Economic Overview

The Thai economy registered a 2.7% expansion in Q1 2023 attributed to the domestic sector and tourism, although it still trailed ASEAN peers in terms of the pace of recovery, as reported by the World Bank Thailand.

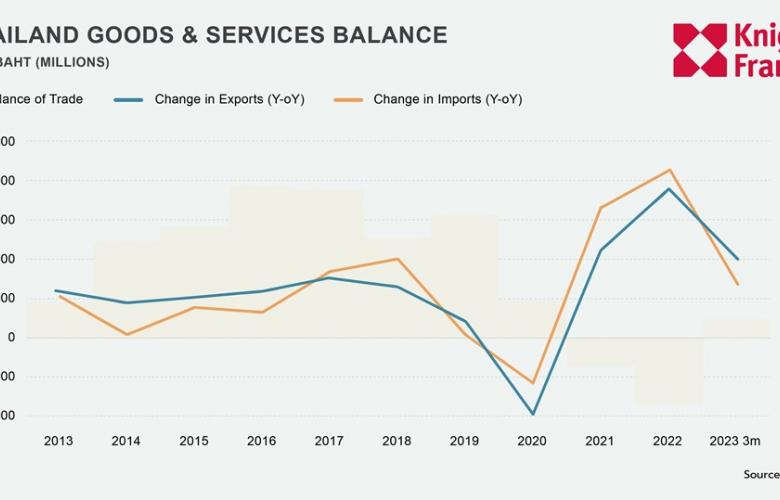

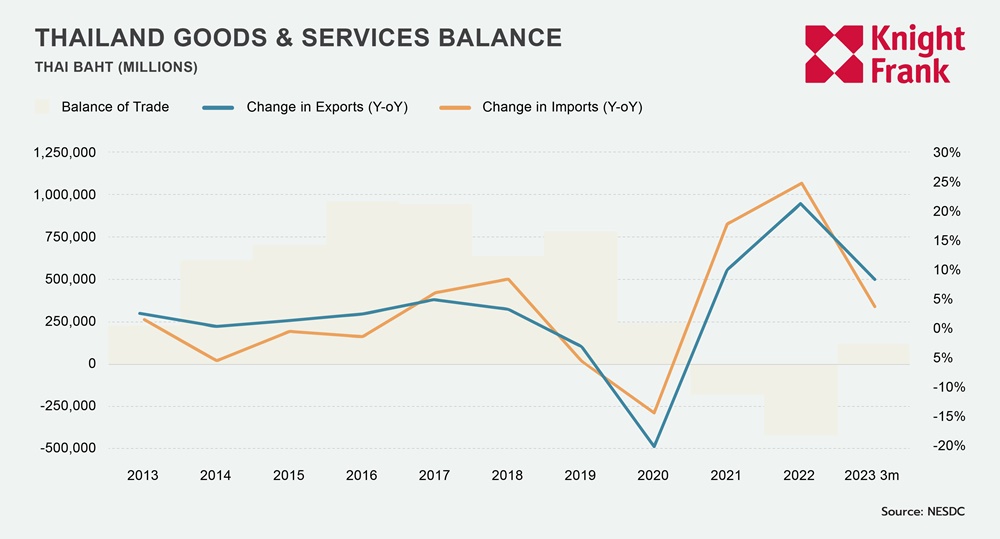

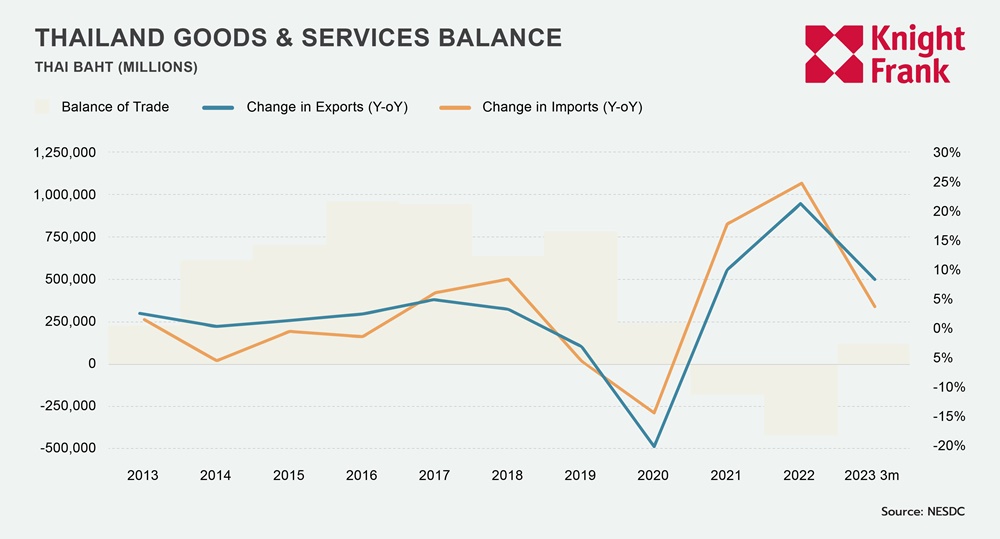

In the first quarter of 2023, Thailand witnessed an 8.5% increase in exports of goods and services, surpassing the 3.5% growth in imports. This led to a surplus in the current account, reaching its highest level in over two years at 3% of the GDP. Private consumption remained solid, growing by 5.4%, driven by a robust labour market and a strong inflow of international visitors. Fixed capital investment also saw growth of 3.1%, primarily driven by investments in construction, machinery, and an upswing in Foreign Direct Investment (FDI). Still, government consumption contracted by 6.2% due to the sharp reduction in COVID-related expenditure. While the overall Thai economy displayed a gradual recovery, it lagged other major ASEAN economies like Vietnam, Malaysia, and Indonesia due to its higher reliance on the external sector, particularly trade and tourism.

Based on data reported by the Ministry of Commerce (MOC), headline inflation increased by 0.2% in June 2023, with a year-to-date average of 2.49%. This marked the sixth consecutive month of decelerating inflation, primarily driven by the slow growth in food prices, significant declines in energy prices, and a high base from the previous year. Core inflation exhibited a similar pattern, reaching 1.3% but remaining above the pre-pandemic average of below 1%. As inflationary pressure persisted, the central bank maintained a gradual monetary policy normalisation approach to address inflation while also supporting economic recovery.

