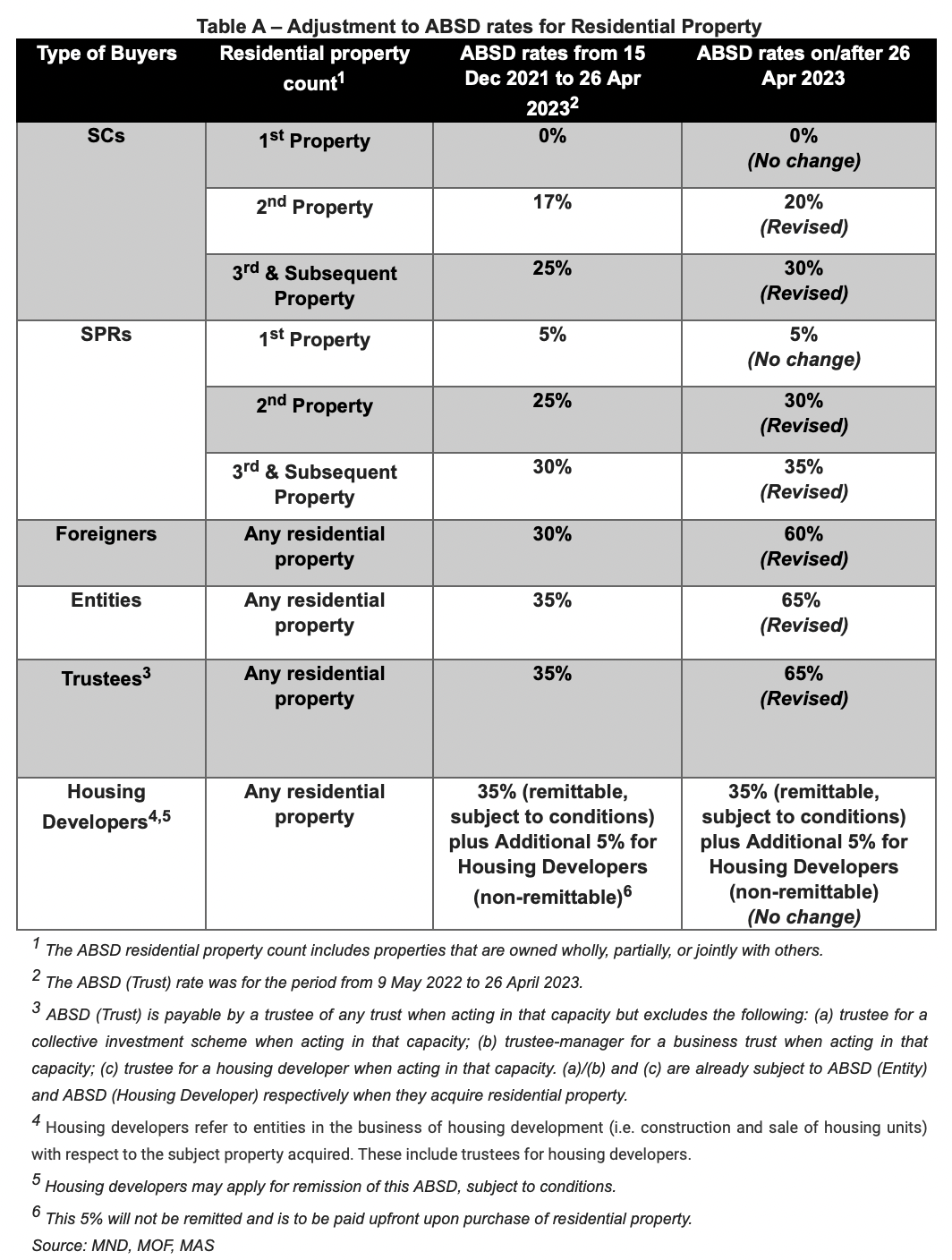

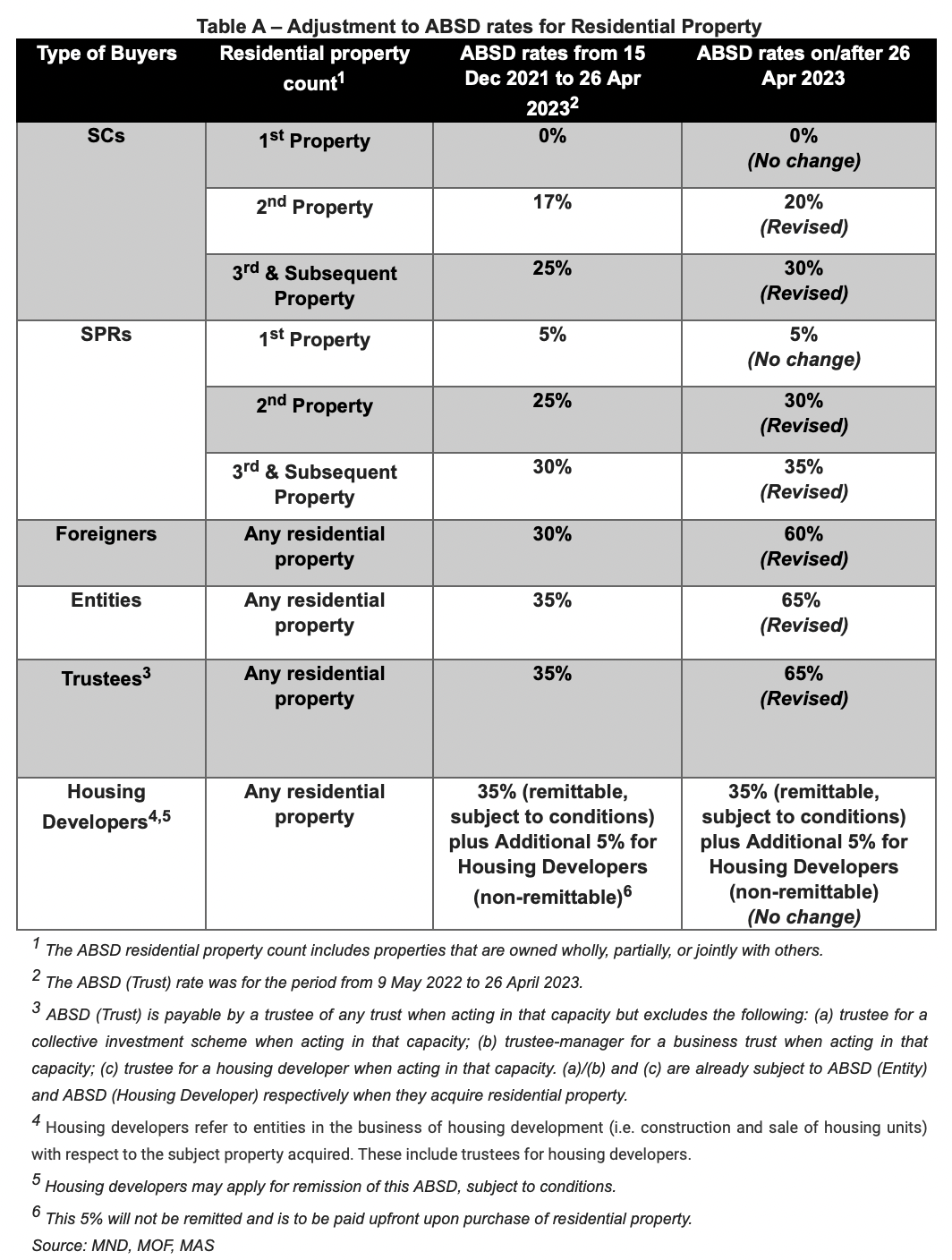

On 26 April 2023, the Ministry of National Development (MND), together with the Ministry of Finance (MOF) and the Monetary Authority of Singapore (MAS), announced property cooling measures to promote a sustainable residential market and to ensure that housing is prioritised for owner occupation. The key measures include raising the Additional Buyer’s Stamp Duty (ABSD) Rates for residents purchasing their second and subsequent residential properties, and for foreigners, entities and trustees purchasing any residential property.

A summary of the property cooling measures is provided in the Appendix.

Ms. Chia Siew Chuin, Head of Residential Research, Research & Consultancy at JLL

谢岫君, 私宅市场研究部主管 (新加坡) commented:

Singapore’s policy makers stepped up ABSD rates for residential properties, under a fresh round of property market cooling measures aimed at curbing investment demand and safeguarding owner-occupation demand of Singapore citizens and first-time buyers.

The curbs have been prompted by the accelerated quarter-on-quarter (q-o-q) price growth of private homes by at least 3.2% in 1Q23, up from 0.4% q-o-q in 4Q22, according to the flash estimates from the Urban Redevelopment Authority (URA). As of 1Q23, private home prices have reached historical highs after running up for 12 consecutive quarters, escalating by at least 27.9% since the low in 1Q20.The final private property price index for 1Q23, which will be released on 28 April 2023, might have been higher. The return of foreign buying interest to Singapore’s private residential market is also likely to have triggered to the fresh market curbs.

Limited impact on first-time home buyers

The latest hike in ABSD rates is one of the most prohibitive yet, particularly for foreign homebuyers and buyers of residential properties for investment purposes.

