On 17 July 2023, the Urban Redevelopment Authority (URA) released the data on developer sales for the month of June 2023.

A summary of the launches and sales is provided in the Appendix.

Ms. Chia Siew Chuin, Head of Residential Research, Research & Consultancy at JLL 谢岫君, 私宅市场研究部主管 (新加坡) commented:

The new private homes market in June 2023 was lacklustre, mainly due to the June school holidays, which deterred the launch of new projects.

Launches of new private homes (excluding executive condominiums or ECs) plummeted 98% from the 1,595 units May to just 31 units in June. This brought total launches in 2Q23 to 2,424 units, almost double that in 1Q23, but 2% lower than the second-quarter average of 2,482 units from 2013 to 2022. In 1H23, an estimated 3,736 new private homes had been launched for sale, exceeding the 2,569 units in 1H22 but down from 1H21, when 6,072 units were continued to be released to meet pent-up demand since the COVID-19 circuit breaker. This reflects the cautious optimism among developers in the face of the April 2023 cooling measures, macroeconomic uncertainties, and elevated interest rates.

In terms of sales, the 278 new private homes sold in June pushed the 2Q23 tally up to an estimated 2,207 units, a 76% increase from the previous quarter. However, this is 17% short of the second-quarter average new home sales of 2,644 units recorded in the last decade. For 1H23, about 3,463 units had been sold in the primary market, some 18% lower than in 1H22, and the lowest first half-year sales seen since 3,862 units were sold in 1H20 when the market was affected by the circuit breaker from April to June 2020. This shows discernment and greater caution among buyers amid the headwinds in the market.

The full impact of the recent cooling measures may not be immediately evident yet and will likely take a few more months for assessment. However, buyers are expected to remain price-sensitive and selective amid elevated interest rates and a slower economic outlook. Developers are likely to attune to market sentiments and align launch prices accordingly.

Notwithstanding the brief pause in primary market activities in June, new project launches in April and May have been fairly well-received. The launches of Blossoms by the Park and Tembusu Grand in April, as well as The Continuum and The Reserve Residences in May are encouraging, and we are likely to see continuity in launches in 3Q23. For example, there has been reasonable interest in projects launched in July, ahead of the seventh lunar month (Hungry Ghost Festival). The Myst in Upper Bukit Timah sold 27% of 408 units over its launch weekend from 8-9 July. The 598-unit Lentor Hills Residences was 50% sold during its launch over the same weekend. Grand Dunman sold 55% of 1,008 units during the launch weekend on 15-16 July. The 520-unit Pinetree Hill sold 29% during the same weekend launch.

With more project launches lined up, developers are on track to achieving a new sales volume of around 7,000 to 7,500 units in 2023, compared to 7,099 units in 2022.

