Investment activity is forecast to increase steadily across the Asia Pacific region in 2024 , according to Colliers’ (NASDAQ and TSX: CIGI) 2024 Global Investor Outlook.

This year’s report points to steadily increasing activity in APAC markets throughout 2024 as certainty around the policy environment takes hold, gaps between buyers and sellers narrow and more investors move to deploy capital.

“2024 definitely looks more positive than 2023, with a lot of pent-up equity which is looking to find a home,” Chris Pilgrim, Colliers Managing Director of Global Capital Markets, Asia Pacific, said. “The depth of capital in most Asian markets has to diversify. We were in one market recently where out of the five large state institutions, all signaled their intentions to significantly increase their allocations to real estate over the next few years.

“Particularly within the region, investors are aware of the resilience of the asset class and the growth opportunities offered in rapidly maturing markets such as India and South Korea. We anticipate a more dynamic year ahead where the ability to act quickly, dig deeply into markets and sectors to identify value, and forge productive partnerships will be key to making the most of the region’s resurgence.”

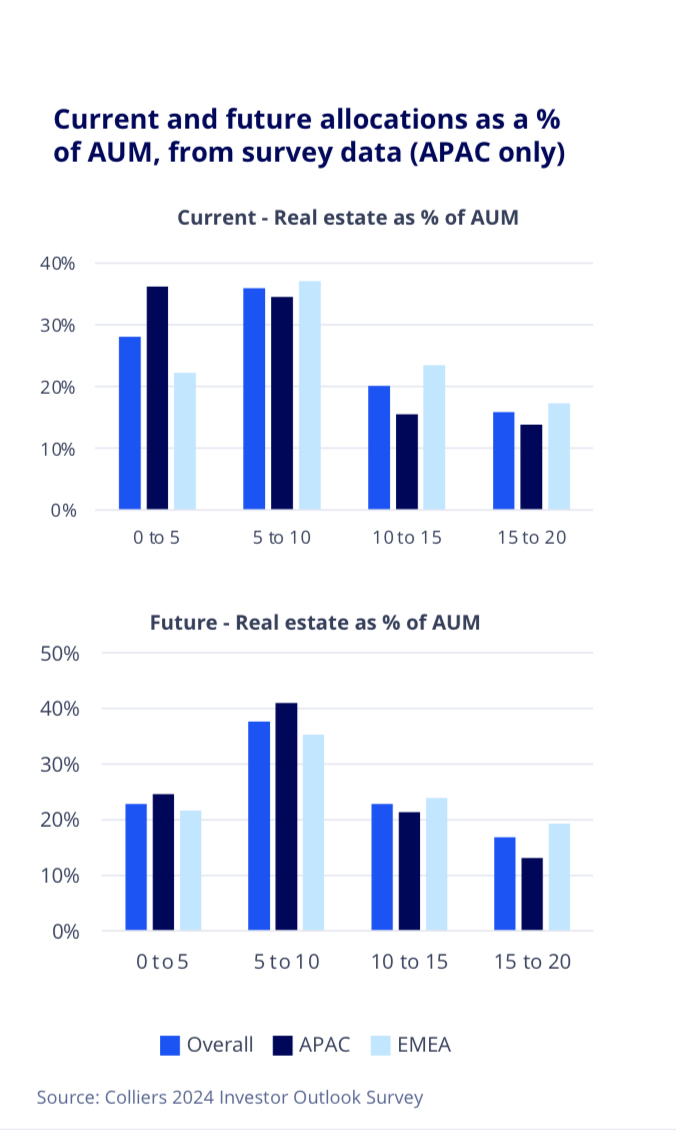

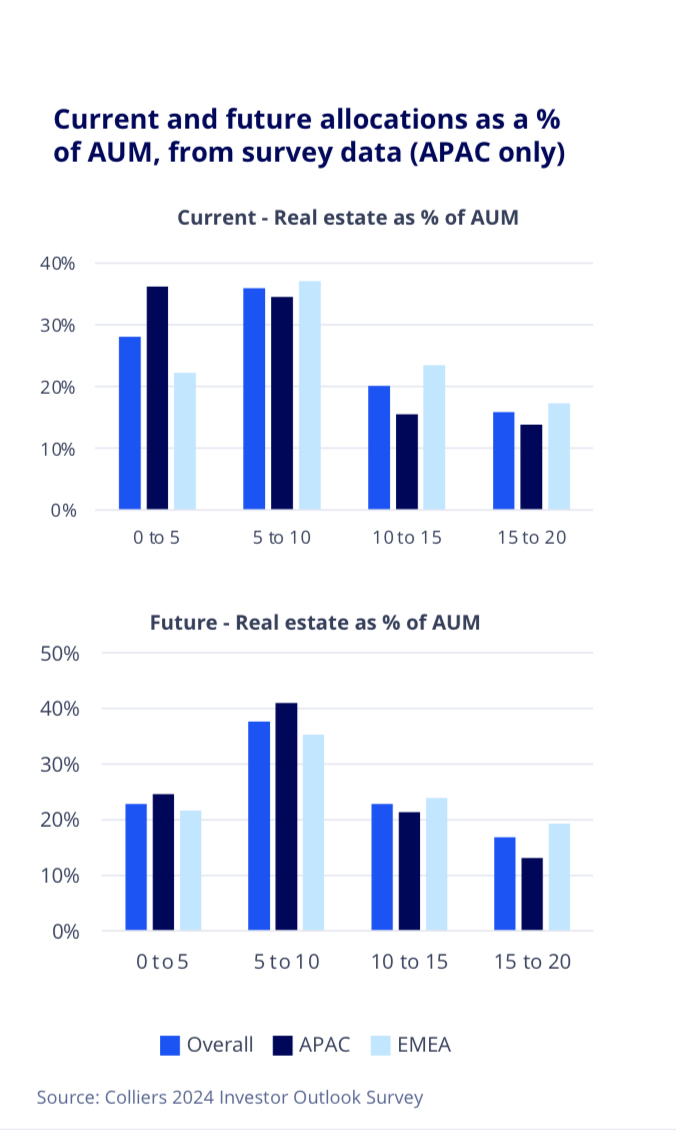

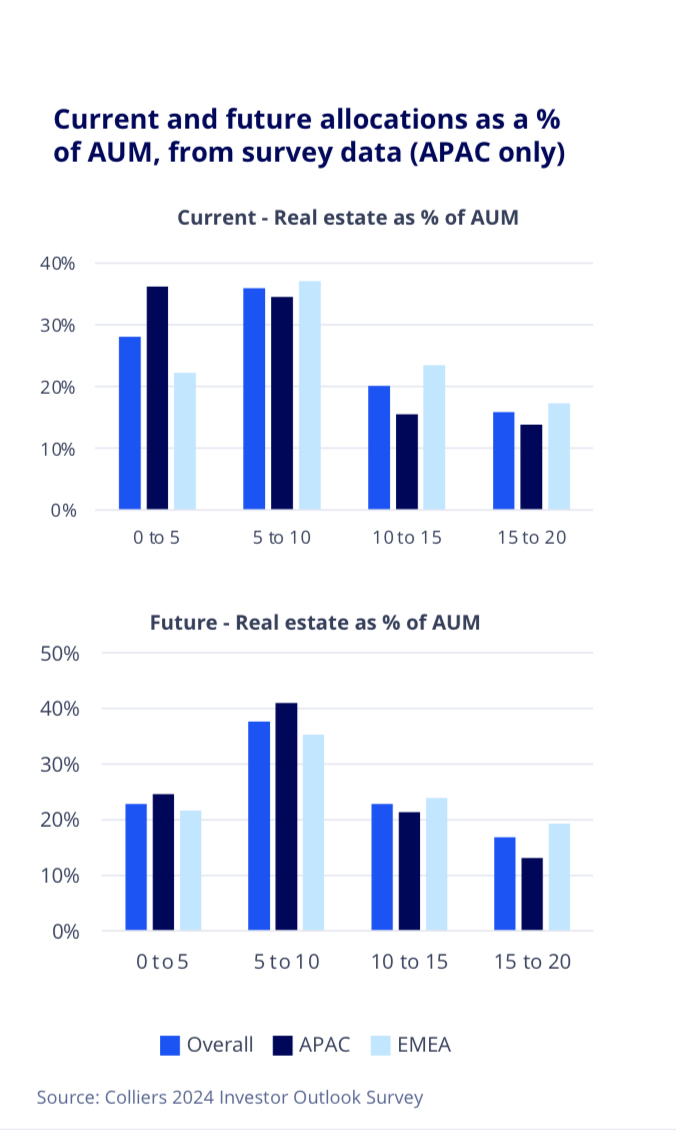

Almost 60% of APAC investors expect regional economic growth to contribute positively to the real estate environment. The survey data also points to an upswing in the proportion of investors planning to boost real estate allocations, with 75% of APAC respondents planning to dedicate 5-20% of assets under management to real estate in the future, up from 64% currently.

Activity is set to be dominated by investors from within the region, with 66% of APAC-based survey respondents planning to invest in Asia Pacific in 2024, up from 62% in 2023. However, major APAC institutions are also expected to continue to channel capital overseas as the outlook for commercial real estate improves and more opportunities

“Globally, there’s a narrative that on-shore investment has increased, but in H1 2023, Singapore was the largest deployer of capital into global real estate with a majority proportion invested outside of Asia Pacific,” Mr Pilgrim said. “Japan has also increased its position as a major source of capital for global real estate with 60% in H1 invested outside of Asia Pacific across the top five geographies.

“Importantly, as we have seen in 2023, we expect continuation of the trend in 2024 that cross-regional real estate investment will be reciprocated, with North American and European investors developing strategies across Asia Pacific. We expect the APAC region will continue to drive global investment levels in 2024 with a growing depth of capital.”

The fact the APAC region has shown resilience, despite a challenging global environment has seen investment activity across the region account for 23% of total global investment volumes YTD 2023, which is five percentage points higher than the long-term average of 18%, according to Colliers National Director of Research Joanne Henderson.

“APAC sales volumes are only down by 30% compared to 2022 levels, whereas global investment activity is down by almost 50%.” Ms Henderson said.

“We expect APAC’s commercial property market will continue to uphold its strong position on the global stage over 2024 and contribute to a growing share of global investment activity.”

Other key highlights from the survey include:

• Both established and emerging markets to be favoured by investors

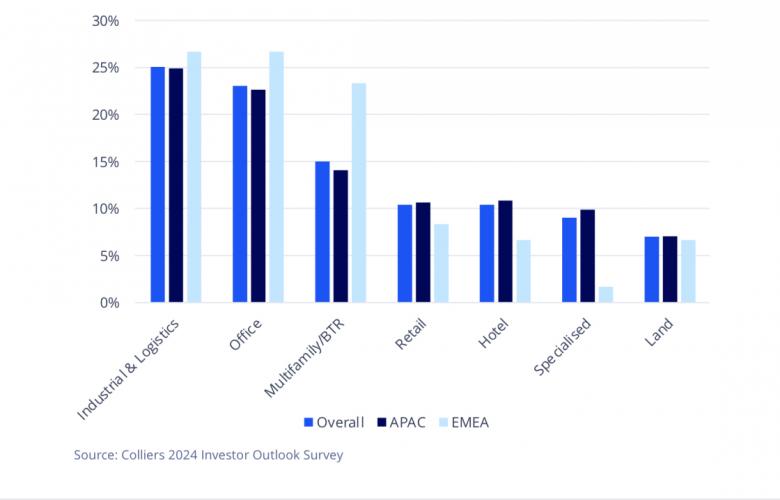

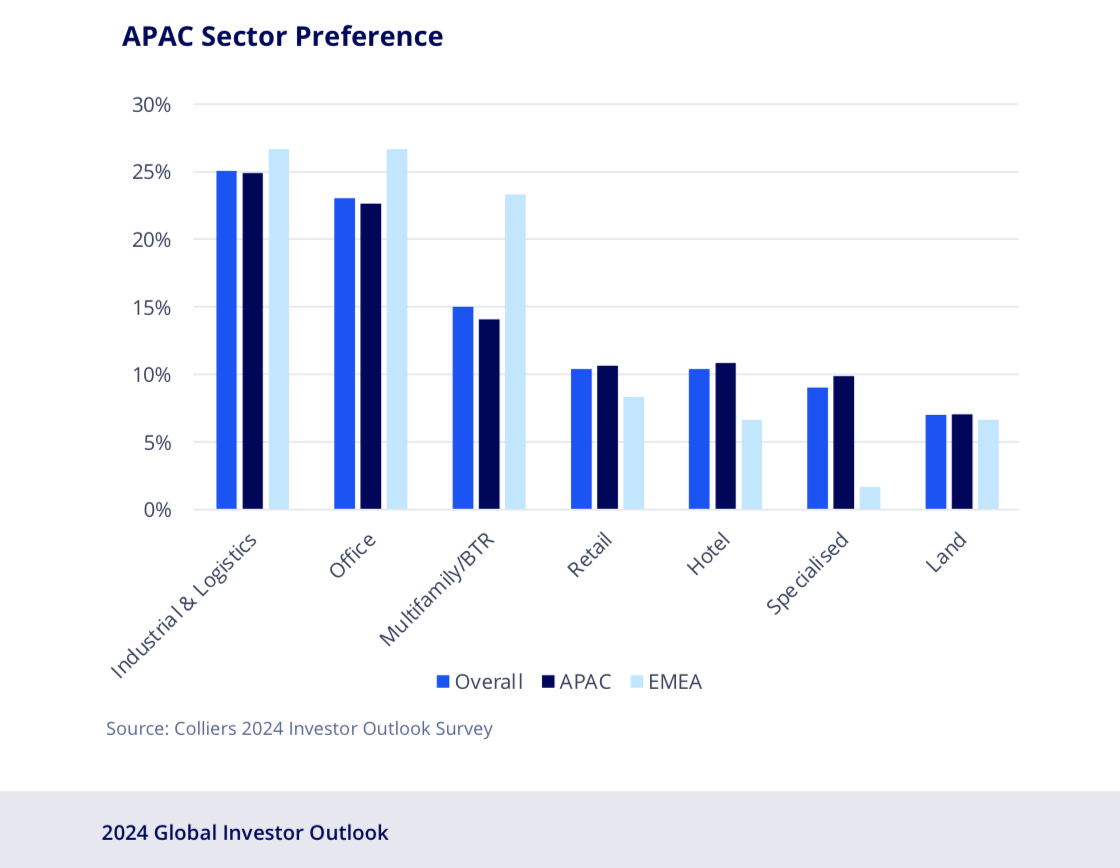

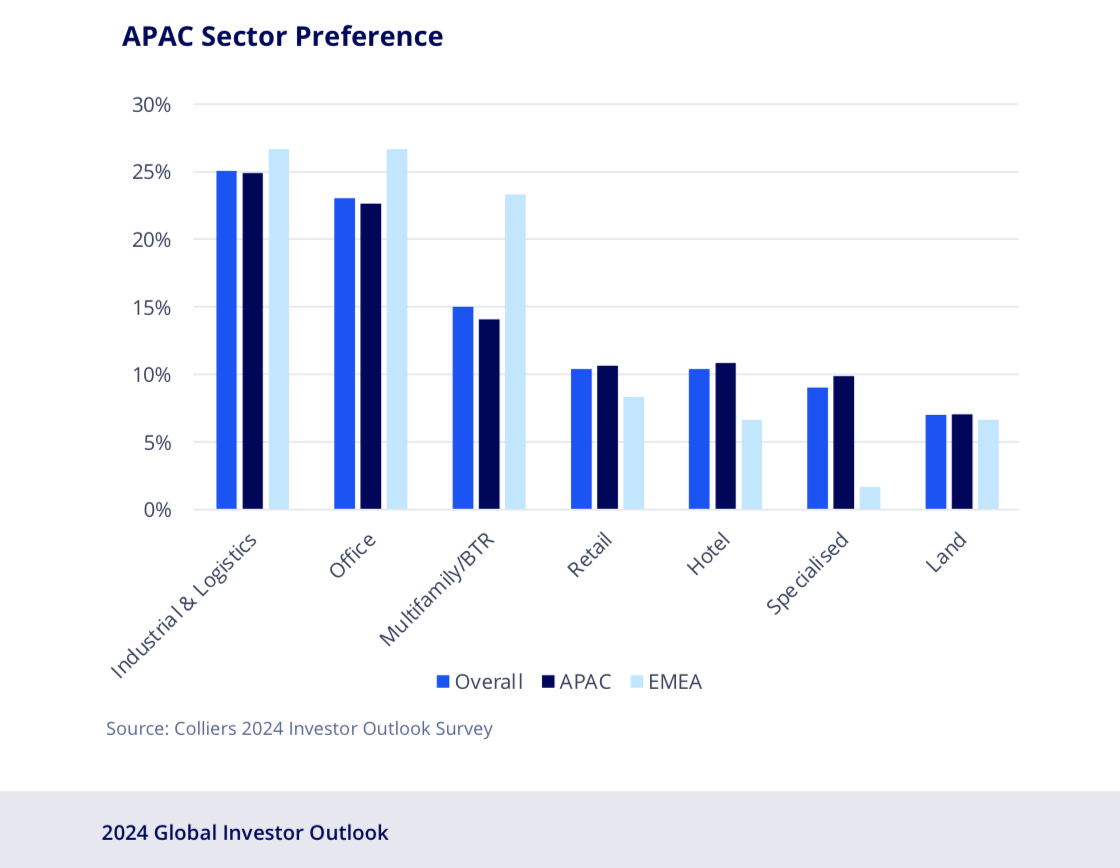

• Office and industrial sectors continuing to lead the charge: On a sector basis, industrial and logistics (I&L) has overtaken office as the asset class of choice for investors in the region, with 25% of investors naming I&L their preferred sector vs. 23% for office, followed by multifamily/BTR (14%), retail (11%) and hotels (11%).

• Rising awareness of ESG driving value: 28% of APAC respondents reported fully assessing the ESG performance of their assets, versus just over 20% last year, and 20% said ESG factors were now dictating CapEx decisions, up from the 15% who said they had an ESG-based disposal and acquisition-based strategy in place last year.

