The Summary Highlight of Q2 2023

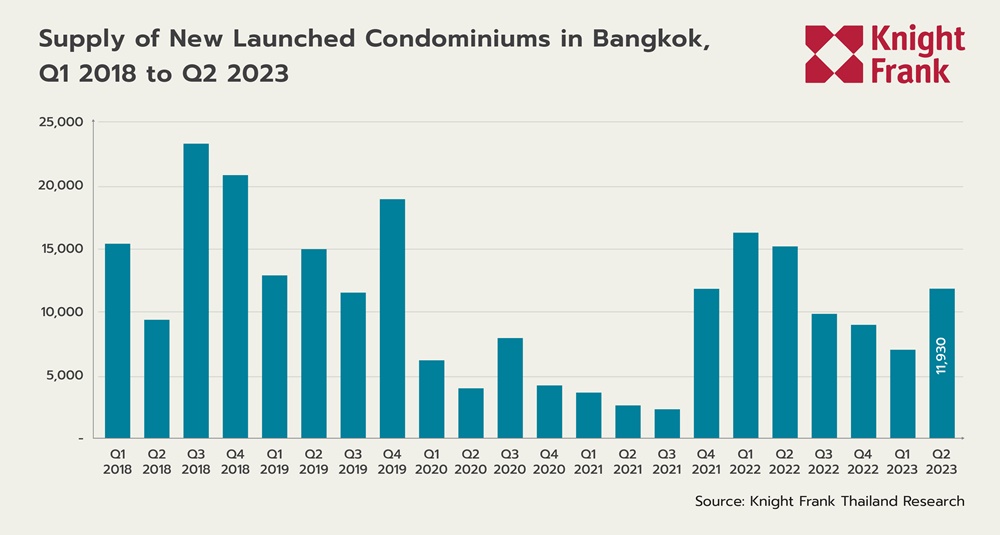

- The number of new supply launched for sale increased by 40.1% from the previous quarter and outpaced demand.

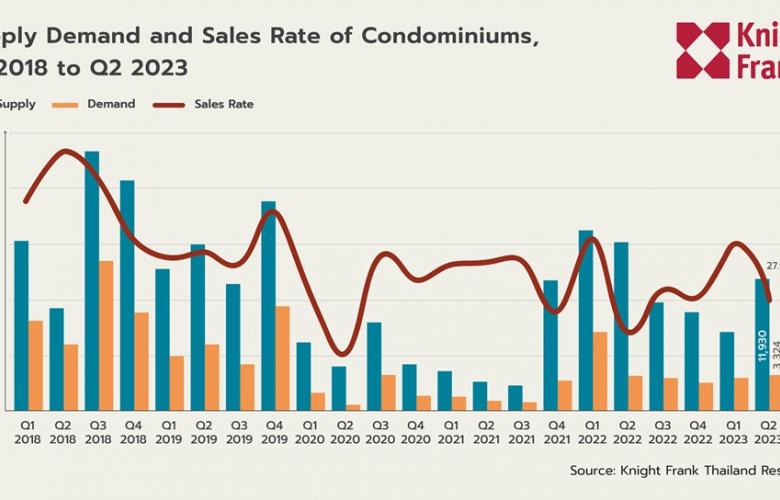

- The total number of new units sold in Q2 2023 amounted to 3,324 units. The sales rate was 27.9% of total supply in this quarter.

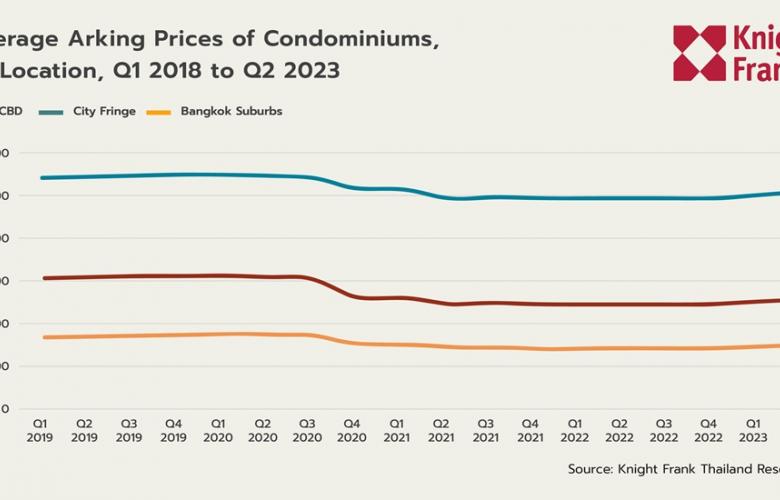

- The average selling price across all areas experienced an increase of 2.2%.

