Hong Kong commercial real estate market showed mixed trends across sectors in 2023. The year saw a noticeable decline in investment volume, while office and retail leasing showed improved velocity. The market faces challenges for a strong recovery in 2024 as geopolitical and economic uncertainties remain in place, however, Hong Kong’s business environment is expected to improve, according to CBRE Hong Kong’s 2024 Market Outlook.

“The commercial real estate market has experienced a slower-than-expected recovery in 2023. Negative carry deepened, and investment appetite halved, hitting a 15-year low as financing costs reached a 22-year high. Hong Kong’s economy will continue to recover in 2024 as the Chinese economy strengthens while potential interest rate cut will improve investment market momentum. Overall property demand is expected to see moderate growth in 2024,” said Marcos Chan, Executive Director, Head of Research, CBRE Hong Kong.

Review and Commentaries

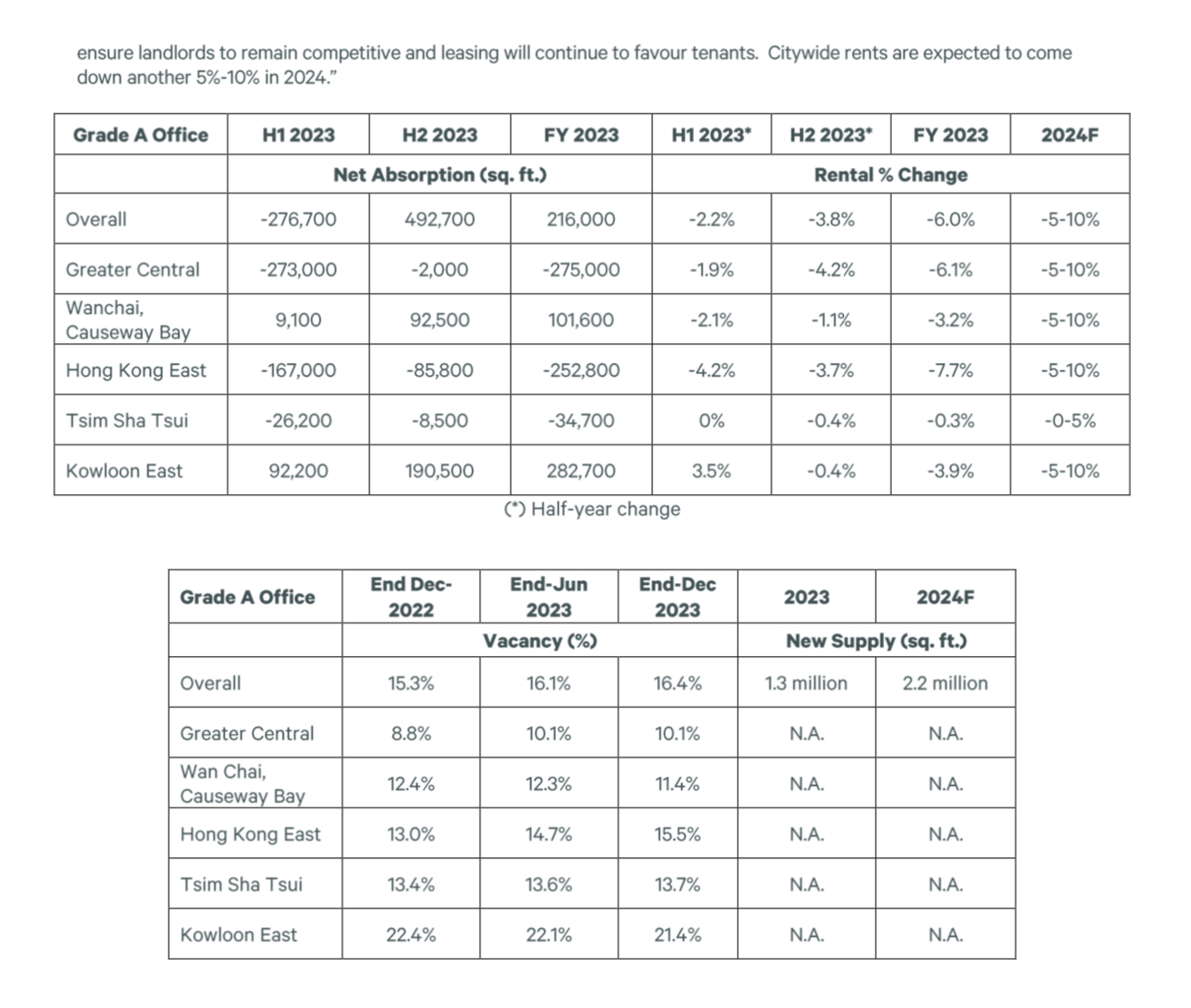

Grade A Office

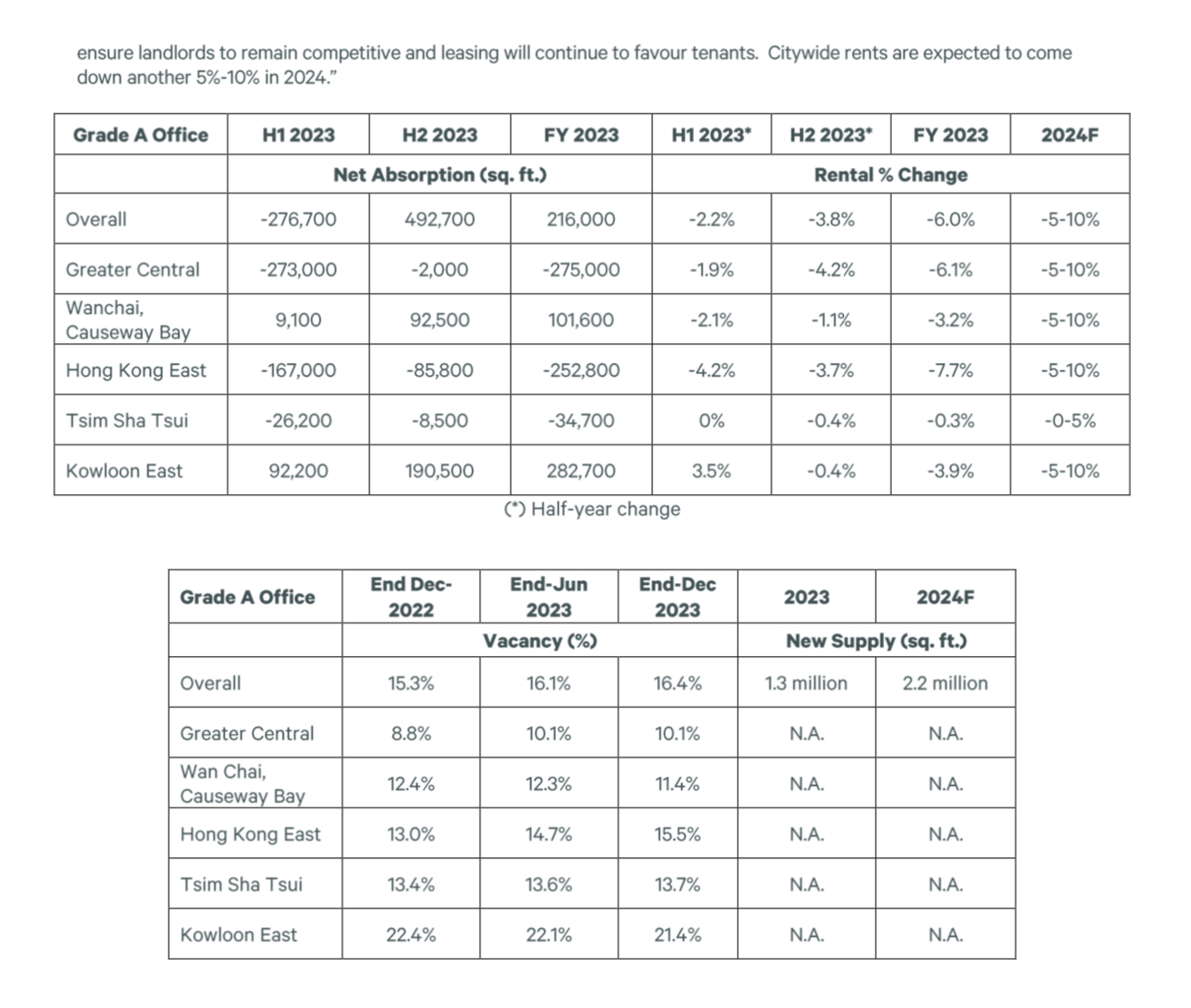

- Office leasing activity was mainly driven by relocation and consolidation demand throughout 2023. Leasing momentum pulled back to its usual seasonally slow momentum in Q4 2023, with gross leasing volume falling by 39% q-o-q to 754,000 sq. ft. This brought full-year leasing volume up to 4 million sq. ft., representing a growth of 8.7% y-o-y.

