Power supply has had difficulty keeping pace with data centre industry growth across the globe, keeping vacancies low and pushing rents up even amid robust construction, according to a new report from CBRE.

Despite strong near-term market fundamentals, power supply constraints could limit or delay development in markets like Tokyo, Singapore, and Hong Kong. These constraints are fueling demand for hyperscale development in emerging markets such as Mumbai and greater Seoul, where power availability is high.

“Data centre availability in Asia Pacific is robust, having seen unprecedented growth over the past two years. Major Tier-1 markets are now attaining or surpassing record levels of live capacity consumption, which was unanticipated just two years ago. The surge in data storage needs, technological advancements, and the transformative effects of the post-COVID era have significantly reshaped the data centre landscape in this region,” said Dedi Iskandar, Head of CBRE Data Centre Solutions, Advisory & Transaction Services, Asia Pacific.

CBRE’s 2023 Global Data Centre Trends report analyzes key variables, such as total inventory, vacancy rates, net absorption, pricing and rental rates, and availability, in established and emerging markets across Asia Pacific, North America, Europe, and Latin America.

The growth of artificial intelligence (AI) has contributed to steady leasing activity, despite higher interest rates and economic uncertainty, and is expected to drive future data centre demand. In addition, emerging technologies such as streaming, gaming, and self-driving cars are expected to further increase the demand for high-performing data centres.

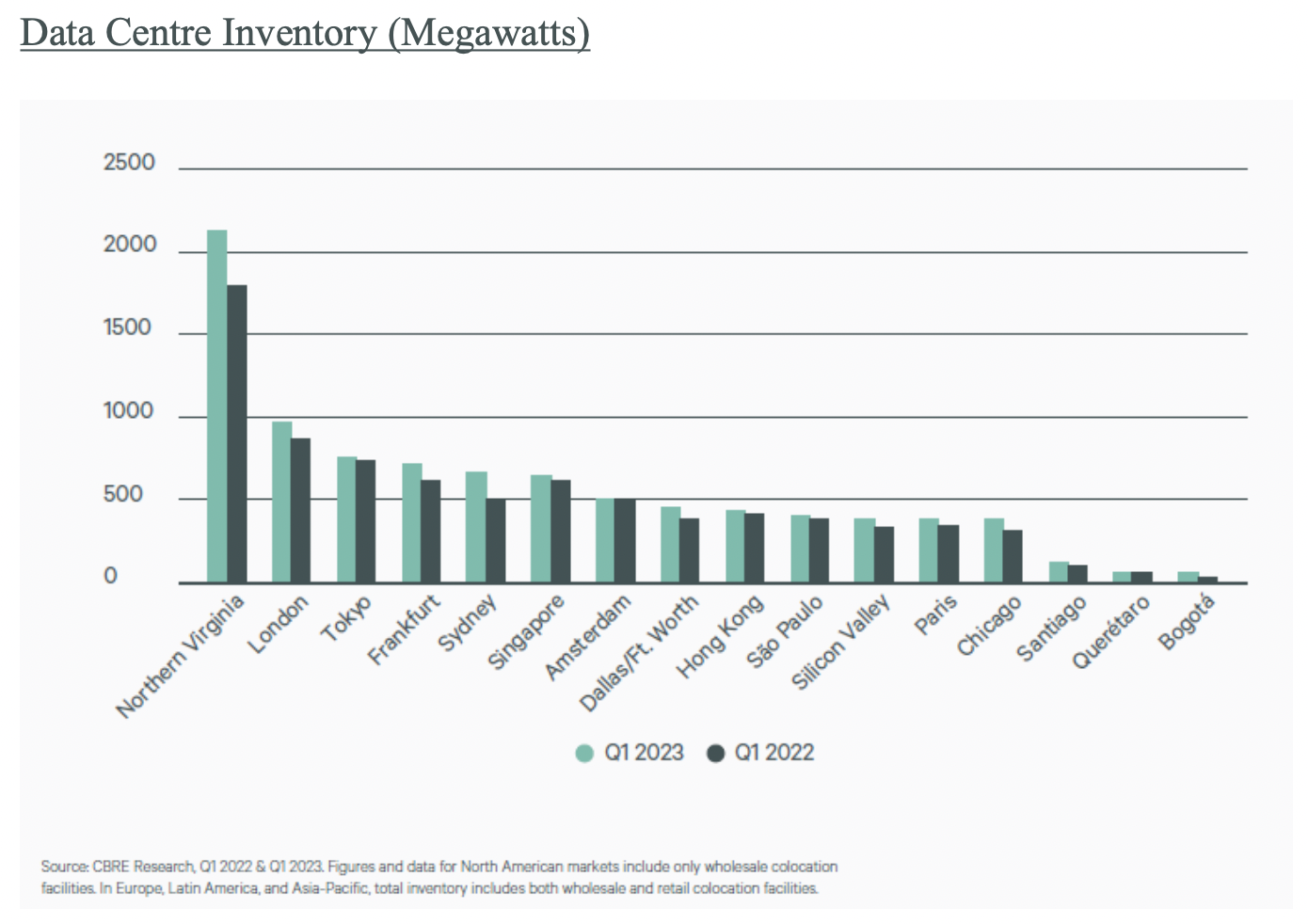

Data centre inventory continues to climb in many markets, where power availability and capacity limits have not yet slowed new development. For example, inventory increased 32% in Sydney from Q1 2022 to Q1 2023.

Despite new development, vacancy rates have declined as strong demand outstrips supply growth. Low supply, construction delays and power challenges are impacting all markets, and large occupiers are finding it difficult to find enough data centre capacity. For example, vacancies in Tokyo and Hong Kong have reduced by 1.5% to 2% year-over-year. Singapore remains the tightest supplied market in the region, with a record-low vacancy rate of under 2%.

Based on a 250-500 per kilowatt (kW) requirement without electricity cost, the current global supply shortage has led to a significant increase in data centre capacity prices. As a result, Singapore is now one of the most expensive markets worldwide, with prices exceeding USD$300 per kW, whereas Tokyo prices have remained relatively stable at around USD$200 per kW.

To read the full report, click here.