Very important information to read:

This article is intended as a preliminary guide only and refers to some but not all elements required to consider in detail prior to starting any property dealings or due diligence. Property dealings are often complex, especially in foreign countries and we highly recommend you seek independent professional advice... read more... Hollywood movie star Angelina Jolie is probably the most famous foreigner to obtain Cambodian citizenship and invest in the country's real estate. She won't be the last because Cambodia's real estate market is heating up due to interest from foreign buyers, says Juwai IQI Co-Founder and Group Managing Director Daniel Ho.

Obtaining Cambodian citizenship through investment is a potentially rewarding route to investing in the affordable real estate of this fast-growing country. Foreigners can become freehold landowners in Cambodia under their own names.

Even during the pandemic, Chinese investment climbed. Chinese fixed-asset investment jumped 67% to US$2.32 billion in 2021. And domestic demand for real estate is strong. An expo for homebuyers in Phnom Penh last August, sold more than US$30 million of property in just two days.

Now that China has re-opened its borders in 2023, more Chinese investment is pouring into the country. The number of large investors we work with who have expressed an interest in Cambodian land is up more than tenfold compared to a year ago.

In fact, I just returned from a trip to the Kingdom, where I accompanied several foreign investors and visited potential investment sites. Our Cambodia Country Head, Chandy Mann, was an invaluable guide.

Migration advisors Henley & Partners ranks Cambodia's citizenship by investment program as the 11th best in the world. That is an impressive ranking, considering the program launched less than a year ago, and dozens of competing residency and citizenship by investment programs exist.

Visa-free travel is a popular benefit of most citizenship by investment programs, and other countries offer such access to many more countries than Cambodia. For example, a Maltese passport provides visa-free or visa-on-arrival travel to 186 destinations compared to Cambodia's 54.

