Asia Pacific region leads top sources of global capital in H1 2023: Colliers

Contact

Asia Pacific region leads top sources of global capital in H1 2023: Colliers

Singapore, Hong Kong, Japan dominate list of top five sources of global capital.

The Asia Pacific region remains the dominant source of global capital this year, with Singapore, Hong Kong and Japan among the top five biggest global deployers of capital so far in 2023.

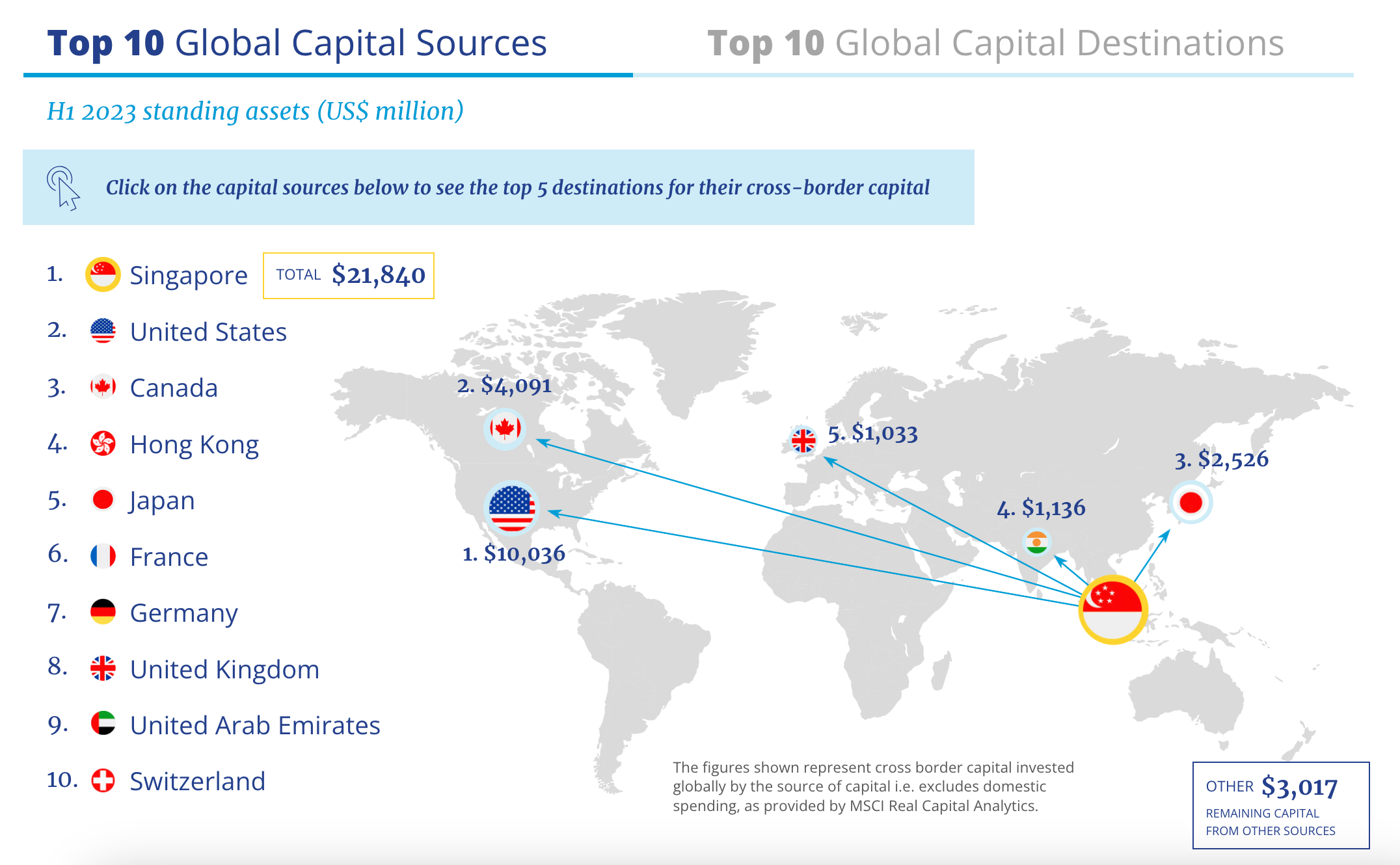

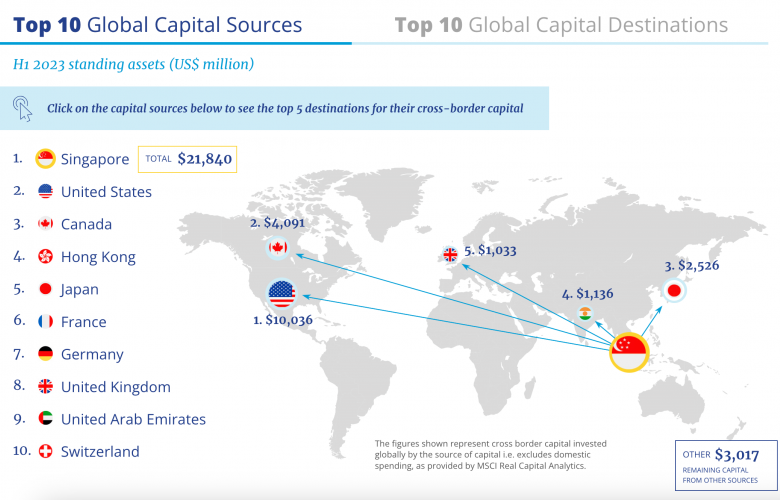

According to Colliers new Global Capital Markets: Insights & Outlook – Global Capital Flows report, Singapore tops the list of biggest global spender so far in 2023 followed by the US.

The Lion City, with cross border capital investments worth USD 21, 840 million in H12023, now represents around a quarter of the total investments and is three times bigger as a spender this year versus Canada in the third position.

Hong Kong and Japan stood out as the fourth and fifth largest source of cross-border capital, spending USD 6,508 million and USD 5,151 million respectively in the first half of this year.

Chris Pilgrim, Managing Director, Global Capital Markets, Asia Pacific at Colliers, said momentum was primarily being dominated by large institutions out of Singapore and Japan, as well as an increase in activity from the Australian superannuation funds.

“In H1 2023, we have seen significant capital being deployed outside the APAC region,” Mr Pilgrim said. “Globally, the US remains ultimately the most liquid market, which has attracted meaningful capital from the APAC region. The UK has also benefited from Asia Pacific capital, partly driven by the fast re-valuations of that market in comparison to parts of Europe and Asia Pacific.

“APAC real estate investors are equity rich, and those who are nimble and flexible have been able to diversify their strategies, targeting growth sectors and geographies within real estate asset classes such as healthcare, senior living and student housing.

