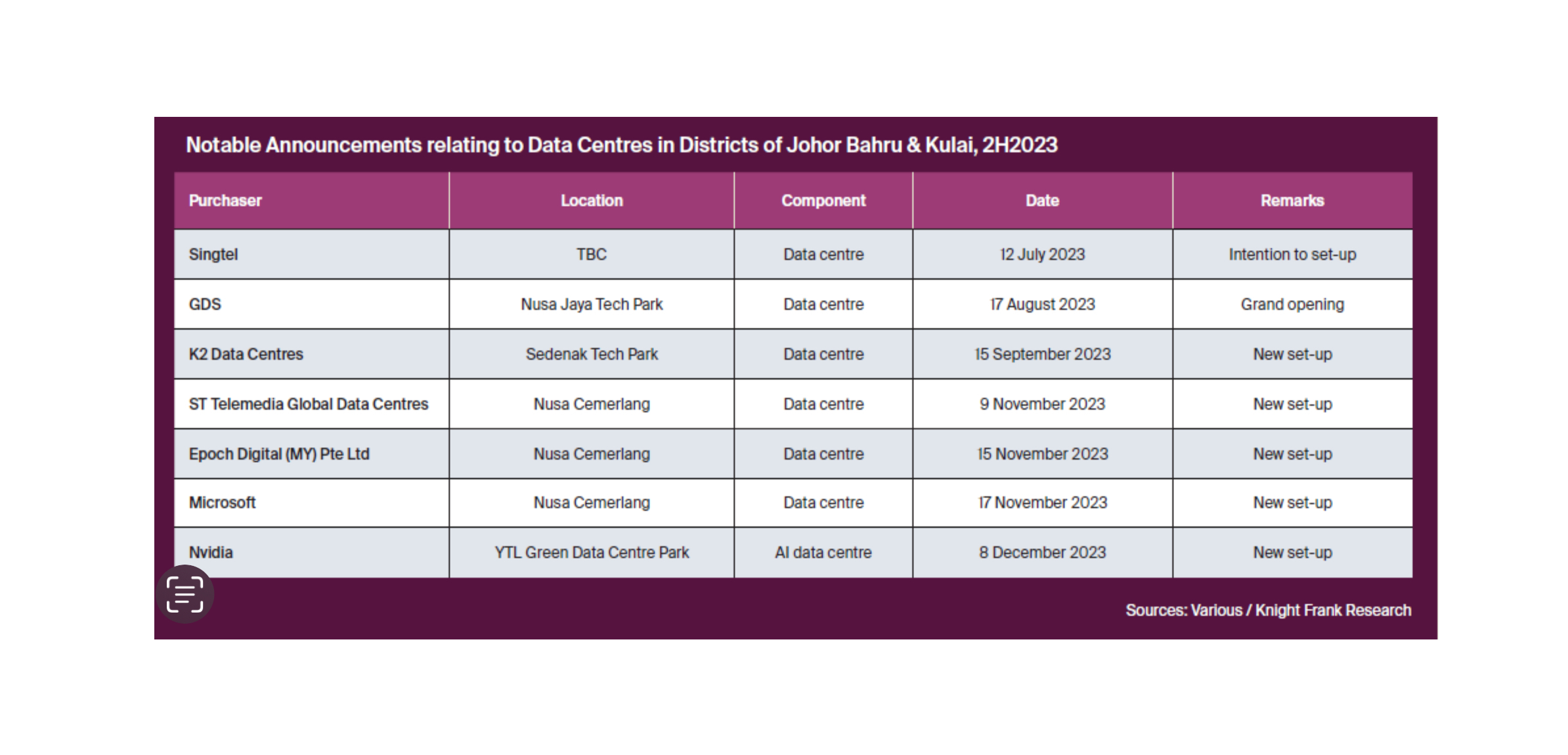

The industrial property sector remains vibrant, with developers actively acquiring land to expand their portfolios. Foreign investments continue to be a key factor in maintaining the sector's allure. Projections for the industrial property market remain optimistic, as shown by heightened industrial pursuits and also aligning with NIMP 2030. Despite Johor’s enduring appeal as an investment destination for data centres, the sector is currently facing challenges to secure sufficient power supply. Anticipations suggest that growing concerns about ESG issues will drive the advancement of eco-friendly businesses such as solar farming and water treatment initiatives.

Figure 5 Notable Announcements relating to Data Centres in Districts of Johor Bahru & Kulai, 2H2023

SABAH PROPERTY MARKET

Sabah registered 4,553 transactions valued at RM2.3 billion in 1H2023 (1H2022: 5,013 transactions worth RM2.7 billion) with market activity led by the development land and industrial sub-sectors. There were 614 transactions valued at RM416.0 million in the development land sub-sector; depicting a notable growth of 88.9% in volume and 21.4% in value of transactions (1H2022: 325 transactions worth RM342.7 million).

The housing sector remains a buyer’s market with new launches of high-rise and landed schemes. As of 3Q2023, the existing supply of residential units in Greater Kota Kinabalu (districts of Kota Kinabalu, Penampang, Tuaran, Putatan and Papar) totalled 136,332 units. The condominium / apartment segment as a singular property type represented majority of the existing stock with circa 54,119 units (39.7% share).

Alexel Chen, Executive Director of Sabah Branch, Knight Frank Malaysia said that, “the review period observed the maiden entry of several notable retailers into the Kota Kinabalu market, mainly under the trade categories of F&B, fashion and sports apparel. Additionally, the retail components of notable mixed-use developments in the city centre are garnering popularity in their F&B offerings as they generate high footfall from local consumers and visitors.”

Meanwhile, the unveiling of 5-star resort in Melinsung, Papar and the launch of water chalets in Semporna underscored the confidence towards the recovery in the State’s tourism sector.

OUTLOOK

In the outlook for 2024, Keith Ooi, the Group Managing Director of Knight Frank Malaysia, anticipates sustained economic growth, anchored by domestic demand. Ooi also expects further recovery in tourist arrivals and increased investment activity as well as the positive impact of measures and initiatives outlined in Budget 2024 to contribute to economic expansion. Overall, the forecast suggests a promising economic landscape for the coming year, underpinned by diverse factors fostering growth and stability.

Related Reading:

Knight Frank Malaysia residential arm Property Hub Sdn. Bhd. Announces Enoch Khoo as new Managing Director | RE Talk Asia

Malaysian Hospitality Industry: On the road to recovery and prosperity - Knight Frank | RE Talk Asia

Leading Real Estate Companies of the World hires Josephine Teh in Malaysia | RE Talk Asia