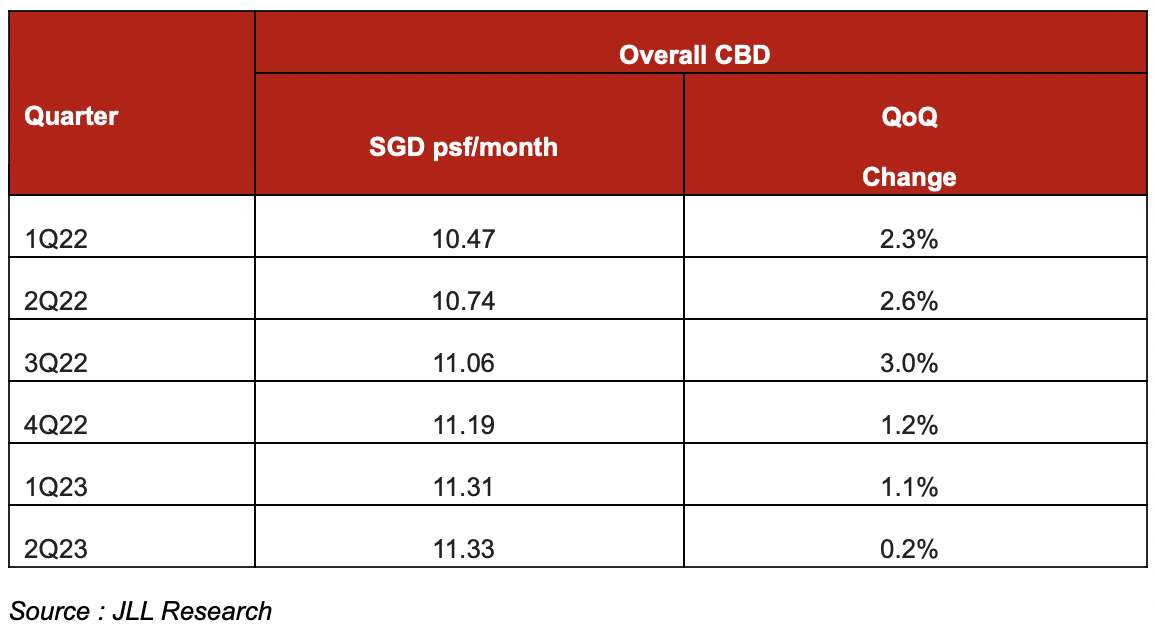

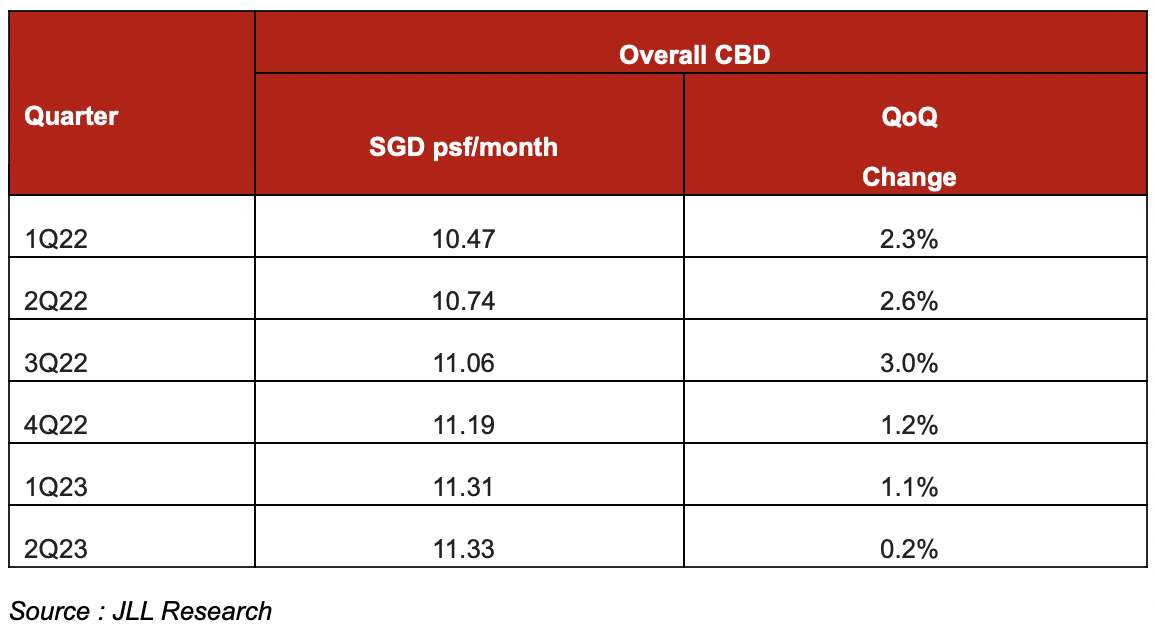

Singapore’s Grade A CBD rent growth tapered for the third consecutive quarter to a near-halt in the second quarter of 2023, according to JLL (NYSE: JLL). The global real estate consultancy’s research showed that the gross effective rent for CBD Grade A office space crept up by 0.2% quarter-on-quarter to an average of SGD11.33 per sq ft, per month, in the second quarter of 2023, from SGD11.31 per sq ft in the first quarter of 2023. This is a slowdown from the 1.2% and 1.1% quarter-on-quarter growth clocked in final quarter of 2022 and the first quarter of 2023, respectively.

Ms Tay Huey Ying, Head of Research and Consultancy, JLL Singapore, elaborates, “The office buildings in our Grade A CBD basket largely saw rents hovering around the same level as a quarter ago. However, landlords of buildings with large pockets of vacant and/or shadow space are starting to cave in to the pressure by lowering rents to boost occupancies in the second quarter of 2023.”

Mr Andrew Tangye, Head of Office Leasing and Advisory, JLL Singapore, comments, “Given the cautious outlook on business prospects, occupiers remained wary and continued to opt to renew or right-size their office premises. Notwithstanding, some financially sound occupiers took a longer-term view and confidently proceeded to conclude deals to upgrade to quality premises.”

Major leasing deals signed in the second quarter of 2023 included Morgan Stanley securing five floors (100,000 sq ft) of space in the soon-to-be-completed IOI Central Boulevard Towers, andPublicis Groupe taking up 55,000 sq ft of office space at the recently completed Guoco Midtown.

Mr Tangye adds, “Leasing activity in the first half consisted largely of enquiries that originated in 2022 on the back of the resurgence of employees returning to the office, business growth following the reopening of the economy, and the relocation of more regional headquarters functions to Singapore. However, the number of new leasing enquiries, particularly from large space users, has been notably scarce in 2023. Given the limited pipeline of leasing transactions and the longer business approval process, we can expect demand for office space to be subdued in the second half of 2023.”