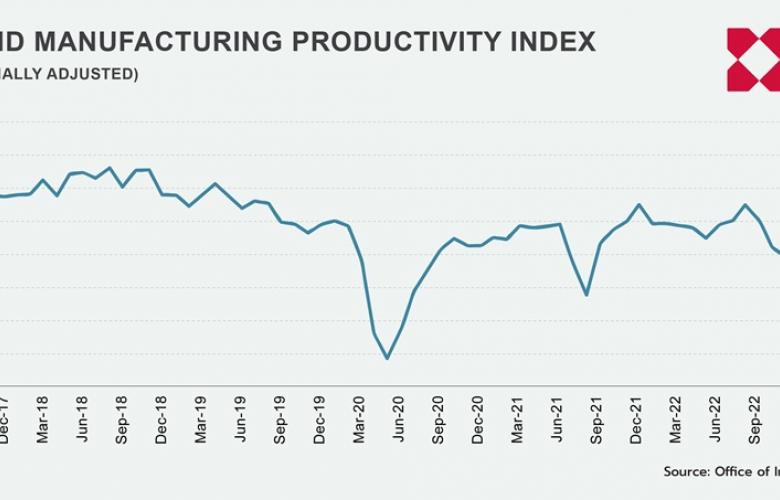

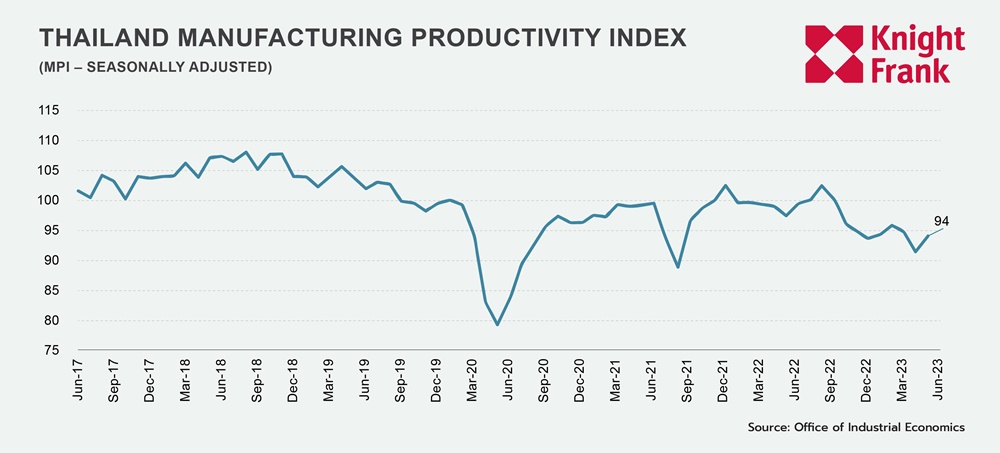

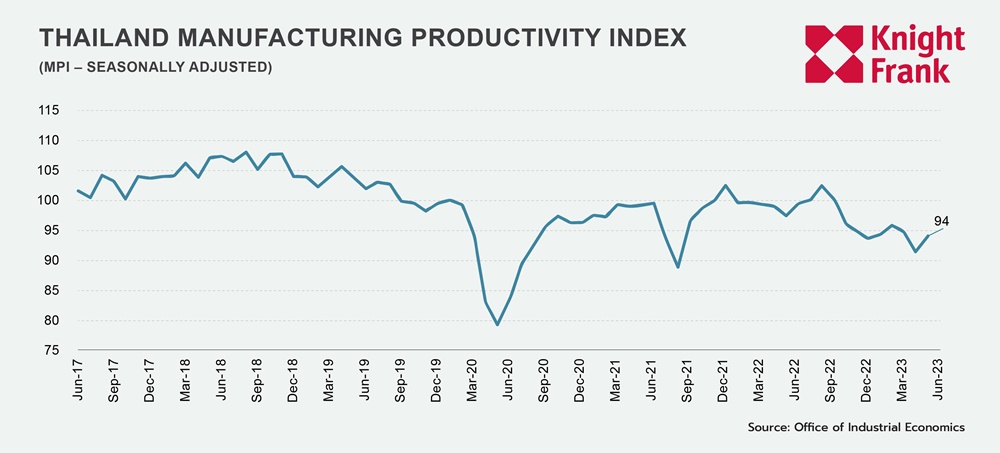

In May 2023, Thailand's manufacturing productivity index (MPI) remained steady at 94%, reflecting no significant change compared to the end of 2022. This comes at a time when global economic growth is projected to decelerate in 2023, primarily due to factors such as monetary tightening and the historical level of global debt, which stands at 270% of the global GDP. Within Thailand's manufacturing sector, the MPI was influenced by lower production levels in specific sectors such as hard disc drives (HDD) and chemical products. Nevertheless, positive signs of growth were observed in automotive manufacturing and petroleum products during the same period.