However, the ABSD revisions have less effect on homebuyers who own only one property at any one time. Therefore, the new ABSD rates would not have a significant bearing on homebuyers acquiring their homes for the first time and those upgrading from one property to the next.

Recovering foreign demand will be nipped

ABSD for foreigners was increased from 30% to 60%, a significant hike as compared to the 5% to 10% increase each time in the last three rounds of adjustments. The latest jump in ABSD for foreigners is considered punitive and is expected to shrink foreign buying demand, given that foreign buyers have just started to return to the local market following the reopening of country borders. The uptick in the number of foreign buyers is in the nascent stage, constituting just 6.9% of all purchases of non-landed private homes in 1Q23.

Among the market segments, the Core Central Region (CCR) – a proxy for high-end/luxury homes – is expected to bear the bulk of the impact due to a higher proportion of foreign buying demand as compared to other regions. Foreign private non-landed purchases in the CCR made up 15.5% in 1Q23, followed by 2.3% in the mid-tier Rest of Central Region (RCR) and 2.3% in mass-market Outside Central Region (OCR).

Singapore’s efforts in drawing private wealth to Singapore has resulted in an increase in the number of family offices in the country, up from 400 in end-2020 to about 700 currently. While this is seen as a positive development, the substantial ABSD imposed on foreign buyers could discourage some of the wealthy from setting up homes in Singapore.

Notwithstanding, foreign buyers looking to buy luxury homes in Singapore may seek alternative avenues. For instance, those who qualify for the Global Investor Programme could seek permanent residency in Singapore if they satisfy all conditions of the programme and in turn purchase their homes as a permanent resident and pay a lower ABSD. This avenue presents a double-win outcome that not only allows foreign buyers the opportunity to set up homes in Singapore but also benefits the country by directing investments into the local start-up ecosystem and the broader financial sector, as well generate more good jobs for Singaporeans.

Buyers purchasing for investment purposes could seek alternative asset classes

The increased ABSD rates will affect buyers purchasing second and subsequent properties for investment purposes more severely than those buying their sole home for owner occupation.

The surge in ABSD for foreign buyers could also erode Singapore’s competitive edge for property investment to some extent, particularly in private residential properties, even though the country does not yet have a wealth tax or capital gains tax, which is a draw on top of Singapore’s investment haven status.

Nonetheless, foreigners’ investment interest may be diverted to alternative asset classes such as shophouses or strata offices that are not regulated by market curbs and have limited risks from market cooling measures.

Value proposition in CCR properties

While the CCR is expected to see softer buying demand from foreign purchasers, high-end homes in the submarket could find favour with local first-time buyers with the financial means in view of the value proposition presented by such homes. Buyers will see value arising from the narrowed price gap between CCR and RCR properties, as the price increases of high-end homes in the CCR in the last two years had been more muted compared to those in the RCR. Less competition from foreign buyers should work in their favour as well.

Developers will remain cautious

While the ABSD for developers remains unchanged in the current round of market curbs, developers will remain prudent in land banking activities in view of the homebuying demand uncertainties arising from the cooling measures. Furthermore, developers will have to continue to contend with inflationary pressures, persistently high interest rates, higher stamp duties, as well as a reduced saleable floor area when the harmonisation of floor area computation comes into effect (affecting all development applications submitted from 1 June 2023 onwards).

Nonetheless, developers are likely to seek out palatable development plots suitable for mass-market development projects as underlying demand for such homes is expected to remain resilient. Collective sale deals for sites in the high-end market will face stronger headwinds.

Market activity and price growth to taper off

The latest measures are likely to temper the recovering market exuberance. Transaction volumes are expected to slow over the short term as demand is channelled to the side-lines due to lower affordability and higher upfront costs amid the new measures.

Buyers are foreseen to adopt a wait-and-see approach, with anticipation that prices will fall on the back of increased negotiating power. However immediate price corrections are unlikely as market fundamentals remain relatively stable with tight supply and resilient underlying demand for private homes, particularly from local households. As developers had incurred increased land acquisition and development costs, they are likely to hold top-line prices of upcoming launches relatively firm, particularly for mass-market projects as the impact on buying demand for mass-market homes is expected to be limited.

Overall, barring any adverse turn of macroeconomic events and job losses, private home prices could increase 3%-4% for the whole of 2023.

Appendix

The government has raised ABSD rates for Singapore Citizens (SCs) purchasing their second and subsequent residential properties by 3 to 5 percentage points, and for Singapore Permanent Residents (SPRs) purchasing their second and subsequent residential properties by 5 percentage points. Foreigners and entities purchasing any residential properties, and those buying under trust are faced with a 30-percentage point increase in ABSD. Meanwhile, ABSD rates remained unchanged for housing developers.