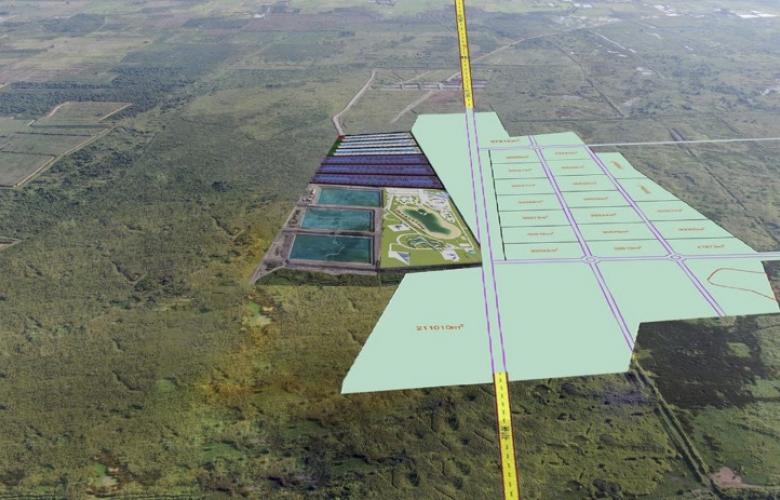

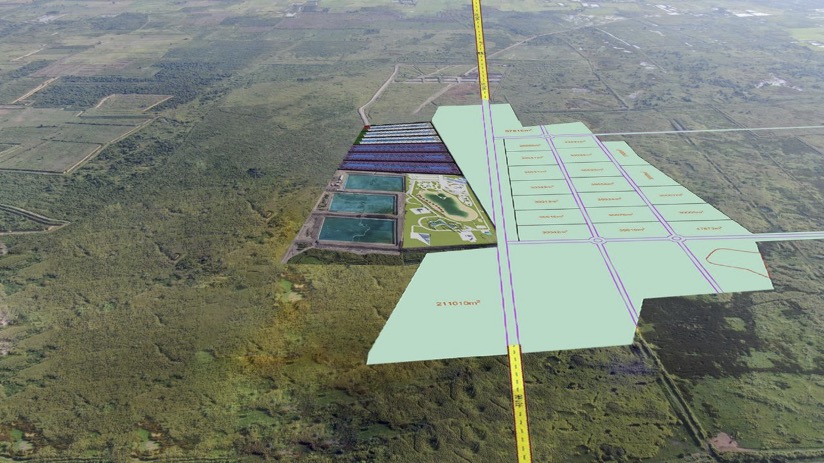

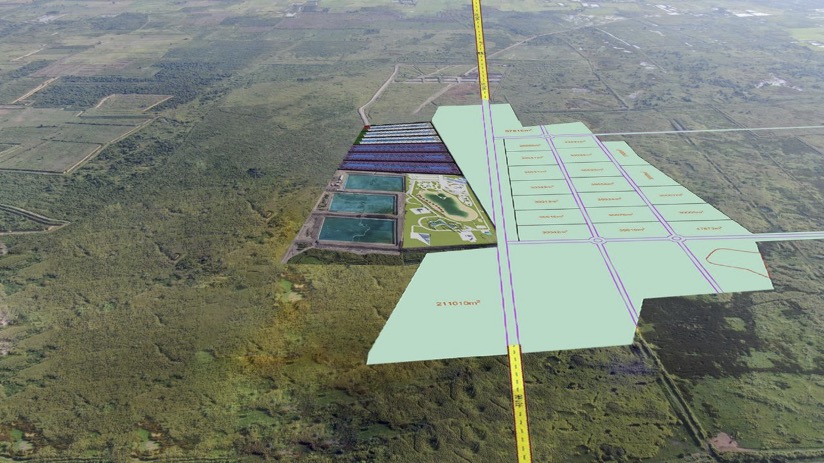

What Cambodia has that Malta does not have is an abundance of developable land alongside an extensive and exciting portfolio of new infrastructure projects. Visa-free travel isn't the reason most investors obtain a passport. They want to participate in Cambodia's economy by making government-approved land acquisitions.

The key advantage of citizenship is that it makes holding Cambodian land more straightforward and secure. Previously, when foreigners wished to invest in Cambodian land or a villa or other property with a land element, they could only do so by establishing a joint venture company with locals.

Through the citizenship by investment program, Cambodia is now the rare Southeast Asian country where foreigners can own land in their own names. That is especially attractive to those with an optimistic outlook on the country's long-term development prospects.

And there are good reasons to be optimistic. Analysts expect Cambodia to log fast economic growth in the decade ahead due to its increasing integration with its ASEAN partners and China through three important trade agreements. The pacts are the Cambodia-China Free Trade Agreement (CCFTA), the ASEAN-China Free Trade Area (ACFTA) and the Regional Comprehensive Economic Partnership (RCEP).

The country achieved lower-middle-income status in 2015 and hopes to attain high-middle-income status by 2030. So it can achieve this goal, the government is investing in infrastructure development.

Several big projects are already planned or underway. One is a US$16 billion coastal entertainment hub in Sihanoukville. Then there is the $4 billion high-speed rail link between Phnom Penh and the Thai border, plus additional high-speed rail routes linking Sihanoukville to Phnom Penh onto the Vietnamese border.

There is also a US$1.4 billion expressway and three airports. The largest airport is a US$1.5 billion new facility in the capital. Two additional airports at Siem Reap and Koh Rong will account for another US$1.2 billion of investment.

All these projects have attracted investor attention because new infrastructure profoundly impacts the value and uses of nearby land. Many Chinese investors consider Cambodia to offer similar opportunities to those available 30 years ago in China, a country that had its own massive infrastructure spree. They see the potential for growth and the chance to make fortunes.

That is probably why Chinese investors are the most numerous participants in the citizenship by investment program. Our team believes that approximately 300 Chinese investors have obtained naturalization in Cambodia since 2018. Other nationalities in the program include Thai, Vietnamese, Malaysian, Singaporean, Emirati, French, American and Russian.

What requirements must these investor migrants meet to qualify? The current regulations specify that an investment of US$310,000 in government-approved or royal family-approved projects qualifies one to apply for naturalization. Cash donations to the nation are also accepted, with a minimum of US$250,000.

The US$300,000 investment amount for Cambodian passports is relatively low compared to similar programs. It falls between the rates of EU countries like Malta (around US$800,000) and Caribbean nations (around US$100,000). Applicants for Turkish passports must invest a similar amount (approximately US$400,000).

The influx of foreign interest in Cambodian real estate has had net benefits for the local economy. It has created job opportunities in construction, property management, and related industries. Local and foreign developers have launched projects, delivering the kind of development Cambodia it would be difficult to obtain by relying exclusively on domestic capital.

Foreign investment in Cambodian real estate is on the rise. The Kingdom's citizenship by investment program may be the best way to take advantage of the opportunity to achieve the once-in-a-generation returns that many believe are possible.

Related Reading:

Considering relocating to Cambodia? See this Cambodia Relocation Guide - Knight Frank

Very important information to read:

This article and the above linked articles are not complete and are intended as preliminary guides only. These guides refer to some elements to consider prior to starting any property dealings or due diligence. Property dealings are often complex areas, especially in foreign countries and we highly recommend you seek independent professional advice... read more...