- The market’s main problem is the low-end buyer segment, which has great demand yethas a high loan rejection rate, while the middle segment has less demand but has no problem with rejected loans.

Market Overview

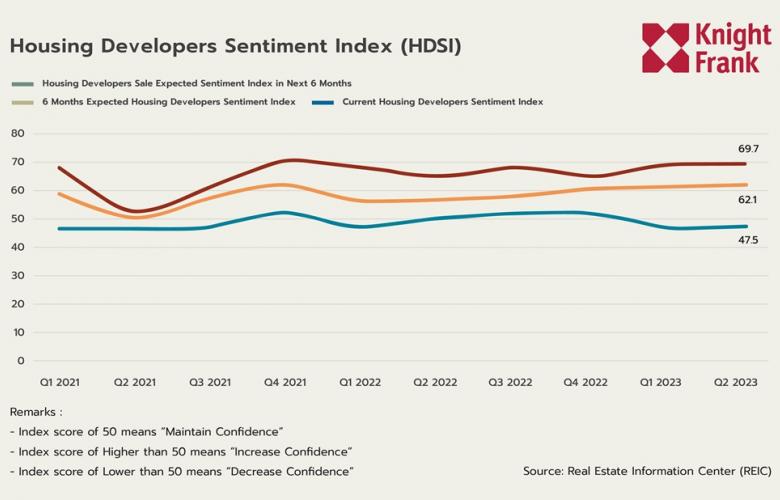

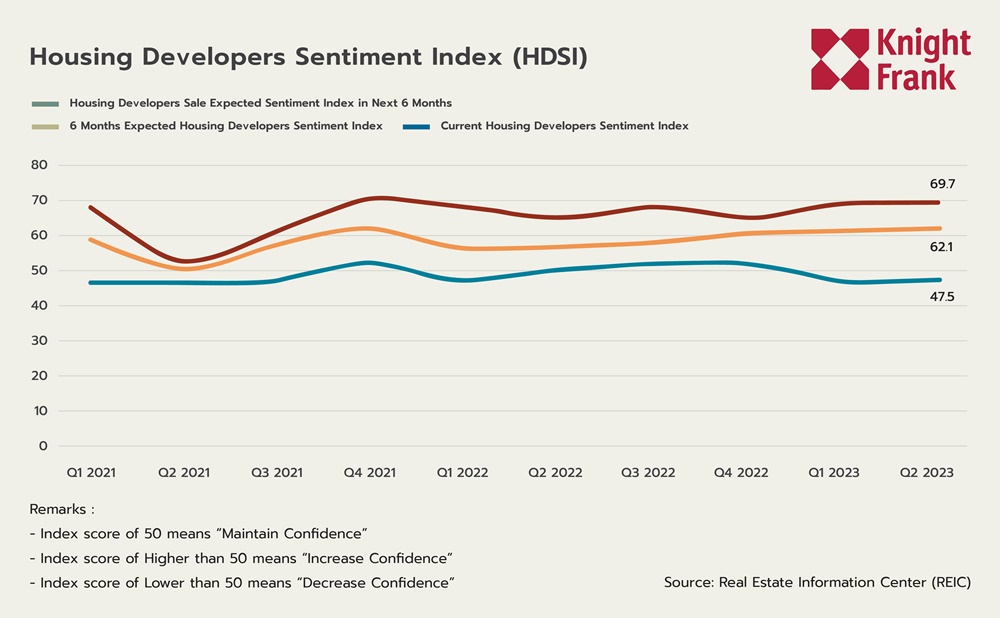

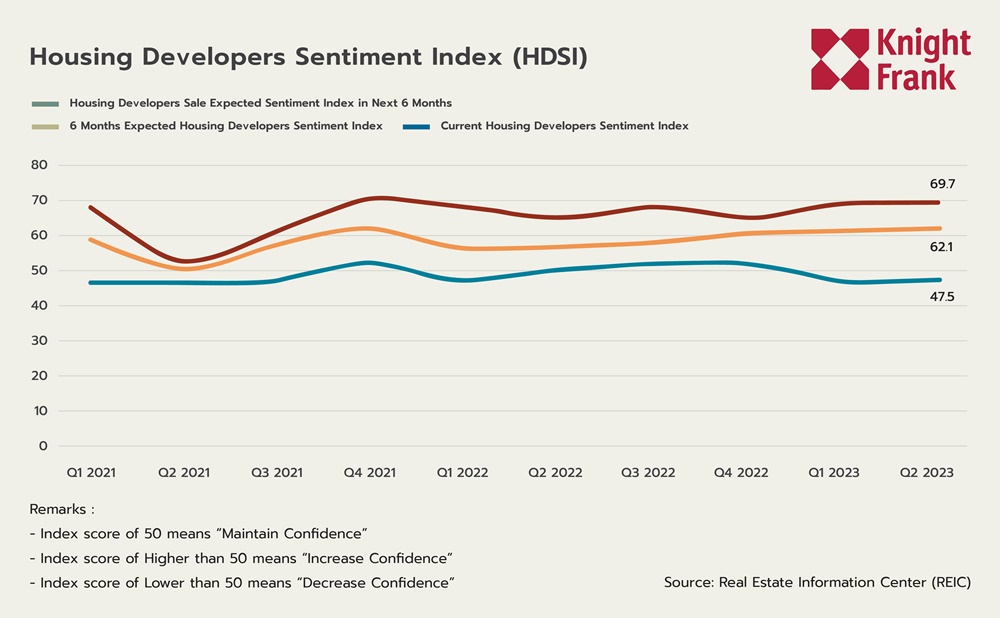

The condominium market in the second quarter remained stable. New supply was added continuously, but when compared to the slowly returning purchasing power, resulting in demand recovery not keeping up with supply, as reflected by the number of accumulated units remaining for sale of low-priced projects continued to increase. As this group of buyers belongs to the middle-income category with limited financial liquidity, their loan applications are more likely to face rejection compared to buyers from other groups. However, business operators are still launching new projects into the market, which is in line with the Confidence Index which increased by 0.8% from the previous quarter. The sales expectation index for the next 6 months tends to adjust as business operators hope that the fully opened country and the steadily expanding tourism sector will positively affect existing supply and new ones, especially from foreigners rather than Thai buyers whom purchasing power are still weak.