- Thanks to some forced relocation and upgrading demand from some non-Grade A buildings in Kowloon, full-year net absorption stayed positive for a second consecutive year, reaching 216,000 sq. ft. In Q4, net absorption registered 318,600 sq. ft. as contributed by a series of deals in Kowloon and earlier pre-commitments to the newly completed 83 King Lam Street in Cheung Sha Wan.

- Despite delays to a few new projects, slow pre-leasing activity in the 1.3 million sq. ft. of new supply added in 2023 ensured vacancy reached a record high of 14.3 million sq. ft. by the year’s end. Overall vacancy rose to an all-time high of 16.4%, growing by 1.1-ppt over the 12 months.

- The vacancy overhang led to a 2.3% q-o-q fall in rents in Q4 2023, bringing the full-year decline to 6.0%.

Ada Fung, Executive Director, Head of Advisory & Transaction Services – Office Services, CBRE Hong Kong: “The office market posted moderate growth in new leasing volume with vacancy rising to another all-time high. Although there were some upgrading activities in Kowloon, cost saving was still the main theme for the year. Fully-fitted office space was sought after as relocating tenants sought to minimize CapEx. For 2024, we expect Hong Kong’s financial markets to recover and support a mild growth in office demand. Companies, however, will remain largely cost-sensitive. High vacancy will ensure landlords to remain competitive and leasing will continue to favour tenants. Citywide rents are expected to come down another 5%-10% in 2024.”