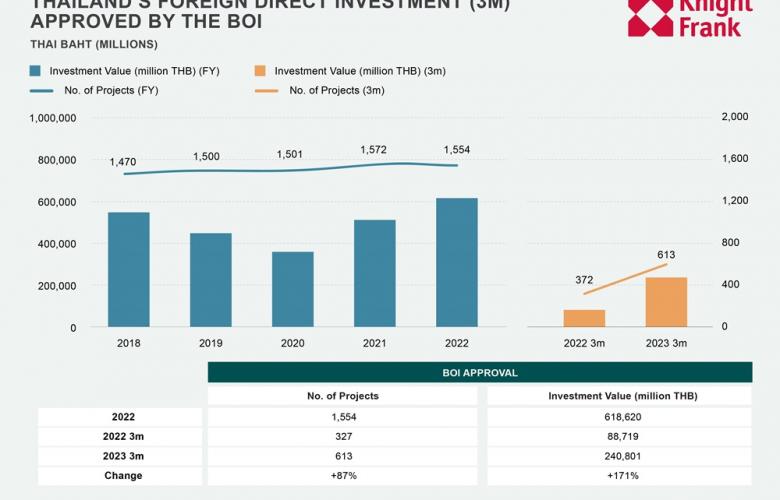

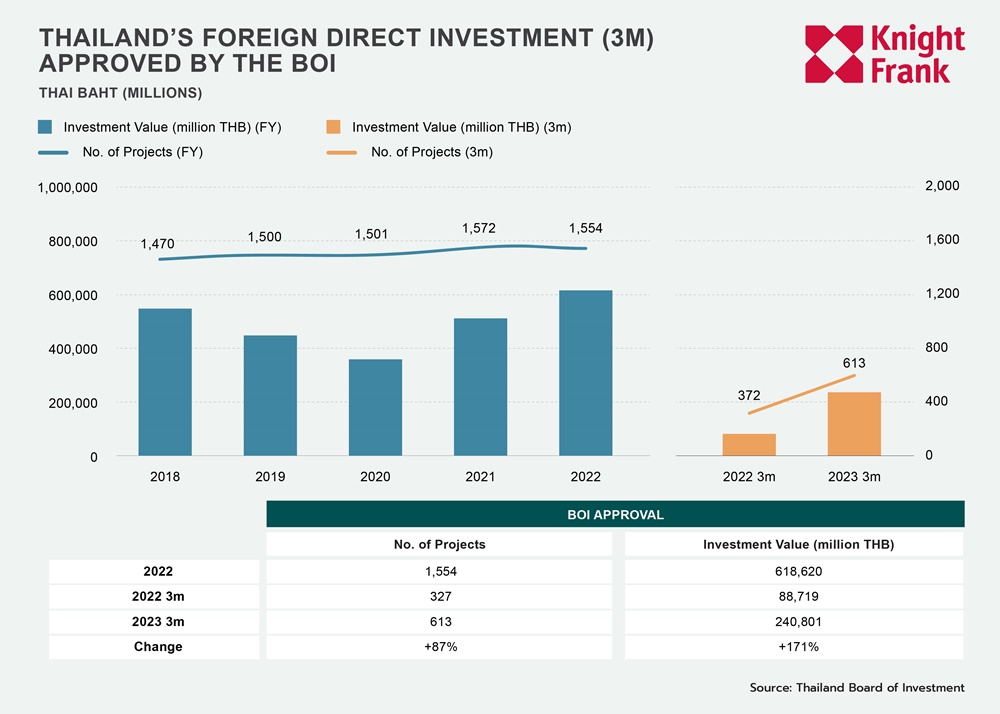

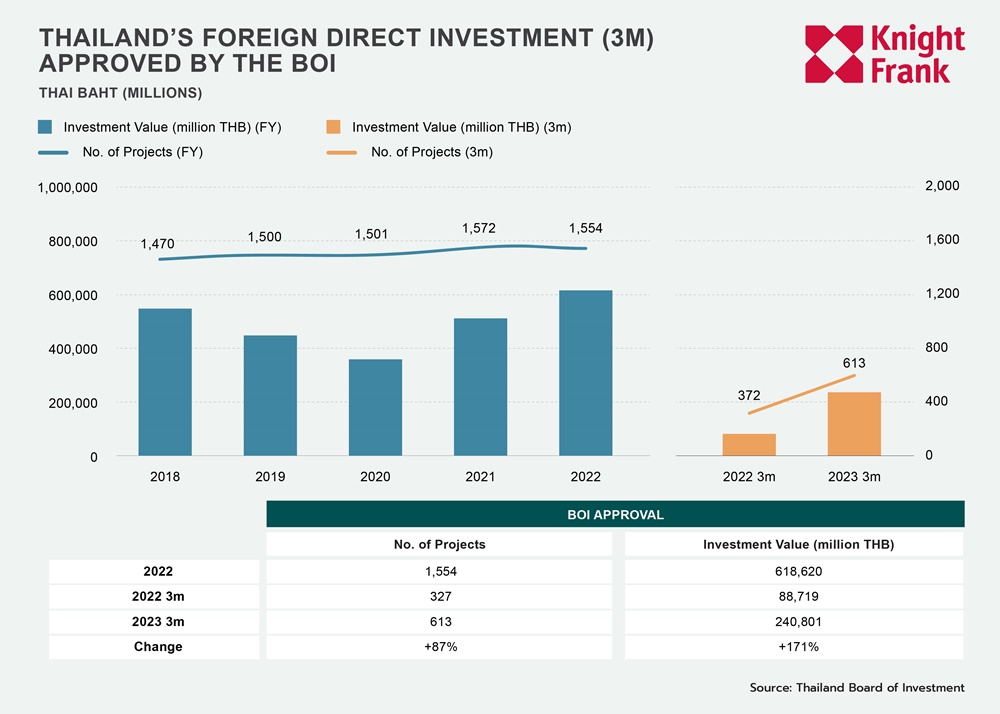

According to the BOI report, there was a significant increase in the number of total investment promotion approvals in Q1 2023, both in terms of the number of projects and the investment value. The total number of approved projects reached 613, increasing from 327 during the same period last year, and the investment value experienced a substantial rise of 171%, reaching 241 billion Baht. The electronics and electrical equipment sector, particularly solar cells and smart electronics, made the largest contribution to this increase, with a remarkable growth rate of 264% and an investment value of 75 billion Baht in Q1 2023. Additionally, certain sectors including automotive and data centres have also witnessed a substantial rise in investment value.

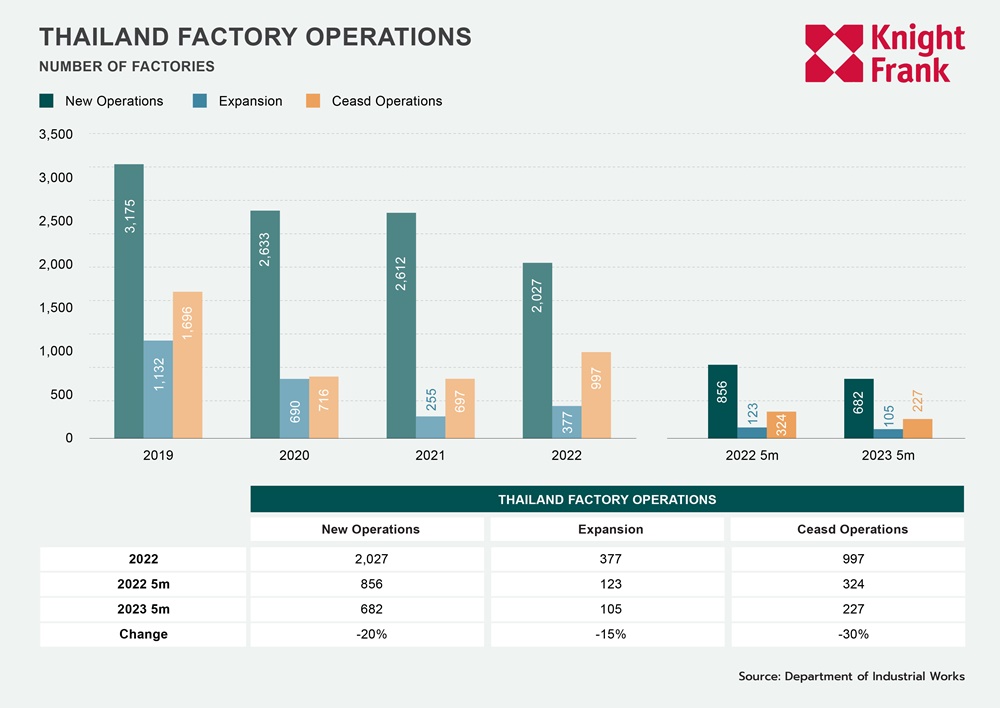

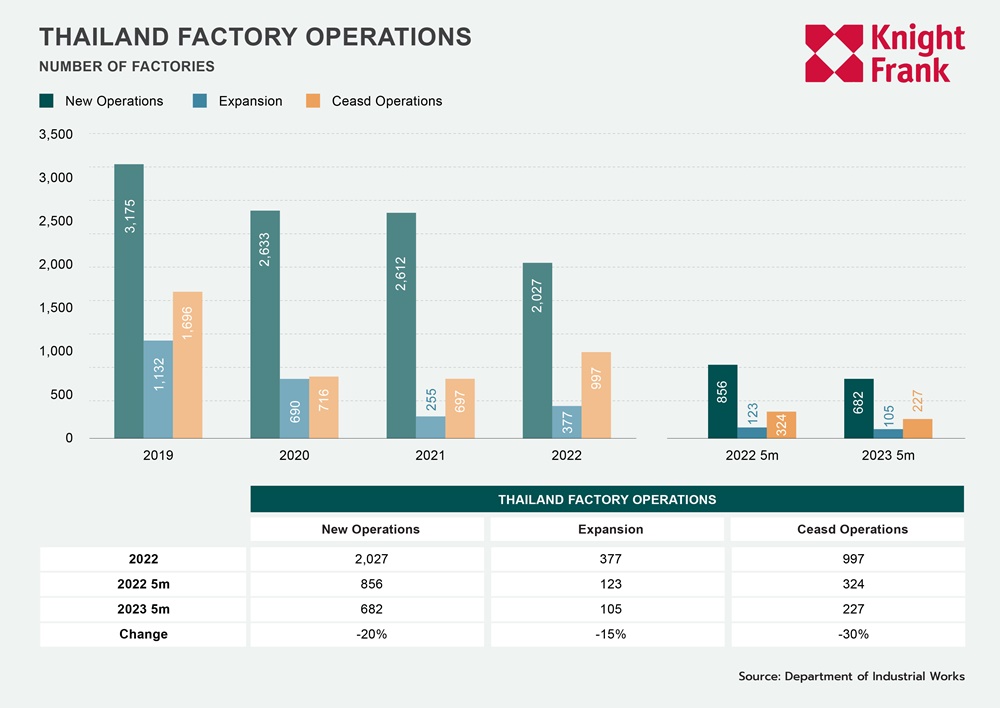

During the first five months of 2023, there was a notable slowdown in factory activities in Thailand. The data indicate a decrease in the number of new factory operations and expansions in 2023, amounting to 787, which is a decline of 20% compared to the previous year. Meanwhile, the number of factories that ceased operations also saw a significant reduction, dropping by 30% to 227.