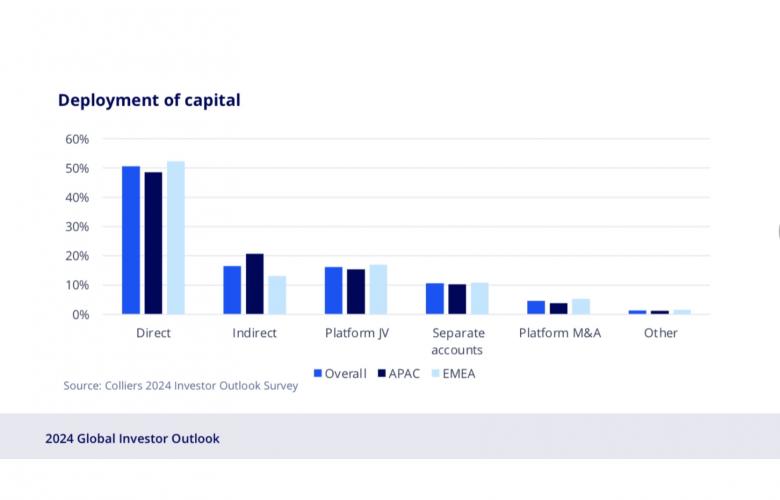

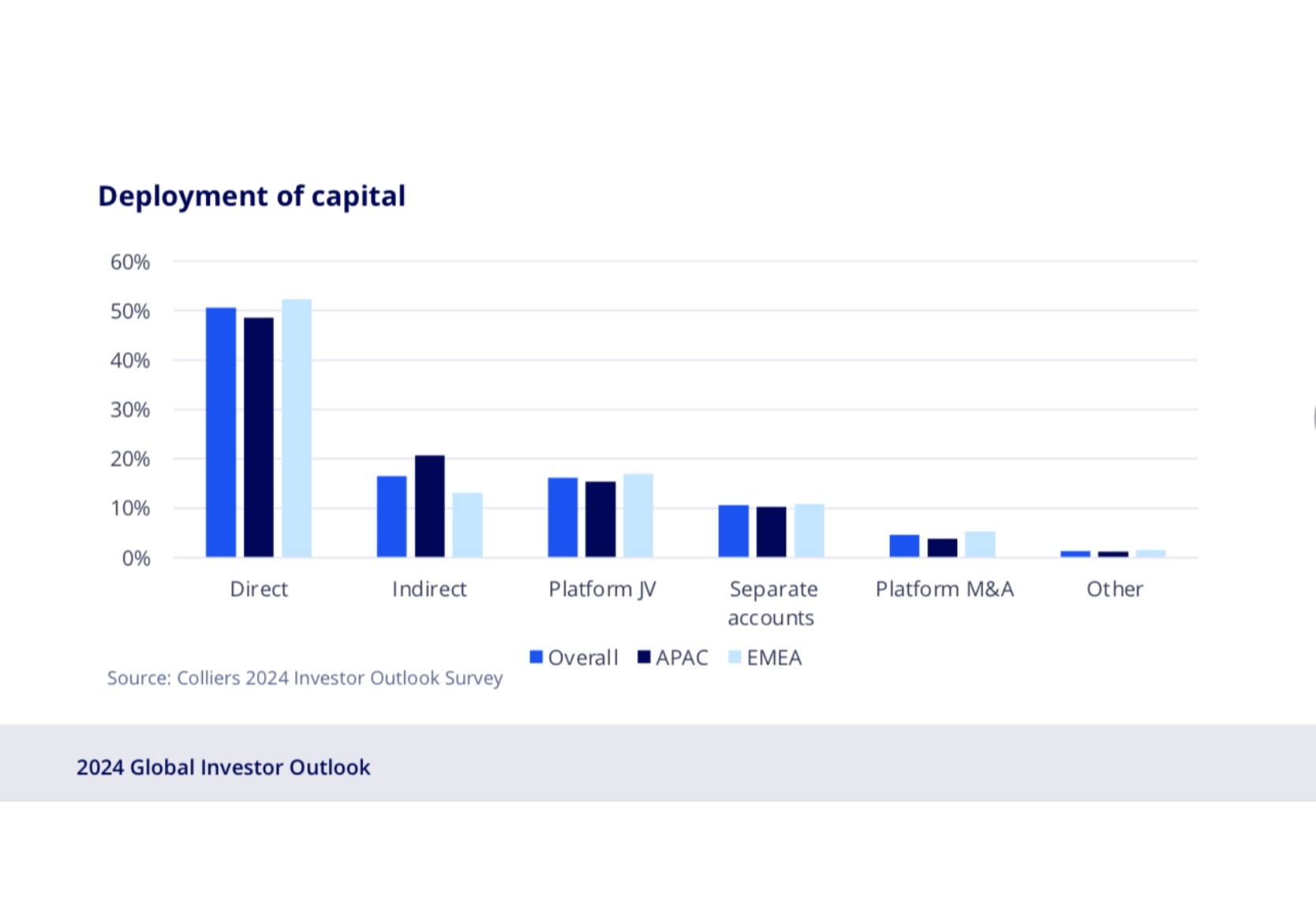

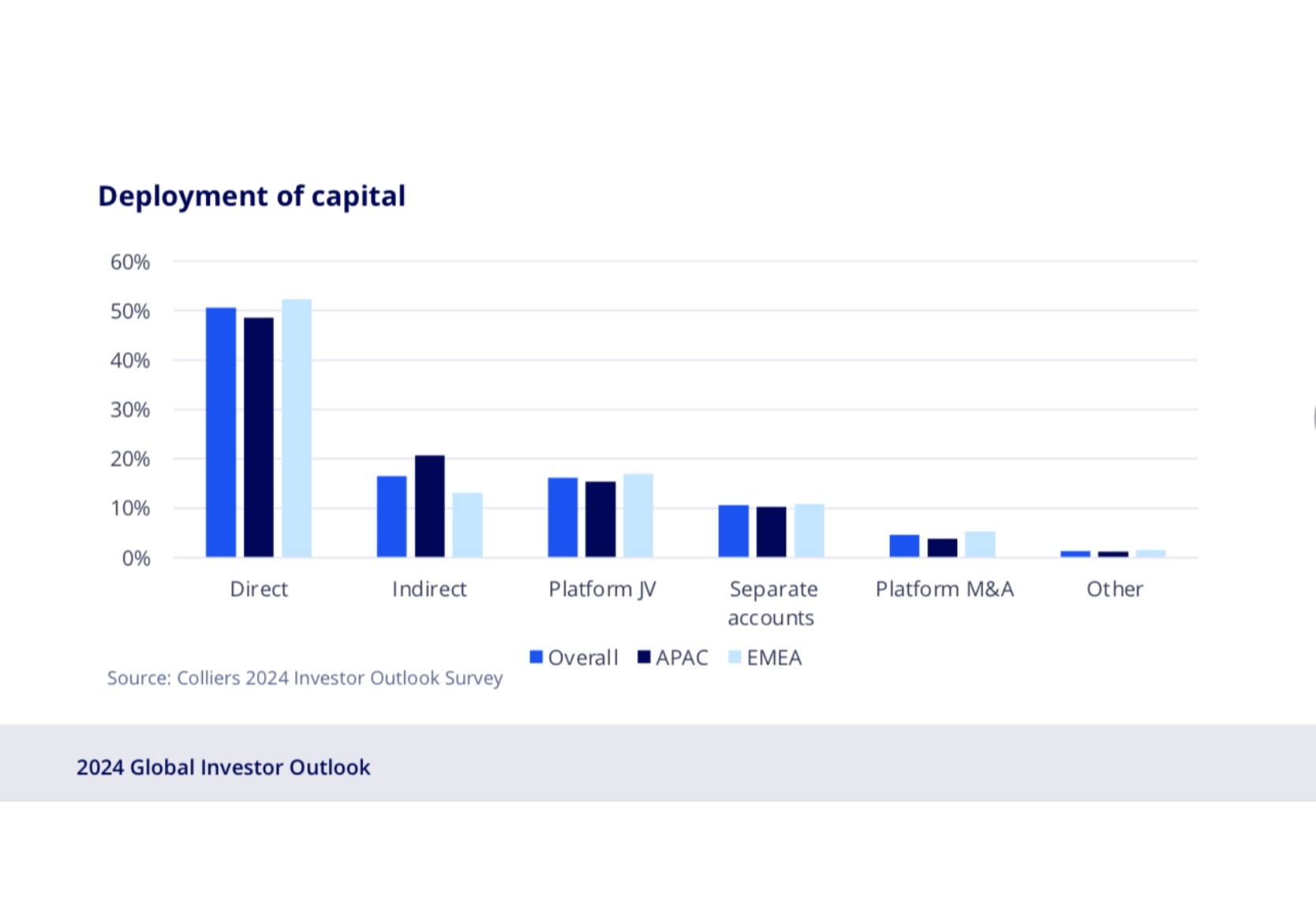

• New alliances and shifting strategies: Around half of APAC investors no longer necessarily deploy capital into real estate in the traditional way, with 21% favouring an indirect approach, 15% exploring platform joint ventures and 10% maintaining separate accounts.

Industrial Australia:

The continued growth of e-commerce and the surge of interest in AI-led platforms mean that demand for data centre space continues unabated across APAC. China has the most tradeable assets, accounting for 37% of historical data centre transaction activity, followed by Japan (16%) and Australia (16%)5. Due to the lack of modern data centres, we expect more global operators to enter the market through development and hold strategies.”

Gavin Bishop Managing Director, Industrial, Australia

New Zealand:

New Zealand continues to attract significant international capital and as inflationary pressure eases we expect direct and indirect investment volumes to increase."

Richard Kirke International Sales Director, Capital Markets, New Zealand

Hotels Australia:

While Luxury resorts are performing strongly amid the resurgence of leisure travel and desire for experiences post pandemic, we expect capital values for the broader Australian hotel market to also remain competitive compared to global peers, as international travel ramps up and revenue defends against economic fluctuations.”