(*) Half-year change

Retail

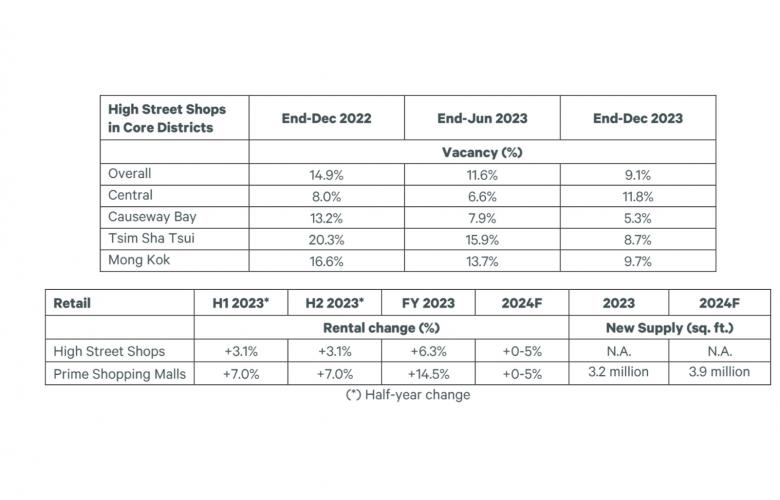

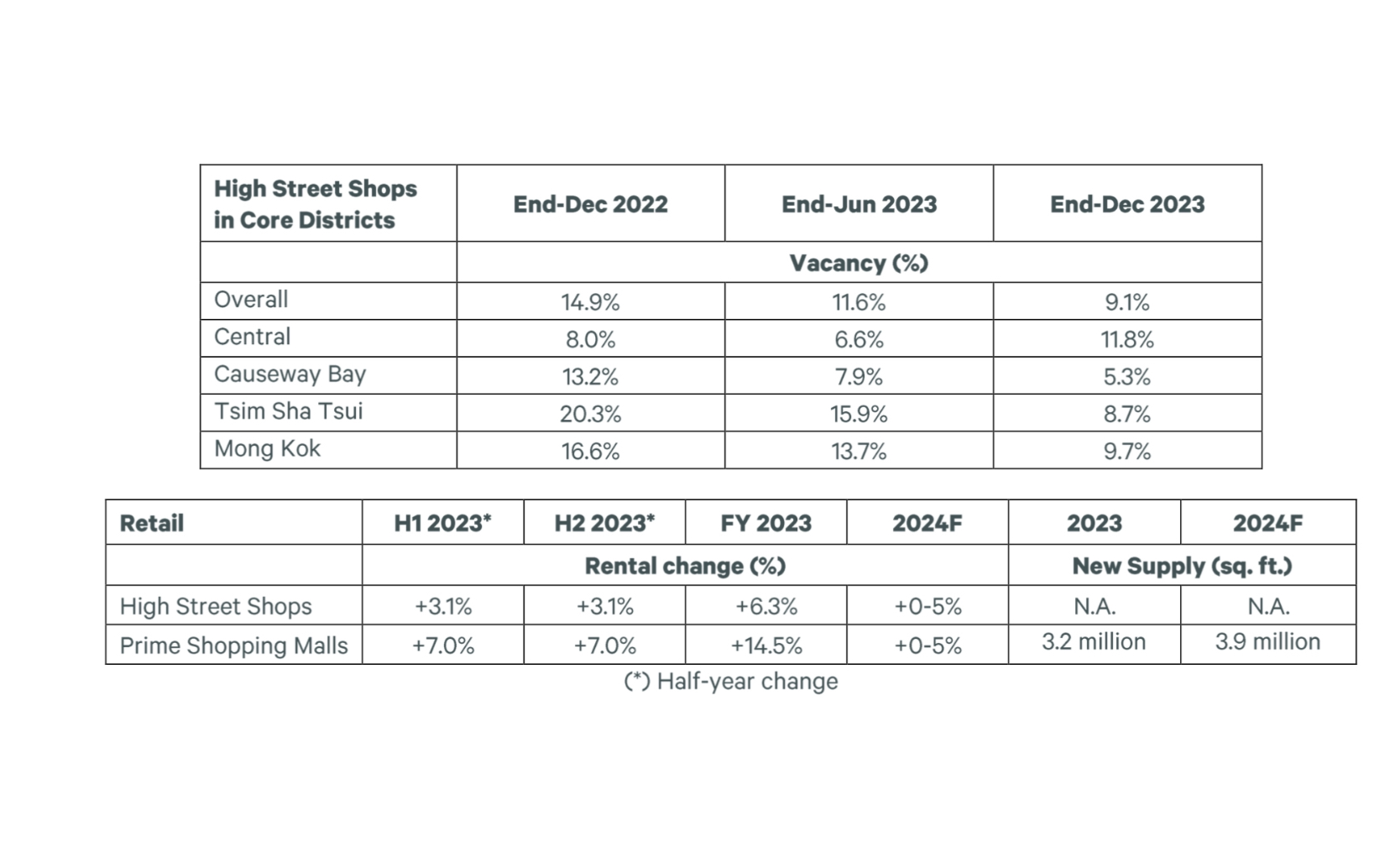

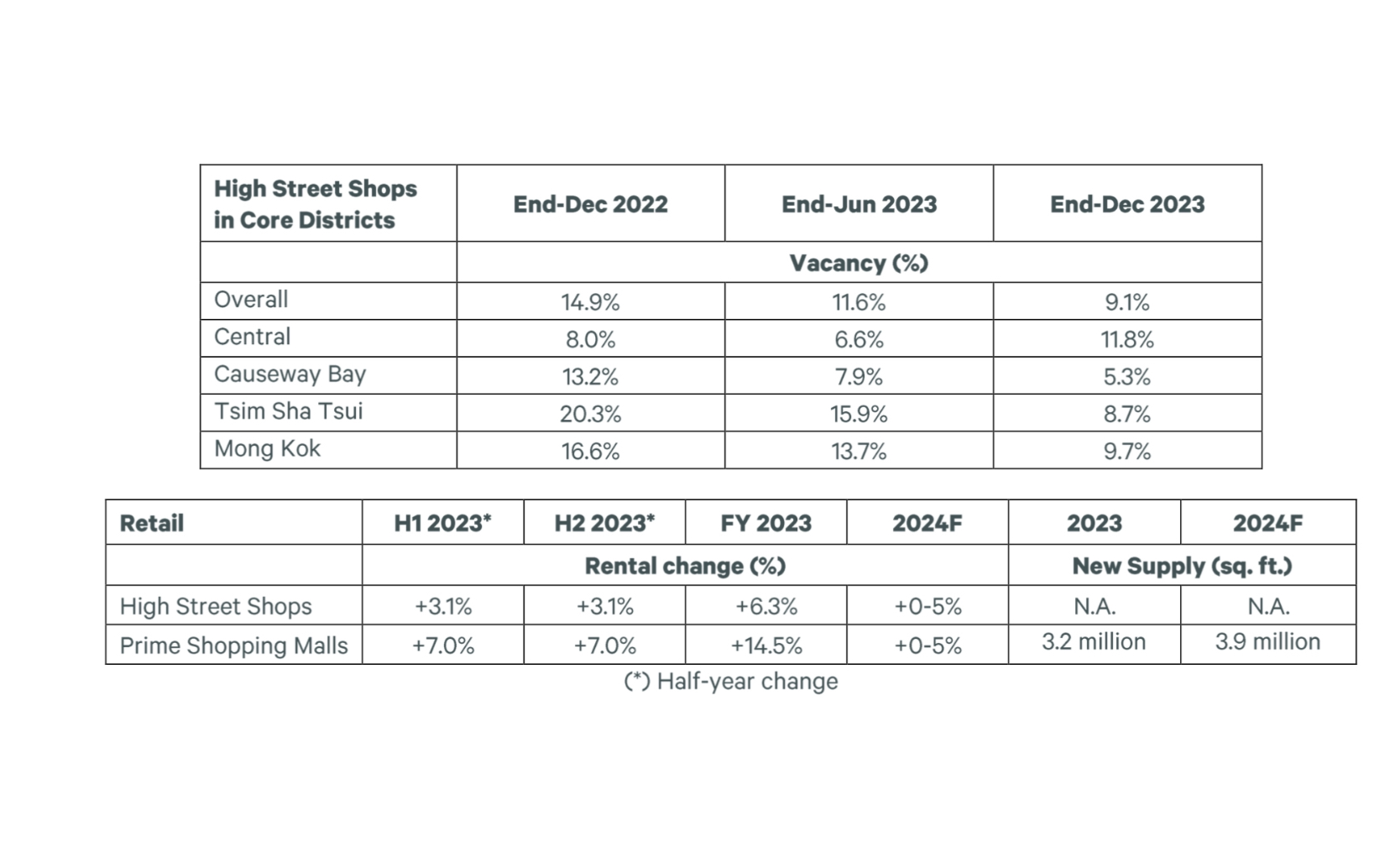

- Retail leasing saw a strong rebound in 2023 despite slower growth in H2 2023. Overall leasing volume registered 1.5 million sq. ft. in 2023, a record high.

- F&B, cosmetics and pharmacies continued to expand on high streets to cater to the growing number of tourists. Luxury labels continued to hold a wait-and-see approach as they observe the change in tourists’ spending patterns.

- Strong leasing demand ensured high-street shop vacancy dropped further to 9.1% in December 2023, the first time it has been in single-digit territory since Q1 2020, much lower than the 14.9% in December 2022.

- High-street rents rose at a slower rate in Q4, increasing by 0.7% q-o-q, the smallest rate of growth since Q4 2022. This brought full-year growth to 6.3% y-o-y.

Lawrence Wan, Senior Director, Head of Advisory & Transaction Services – Retail, CBRE Hong Kong: “The retail leasing market has improved significantly over the year, and even broke a record in new leasing volume of high-street shops. Looking ahead into 2024, recovery of the Chinese economy, anticipated strengthening of the RMB and potential interest rate cuts will lend support to tourist and local consumptions. Attractive rental levels will also encourage retailers to reconfigure their branch networks. Retail leasing is expected to stay healthy. A moderate rental growth in the range of 5% is possible for high street shops in 2024.”

