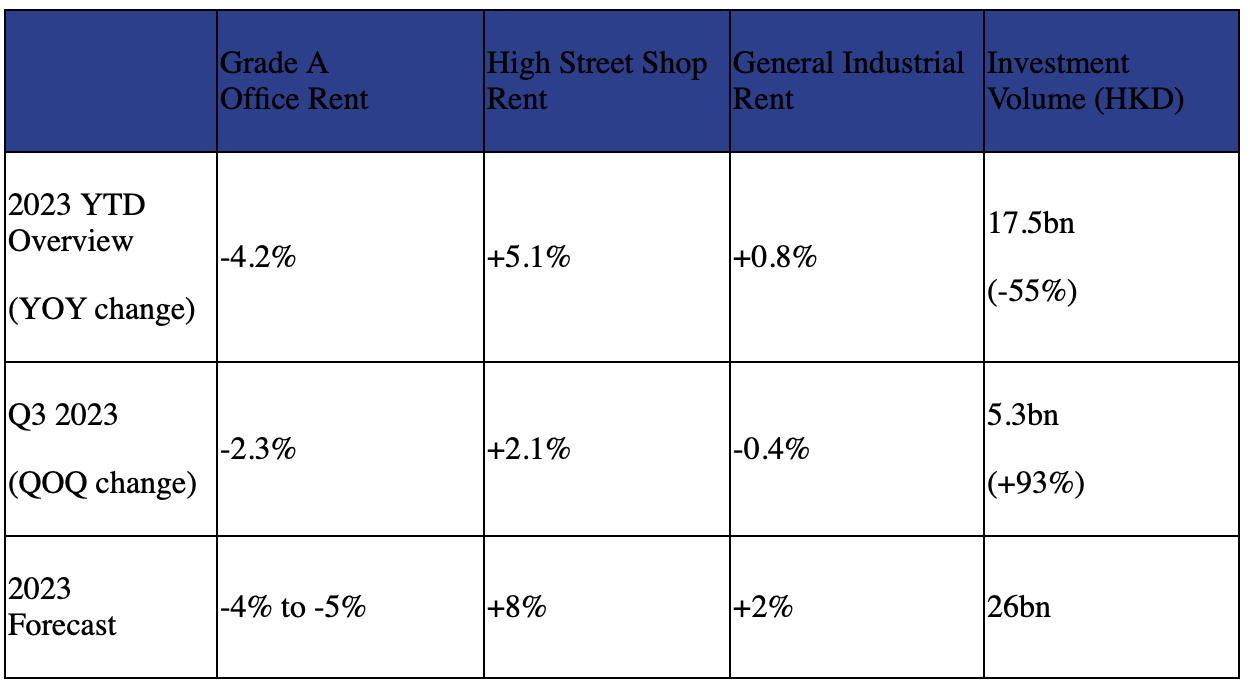

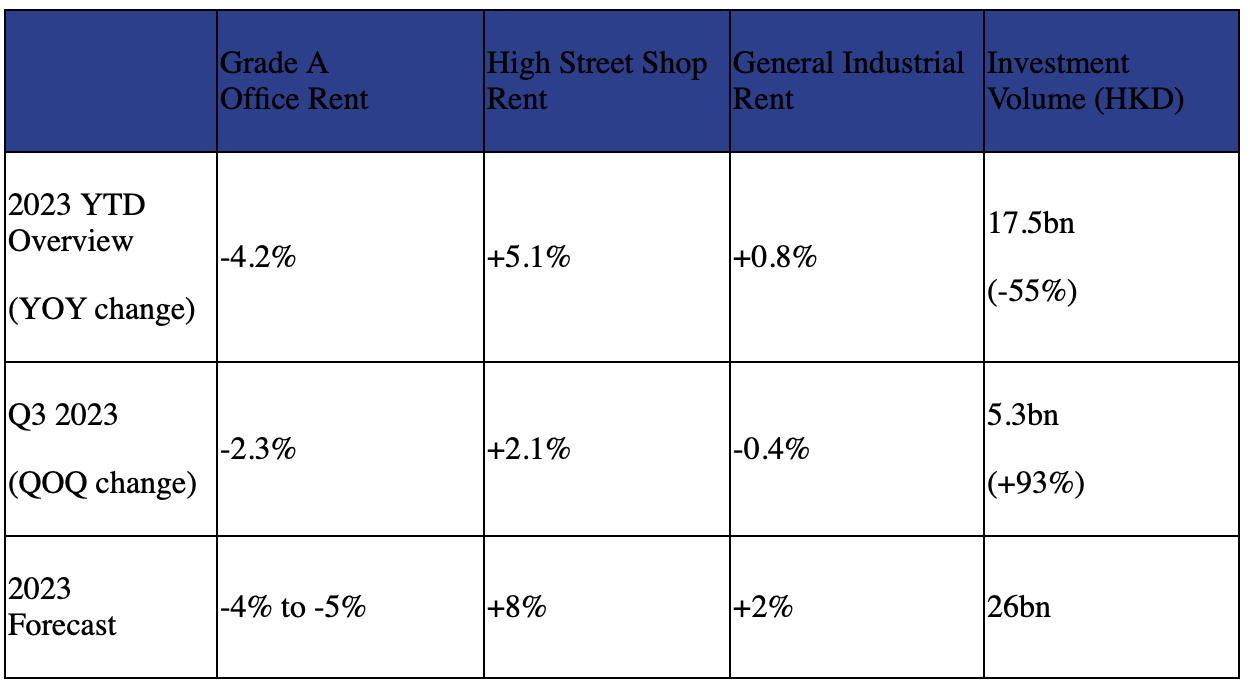

Leading diversified professional services and investment management company Colliers (NASDAQ and TSX: CIGI) has released its quarterly review for Q3 2023. The data indicates that there is mixed sentiment across Hong Kong’s core real estate sectors with retail being the only one to demonstrate resilience with a slight growth in high street shop rents. The real estate market’s overall slow performance can be attributed to prevailing interest rate hikes and ongoing geopolitical tension and how they have continued to weigh on Hong Kong’s economy and property market.

“Against the backdrop of economic and geopolitical uncertainties, the market sentiment was generally subdued, and activity was low. The recent Government retail campaigns have boosted tourism and domestic spending, resulting in a relatively resilient retail market. Yet, office and industrial leasing markets softened amid a slower-than-expected economic recovery. From an investment perspective, the transaction volume remained low due to the high interest rate environment. We anticipate a stronger market revival by H2 2024 and beyond across retail, office and industrial,” said Kathy Lee, Head of Research at Colliers in Hong Kong.

Source: Colliers’ property market summary for Hong Kong in Q3 2023 and forecast for FY 2023.

Office

The Grade A office rental market has observed a drop in rents of 2.3% QOQ to HKD54.1 per sq. ft. amidst a high overall vacancy standing at 14.9% in Q3 2023. Submarkets like Central / Admiralty and Wan Chai / Causeway Bay were subject to the downward trajectory in office rents.

“We foresee an overall drop of 4% to 5% in Grade A office rent in 2023 as vacancy rate is expected to remain high despite some minor fluctuations throughout the year. In line with our findings from the Occupier Survey 2023, there is a mixed approach in space requirements. We see large-scale banks adopting a more cost-conscious space optimisation strategy, whereas there is a notable increase in demand from the Technology, media and telecom (TMT) and insurance sectors.” said Fiona Ngan, Head of Office Services at Colliers Hong Kong.

Retail