Serviced Industrial Land Plots

Supply

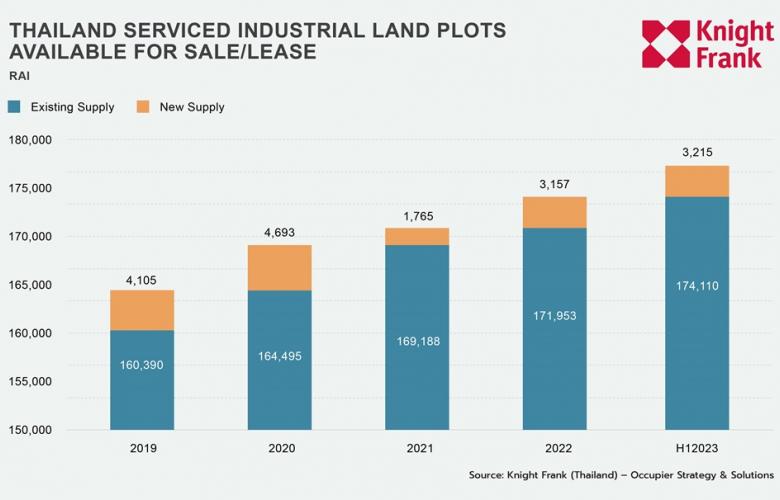

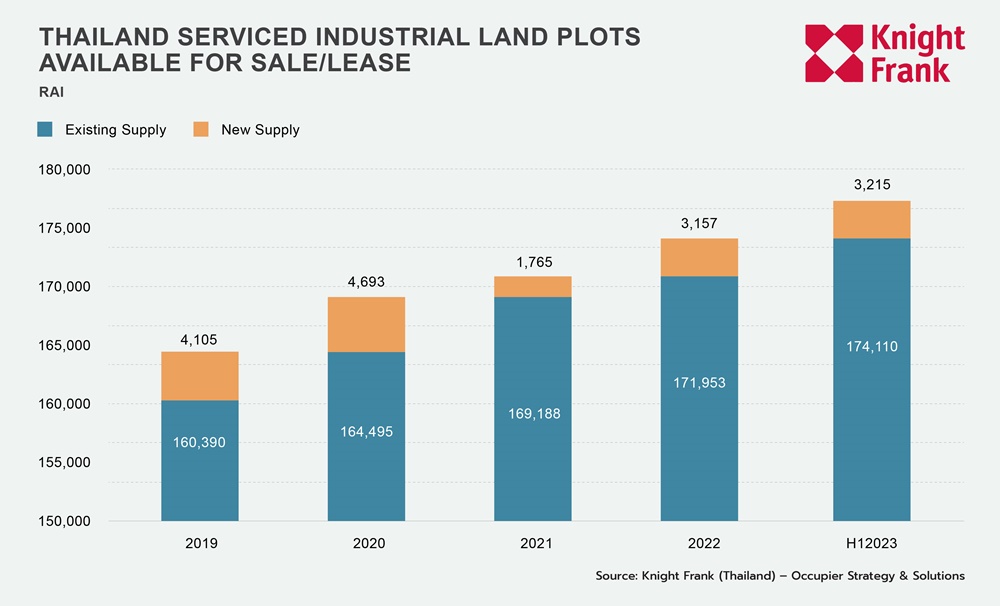

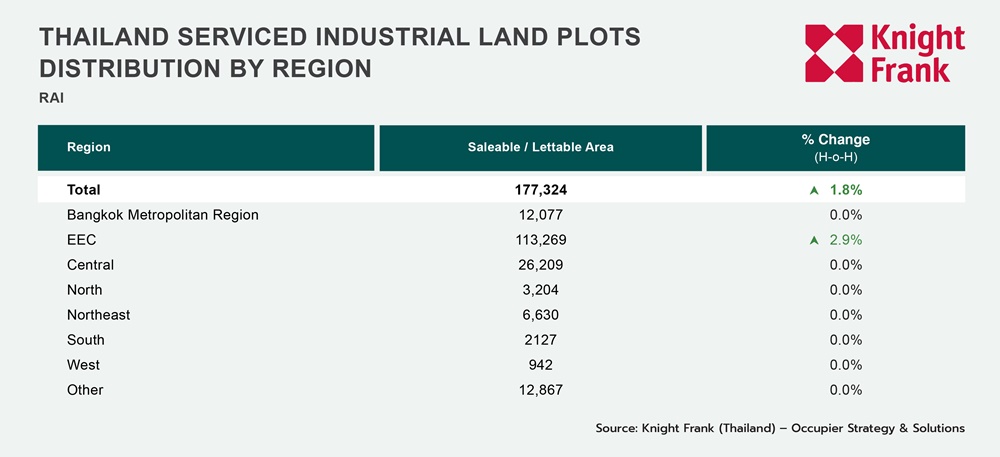

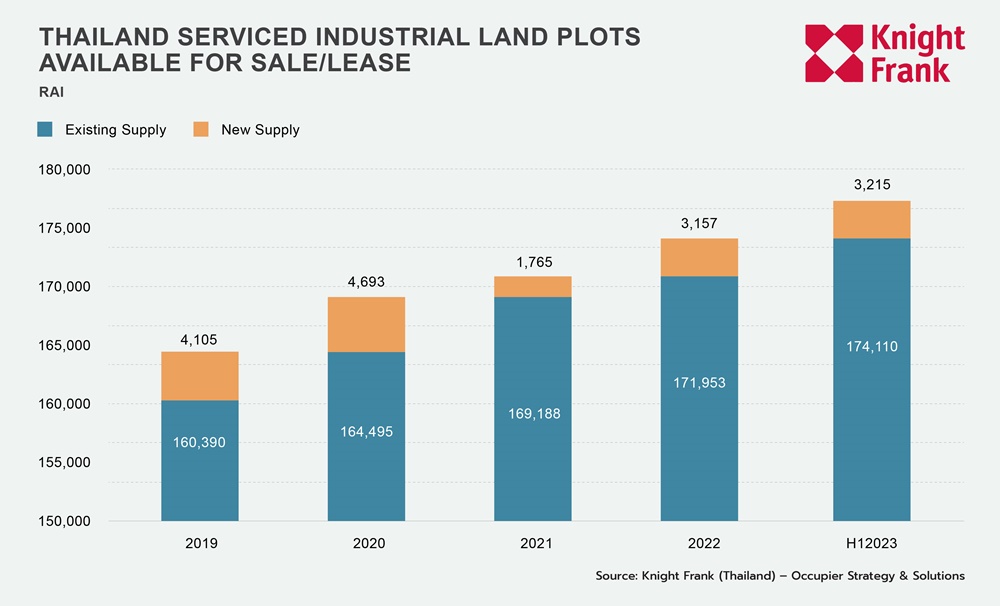

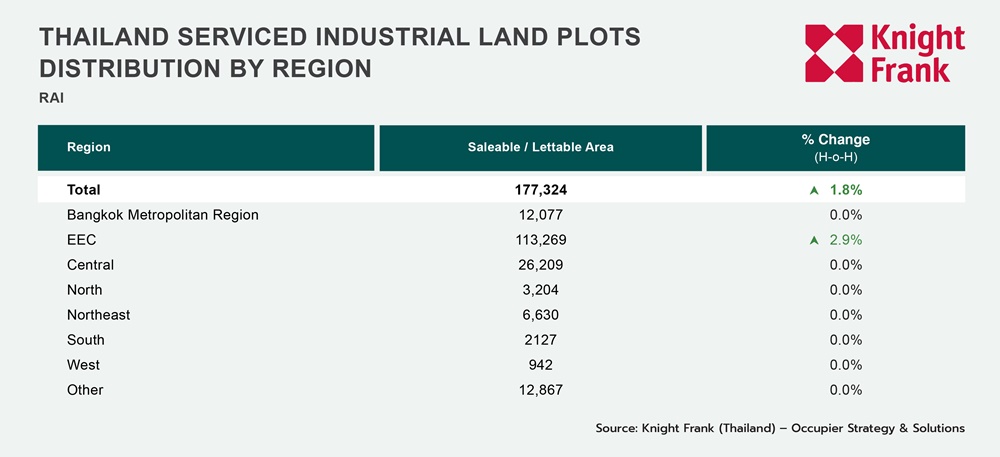

In H1 2023, the Industrial Estate Authority of Thailand (IEAT) approved two new projects, namely the Apex Green Industrial Estate and Nonglalok Industrial Estate. As a result, the total amount of serviced industrial land made available for sale or lease in industrial estates, zones, and parks, increased by 1.8%, or 3,215 rai, to a total of 177,324 rai.