(*) Half-year change

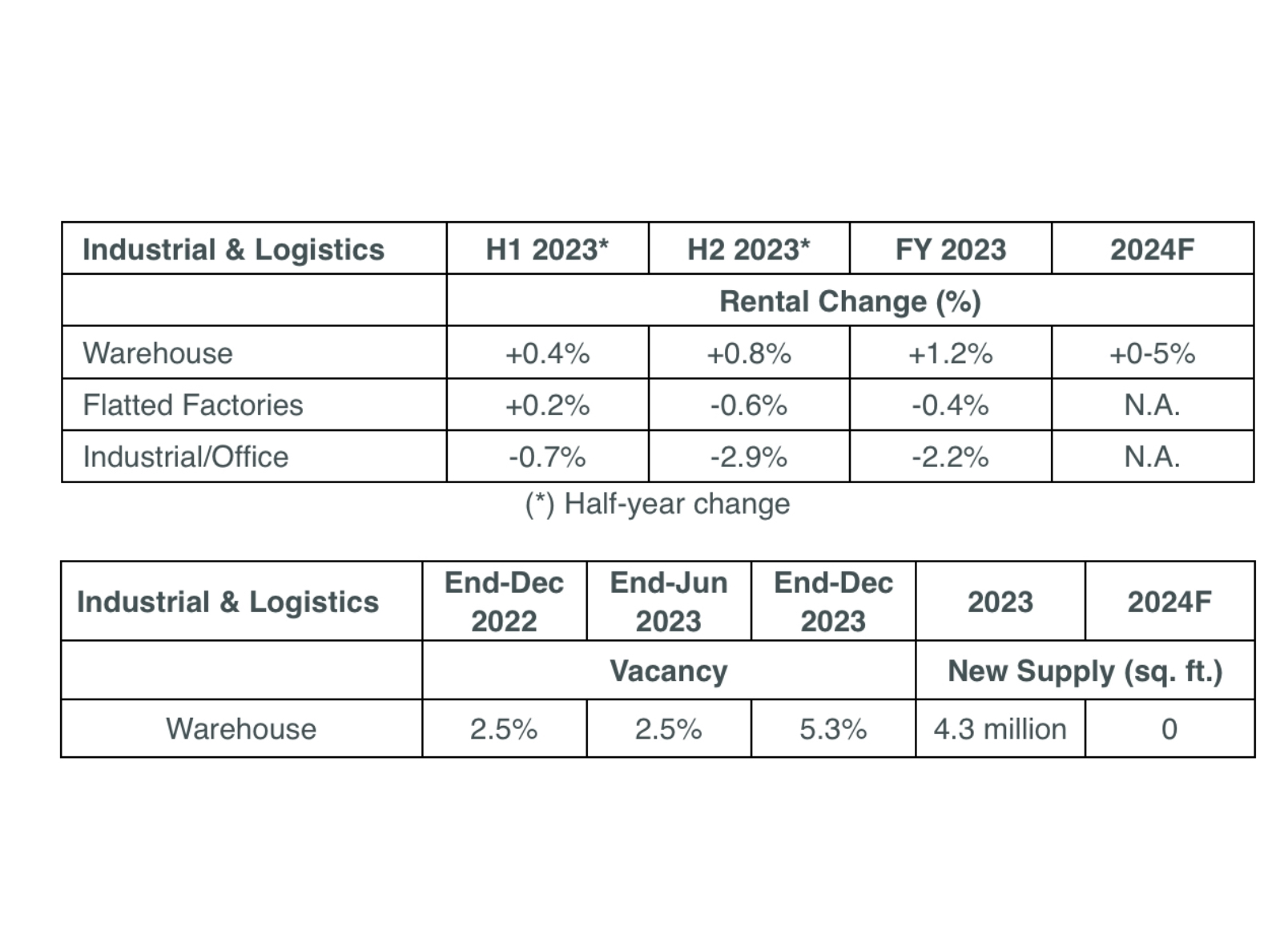

Industrial

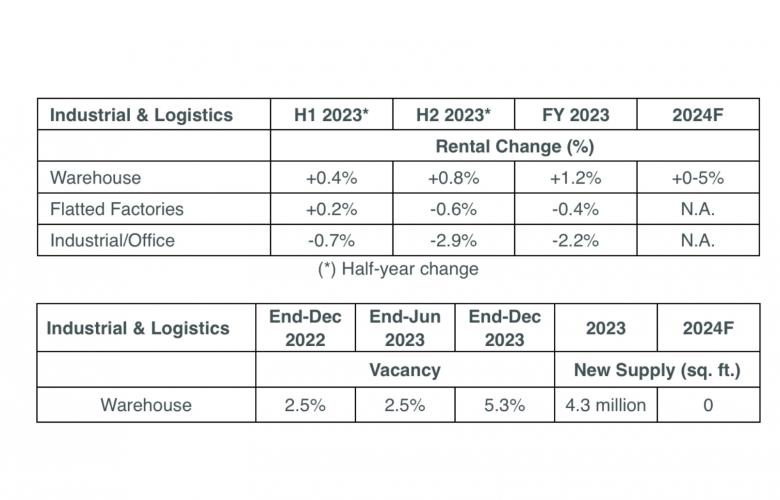

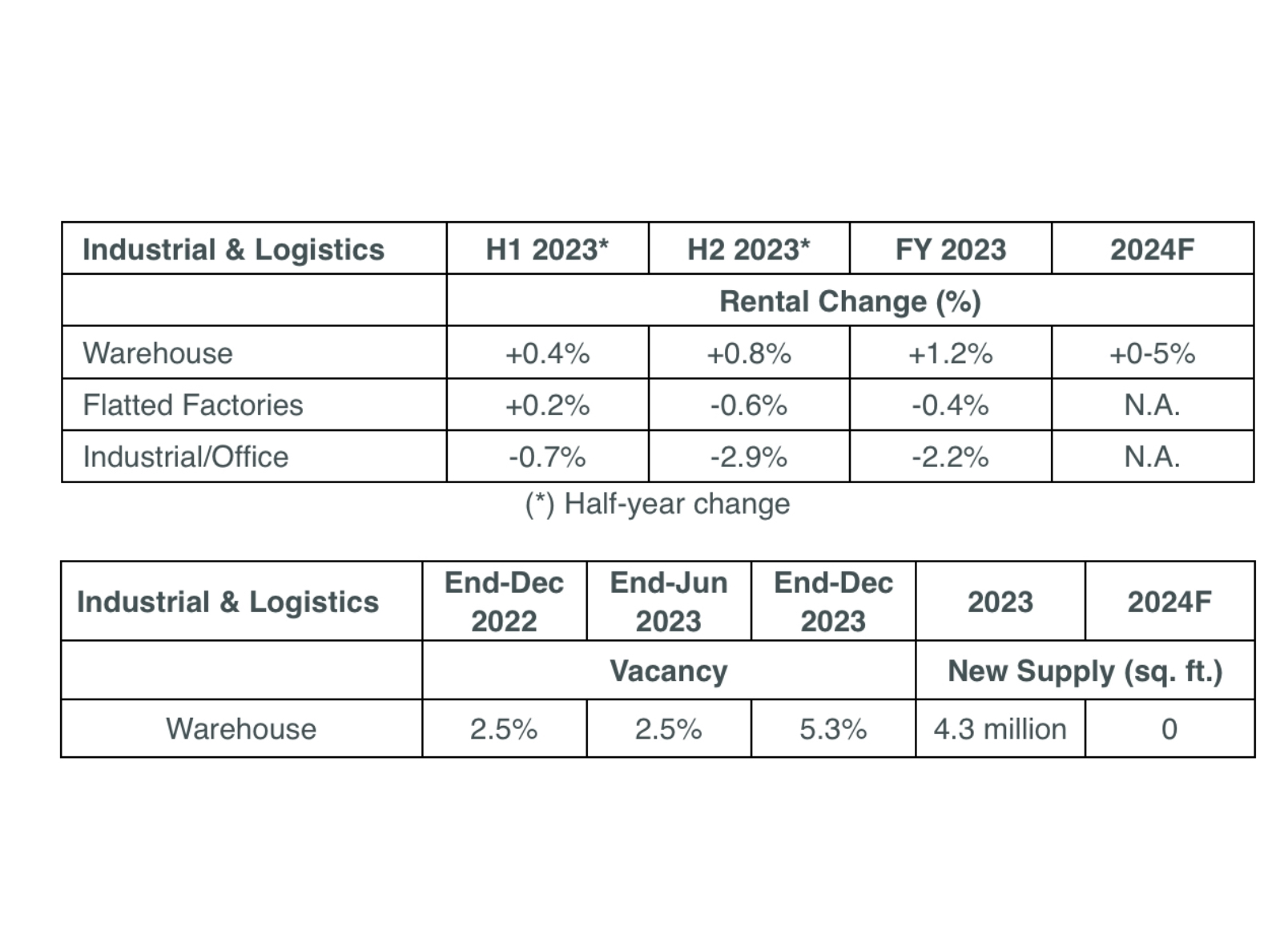

- Industrial leasing sentiment, in general, weakened in 2023 due to weak global trade demand. New leasing volume for the sector fell from 6.3 million sq. ft. in 2022 to 2.9 million sq. ft. in 2023.

- Some emerging sectors were expanding. Electric vehicle dealers and I&T firms were the more active sectors.

- Warehouse vacancy climbed from 2.5% to 5.3% over the year due to the completion of a new project in Chek Lap Kok. Excluding the new supply, vacancy for the rest of the market edged down 0.8-ppt to 1.7%.

- Despite the sour sentiment and new supply, single-digit vacancy supported rental growth of 0.1% q-o-q in Q4 2023, bringing the full-year rental growth to 1.2% y-o-y.

Samuel Lai, Executive Director, Head of Advisory & Transaction Services – Industrial & Logistics, CBRE Hong Kong: “Weak trade flow ensured a subdued leasing environment for industrial properties in 2023. Traditional occupier groups such as 3PLs were slow in leasing, but emerging trades brought some new demand for space. The outlook for 2024 would depend on the pace of recovery of global trade flow. Further strengthening of the Chinese economy will gradually improve Hong Kong’s exports and hence potential demand for logistics space. The return of some expiring space in H1 2024, however, will require landlords to remain flexible. Warehouse rents are expected to edge down within a 5% range in 2024.”