The recovery in Hong Kong’s retail market has been more evident with a notable increase in retail sales by 15% YOY in July and August, and high street rents pushed up by 2.1% QOQ in Q3. Key resilient retail trades including F&B, ath-leisure apparel, goldsmiths, and cosmetics & pharmaceuticals have been able to leverage the current rental level to conduct expansion and relocation exercises to tier-one locations.

“High street rents are forecasted to grow by 8% YOY in 2023, though retailers remain cautious on short-term expansion plans. We foresee a more distinguished market recovery from H2 2024 and beyond, with a focus on retail experiences and a greater diversity of brands,” said Cynthia Ng, Head of Retail Services at Colliers in Hong Kong.

Industrial

Total export volume recorded a yearly decline of 13.2% with total imports dropping 11% annually for first eight months of the year, resulting in a slight drop in both general industrial and warehouse rents to HKD14.6 per sq. ft. and HKD14.8 per sq. ft., respectively.

“We have seen industrial tenants remain very cautious in their market outlook and we expect this to translate into a weaker leasing demand in the coming quarters. Lease renewals and relocations from existing portfolios are both contributing to the upward trend and the growing vacancy rate of 3.2% in Q3. Our full year general industrial rental forecast remains at 2% growth, while warehouse rents will experience a slight decline of 3% to 4% in 2023,” said Bill Chan, Head of Industrial Services at Colliers in Hong Kong.

Investment

Despite a growth of 93% QOQ from Q2’s extremely low base, the investment volume of HKD5.3 billion in Q3 was still the third lowest single quarter since Q4 2013. Street shops and strata-title offices were most sough-after by end-users and bottom-fishers with a few distressed deals recorded in Q3.

“The investment market will be further hampered by the sluggish economy and interest rate hike. This means we have further adjusted our transaction volume forecast to HKD26 billion with distressed sales and the hotel sector being the only bright spots for now. To stimulate activity, we’d like to see the Government take action and lift the real estate cooling measures to help enterprises”, said Thomas Chak, Co-head of Capital Markets & Investment Services at Colliers in Hong Kong.