Supply Distribution

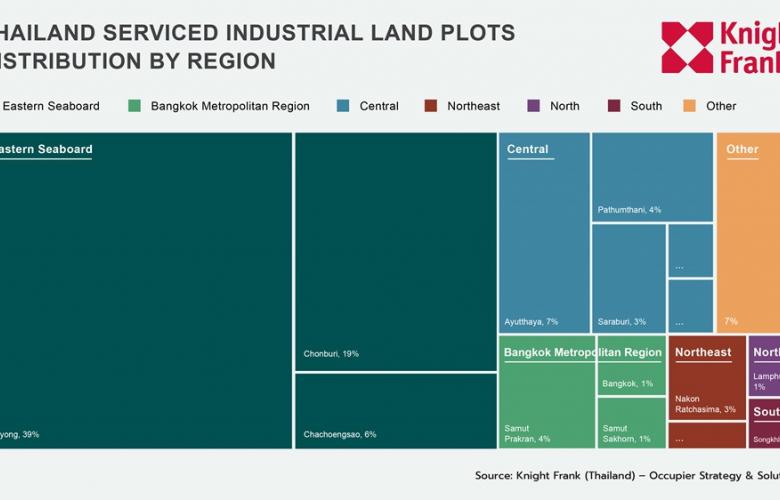

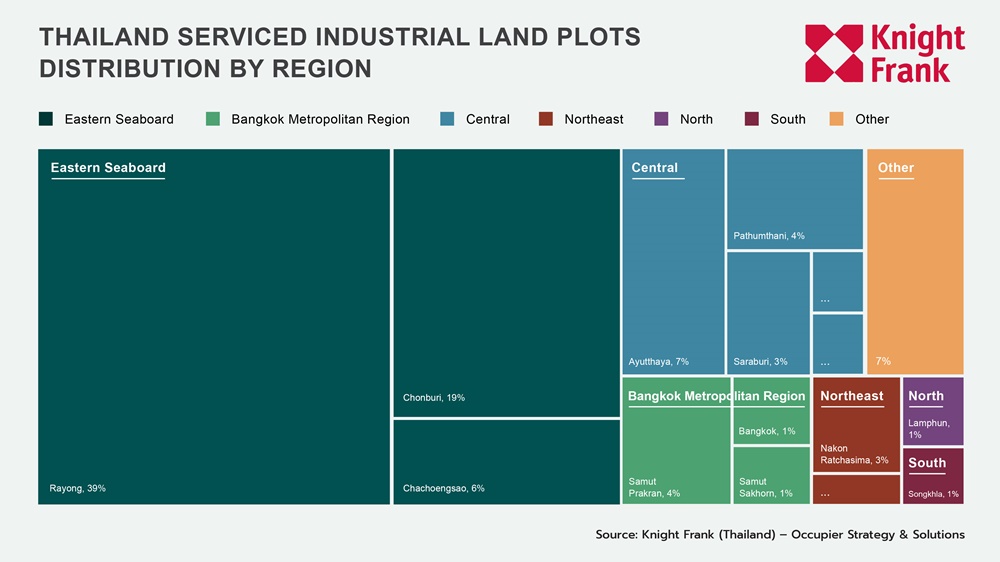

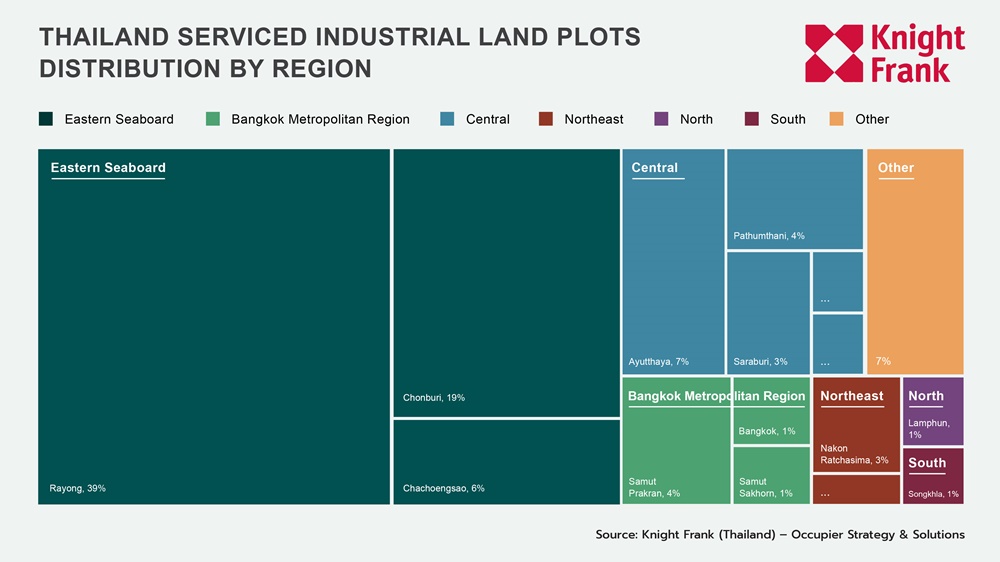

Services Industrial Land in Thailand is primarily concentrated in the EEC, which accounts for 64% of the market share. Among the provinces in this region, Rayong holds the largest share at 39%, followed by Chonburi at 19% and Chachoengsao at 6%. The Central Region is the second-largest sub-market, comprising 16% of the total supply. Within this region, notable locations include Ayutthaya at 7%, Pathumthani at 4%, and Saraburi at 3%. In other regions, Samut Prakarn and Nakhon Ratchasima serve as primary destinations, representing 4% and 3% of the total serviced industrial land, respectively.

During the first half of 2023, the EEC was the only area that experienced an increase in total supply, expanding by 2.9% compared to the previous half, reaching a total of 113,269 rai.