Ms Tay concludes, “We can expect rents to enter into a correction mode in the final six months of 2023 given that near-term demand will likely fall short of supply. IOI Central Boulevard Towers will introduce over 1 million sq ft of additional office space to the CBD inventory when completed in the course of the next few months. While approximately 50% of this space has already been pre-committed or is currently undergoing advanced negotiations, there remains a substantial amount of over half a million sq ft of space waiting to be taken up. Coupled with the rising amount of shadow space in the market competing for tenants in a subdued market, rents will come under downward pressure in the second half. Nevertheless, there is potential for rent to rebound in 2024 on brighter economic prospects stoking occupier confidence.”

On the investment sales front, institutional investors have largely retreated to the sidelines given the unfavourable interest rates vis-à-vis office yields. A mismatch in price expectations between buyers and sellers continues to hamper deal-making, particularly for large en bloc deals. In contrast, driven by cash-flush, ultra-high-net-worth individuals and family offices, the investment grade strata-titled office market has been buoyant with Solitaire on Cecil reportedly selling out all of their office floors during the quarter.

Ms Ting Lim, Head of Capital Markets for JLL Singapore, comments, “The office investment sales market is anticipated to stay muted in the second half as investors will likely stay cautious given the uncertain interest rate climate and the wary leasing activity. However, we are observing strong interest for rare freehold acquisition opportunities below the SGD500 million ticket size which have recently become available in the market.”