Karen Wales Head of Hotels, Transaction Services, Australia

Japan:

Hotels particularly is expected to be the sector with the highest growth potential, as the weak yen will increase the number of international travellers, as well as international standard pricing being easier to achieve, and operators can easily increase revenues.”

Hisakazu Iso Deputy Managing Director & Head of Capital Markets, Japan

Retail Capital Markets Asia:

We are continuing to see a focus on more experience- based retail throughout Asia Pacific as a key driver for sales and footfall. It has proven to be a key differential in delivering stable performance compared to other markets.”

Lachlan MacGillivray Managing Director, Retail Capital Markets, Asia Pacific

Singapore:

In 2024, we expect buying momentum to pick up in Singapore as investors adjust to an environment of 'higher-for-longer' interest rates, focusing on higher asset performance that delivers more value. This will be necessary to offset the increased interest costs. Good quality and ESG-compliant assets will be strongly preferred, driving strategic investments and a notable increase in transaction volumes from the second quarter onwards.”

Tang Wei Leng Managing Director and Head of Capital Markets & Investment Services, Singapore

Hong Kong:

Hong Kong is expected to be relatively slow in regaining momentum through 2024 on rate-rising cycle. We see cash-rich investors, high net worth individuals and family offices dominating the market and eyeing distressed stock. Delving into sub-assets, high-street retail and en-bloc hotels remain a high priority for investment."

Thomas Chak Co-Head of Capital Markets & Investment Services, Hong Kong

International Capital Asia Pacific:

With most big institutions or funds in the region having increased allocations to real estate, just the sheer quantum of capital they have to deploy means we're likely to see more indirect strategies. In sectors like build-to-rent, the thematic of partnership with best-in-class developers and managers is very much in place. Certainly, a partnership can provide the ability to access a market or product without necessarily the full responsibility of the operational side of it as well.”

John Howald Executive Director & Head of International Capital, Asia Pacific

South Korea:

Despite elevated interest rates, the Korean commercial real estate market continues to expand in both the investment and leasing sectors. Unlike other global cities, struggling with a return to the office, fundamentals in Seoul remain very strong with high demand and vacancies at an all-time low. Rents will continue to rise amid stable demand and rising inflation.”

Sungwook Cho Managing Director & Head of Capital Markets, South Korea

India:

As more established markets start to stabilise, investors are growing more confident about extending their search for opportunities in growth markets. This is particularly apparent in India, which is expected to remain one of the fastest-growing major global economies, led by private consumption and capital formation. The opportunities to invest in India continue to spread across office, logistics, private credit, residential and data centres.”

Piyush Gupta Managing Director Capital Markets & Investment Services, India

Capital Markets Residential Australia:

Given the dynamics of declining affordability, elevated population growth and new supply headwinds across Australia's major cities, interest in the emerging build-to-rent sector has increased from a range of capital sources. Several announced changes to federal and state tax settings are undoubtedly reinforcing the appeal of investment in Australia’s BTR sector.

Both incumbent and new entrant international capital partners, alongside increasing numbers of domestic institutions, are seeking exposure to the low-risk nature of Australia's residential real estate given its undeniable market fundamentals and policy imperatives. Real estate allocations from sophisticated investors are being attracted to the residential thematic via an asset type that is only now becoming available in the Australian market”

Robert Papaleo National Director, Capital Markets Residential, Australia

The APAC region has shown resilience, despite a challenging global environment. This has translated into Investment activity across the region which has accounted for 23% of total global investment volumes YTD 2023, which is 5 percentage points higher than the long-term average of 18%. APAC sales volumes are only down by 30% compared to 2022 levels, whereas global investment activity is down by almost 50%8.

We expect APAC’s commercial property market will continue to uphold its strong position on the global stage over 2024 and contribute to a growing share of global investment activity".

Joanne Henderson National Director, Research, Australia

About the 2024 Global Investor Outlook

The fourth edition of our annual outlook for global property investors synthesizes the views of Colliers Capital Markets experts and the results of a survey of international investors. The findings and opinions featured in the report are shaped by their responses.

Read and download the full report 2024 Global Investor Outlook.

Related Reading:

COMMO

The INDUSTRIALIST

The Hotel Conversation

The ASEAN Developer