(*) Half-year change

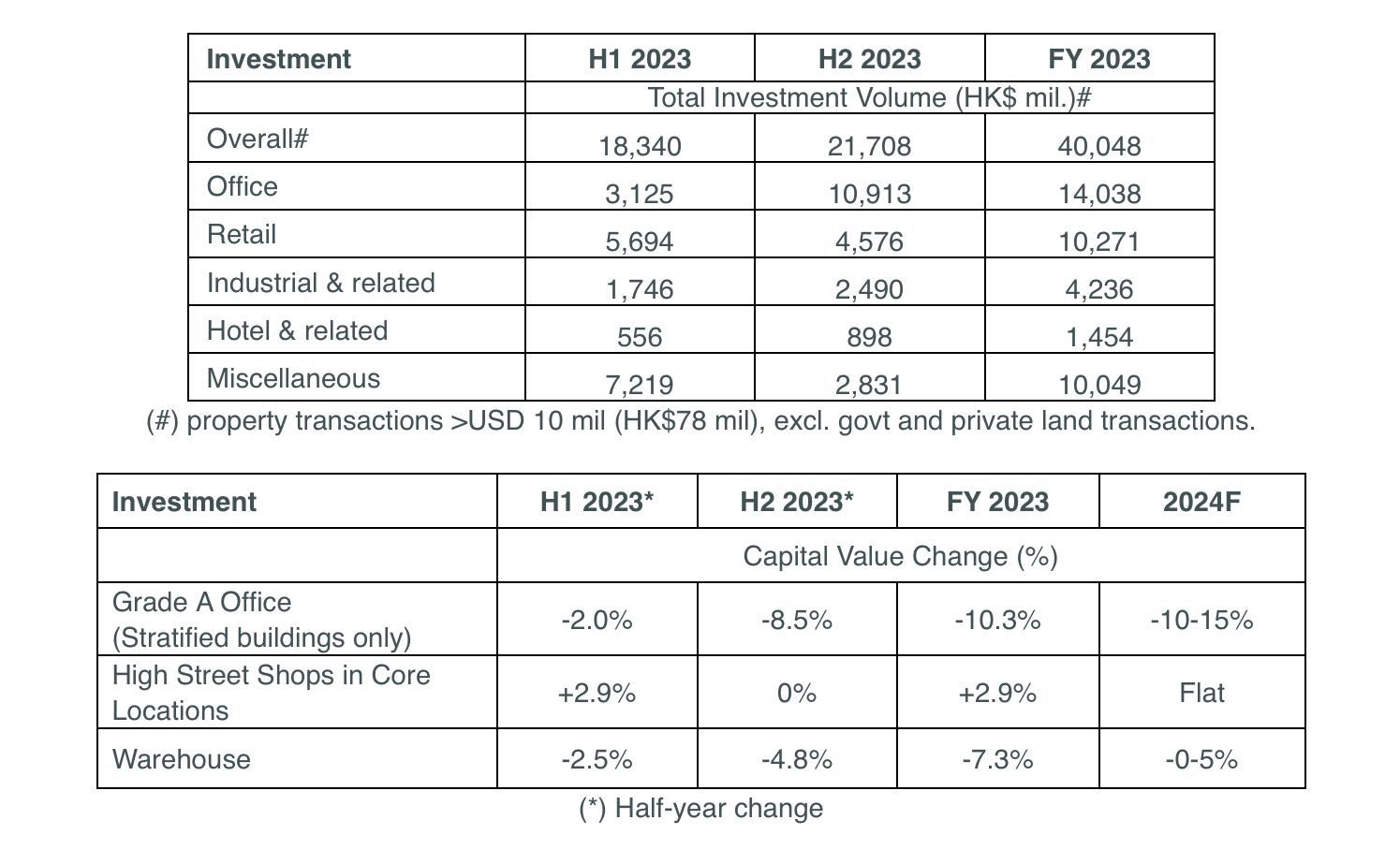

Capital Markets

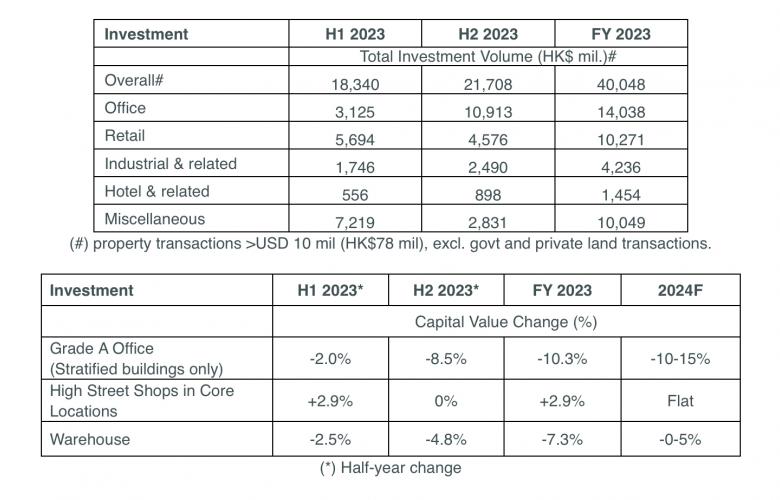

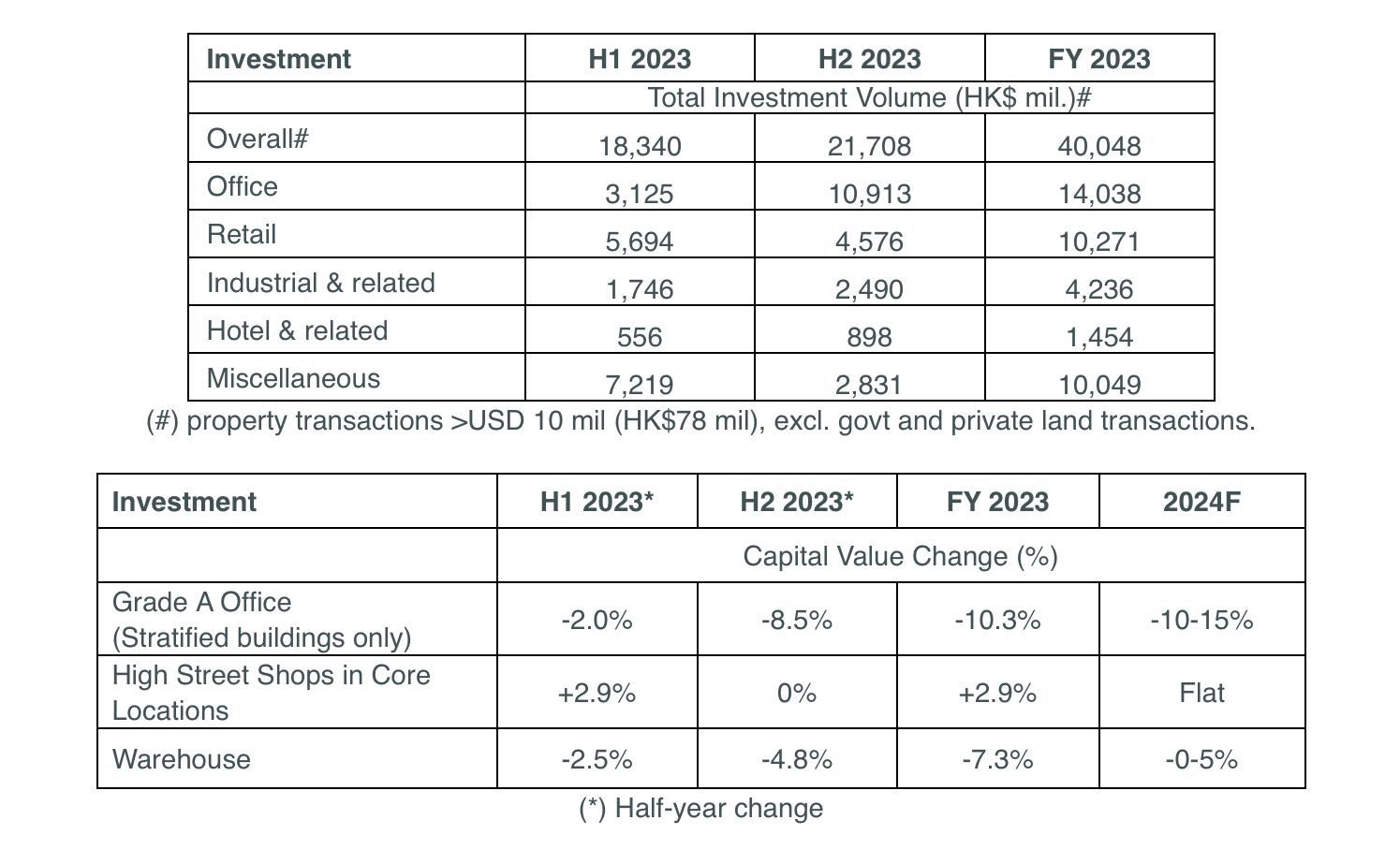

- High financing costs deepened negative carry of investment properties, causing investors to display smaller appetite.

- Commercial real estate investment volume (deals worth over HK$77 million, excluding pure land or related transactions) totaled HK$40.0 billion, just 53% of last year’s total. Only 105 deals were completed during the year, about 60% of that in 2022.

- Despite weak demand from return-driven investors, owner-occupiers displayed resilient demand in the second half of the year. The largest transactions involved the Securities and Futures Commission spending HK$5.4 billion on 12 floors at One Island East in Quarry Bay for self-use. Li-Ning also paid HK$2.2 billion for Harbour East in North Point for use as its regional headquarters.

- The resumption of quarantine-free travel failed to result in a noticeable recovery in Chinese investor demand. Only HK$8.5 billion of transactions involved mainland Chinese investors, down from HK$14.6 billion in 2022.

Jonathan Chau, Executive Director, Head of Investment Property & Private Office, Capital Markets, CBRE Hong Kong: “Deep negative carry, banks’ cautious lending, economic and geopolitical uncertainties as well as weak demand in some local property sectors combined to half investment volume year-on-year in 2023. It has also hit a 15-year low. Looking ahead, anticipated rate cuts will likely improve business and investment market sentiment and result in a recovery in deal flow in 2024. Relatively high levels of financing costs, however, will prevent a v-shape rebound in transaction volume and capital values.”

(#) property transactions >USD 10 mil (HK$78 mil), excl. govt and private land transactions.

(*) Half-year change