Demand

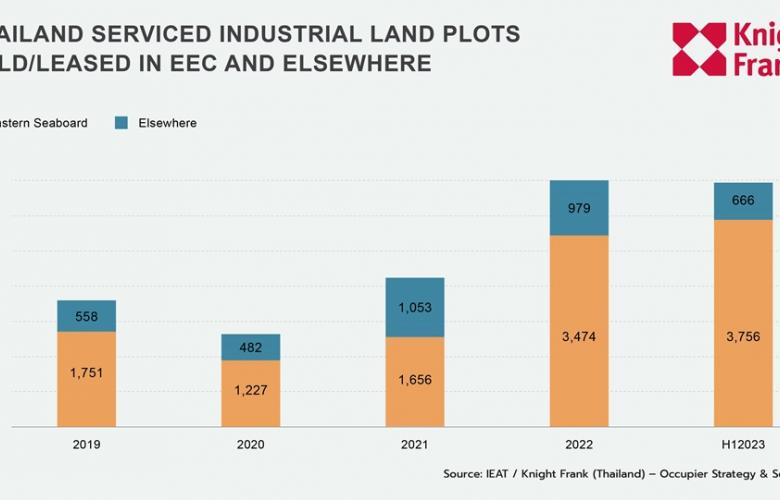

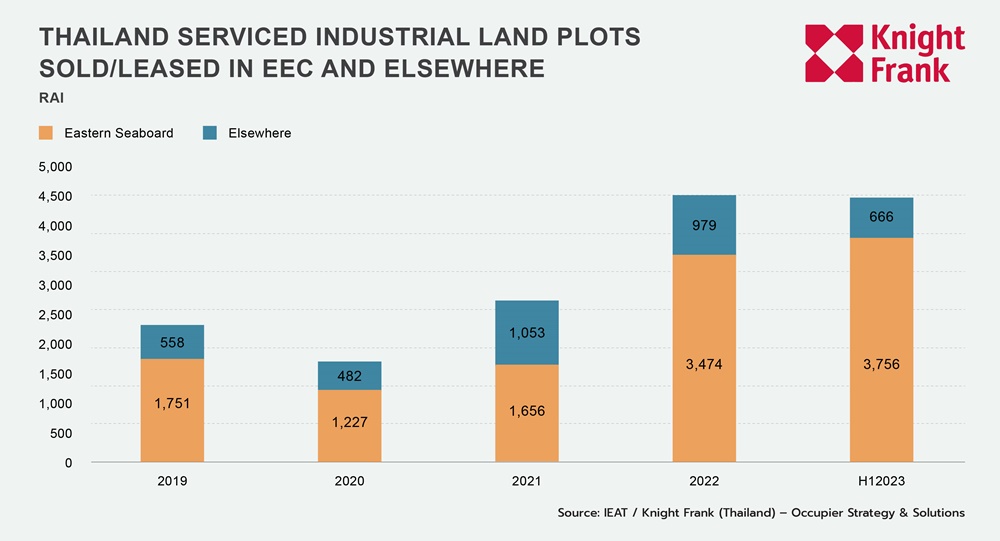

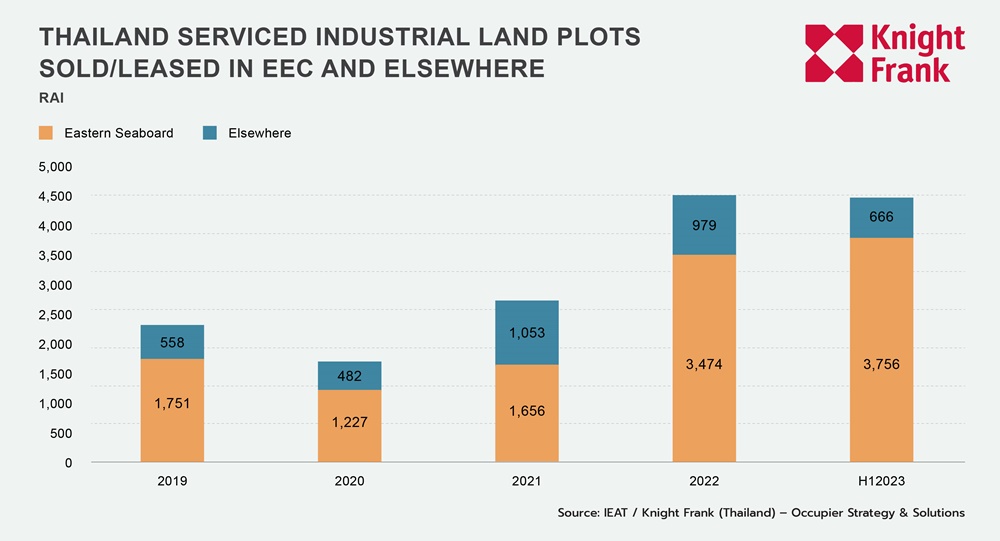

Based on the IEAT report, the demand for serviced industrial land in H1 2023 displayed a positive trend. The total area sold or leased during this period amounted to 4,422 rai, representing a notable 12% increase compared to H2 2022. The surge in demand was primarily driven by key industries such as automotive and transport, steel and metal products, rubber, plastic, and artificial leather.

In terms of geographical distribution, the Eastern Economic Corridor (EEC) maintained its status as the most active sub-market, with 3,756 rai transacted, or 85% of the total transactions. A noteworthy transaction within the EEC involves BYD, a prominent EV manufacturer from China, which acquired a significant land area of 600 rai in the WHA Rayong 36 Industrial Estate. Outside the EEC, 666 rai were sold or leased, with substantialdemand observed in Samut Prakarn and Prachinburi.

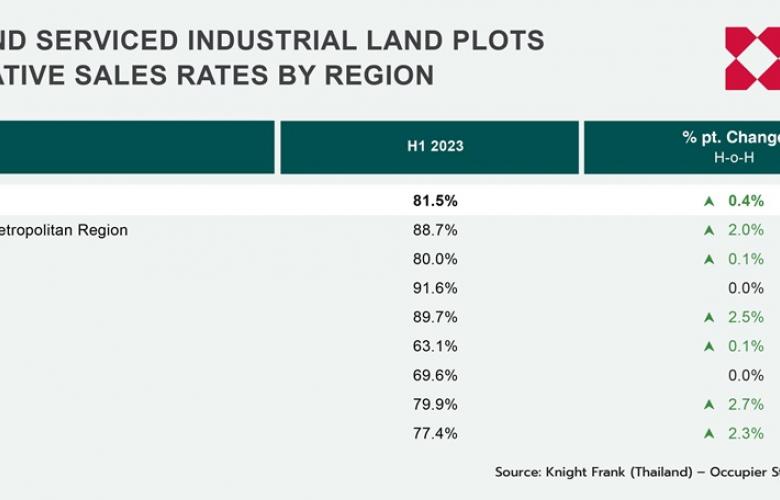

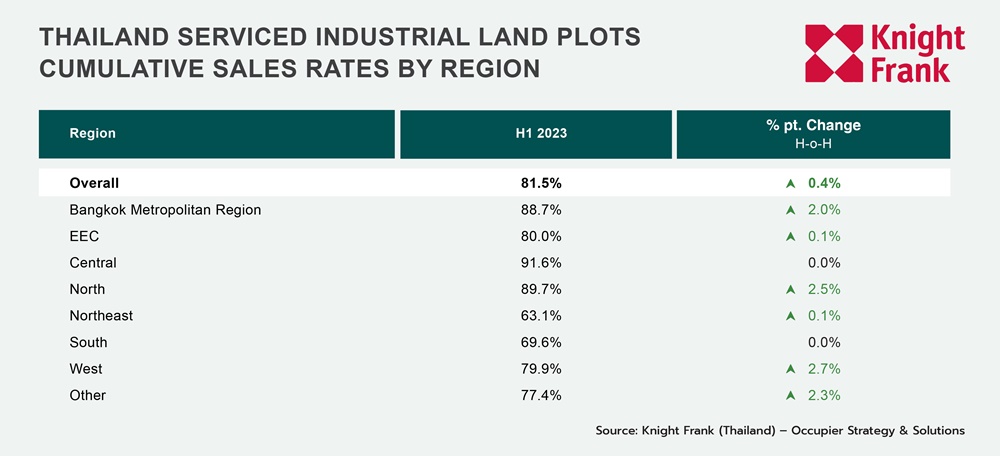

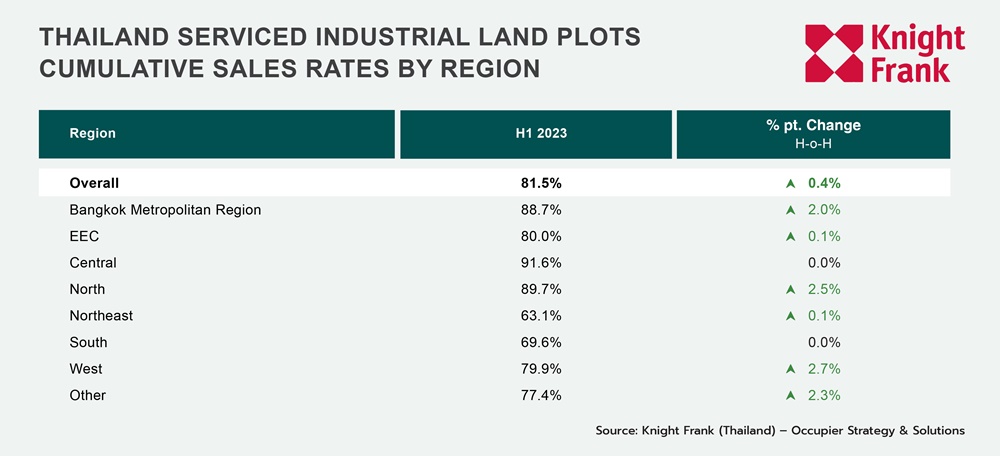

The overall market cumulative sales rate showed a positive increase of 0.4%, reaching 81.5%. It is worth noting that no region experienced a decline in sales rate. Among the main regions, the Bangkok metropolitan region demonstrated a robust expansion with a 2.0% H-o-H increase. The cumulative sales rate for the Eastern Economic Corridor (EEC) and the Central region remained steady at 80.0% and 91.6%, respectively.

