Singaporean Capital continue to lead in Asian Outbound Real Estate Investment in 2022 amid the drop in volume - CBRE

Contact

Singaporean Capital continue to lead in Asian Outbound Real Estate Investment in 2022 amid the drop in volume - CBRE

US$28 billion deployed by Singapore-based investors, normalising from record high in 2021, U.K overtakes U.S as Top Country for Outbound Investment from Singapore.

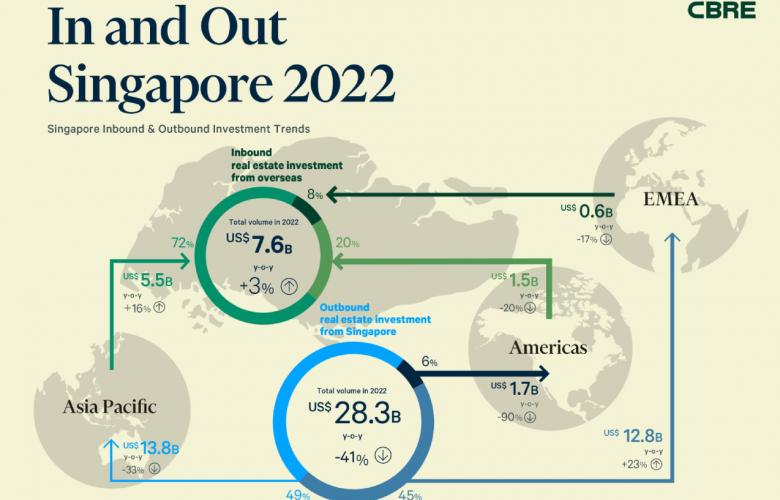

Singapore outbound commercial real estate investment reached US$28.284 billion, amid normalising from 2021’s record high, according to data from CBRE’s Singapore Viewpoint - Investment In & Out 2022.

Despite the drop in Singapore’s outbound investment volume in 2022, Singapore remained the top APAC outbound investor. While outbound investment volumes were driven primarily by higher investment in the U.K., witnessing a 120% y-o-y increase, China was the top destination in APAC for Singaporean investors with transaction volumes amounting to US$5.914 billion.

Among all sectors, Singaporean investors’ capital was mainly deployed to office and residential assets in 2022. Office assets remained the preferred sector among investors, however, on a y-o-y basis, transaction volumes in office and logistics properties fell by 33.5% and 81.8% respectively.

Inbound investment into Singapore in 2022 saw a marginal increase of 3.4% y-o-y reaching US$7.585 billion, with 72% coming from APAC. Japanese investors were the most active seeing a substantial y-o- y jump of 762%, followed by Indonesians and Chinese.

Commenting on the findings, Michael Tay, Head of Capital Markets, Singapore for CBRE, said, “The real estate investment sales scene in Singapore was relatively active in 2022, particularly in the first half. Several notable deals were transacted which was a clear indication of institutional investors’ confidence in Singapore. The second half of 2022 was dominated by buying interest from high net-worth individuals and well-heeled families, who were actively picking up high quality strata office units. Singapore continues to be well positioned to serve as a good gateway hub for international investors interested to venture into the region.”

On the investment outlook for 2023, Tricia Song, Head of Research, Southeast Asia for CBRE, said, “In the near term, transaction volumes could remain low as investors adopt a wait-and see approach on the back of sustained rate hikes and the deteriorating global macroeconomic backdrop. However, with Singapore ranking second among the top ten preferred cities for cross-border investments according to CBRE’s 2023 Asia Pacific Investor Intentions Survey, we expect transaction volumes to pick up in H2 2023, and full year volumes to be comparable with 2022’s”.