Leading diversified professional services and investment management firm Colliers (NASDAQ and TSX: CIGI) today releases its Q2 2023 Singapore Investment Market Report.

Key highlights include:

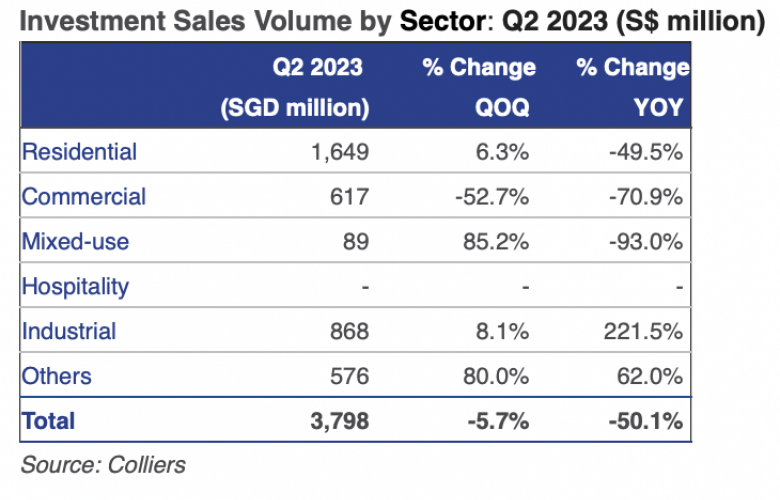

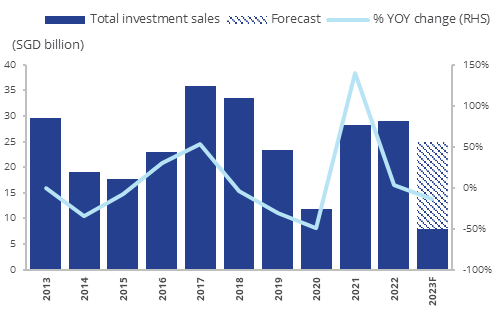

- Close to SGD3.8 billion of investments were recorded in Q2 2023, marking a 5.7% decline QOQ and a 50.1% decline YOY.

- Volume this quarter was boosted by Government Land Sales (GLS) transactions, which made up 17.7% of the total; without the GLS deals, investment volume would come in at SGD3.1 billion, a decline of 19.2% QOQ.

- Private investments continued to lag due to high borrowing costs, which makes larger assets less digestible.

- For the rest of the year, early movers such as opportunistic investors looking for price dislocations, together with private wealth, are likely to drive investment volume.

Close to SGD3.8 billion of investments were recorded in Q2 2023, marking a 5.7% decline QOQ and a 50.1% decline YOY, as higher borrowing costs continue to restrict the activity of market players.

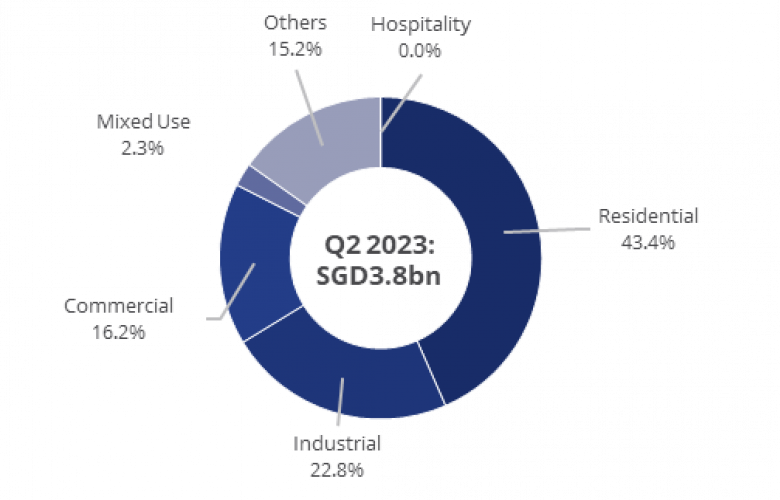

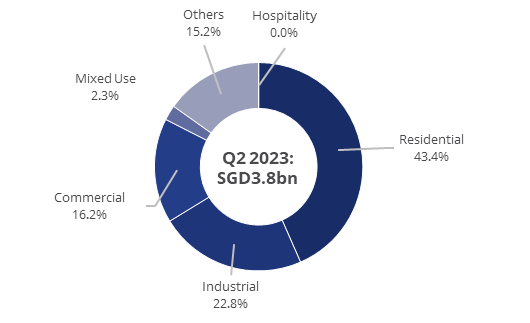

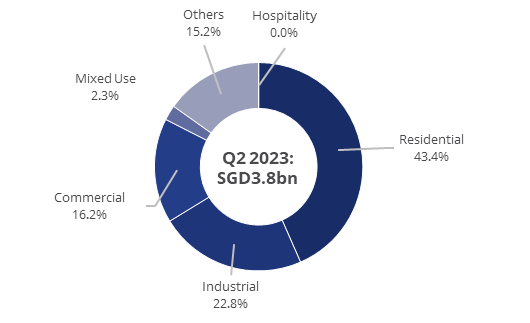

Excluding the GLS deals, investment volume this quarter was supported by the Residential (33.5%), Industrial (26.7%), and Office (18.3%) sectors; or Residential (43.4%), followed by Industrial (22.8%) and Office (15.7%) when including GLS transactions.

