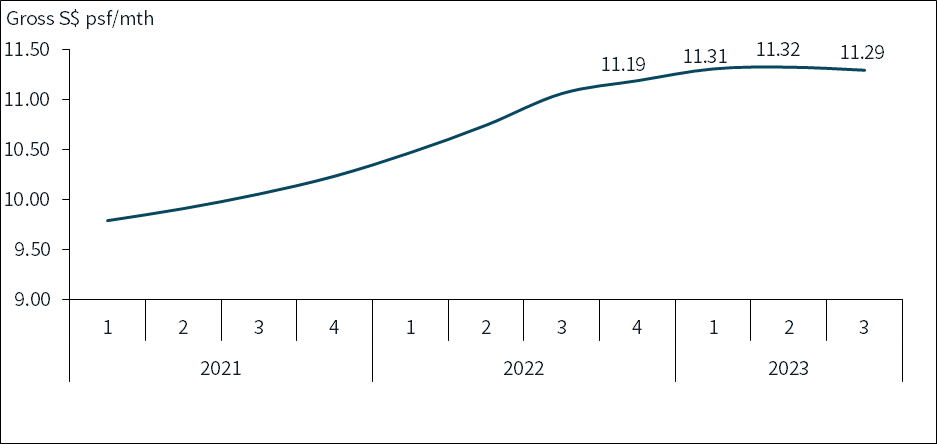

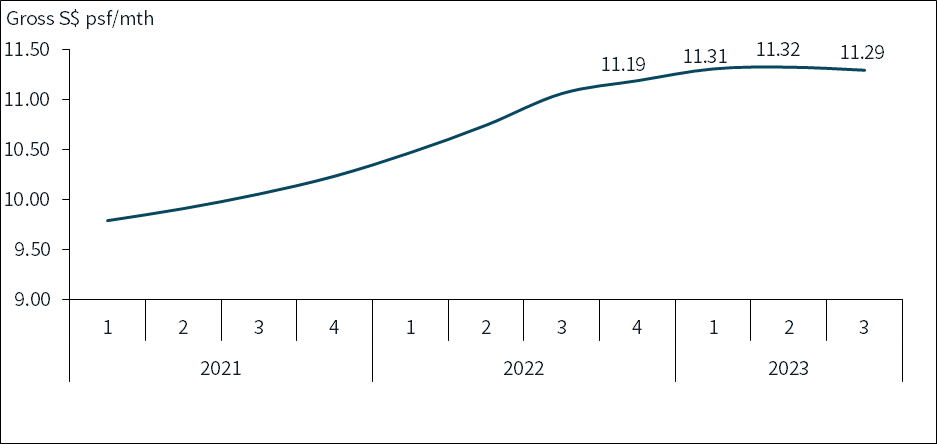

Singapore office rents posted its first quarterly decline in the third quarter of 2023, influenced by ongoing economic pressures. The decline ended nine consecutive quarters of growth in Singapore spurred by the return-to-office wave following the relaxation of COVID-19 workplace restrictions, according to research by JLL (NYSE: JLL).

The global real estate consultancy’s research showed that the gross effective rent for central business district (CBD) Grade A office space fell 0.3% quarter-on-quarter to an average of SGD11.29 per sq ft per month in 3Q23, from SGD11.32 per sq ft in 2Q23.

Monthly Gross Effective Rents for Grade A CBD Office Space

Source : JLL Research

Mr Andrew Tangye, Head of Office Leasing and Advisory for JLL Singapore, says, “The uncertain near-term outlook stemming from a combination of slowing economic growth, geopolitical tensions and rising prices have continued to keep occupiers wary and cost-conscious, resulting in weaker take-up of office space. At the same time, office stock is being returned to the market at an increasing pace as more occupiers opt to right-size upon lease renewal to manage costs.”

Mr Tangye continues, “Leasing activity from small-to-medium space users is holding up better than from large space users. To bolster occupancy, landlords are taking proactive steps such as sub-dividing larger spaces into leasable units, providing fit-out incentives, and adjusting their rental expectations to meet the market.

Ms Tay Huey Ying, Head of Research and Consultancy for JLL Singapore, adds, “The combination of subdued demand and rising supply led to an office rent correction that became more widespread in 3Q23. Our analysis shows that more than 15 assets commanded lower rents in 3Q23 than in 2Q23, which dragged down the average rents for CBD Grade A space for the first time since they turned around in 2Q21.”

Ms Tay continues, “The short-term outlook for the office leasing market is weak if the macro environment remains turbulent and the geopolitical situation stays tense. This will weigh on Singapore’s economic growth, forcing office occupiers to apply a tentative mindset towards their real estate strategy. Against the backdrop of an influx of upcoming projects competing for a limited pool of tenants, the short-term oversupply of office space could become more pronounced. Downward pressure on rents is set to intensify and we could see rents correcting further in the coming quarters.”

Three office projects are scheduled for completion in the CBD over the next 24 months -IOI Central Boulevard Towers (1.3 million sq ft) and Keppel South Central (0.6 million sq ft) in 2024, and the redeveloped Shaw Tower (0.4 million sq ft) in early 2025. Marketing activities for these projects are ongoing, but to-date, more than 1.5 million sq ft are estimated to have remained uncommitted.

Despite the short-term challenges, the medium-term outlook for Singapore’s office leasing market for Grade A space in the CBD remains bright. Demand will be underpinned by Singapore’s flourishing reputation as a global/regional business hub. On the other hand, supply of office space in the CBD will remain constrained by the lack of greenfield sites and the planning authority’s drive to curate a dynamic 24/7 downtown by lightening the dominance of offices and injecting more live and play spaces.