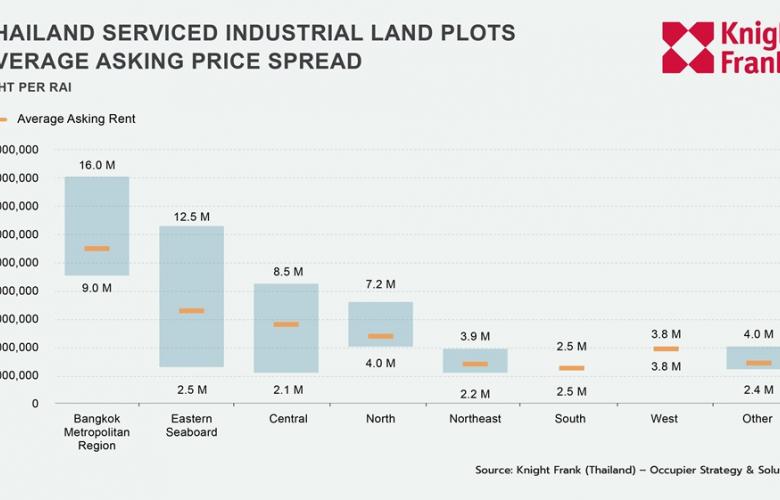

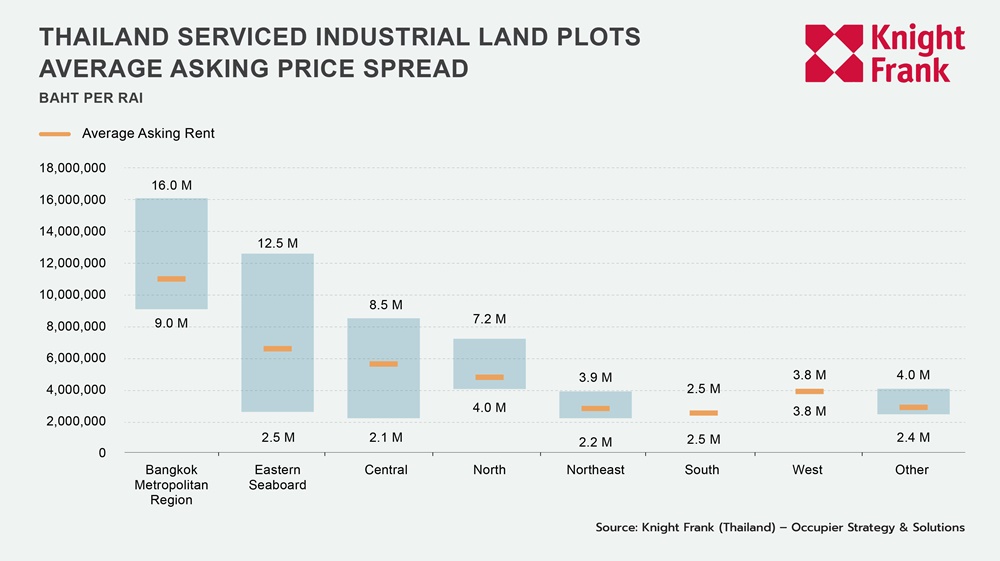

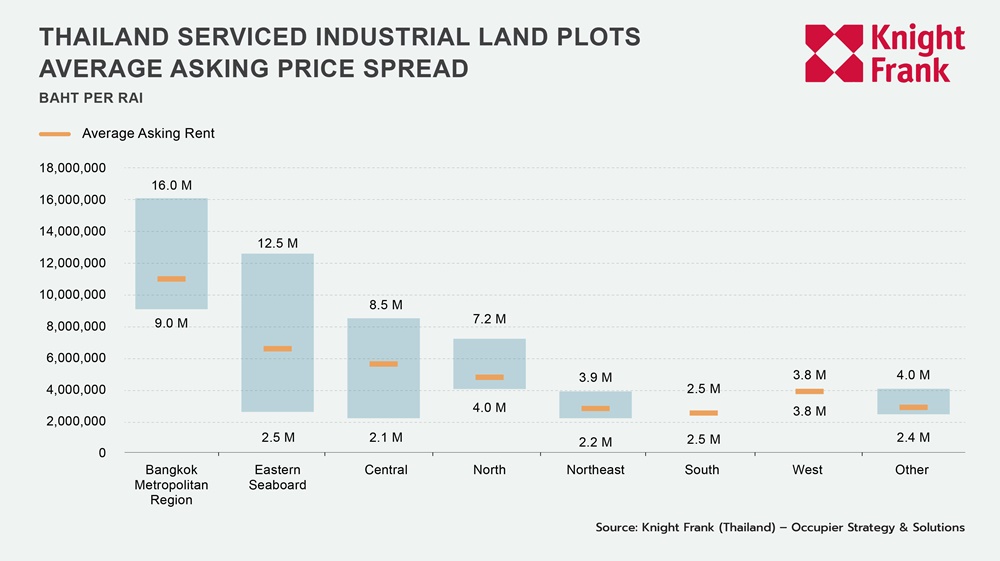

Asking Prices

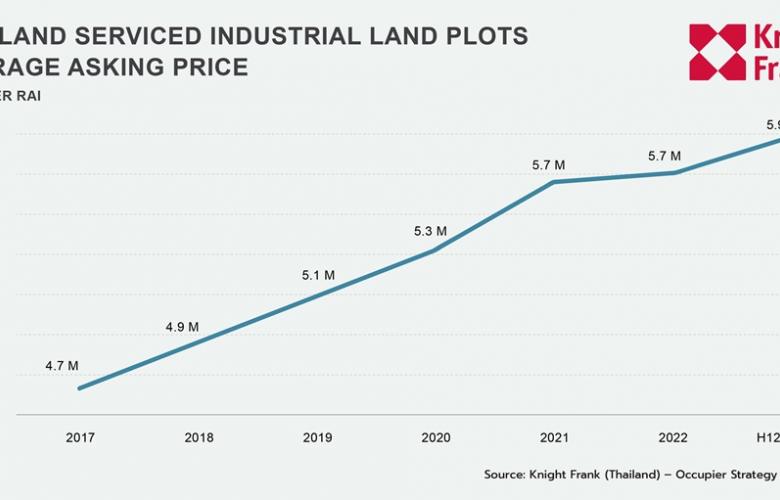

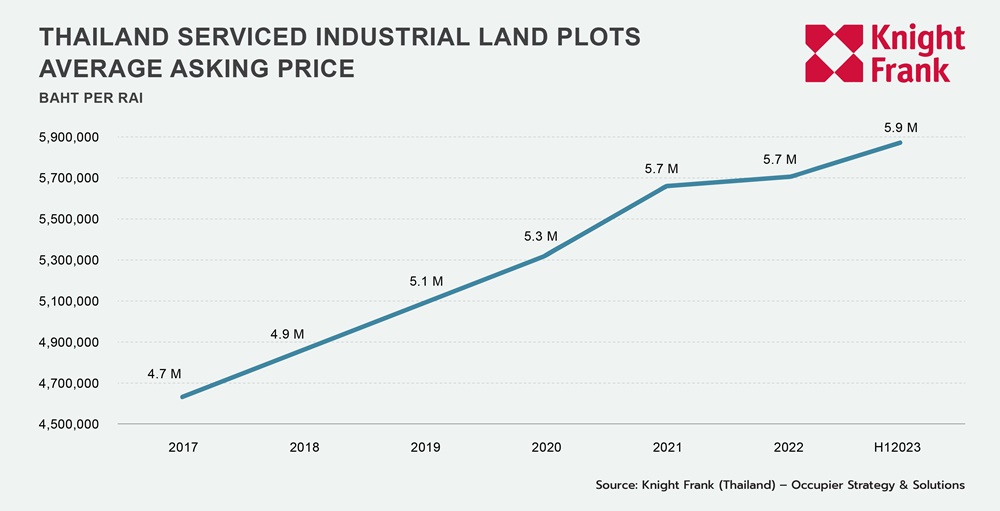

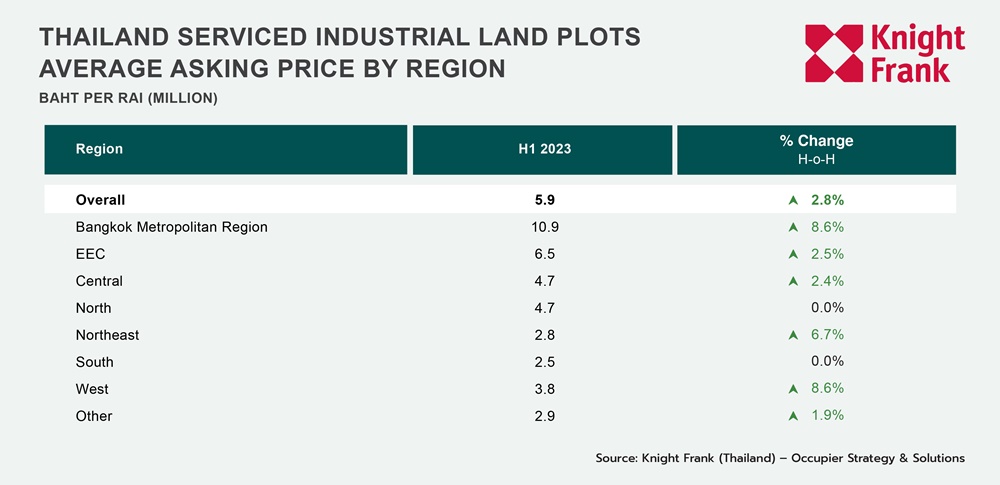

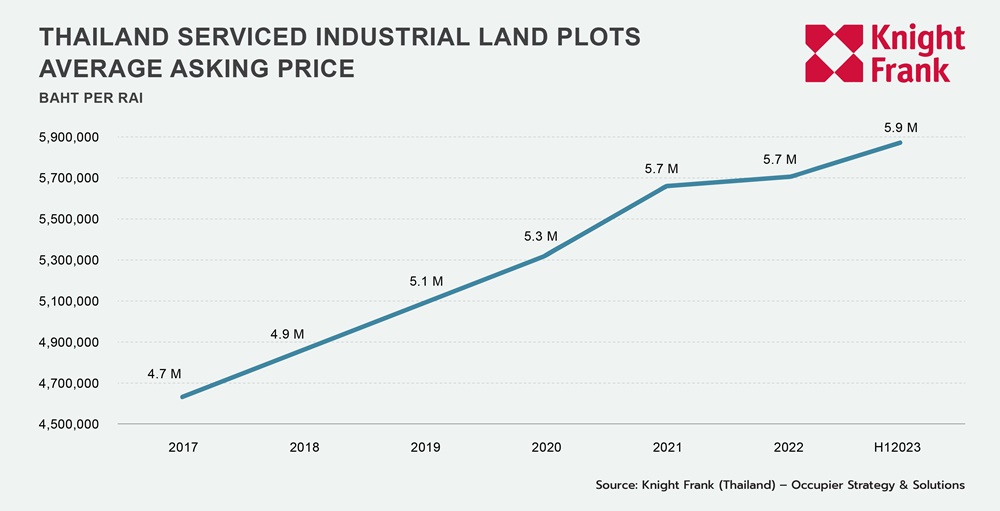

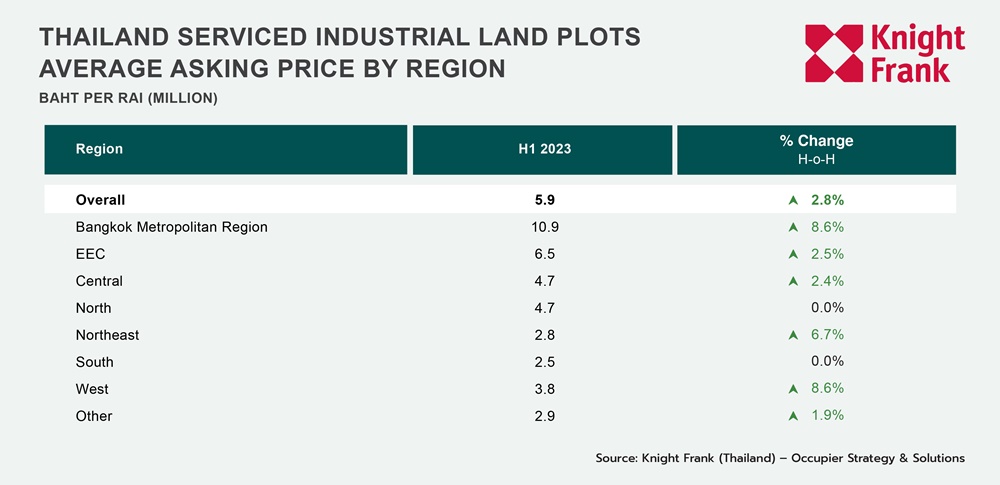

In the first half of 2023, the market rate experienced a notable increase of 3.1%, reaching 5.9 million baht per rai. This year's price increase marks a return to a growth trend following a slower rate of growth observed in the previous year. Among the three major manufacturing regions, the Bangkok Metropolitan Region (BMR) witnessed the highest price surge, with an 8.6% rise. The Eastern Economic Corridor (EEC) and the Central Region also saw price increases of 2.5% and 2.4%, respectively. In the EEC, the asking price range remains the widest among all the sub-markets, ranging from 2.5 to 12.5 million baht per rai, reflecting the diverse set of geographical and logistical factors in the region. Meanwhile, the highest price recorded was in the Gemopolis Industrial Estate in Samut Prakan, at 16.0 million baht per rai.

Review & Outlook

During the first half of 2023, Thailand's Manufacturing Sector experienced significant growth in Serviced Industrial Land Sales, driven by a surge in demand across various industries. The expansion of sectors such as advanced electronics and electric vehicles (EVs) played a pivotal role in fueling the need for industrial land, in anticipation of future demand. Notably, the statistics from the Board of Investment (BOI) indicate a remarkable seven-fold increase in the applications for BOI incentives in the electronics sector, particularly in smart electronics and appliances, during the first five months of 2023. In addition, we observed the presence of several EV companies that have chosen Thailand as their manufacturing bases, including prominent names such as MG, BYD, GWM, Foxconn, GAC AION, and the latest addition, Hozon's Neta. These notable investments highlight Thailand's increasing significance in the EV industry and reinforce its attractiveness as a prime location for EV manufacturing.