Appendix

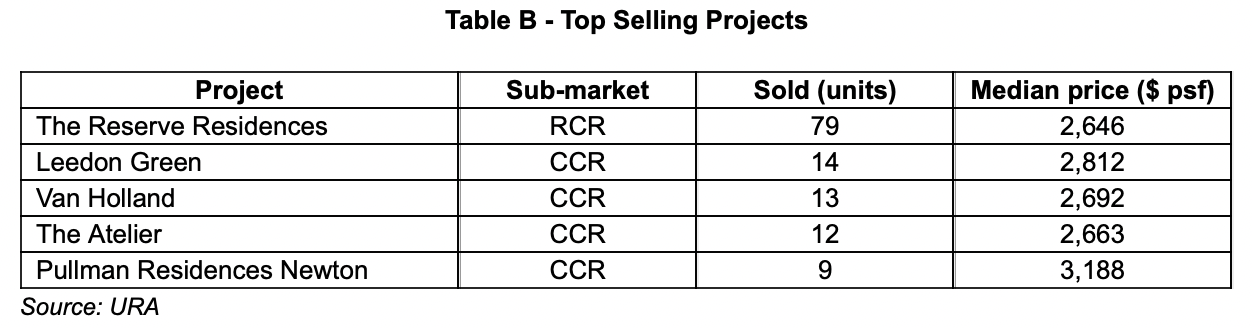

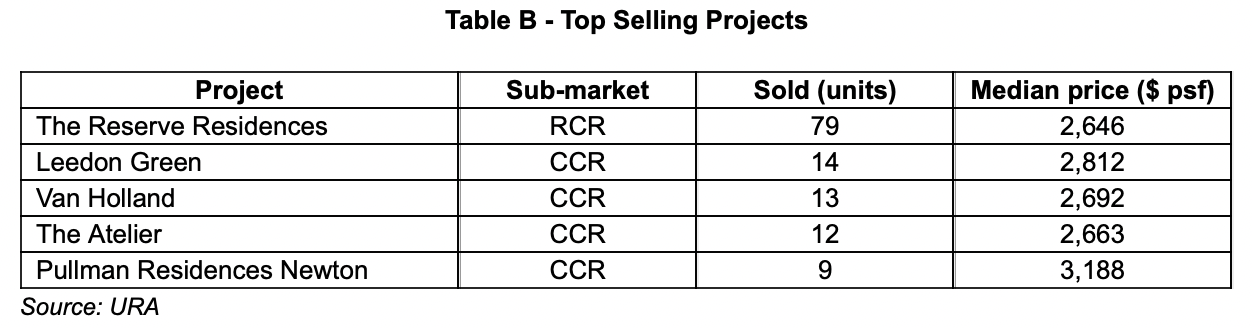

A total of 31 units were newly launched for sale in June 2023, 98% down the 1,595 units launched a month prior, and 92% lower y-o-y.

Only one project, Lavender Residence, was freshly launched in June. The small-sized project accounted for about 55% of total units launched in the month.

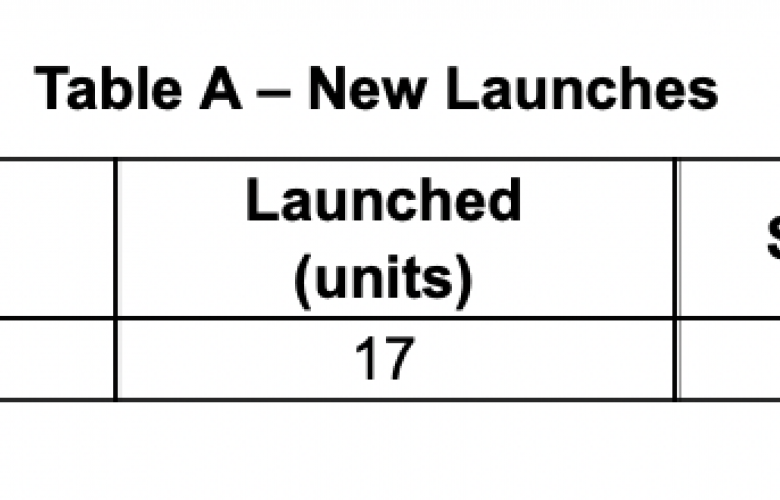

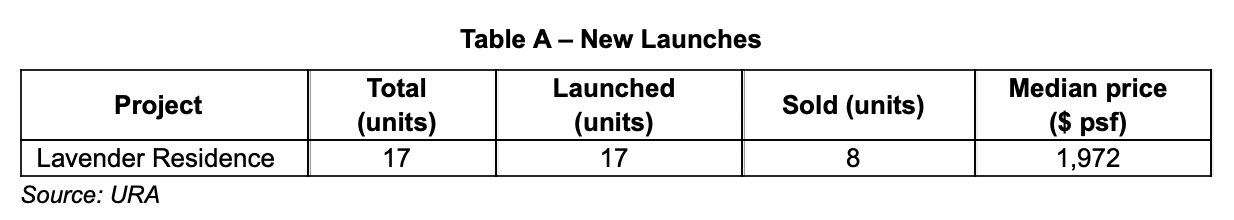

Developers sold 278 new private homes (excluding ECs) in June 2023. The take-up was led by the city fringes in the RCR with 147 units sold, followed by the prime CCR with 112 units sold. Meanwhile, the suburbs or OCR sold 19 units during the month.

The top selling projects during the month are listed in Table B below. The previously launched projects known as The Reserve Residences and Leedon Green were the top-selling projects of the month, transacting 79 units and 14 units respectively.