Transaction volumes are expected to pick up towards the end of 2023 with more clarity on the trajectory of interest rates and inflation, helping investors in their decision making.

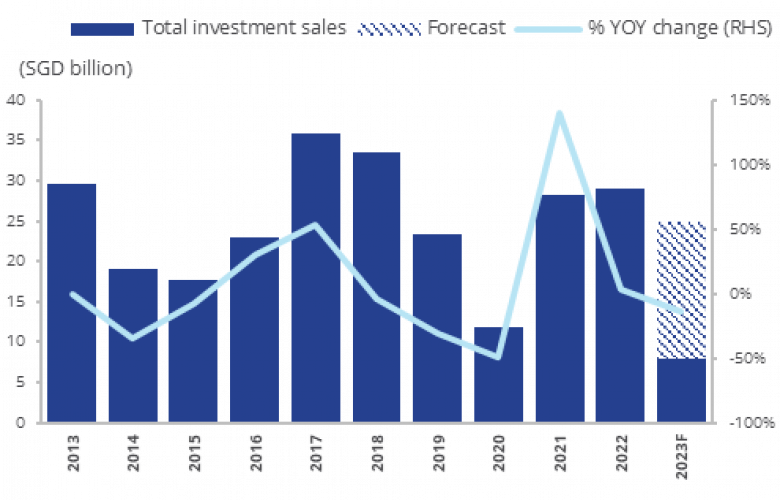

Singapore Investments: Q2 2023 (S$ billion, %)

Source: Colliers

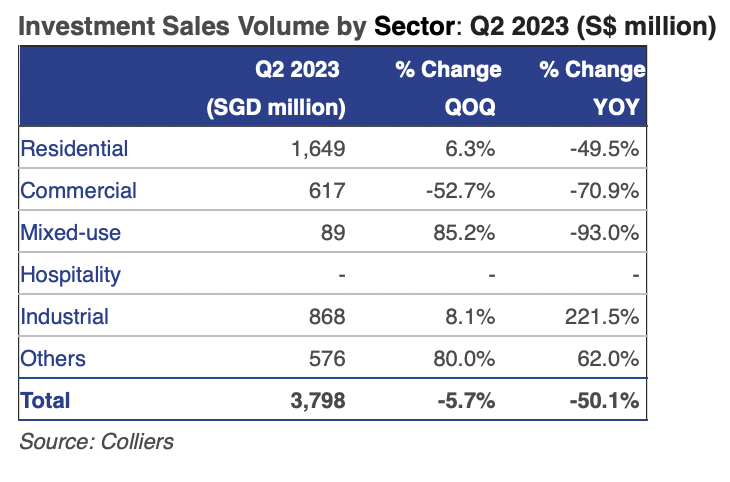

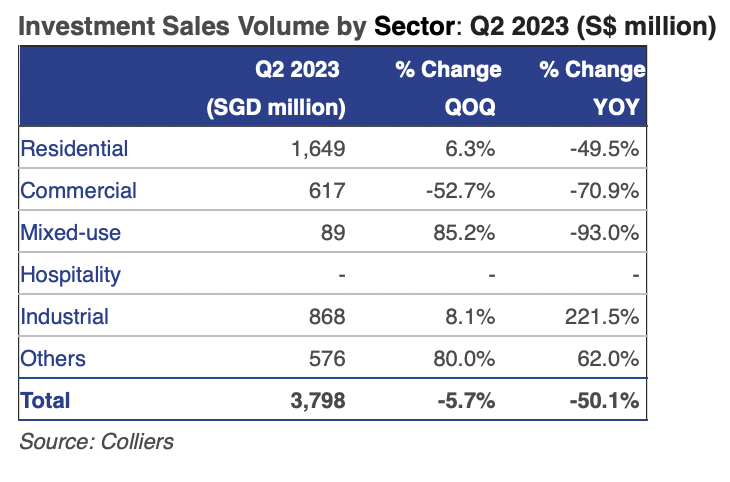

Investment Sales Volume by Sector: Q2 2023 (S$ million)

Source: Colliers

Investment Sales by sector: Q2 2023 (S$ million, %)

Source: Colliers

Private investments continued to lag due to the uncertain macroeconomic environment and high borrowing costs, which makes larger assets less digestible. There may be a pause in larger scale deals, but there will still be demand for core assets as rents for these assets have remained resilient.

Despite the challenging environment, attractive deals will continue to come onto the market such as the sale and leaseback of The Shugart to Ascendas REIT, and Chinese private equity firm Hillhouse Capital picking up most of ESR REIT’s industrial portfolio at a discount. This trend is set to continue as asset owners look to redeploy capital and reduce debt.

Ms Tang Wei Leng, Head of Capital Markets & Investment Services, Singapore at Colliers said, “Driven by refinancing challenges, pressure from the balance sheet, and the motivation to sell before any price corrections, the pace of asset sales should pick up in the second half of the year.”

Ms Catherine He, Head of Research, Singapore at Colliers added, “Going forward, limited cap rate expansion and price expectation gaps might continue to impede deals.Nevertheless, with most of the known risks already priced in, investment volume is more likely to surprise on the upside.”