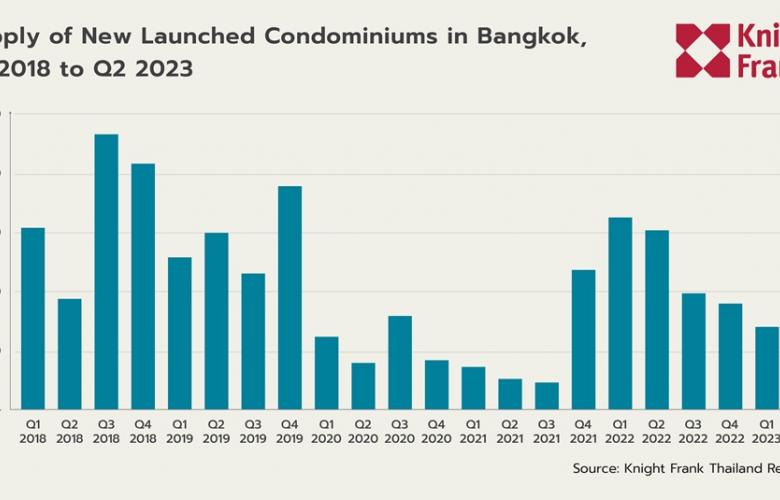

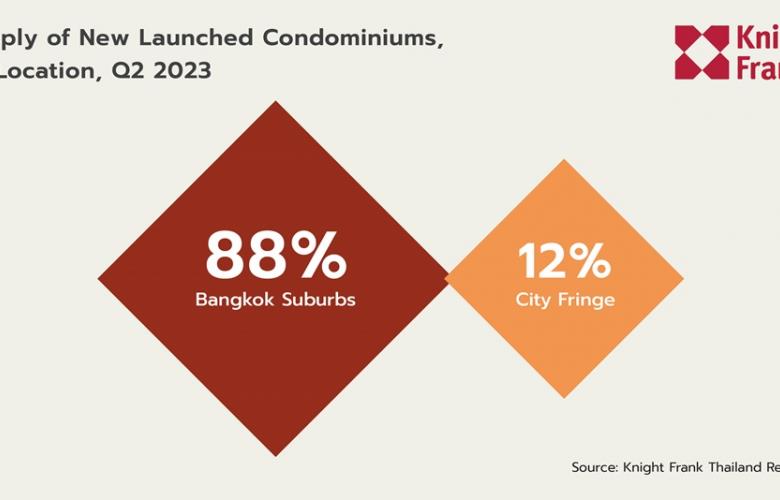

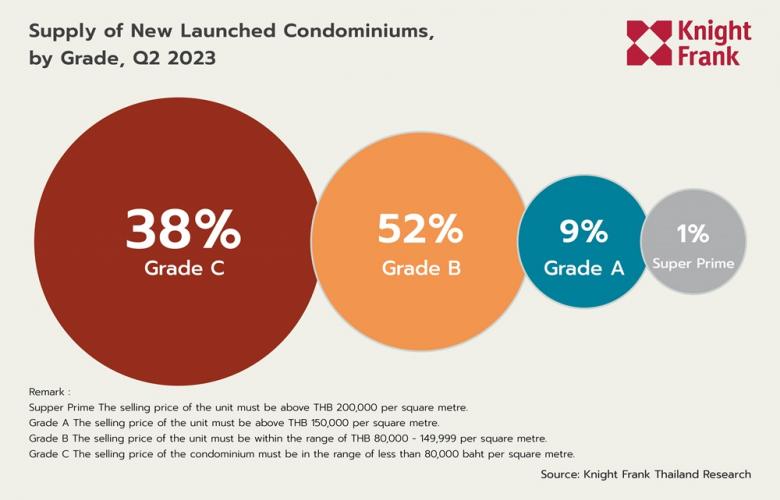

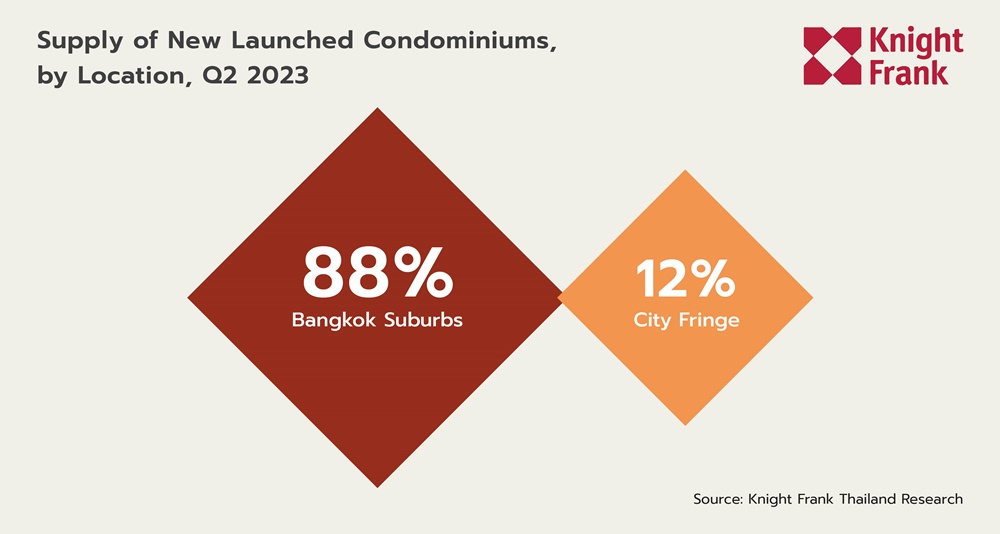

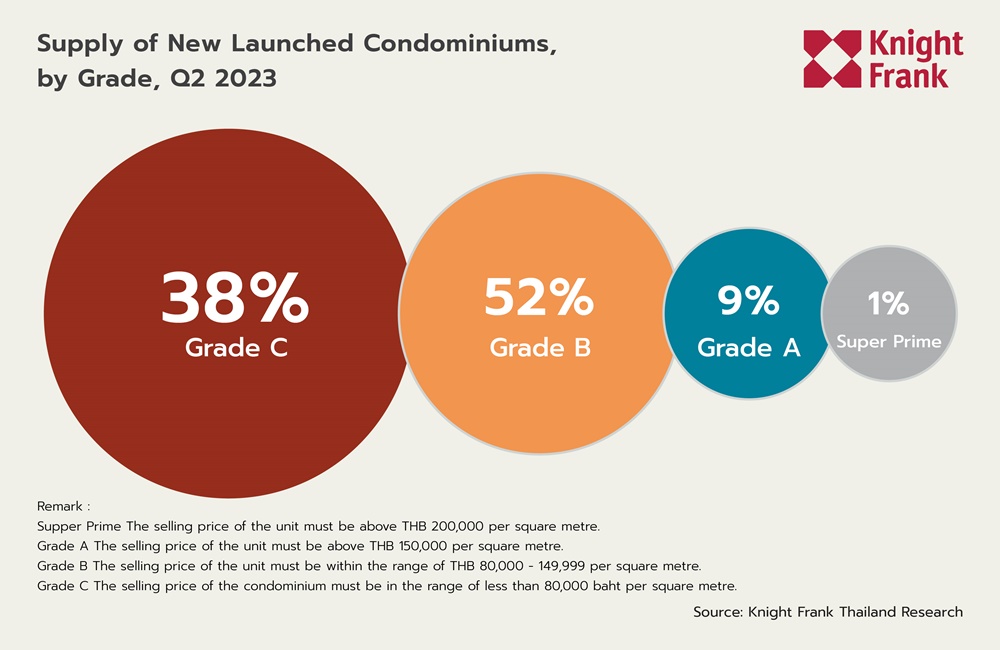

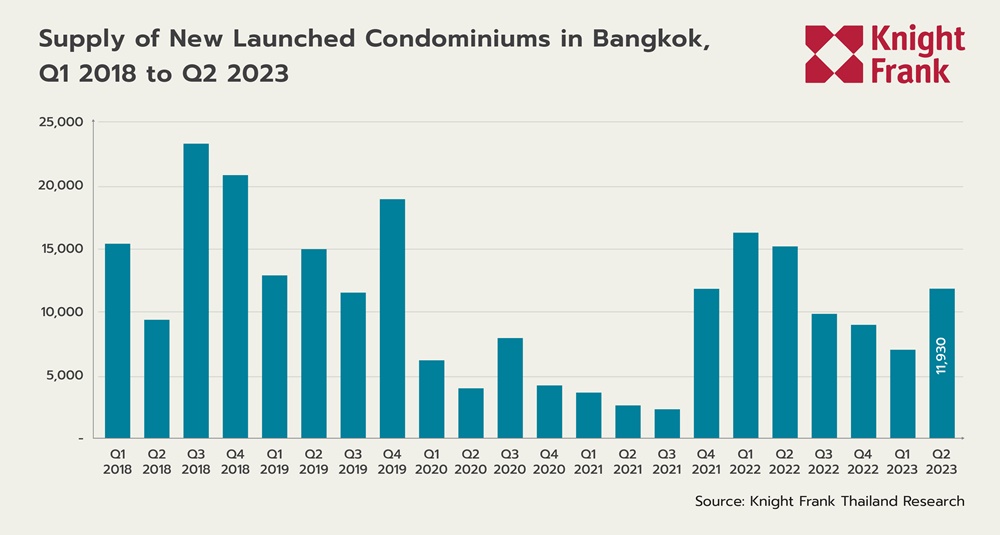

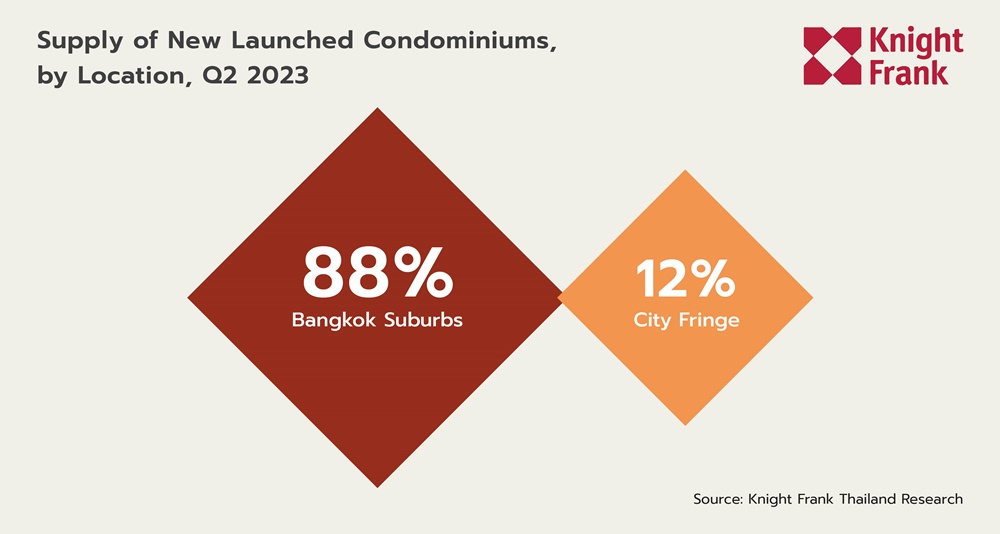

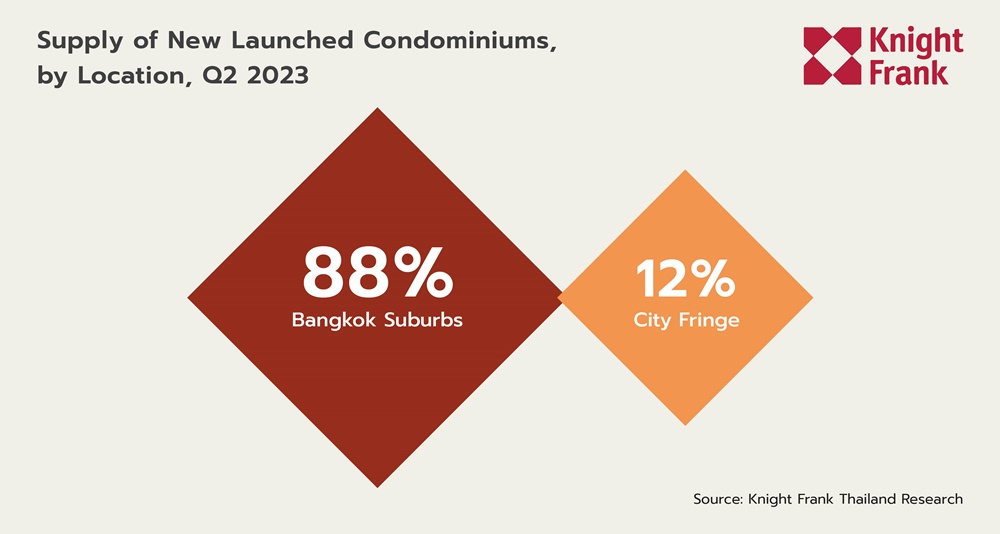

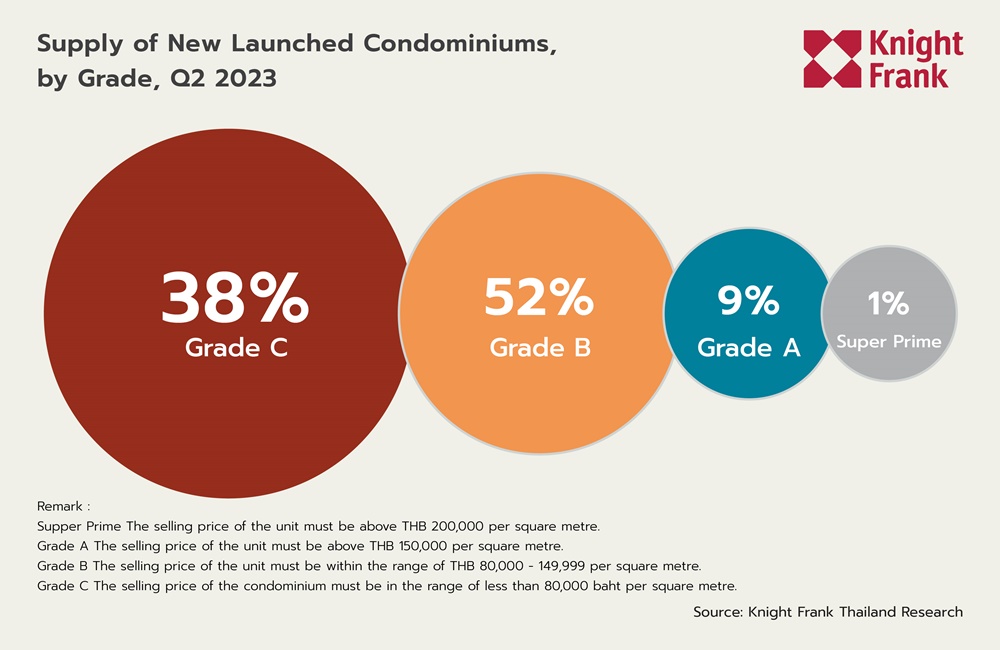

During Q2 2023, the number of newly launched for sale amounted to 11,930 units, representing an increase of 40.1% compared to the previous quarter and a decrease of 21.3% compared to the same period last year. The total supply of newly launched condominiums in suburban areas of Bangkok