The widespread adoption of the China Plus One strategy, stemming from the ongoing trade conflict between the United States and China and tensions between China and Taiwan, has created a favourable opportunity for neighbouring countries to attract international businesses seeking alternative manufacturing facilities. Thailand is well-positioned to benefit from this regional dynamic thanks to its well-established manufacturing sector and robust infrastructure. Prime examples of companies diversifying manufacturing bases in the country include Sony, which has shifted almost all of its digital camera production bases from China to Thailand. Another instance can be seen with Panasonic, which has consolidated and relocated production lines for their high-tech smart electronics such as Programmable Logic Controllers (PLCs) (a specialised computer used in industrial automation systems to control and monitor machinery and processes), automatic switches, and infotainment products from the Chinese mainland.

Towards the remainder of 2023, the Bank of Thailand predicts a decline in inflation rates alongside gradual economic growth for the Thai economy, attributable to sluggish global demand. It is also crucial to closely monitor the evolving political landscape, including the establishment of a new government and the upward trajectory of wages. Within the industrial sector, there is a growing emphasis on green energy, fueled by foreign investors aiming to enhance industrial sustainability. Though the adoption of green energy is still in its early stages, some progress has been observed. A notable example of this is the integration of solar cells with microgrid systems in certain industrial estates, enabling localised clean power generation and storage, thereby reducing reliance on the primary power grid. These measures, along with similar initiatives, are expected to advance and gain more prominence within Thailand's industrial sector in the near future.