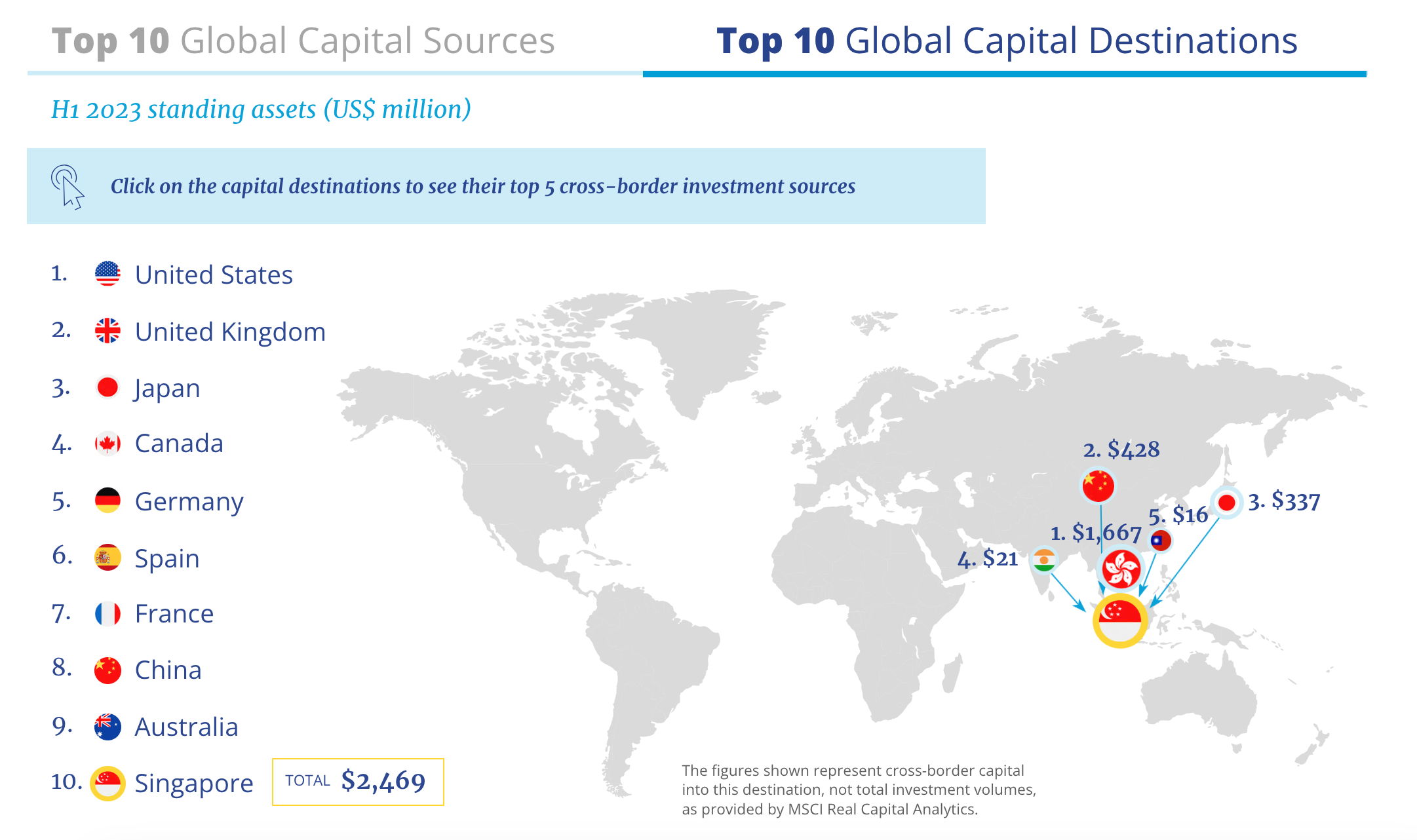

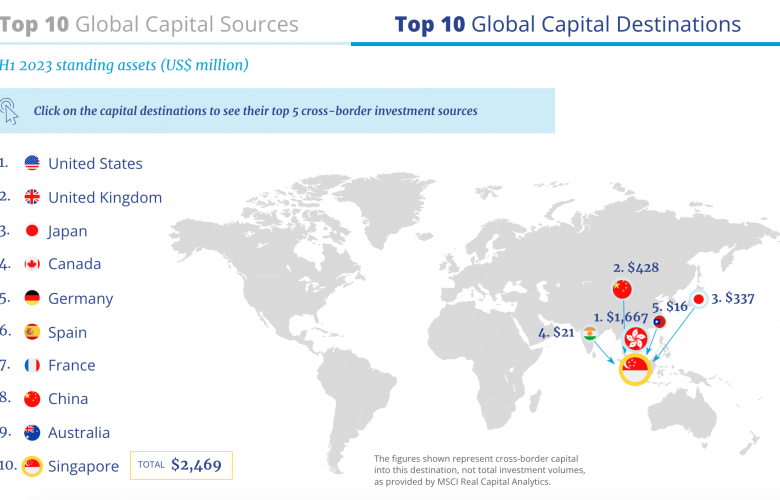

“While APAC investors in general remain active, both in terms of inbound and outbound capital, global investors, drawn to the depth of the market, also see potential for growth in the APAC region with an increased number of funds from North America and Europe domiciling in Singapore for regional strategies.”

The APAC region came out equally strong as an investment destination. Japan, China, Australia and Singapore are among the top 10 investment destination globally to date in 2023 with healthy investment growth seen across each of these markets.

“APAC has expanded its influence as a global capital source, reflected by the prominence of Singapore, Hong Kong and Japan in the global top five,” Mr Pilgrim said. “Singapore tops the charts as the biggest global spender so far in 2023, with cross border capital now representing 24.9% of total investment – up from 8.9% from 2018-2022. Singapore has spent most of its cross border capital on real estate within its own region.”

“Despite subdued economic growth outlook globally, the Asia Pacific region is currently projected to increase this year to 4.6%, up from 3.8% in 2022,” Mr Pilgrim said. “This means that the region is currently estimated to contribute close to 70% of global economic growth for 2023.

“Given this, we are positive that the Asia Pacific markets will continue to outperform, whilst capital from the region will continue to be the dominant capital source in the global real estate markets.”

To find out more, read the full report HERE.