accounted for 88%, while areas around the central business district accounted for 12% and none were located in Bangkok city centre areas. The most popular new supply launched for sale was grade B, accounting for 52% of the total, followed by grade C accounting for 38% and grade A accounting for 9% while the super prime segment accounted for only 1%.

Grade A The selling price of the unit must be above THB 150,000 per square metre.

Grade B The selling price of the unit must be within the range of THB 80,000 - 149,999 per square metre.

Grade C The selling price of the condominium must be in the range of less than 80,000 baht per square metre.

Demand

In this quarter, the demand for new units sold quite contracted as there was insufficient purchasing power to boost up the market. The total number of new units sold in Q2 2023 amounted to 3,324 units out of a total supply of 11,930 units. The sales rate was 27.9%, decreased by 14.5% from the previous quarter but increased by 7.7% compared to the same period last year. The primary factors contributing to the group of middle-income earners not responding to the condominium market are rooted in the fact that a significant portion of this demographic is in the phase of building their financial stability. They typically have medium to entry-level incomes. Furthermore, the ongoing price adjustments in the condominium market have resulted in reduced affordability for this group when it comes to purchasing residential properties. While the interest of investors in the second-hand condominium market has been on the rise, it can be attributed to factors such as sought-after locations along transit lines, suitable unit sizes, and competitive prices. Moreover, the growing number of buyers failing to meet loan obligations has led to banks repossessing assets and categorizing them as NPLs. This has notably boosted the presence of repossessed assets in the market, potentially fueling positive trends in the second-hand property market.

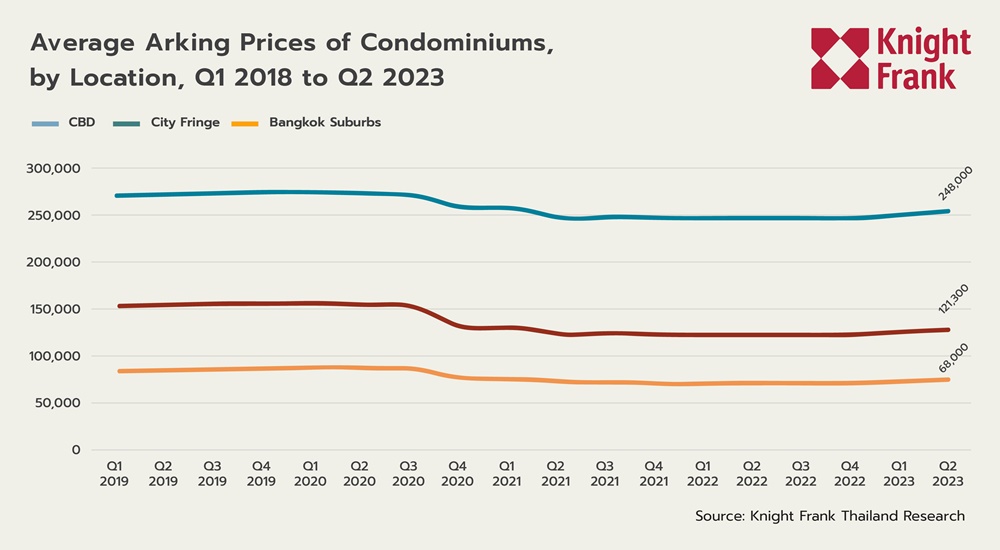

Asking Price

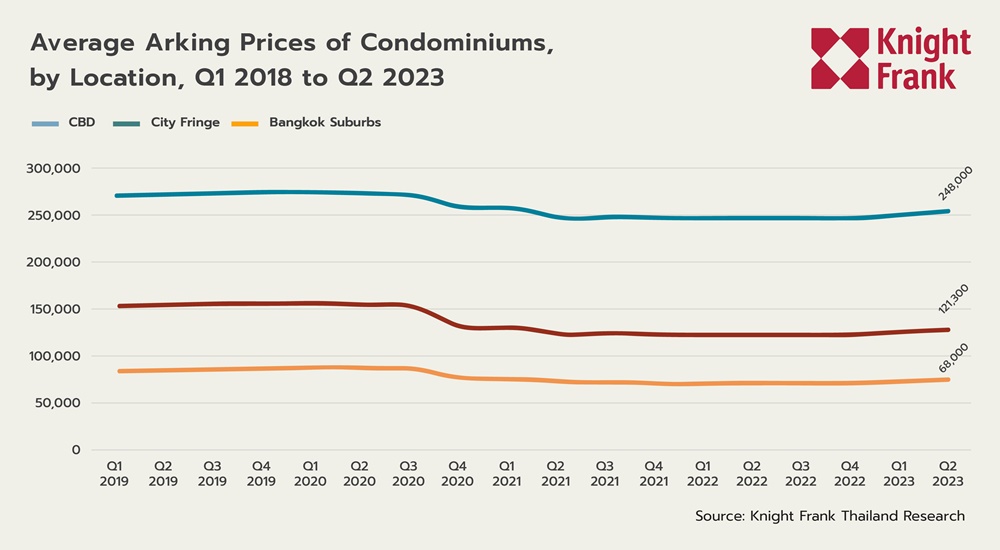

The selling price of condominiums in Q2 2023 increased in all areas. The selling price of condominiums in the central business district (CBD) was approximately 248,000 baht per square metre, representing a 1.72% increase from the previous quarter. Similarly, the selling price of condominiums around the city fringe was 121,300 baht per square metre, a 1.85% increase from the previous quarter. In the suburban areas of Bangkok, the selling price of condominiums was approximately 68,000 baht per square metre, indicating a 3.0% increase from the previous quarter. The average selling price across all areas experienced a slight increase of 2.2% due to the rise in construction costs. Thus, business operators have not been able to lower the price, especially newly launched and under construction projects. As a result, the selling price has to be adjusted and increased.

What Next?

- It is expected that the market will remain stable during the second half of the year because most of visiting foreigners are still focusing on tourism rather than investment.

- Demand from foreign buyers expanded well in some areas as they are looking for new locations to live such as suburban areas along the skytrain lines and other provinces.

- The second-hand condominium market attracted both Thai and foreign investors, especially projects along the skytrain line. In addition, NPL condominiums also get quite a lot of attention due to its attractive price.

- Increasing household debts may affect demand in the medium to low condominium market as these are the group with fragile financial liquidity, reflecting by an increasing number of seized assets. As a result, banks are cautious in granting loans to this group of buyers.

About Knight Frank Chartered (Thailand) Limited

Knight Frank Chartered (Thailand) Limited is a subsidiary of the Knight Frank group, which was founded in 1800. It is a well-known global real estate consultancy and property appraisal company with a long history of serving clients worldwide. The company has earned the trust of clients in various aspects of real estate, including property valuation, real estate marketing, property management, and legal advisory services related to real estate. The company boasts a highly knowledgeable and experienced team that specializes in a wide range of real estate operations.